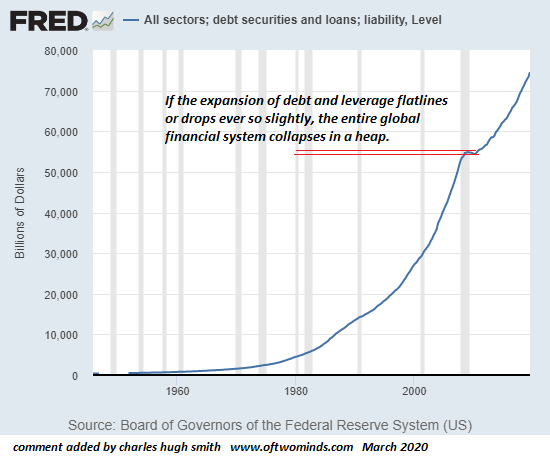

Once confidence and certainty are lost, the willingness to expand debt and leverage collapses. Even though the first-order effects of the Covid-19 pandemic are still impossible to predict, it’s already possible to ask: did the pandemic pop all the global financial bubbles? The reason we can ask this question is the entire bull mania of the 21st century has been based on a permanently high rate of expansion of leverage and debt. The lesson of the 2008-09 Global Financial meltdown was clear: any decline in the rate of debt/leverage expansion is enough to threaten financial bubbles, and any absolute decline in debt and leverage will unleash a cascade that collapses all the speculative bubbles in stocks, real estate, collectibles, etc. What’s the connection between

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Once confidence and certainty are lost, the willingness to expand debt and leverage collapses.

Even though the first-order effects of the Covid-19 pandemic are still impossible to predict, it’s already possible to ask: did the pandemic pop all the global financial bubbles? The reason we can ask this question is the entire bull mania of the 21st century has been based on a permanently high rate of expansion of leverage and debt.

The lesson of the 2008-09 Global Financial meltdown was clear: any decline in the rate of debt/leverage expansion is enough to threaten financial bubbles, and any absolute decline in debt and leverage will unleash a cascade that collapses all the speculative bubbles in stocks, real estate, collectibles, etc.

What’s the connection between Covid-19 and the rate of debt/leverage expansion? Confidence and certainty: people will make bets on future growth and take on additional debt and leverage when they feel confident and have a high degree of certainty that the trends are running their way.

|

Over the past 20 years, the certainty that central banks would support markets has been high, as central banks stepped in at every wobble. Today’s 50 basis-points cut by the Fed sustains that certainty. What’s now broken is the certainty that central bank interventions will lift risk assets and the real-world economy. Given the uncertainties of the eventual consequences of the pandemic globally, confidence in future trends has been either dented or destroyed, depending on your perspective and timeline. Certainty that central bank interventions will push markets and real-world economies higher has also been dented. What happens if the market tanks after every 50 basis-points cut by the Fed? We wouldn’t be in such a precariously brittle state if the global economy hadn’t been ruthlessly financialized to the point that market dependence on central bank intervention is now essentially 100%. Once confidence and certainty are lost, the willingness to expand debt and leverage collapses, and that reduction in the rate of expansion will pop all the global asset bubbles. |

All Sectors Debt Securities and loans, 1960-2019 |

Tags: Featured,newsletter