Those who don’t see the fragmentation, the scarcities and the battlelines being drawn will be surprised by the acceleration of the unraveling. I recently came across the idea that inflation is a two-factor optimization problem: inflation is necessary for the macro-economy (or so we’re told) and so the trick for policy makers (and their statisticians who measure the economy) is to maximize inflation in the economy but only to the point that it doesn’t snuff out...

Read More »Sacrifice for Thee But None For Me

The banquet of consequences for the Fed, the elites and their armies of parasitic flunkies and factotums is being laid out, and there won’t be much choice in the seating. Words can be debased just like currencies. Take the word sacrifice. The value of the original has been debased by trite, weepy overuse to the point of cliche. Like other manifestations of derealization and denormalization, this debasement is invisible, profound and ultimately devastating. Consider...

Read More »The Four D’s That Define the Future

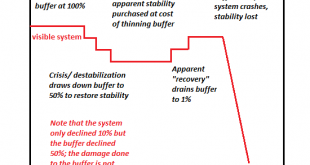

When the money runs out or loses its purchasing power, all sorts of complexity that were previously viewed as essential crumble to dust.Four D’s will define 2020-2025: derealization, denormalization, decomplexification and decoherence. That’s a lot of D’s. Let’s take them one at a time. I use the word derealization to describe the inner disconnect between what we experience and what the propaganda / marketing complex we live in tells us we should be experiencing....

Read More »This Is How It Ends: All That Is Solid Melts Into Air

While the Federal Reserve and the Billionaire Class push the stock market to new highs to promote a false facade of prosperity, everyday life will fall apart. How will the status quo collapse? An open conflict–a civil war, an insurrection, a coup–appeals to our affection for drama, but the more likely reality is a decidedly undramatic dissolution in which all the elements of our way of life we reckoned were solid and permanent simply melt into air, to borrow Marx’s...

Read More »Intolerance and Authoritarianism Accelerate Disunity and Collapse

Scapegoating dissenters only hastens the disunity and disarray that accelerates the final collapse. Authoritarianism is imposed on us, but its sibling intolerance is our own doing. Intolerance and authoritarianism are two sides of the same coin: as intolerance becomes the norm, the intolerant start demanding that the state enforce their intolerance by suppressing their enemies via increasingly heavy-handed authoritarian measures. Intolerance and authoritarianism...

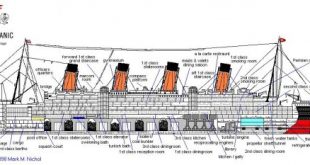

Read More »The Sinking Titanic’s Great Pumps Finally Fail

The greater fools still partying in the first-class lounge are in denial that even the greatest, most technologically advanced ship can sink. On April 14, 1912, the liner Titanic, considered unsinkable due to its watertight compartments and other features, struck a glancing blow against a massive iceberg on that moonless, weirdly calm night. In the early hours of April 15, the great ship broke in half and sank, ending the lives of the majority of its passengers and...

Read More »The American Economy in Four Words: Neofeudal Extortion, Decline, Collapse

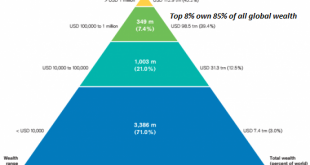

Our society has a legal structure of self-rule and ownership of capital, but in reality it is a Neofeudal Oligarchy. Now that the pandemic is over and the economy is roaring again–so the stock market says–we’re heading straight back up into the good old days of 2019. Nothing to worry about, we’ve recovered the trajectory of higher and higher, better every day in every way. Everything’s great except the fatal rot at the heart of the U.S. economy hasn’t even been...

Read More »What Makes You Think the Stock Market Will Even Exist in 2024?

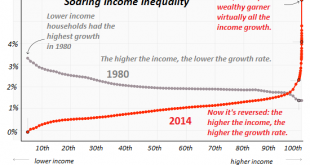

Given the extremes of the stock market’s frauds and even greater extremes of wealth/income inequality it has created, tell me again why the stock market will still exist in 2024? When I read a financial pundit predicting a bull market in stocks through 2024, blah-blah-blah, I wonder: what makes you think the stock market will even exist in 2024, at least in its current form? Given the current trajectory of the real economy into the Greatest Depression while the...

Read More »Dancing Through the Geopolitical Minefield

The elites dancing through the minefield all have plans, but how many are prepared for the punch in the mouth? Open any newspaper from the past 100 years and you will soon find a newsworthy geopolitical hotspot or conflict. Geopolitical conflict is the default setting for humanity, it seems, but it does feel as if the minefield of geopolitical rivalries and flashpoints has been thickly sown and many of the players are dancing through the minefield with a worrisomely...

Read More »An Interesting Juncture in History

Just as the rewards of central-bank bubbles have not been evenly distributed, the pain created by the collapse of the bubbles won’t be evenly distributed, either. We’ve reached an interesting juncture in history, and I don’t mean the pandemic. I’m referring to the normalization of extremes in the economy, in social decay and in political dysfunction and polarization. Let’s ask a very simple question. The S&P 500 stock index went up five-fold from its 2009 low...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org