Clearly, the Fed reckons the public is foolish enough to believe the Fed’s money will actually be “free.” It’s pretty much universally recognized that authorities use crises to impose “emergency powers” that become permanent. This erosion of civil and economic liberties is always sold as “necessary for your own good.” Of course the accretion of ever greater power in the hands of the few is for our own good. How could it be otherwise? (Irony off) In this environment...

Read More »Will the Stock Market Be Dragged to the Guillotine?

The Fed’s rigged-casino stock market will be dragged to the guillotine by one route or another. The belief that the Federal Reserve and its rigged-casino stock market are permanent and forever is touchingly naive. Never mind the existential crises just ahead; the financial “industry” (heh) projects unending returns of 7% per year, or is it 14% per year? Never mind the details, the Fed has our back and since the Fed is forever, so too will be the gains for everyone...

Read More »Why We’re Doomed: Our Delusional Faith in Incremental Change

Better not to risk any radical evolution that might fail, and so failure is thus assured. When times are good, modest reforms are all that’s needed to maintain the ship’s course. By “good times,” I mean eras of rising prosperity which generate bigger budgets, profits, tax revenues, paychecks, etc., eras characterized by high levels of stability and predictability. Since stability has been the norm for 75 years, institutions and conventional thinking have both been...

Read More »Our Simulacrum Economy

In the hyper-real casino, everyone has access to the terrors of losing, but only a few know the joys of the rigged games that guarantee a few big winners by design. Readers once routinely chastised me for over-using simulacrum to describe our economy and society. The problem is this word perfectly describes the hollowed-out, rigged economy and social order we inhabit and so synonyms don’t quite cut it: it’s not the same as simulation or imitation or counterfeit. My...

Read More »A Hard Rain Is Going to Fall

The status quo is about to discover that it can’t stop the hard rain or protect its fragile sandcastles. You’ll recognize A Hard Rain Is Going to Fall as a cleaned-up rendition of Bob Dylan’s classic “A Hard Rain’s a-Gonna Fall”. Since the world had just avoided a nuclear conflict in the Cuban Missile Crisis, commentators reckoned Dylan was referencing a nuclear rain. But he denied this connection in a radio interview, stating: “…it’s just a hard rain. It isn’t the...

Read More »Things Change

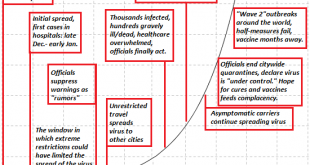

Things Change October 2, 2020 “Doing more of what’s hollowed out our economy and society” is a slippery path to ruin. Things change, supposedly immutable systems crumble and delusions die. That’s the lay of the land in the The Empire of Uncertainty I described yesterday. It’s difficult not to be reminded of the Antonine Plague of 165 AD that crippled the Western Roman Empire. The exact nature of the virus that struck down as many as one-third of the Empire’s...

Read More »The Urban Exodus and How Greatness Goes Bankrupt

The best-case scenario is those who love their “great city” will accept the daunting reality that even greatness can go bankrupt. Two recent essays pin each end of the “urban exodus” spectrum. James Altucher’s sensationalized NYC Is Dead Forever, Here’s Why focuses on the technological improvements in bandwidth that enable digital-economy types to work from anywhere, and the destabilizing threat of rising crime. In his telling, both will drive an accelerating urban...

Read More »The Empire of Uncertainty

Anyone claiming they can project the trajectory of the U.S. and global economy is deluding themselves. Normalcy depends entirely on everyday life being predictable. To be predictable, life must be stable, which means that there is a high level of certainty in every aspect of life. The world has entered an era of profound uncertainty, an uncertainty that will only increase as self-reinforcing feedbacks strengthen disrupting dynamics and perverse incentives drive...

Read More »The Silent Exodus Nobody Sees: Leaving Work Forever

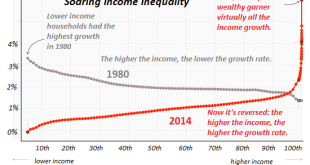

The “take this job and shove it” exodus is silently gathering momentum. The exodus out of cities is getting a lot of attention, but the exodus that will unravel our economic and social orders is getting zero attention: the exodus from work. Like the exodus from troubled urban cores, the exodus from work has long-term, complex causes that the pandemic has accelerated. These are the core drivers of the exodus from work. 1. labor’s share of the economy has been in...

Read More »Inflation and “Socialism-Lite” Are Just What the Billionaires Want

After a bout of inflation and “socialism-light”, we could end up with even more extreme inequality when the whole rotten structure collapses. Imagine owning a Buffett-Bezos fortune of bilious billions, or even 10% of these mega-fortunes, i.e. between $5 billion and $20 billion. Heck, imagine owning 1% of these mega-fortunes, i.e. $500 million to $2 billion. You’re extremely rich so you can buy the best advice. Your capital is mobile, and so are you. You can live...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org