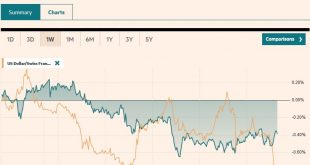

Swiss Franc The Euro has risen by 0.19% to 1.1651 CHF. EUR/CHF and USD/CHF, July 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is little changed but mostly softer as the week draws to a close. The market is digesting the implications of yesterday’s comments by President Trump about interest rates and foreign exchange, and without fresh economic data, are...

Read More »FX Daily, July 19: Greenback Extends Gains

Swiss Franc The Euro has risen by 0.03% to 1.1625 CHF. EUR/CHF and USD/CHF, July 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is extending its recent gains against most of the world’s currencies. We continue to see the most compelling case for the macro driver being the diverging policy mixes. There are also more immediate factors too. The surprisingly...

Read More »FX Daily, July 18: Greenback Extends Gains-For Now

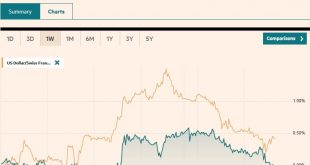

Swiss Franc The Euro has fallen by 0.21% to 1.1635 CHF. EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is at its best level here in July against the Canadian dollar. The CAD1.3265 area corresponds to a 61.8% retracement of the leg down in late June from almost CAD1.3390 to the recent low near CAD1.3065. The Australian dollar has...

Read More »Great Graphic: Fed Raising Rates, but Yields Still Negative

The yield on the 3-month US Treasury bill is pushing above 2% today for the first time since 2008. The yield had briefly dipped below zero as recently as late 2015. Although today’s yield seems high, this Great Graphic shows the nominal generic three-month yield going back to 1990. Then the three-month bill yielded 8%. The peak in the last cycle (2006-2007) was a little above 5%. It is true that in the past business...

Read More »FX Daily, July 17: Dollar on Back Foot Ahead of Powell

Swiss Franc The Euro has fallen by 0.21% to 1.1645 CHF. EUR/CHF and USD/CHF, July 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar eased in Asia session and the European morning. The greenback had appeared technically vulnerable, and the economic news stream is light. Sterling, unlike most of the other major currencies, remains within yesterday’s range....

Read More »Great Graphic: Two-year Rate Differentials

Given that some of the retail sales that were expected in June were actually booked in May is unlikely to lead to a large revision of expectations for Q2 US GDP, the first estimate of which is due in 11 days. Before the data, the Atlanta Fed’s GDP Now projects the world’s biggest economy expanded at an annualized pace of 3.9% in Q2. If true, it would be the strongest quarterly expansion since Q3 14, when the economy...

Read More »FX Daily, July 16: Dollar Softens a Little as Market Awaits Developments

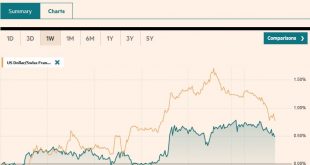

Swiss Franc The Euro has fallen by 0.05% to 1.1683 CHF. EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is slightly softer against most of the major currencies but is in narrow ranges ahead of today’s key events, which include US retail sales and the debate in the UK parliament over Brexit. The yen is the main exception. The local...

Read More »FX Weekly Preview: For the Millionth Time: Investors Exaggerate Trade Tensions at Their Own Peril

You would never have guessed it reading many of the op-eds and pundits pronouncing the end to globalization or the West, or liberalism. Global equities have rallied. Of course, stock prices are not the end all and be all, but it stands in stark contrast to the cries that the sky is falling. The MSCI World Index of developed markets advanced for the second consecutive week adding 2.2%. The US S&P 500 moved above...

Read More »Great Graphic: Two Stories for Two Trend Lines

The Dollar Index made a marginal new high for the year at the end of June a touch below 95.55. It fell through the start of this week when it reached nearly 93.70. With the earlier gains, the Dollar Index briefly traded above the 61.8% retracement of the pullback (~94.85). A move now below 94.20 would be disappointing. The Dollar Index is not a trade-weighted. It is too concentrated in Europe and does not include two...

Read More »Great Graphic: Is Mr Market Thinking About the First Fed Cut?

The US economy is among the strongest among the large economies. Goosed by the never-fail elixir of tax cuts and spending increases, the US economy is accelerating. Nevertheless, we continue to see the fiscal boost as short-lived, and a recent Fed paper suggested that fiscal stimulus in an upswing may not have the same multiplier as during a downturn. Evidence of late-cycle behavior continues to accumulate. We have...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org