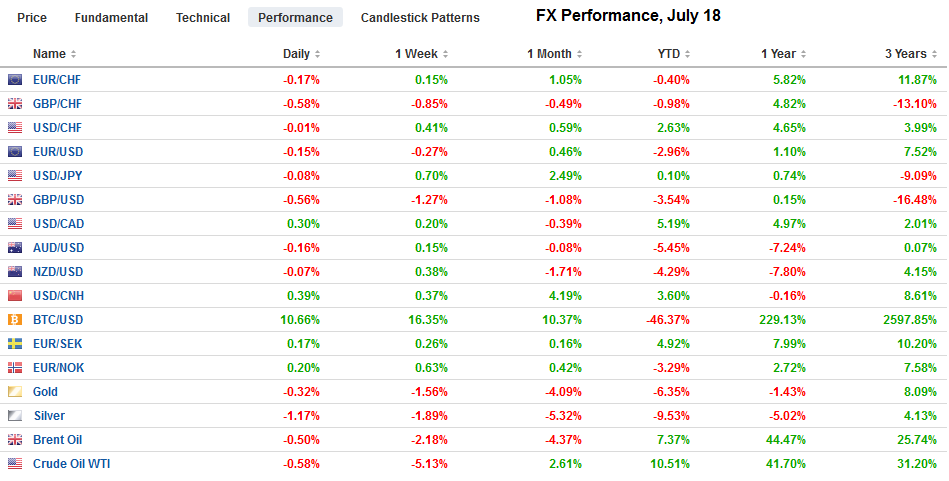

Swiss Franc The Euro has fallen by 0.21% to 1.1635 CHF. EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is at its best level here in July against the Canadian dollar. The CAD1.3265 area corresponds to a 61.8% retracement of the leg down in late June from almost CAD1.3390 to the recent low near CAD1.3065. The Australian dollar has spent the session so far below %excerpt%.7400, the middle of its %excerpt%.7300-%excerpt%.7500 range. The New Zealand dollar was unable to sustain yesterday’s CPI-led bounce and slipped to a new low for the week today a little above %excerpt%.6740. Lastly, there are a few levels to be watching today. The euro is trading at a

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, Daily FX, EUR, EUR/CHF, Featured, GBP, JPY, newsletter, NZD, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.21% to 1.1635 CHF. |

EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is at its best level here in July against the Canadian dollar. The CAD1.3265 area corresponds to a 61.8% retracement of the leg down in late June from almost CAD1.3390 to the recent low near CAD1.3065. The Australian dollar has spent the session so far below $0.7400, the middle of its $0.7300-$0.7500 range. The New Zealand dollar was unable to sustain yesterday’s CPI-led bounce and slipped to a new low for the week today a little above $0.6740. Lastly, there are a few levels to be watching today. The euro is trading at a two-week low near $1.16. There is a $1.1610 strike that expires today for 780 mln euros, and a 1.48 bln euros struck at $1.1625-$1.1630. The euro is a 3.5 cent range between $1.15 and $1.1850. We have suggested that the dollar was in a three-yen range (JPY105-JPY108) early this year and more recently has been in a JPY108-JPY111 range. The dollar broke out of that range last week. We suspect the new range maybe JPY111-JPY114, but it is fluid as the extremes are established. |

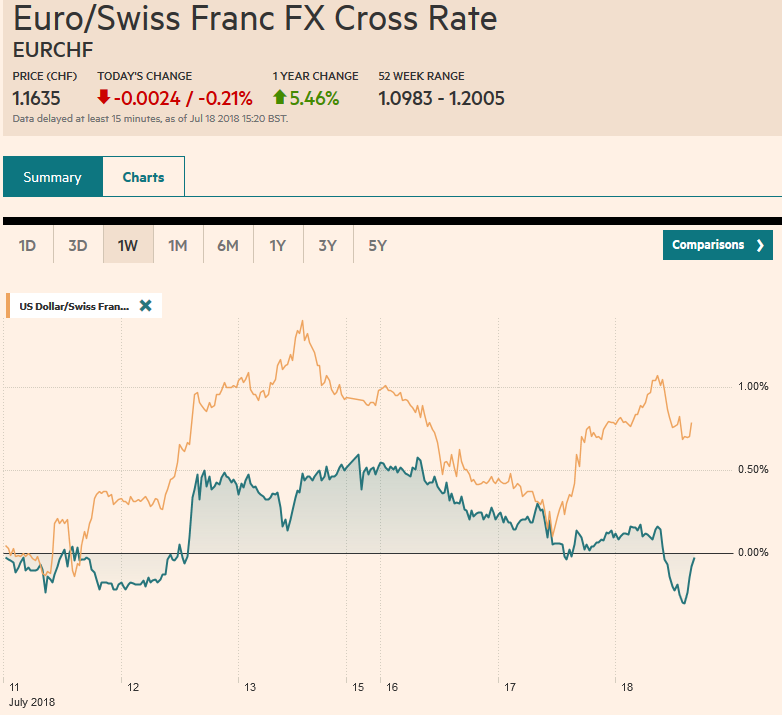

FX Performance, July 18 |

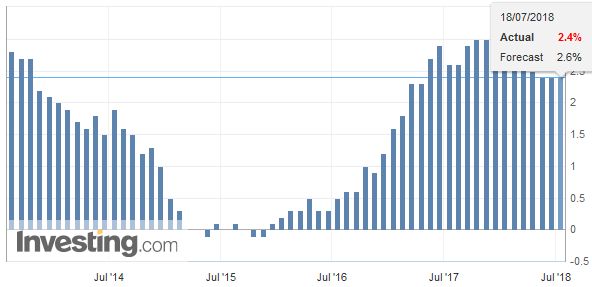

United KingdomSterling had been holding the $1.3080 area before the CPI. The CPI flat and many expected an increase. The pound tumbled, and the implied yield of the September short-sterling futures contract slipped 1.5 bp. The headline CPI was unchanged on the month, leaving it at 2.4% on the year. Economists had expected a 2.6% print. Higher fuel prices (gasoline 2.2% and diesel 2.9%) were offset by discounts for clothing and footwear (-2.1%, the most since 2012). The core rate of inflation eased to 1.9%, a 15-month low. A break of $1.30 would target $1.28, the 61.8% retracement of the recovery from the flash crash low in October 2016, which Bloomberg records as $1.1840. In recent days, sterling has been straddling the $1.31 area, which is the 50% retracement. |

U.K. Consumer Price Index (CPI) YoY, Aug 2013 - Jul 2018(see more posts on U.K. Consumer Price Index, ) Source: investing.com - Click to enlarge |

After softening in Europe yesterday, the dollar recovered in the North American session with the help of assurances by Fed Chair Powell who reaffirmed the path gradual path despite clear recognition that tariffs threaten wages and growth. The greenback has extended those gains today and is higher against all the emerging market currencies, expected the Turkish lira, which is slightly firmer.

In the emerging market space, the South Korean won is the weakest, off nearly 0.75% today, even though foreign investors bought Korean shares for the first time this week. The finance ministry shaved this year’s growth forecast to 2.9% from 3.0%. Rising trade tensions were cited. Last week, the central bank also trimmed its GDP forecast to 2.9%. The inflation forecast was also pared to 1.6% from 1.7%.

Sterling is the weakest of the major currencies and recorded a new low for the year just above $1.30. It was unable to recover much late yesterday when a pro-EU amendment that would have forced the government to stay in the customs union was narrowly defeated (307-301). May must navigate between this wing and the hard Brexit wing. Because of the close contest of wills, many fear that the UK may leave the EU without an agreement and this weighs on sentiment.

Separately, the UK reported producer prices. Input prices rose 10.2% (from a revised 9.6%) while output prices edging 3.1% higher (from a revised 3.0%). The government’s house price index eased to 3.0% from 3.5% (initially 3.9%). It is the smallest increase since August 2013. Prices were the softest in London, which is understood to be a knock-on effect of Brexit.

Powell testifies before a House committee today. His comments yesterday were as expected. There was one twist: “With a strong job market, inflation close to out objective, and the risks to the outlook roughly balanced, the FOMC believes that-for now-the best way forward is to keep gradually raising the federal funds rate.” “For now” is new. This appears to be a way for Powell to underscore the fluidity of conditions and the risks to the economic outlook emanating from the rising trade tensions.

There have been a few regional Fed presidents that have cited the flattening of the yield curve as a reason to slow or stop the gradual rate hikes. However, we do not think that the “for now” was a compromise with the doves like Kashkari who has consistently been opposed to the normalization of monetary policy. Powell’s comment also is a useful reminder that the shift of the median Fed forecast to two hikes in H2 18 from one was based on a changed forecast by a single member.

The MSCI Asia Pacific Index rose slightly for the first time this week primarily because of the gains in Japanese shares, which have been helped by the weaker yen. The dollar edged above JPY113 for the first time since early January. Excluding Japan, the MSCI Asia Pacific Index slipped less than 0.1% but is lower for the third session. Early gains in Chinese shares were reversed, and the Shanghai Composite finished on its lows; extending its losing streak to the fourth consecutive session.

European shares are doing better. The Dow Jones Stoxx 600 is up about 0.6% near midday in Europe, led by a 2.2% jump in the information technolog.y and a 1% gain in healthcare. Energy and utilities are trading slightly lower on the day. The German DAX is the strongest of the major markets, while Italy near flat. An index of Italian bank shares is off 1.2% to end a three-day advance.

Core bond yields are fractionally lower, though the yield of the 10-year Gilt is off 3.5 bp. At 1.22%, the yield is the lowest since late May. Peripheral bond yields are slightly firmer. The US 10-year is flat at 2.86%. Oil prices are softer and seem to be in a bearish consolidation after the large loss on Monday. Supply concerns have eased, and the API estimate showed US stocks increased by 629k barrels rather than fall by 4.1 mln as had been expected. The EIA estimate will be closely scrutinized after last week 12.6 mln barrel decline. The median forecast in the Bloomberg survey was for a 3.45 mln barrel drawdown.

Between Powell and the oil figures, the market may look past the expected softness of housing starts. Housing starts hit a new cyclical peak in May, and a modest pullback will not make a difference to the trend. Moreover, permits, which fell 4.6% in May are expected to rebound. Permits are a leading economic indicator. That said, a decline would be the third in a row. The 24-month average stand at 1.283 mln. A break below that would be a yellow card if it is not too late for a football analogy.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,Daily FX,EUR/CHF,Featured,newsletter,NZD,USD/CHF