Swiss Franc The Euro has risen by 0.22% to 1.1597 CHF. EUR/CHF and USD/CHF, July 27(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The US dollar is trading firmly in Europe after consolidating yesterday’s gains during the Asian session and ahead of the first look at Q2 GDP. Yesterday’s economic reports, including durable goods orders and inventory data, saw the...

Read More »FX Daily, July 26: Equities like EU-US Trade Truce more than the Euro

Swiss Franc The Euro has fallen by 0.29% to 1.1597 CHF. EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar is mostly firmer. The Australian dollar is off the most (~0.35%, ~$0.7425), after peaking a little above $0.7460. The price action reinforces the $0.7300-$0.7500 range. The yen is the strongest of the majors. Near JPY110.80, the yen...

Read More »Great Graphic: US 2-year Premium Grows and Outlook for G3 Central Banks

A cry was heard last week when President Trump expressed displeasure with the Fed’s rate hikes. Some, like former Treasury Secretary Lawrence Summers, claimed that this was another step toward becoming a “banana republic.” Jeffrey Sachs, another noted economist, claimed that “American democracy is probably one more war away from collapsing into tyranny.” The line that Trump supposedly crossed did not change investors’...

Read More »FX Daily, July 25: Narrow Ranges Prevail

Swiss Franc The Euro has risen by 0.04% to 1.1613 CHF. EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trapped in narrow trading ranges. That itself is news. At the end of last week ago, the US President seemed to have opened another front in his campaign to re-orient US relationships by appearing to talk the dollar down....

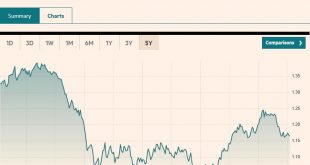

Read More »Great Graphic: Is the Euro’s Consolidation a Base?

Speculators in the futures market are still net long the euro. They have not been net short since May 2017. In the spot market, the euro approached $1.15 in late-May and again in mid-June. Last week’s it dipped below $1.16 for the first time in July and Trump’s criticism of Fed policy saw it recover. Yesterday it reached $1.1750 before retreating. On the pullback, it held the 61.8% retracement of the recovery...

Read More »FX Daily, July 24: China Turns To Domestic Stimulus, Weighs on Yuan but Lifts Stocks

Swiss Franc The Euro has risen by 0.22% to 1.1626 CHF. EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Following a record injection via the medium-term lending facility yesterday, China’s officials unveiled a set of policies designed to support the weakening economy that soon could face a substantial drag from US tariffs. The effort...

Read More »Cool Video: Bloomberg Television–Dollar Outlook

I had the privilege to join Alix Steel, the Bloomberg anchor, and Laird Landmann from TCW on the set earlier today. Here is the link to the 2.5-minute clip. The issue is the dollar’s outlook. The greenback had looked to be on the verge of breaking out higher before the US President expressed disapproval with the Fed rate hikes and, then the following day, aggressively accused the EU and China of manipulating their...

Read More »FX Daily, July 23: Dollar Consolidates Trump-Inspired Losses, BOJ Resolve Tested

Swiss Franc The Euro has fallen by 0.24% to 1.1609 CHF. EUR/CHF and USD/CHF, July 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US Treasury Secretary Mnuchin told G20 finance ministers and central bankers that President Trump was not trying to interfere in the foreign exchange market or encroach upon the Federal Reserve’s independence. Trump’s comments and tweets...

Read More »FX Weekly Preview: It was Supposed to be a Quiet Week

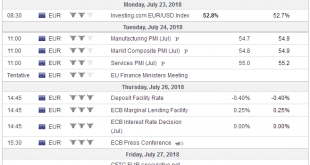

It was supposed to be a quiet week. The economic data and event calendar was light. There were three features, and none would likely disrupt the markets much. Eurozone The first two are in Europe. The eurozone flash PMI for July, the first insight into how Q3 has begun. The PMI is expected to paint a mostly steady economic activity. The June composite PMI rose for the first time since January, and it is forecast to be...

Read More »Euro, Yen, and Equities: Reviewed

US equities and the dollar appear to be moving higher together. The greenback is near its best level this year against most of the major and emerging market currencies. The Chinese yuan is not an exception to this generalization. At the same time, the S&P 500 is at its best levels since the downdraft February, and the NASDAQ set a new record high earlier in the week. Many investors and observers speculate about the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org