Oil prices are weaker for the third straight day and are off in four of the past five sessions, the poorest run in two months. Supply considerations may threaten a year-old trend line. OPEC and non-OPEC, essentially Saudi Arabia and Russia are making good on their commitment to boost output, and US oil inventories unexpectedly rose. Saudi output appears to have risen by about 230k barrels per day. Production in Nigeria...

Read More »FX Daily, August 03: Greenback Remains Firm Ahead of Jobs, JGBs Stabilize, Italian Debt Moves into Spotlight

Swiss Franc The Euro has fallen by 0.19% to 1.1503 CHF. EUR/CHF and USD/CHF, August 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading at the upper end of its recent ranges against the euro and sterling. The euro finished below $1.16 yesterday for the first time since the end of June and has not been able to resurface that level so far today. We...

Read More »Fed Looks to September

There was little doubt in the market’s collective mind that the Federal Reserve, which hiked rates in July, would stand pat today. It did not disappoint. The statement itself was almost identical. Growth was said to be “strong” instead of “solid,” for example, a nuance to be lost on most observers. It recognized that the unemployment rate stabilized after falling. Most notable is what is not included. The June minutes...

Read More »FX Daily, August 02: BOJ Surprises, BOE on Tap, Trade Worries Weigh on Stocks

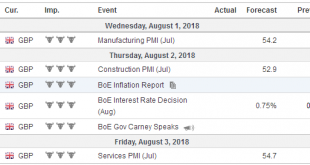

Swiss Franc The Euro has fallen by 0.14% to 1.1548 CHF. EUR/CHF and USD/CHF, August 02(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Bank of England meeting concludes a run of major central bank meetings over the past fortnight. The BOE is widely expected to join the Bank of Canada in raising rates. The Federal Reserve and the ECB were content to do and say...

Read More »FX Daily, August 01: Trade and Japan Drive Markets Ahead of Stand Pat Fed

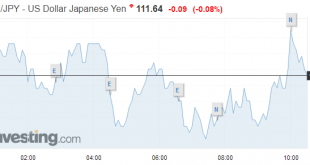

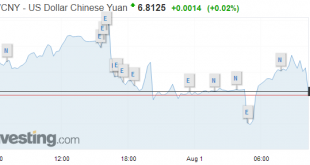

Swiss Franc The Euro has risen by 0.11% to 1.1588 CHF. EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Investors recognize the risks to growth posed by the tariffs and counter-tariffs being imposed, but the way the US is going about it is also disconcerting. Within a few hours of signals that the US and China were looking to re-engage...

Read More »Tensions Beyond Trade

Chinese officials do not seem to appreciate the extent of its isolation. The disruption from the US as Trump positions the US as a revisionist power-one that wants to alter the world order, which it was instrumental in constructing, may have obscured the fact that China’s practices are a source of frustration and animosity broadly and widely. Chinese officials do not seem to understand why Europe, for example, does not...

Read More »FX Daily, July 31: BOJ Prepares for QE Infinity

Swiss Franc The Euro has risen by 0.15% to 1.1582 CHF. EUR/CHF and USD/CHF, July 31(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Japanese yen has been sold following the adjustments to policy and outlook by the BOJ that will allow the unconventional policies continue for an “extended period of time.” Cross rate pressure and month-end demand have lifted the...

Read More »Great Graphic: USD Pushes Below CAD1.30

For the first time since mid-June, the US dollar has traded below CAD1.30. The greenback is weaker against all the major currencies. However, for the most part, it is still in well-worn ranges, which makes the breakdown against the Canadian dollar even more notable. It is not clear that today’s break will be sustained. Indeed, we lean against it. However, a bounce back into the CAD1.3040-CAD1.3060 may offer a better...

Read More »FX Daily, July 30: Equities, Bonds, and the Dollar Start Week Softer

Swiss Franc The Euro has fallen by 0.03% to 1.159 CHF. EUR/CHF and USD/CHF, July 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The week’s big events lie ahead. It is seen as the last important week before the dog days of summer when many participants will take holidays. The BOJ’s two-day meeting concludes tomorrow. Speculation that the BOJ is looking for ways to...

Read More »FX Weekly Preview: Three Central Bank Meetings and US Jobs data

The week ahead sees three major central bank meetings and the US employment report. It will likely be the most important work before a hiatus that runs through the end of August. Of course, and perhaps more than ever, market participants are well aware that the US President’s communication and penchant for disruption is a bit of a wild card. That said, the equity market has learned to take individual company references...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org