Zurich, 16 March 2021 – Art Basel and UBS announced today the publication of the fifth Art Basel and UBS Global Art Market Report, authored by renowned cultural economist Dr Clare McAndrew. The report integrates insight from a recent survey of 2,569 high-net-worth (HNW) collectors, conducted by Arts Economics and UBS Investor Watch, across ten markets: the United States, United Kingdom, France, Germany, Italy, Hong Kong, Taiwan, Singapore, Mexico, and for the first time Mainland China, as well as data from UBS Evidence Lab. A comprehensive and macro-level analysis of the global art market in 2020, the report analyzes how the COVID-19 pandemic has impacted the market and identifies key trends that will shape the market in 2021 and beyond. The findings include:

Topics:

UBS Switzerland AG considers the following as important: 3.) Swiss Banks, 3) Swiss Markets and News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Zurich, 16 March 2021 – Art Basel and UBS announced today the publication of the fifth Art Basel and UBS Global Art Market Report, authored by renowned cultural economist Dr Clare McAndrew. The report integrates insight from a recent survey of 2,569 high-net-worth (HNW) collectors, conducted by Arts Economics and UBS Investor Watch, across ten markets: the United States, United Kingdom, France, Germany, Italy, Hong Kong, Taiwan, Singapore, Mexico, and for the first time Mainland China, as well as data from UBS Evidence Lab. A comprehensive and macro-level analysis of the global art market in 2020, the report analyzes how the COVID-19 pandemic has impacted the market and identifies key trends that will shape the market in 2021 and beyond.

The findings include:

- Global Sales and Leading Markets: Global sales of art and antiques were an estimated $50.1 billion in 2020, down 22% on 2019, but still above the 2009 recession low, when sales fell by 36% to $39.5 billion. The US market retained its leading position, with a share of 42% of global sales values, with Greater China and the UK on par at 20%. However, Greater China overtook the US to become the largest public auction market, with a share of 36% of sales by value.

- Online Sales: Despite the contraction of sales overall, aggregate online sales reached a record high of $12.4 billion, doubling in value from 2019. The share accounted for by online sales also expanded from 9% of total sales by value in 2019 to 25% in 2020, and notably the first time the share of e-commerce in the art market has exceeded that of general retail.

- HNW Collector Survey, conducted by Arts Economics and UBS Investor Watch:

- Increased interest: 66% of the collectors surveyed felt the pandemic had increased their interest in collecting, 32% reported it had significantly done so. HNW collectors will be active in the market in 2021, with the majority (57%) planning to purchase more works for their collections.

- Instagram as a key channel: Social media continued to be a key channel used by the art market and roughly one third of collectors purchased art using Instagram in 2020.

- Gender: Female collectors spent more than men in 2020, with their median expenditure rising by 13% year-on-year and even higher in the US, UK, France and Mainland China.

- Generational trend: Millennial HNW collectors were the highest spenders in 2020, with 30% having spent over $1 million (versus 17% of Boomers).

- Art fairs: Despite the high number of events being cancelled, 41% of collectors reported that they made a purchase at an art fair in 2020, while 45% reported making one through an art fair’s online viewing room (OVR).

- In-person preference: Around 90% of all HNW collectors surveyed had visited a gallery or art fair online viewing room (OVR) during the year, however, the majority (66%) still preferred to attend a physical exhibition at a gallery or an art fair to view works for sale.

In addition to the UBS and Arts Economics research collaboration on the HNW collectors survey, the report includes UBS Evidence Lab insights on: US consumer confidence and travel, and a foot traffic index comparing commercial galleries, retail and museums in the US. The data illustrates early indications of renewed visits to commercial galleries in 2021, but a steeper path to recovery for museums.

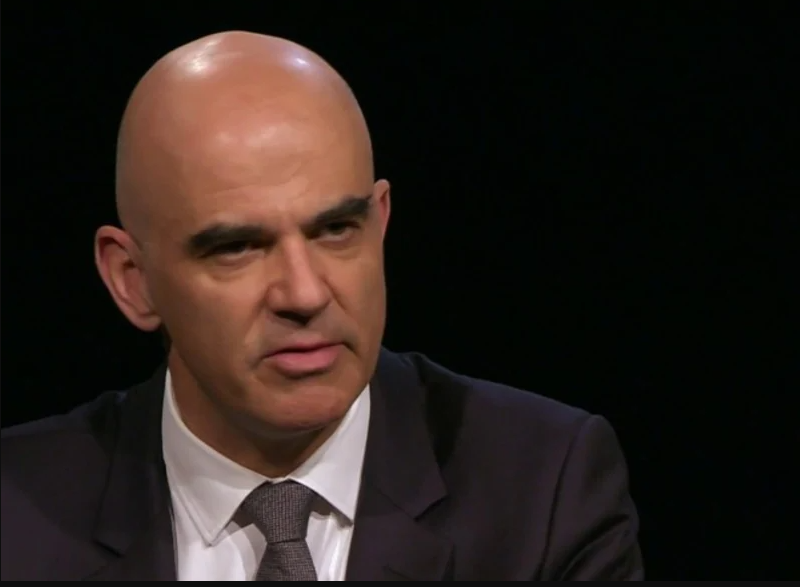

Christl Novakovic, CEO UBS Europe SE, Head Wealth Management Europe and Chair of the UBS Art Board said: “The year 2020 marked a turning point for digital innovation in the art market. The shift to online platforms enabled collecting, increased transparency, and bolstered the market even when national lockdowns forced gallery, live auction, and museum closures. The pandemic proved that we need art to lift our gaze above hardship, to express our views and emotions, and to find levity in trying times. Collectors remained passionately engaged during the hardest moments and devoted to collecting with purpose and a long-term plan.”

Clare McAndrew, Founder, Arts Economics said: “The art market was uniquely placed to struggle with the realities of the COVID-19 pandemic in 2020 as it is populated by mainly small businesses that rely on discretionary purchasing, travel and personal contact. The fall in sales was inevitable. But the crisis also provided the impetus for change and restructuring, the most fundamental shift being the rollout of digital strategies and online sales, which had lagged behind other industries up to now. The art trade showed incredible resilience in how it adapted to some of the new realities, and although businesses are still figuring out how to balance the new more online-based market with the shared experience and excitement of offline sales and events, few see these shifts as transient. One of the most worrying impacts of the pandemic will be its effects on employment, and this economic fallout is likely to extend well into 2021.”

Noah Horowitz, Director Americas, Art Basel said: “The findings from Clare McAndrew’s latest annual report are critical – not only in terms of the insights they provide into one of the most unusual and challenging years the global art market has ever endured, but also in regards to what they portend for the future of our industry. While the market contracted sharply across all sectors in 2020, with declines in both value and volume of sales for dealers and auction houses alike, the resilient interest in collecting throughout it all was profound, as the year also marked a transformative period of innovation, restructuring, and new consumer behaviors, especially online – all of which have the potential to significantly redefine the shape of the art business in the coming period.”

UBS Group AG

Tags: Featured,newsletter