It isn’t just semantics, nor some trivial, egotistical use of quotation marks. There is an actual and vast difference between inflation and “inflation.” And in the final results, that difference isn’t strictly or even mainly about consumer prices. Who cares, most people wonder. After all, what does it really matter why prices are going up so far? The pain this causes is pain regardless of any post hoc pedantry. Insisting on proper terminology, however, is an attempt to get people to focus up on the future, not litigate the past. It may seem the latter, though the stakes are far higher moving forward than debating what has already happened. What happened was never inflation. Sorry, it just wasn’t (and don’t need to take my word for it). But anyone is forgiven for

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Consumer Prices, currencies, economy, Featured, Federal Reserve/Monetary Policy, imports, inflation, Inventory, Markets, newsletter, Retail sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It isn’t just semantics, nor some trivial, egotistical use of quotation marks. There is an actual and vast difference between inflation and “inflation.” And in the final results, that difference isn’t strictly or even mainly about consumer prices.

Who cares, most people wonder. After all, what does it really matter why prices are going up so far? The pain this causes is pain regardless of any post hoc pedantry.

Insisting on proper terminology, however, is an attempt to get people to focus up on the future, not litigate the past. It may seem the latter, though the stakes are far higher moving forward than debating what has already happened.

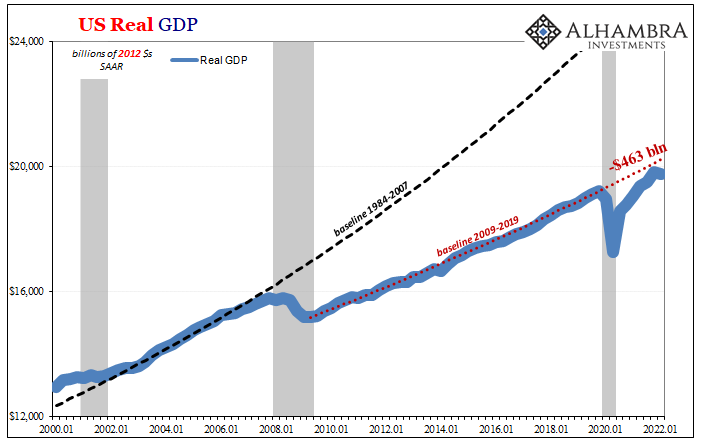

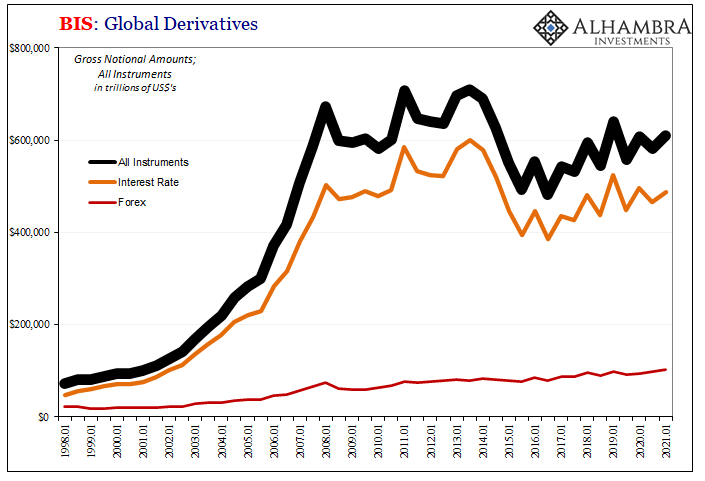

| What happened was never inflation. Sorry, it just wasn’t (and don’t need to take my word for it). But anyone is forgiven for believing otherwise. The term was thrown around wildly by practically everyone from the studious and stuffy Economist to the local media commentator along with laypersons all over the world.

Anyone who dared correct the matter was immediately accused of the current culture’s equivalent blasphemy, at best being astonishingly obtuse. It was 1979 all over again, they boisterously declared, without the first idea what actually happened in the (sixties and) seventies.

This misidentification was near universal. Big Execs at Big Companies tasked with doing the Big Things, just like everyone else they, too, all surrendered easily to the sordid spell of what had been a price illusion. Easily confusing accelerating CPIs for accelerating legit recovery because who has ever been shown the difference? As with all things, it starts with Economics. To this day, companies big and small use mainstream, neo-Keynesian econometric models (packaged neatly into sellable though useless products like the Blue Chip Economic Survey) to forecast and make crucial business decisions. Neo-Keynesians and their models simply love the idea of “stimulus.” In fact, they love it so much whenever any government does anything and slaps that label on whichever newest program, econometricians rush to update their simulations with presumed positive results. They’ll claim to the final days of Earth that “stimulus” produces a multiplier greater than one. |

|

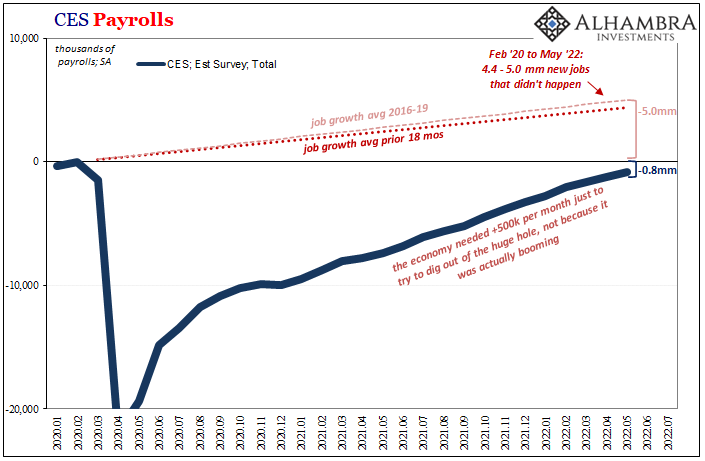

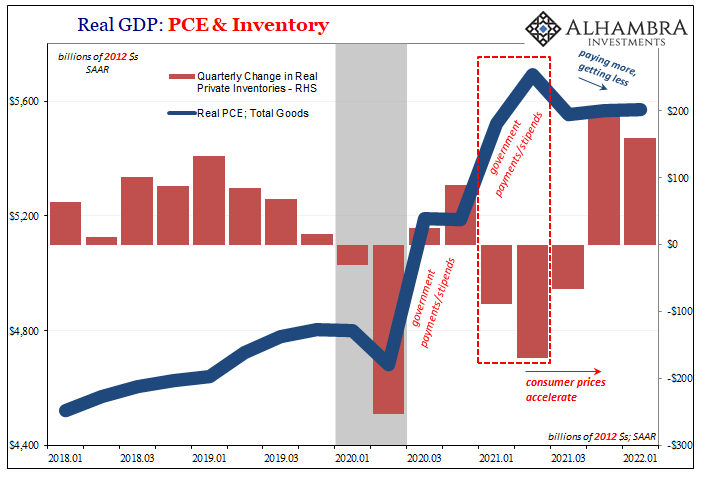

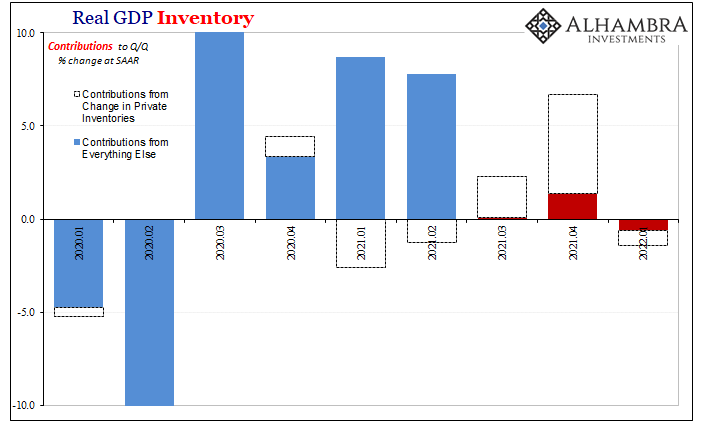

| When Spring 2021 turned to Summer 2021, Economists told their various Big Corporate Customers that Uncle Sam’s massive helicopter drop (which wasn’t a true helicopter no matter how many times people say it was; redistribution at best) would not only shift the demand curve in the US, it would shift it for much of the world and, best part, make that shift permanent (their greater-than-one multiplier).

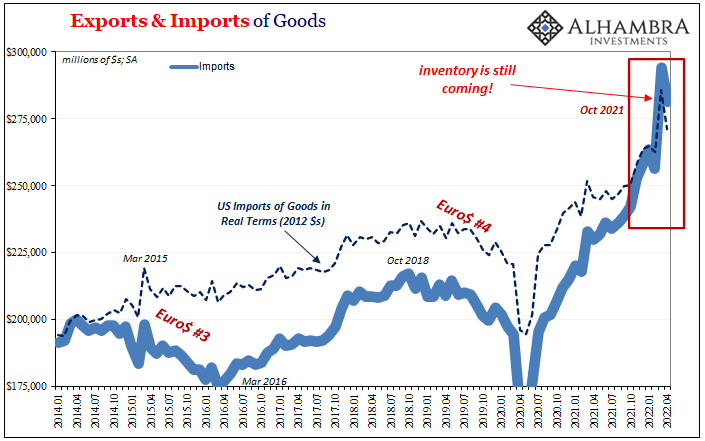

Big Business at that time was focused elsewhere, struggling with other worries, notably railroads, truckers and chassis, West Coast port problems, you remember the things. Having just been told that demand had been Big Time Juiced, and that it was going to stay juiced, with dollar signs (rather than eurodollars) in everyone’s eyes the race was on to order everything and anything. Just make it, companies cried, and get it here as fast as humanly possible!

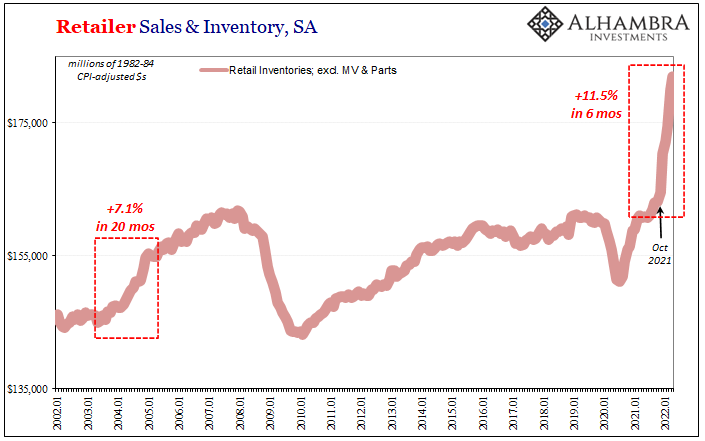

Overordering in such crude fashion was a complete afterthought, not even a worry because, greater-than-one multiplier, the models all said as frenzied as 2021 was turning out to be (though not for service providers; maybe that should’ve figured in here somewhere first), 2022 would be even better. Just make the stuff, get it on a boat and moving. They even called it “investment”; as in, inventory. On its third quarter conference call held last November 17, Big Box Retail Giant Target (not the official company name) referred to its smart inventory investment repeatedly. Boasted their foresight. |

|

But you could tell the purpose wasn’t making investments, it was going the extra mile (literally, in some cases) for the sweet smell of consumer opportunity.

Just how “healthy” was Target’s “position overall?”

Also the few weeks after those. Then several more weeks. Months. Many months. And it’s still coming (see: imports for April 2022, latest data below). |

|

| Despite entering the holiday season with a third more inventory than during 2019’s rather crappy Christmas shopping, no one was worried. Say it with me, greater-than-one demand multiplier.

Economics had mixed up supply shock with inflation, and passed it along as recovery to the world. Even now fixing the mistake is near impossible (see: media). The difference between genuine inflation (money, always money) and “inflation” is starting to take hold. To begin with, it had been Target along with Walmart which recently had admitted consumers were changing spending habits. And not in the way econometrics had pre-assigned. |

|

Today, Target is back in the news because of, surprise, inventory. Apocalyptic inventory, though the mainstream press is having a doozy of a time trying to make sense of what’s going on.

Even now, the media doesn’t get it right, can’t get it right; look at the first sentence of the second paragraph. |

|

| Utter nonsense in Chicago, to which the Tribune adds, “The speed at which Americans pivoted away from pandemic spending was laid bare in the most recent quarterly financial filings from a number of major retailers.”

Pivoted away from spending, period. Clinging to the inflation narrative to the bitter end, an end whose expiration was both predictable as well as now in sight. “Inflation” contrary to inflation is a harmful redistribution of economic spending power and resources, having little or nothing to do with excessive money or currency (which we know never happened because the monetary system itself continuously said so). Someone once observed how fools and their money are easily parted. What about fools chasing what they thought was money into inventory? They can’t even give it away. And it’s not just Target who is about to try. All because it was never inflation. |

|

Tags: Consumer Prices,currencies,economy,Featured,Federal Reserve/Monetary Policy,imports,inflation,Inventory,Markets,newsletter,Retail sales