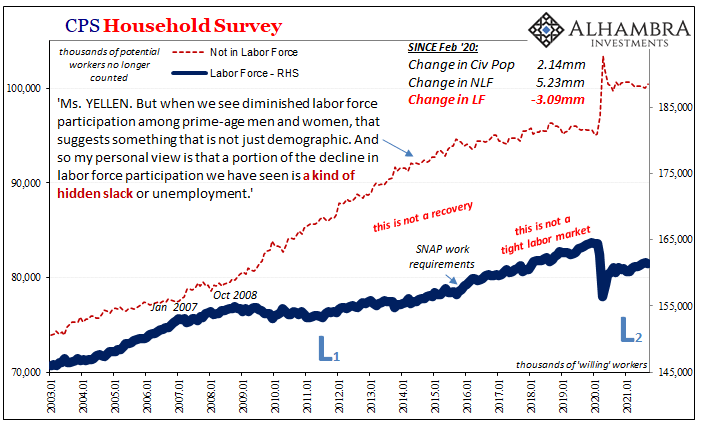

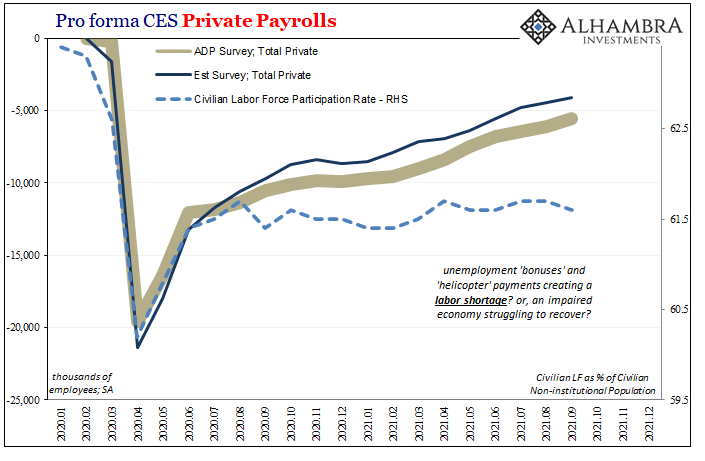

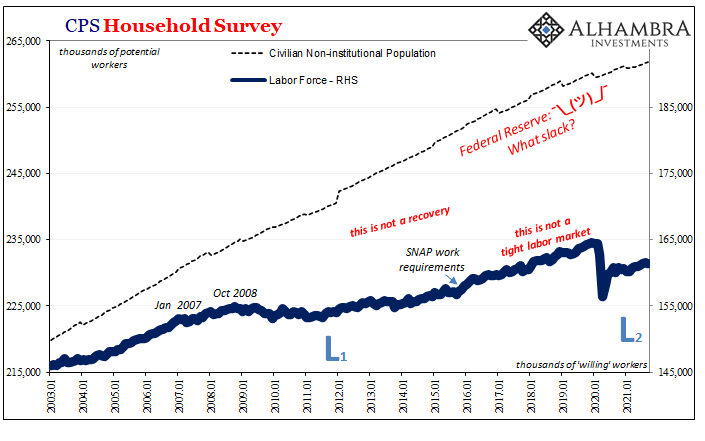

Here we are again. The labor force. The numbers from the BLS are simply staggering. During September 2021, the government believes it shrank for another month, down by 183,000 when compared to August. This means that the Labor Force Participation rate declined slightly to 61.6%, practically the same level in this key metric going back to June. Last June. These millions, yes, millions (see: below), are being excluded from the official labor force therefore unemployment rate because they admit to the government’s data collectors they haven’t looked for work at any time during the last four weeks. The simplest, most intuitive reason to explain why is that those keeping themselves out of the labor force – like in 2017-18 – understand the macro situation in a way that

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, civilian non-institutional population, currencies, economy, employment, establishment survey, Featured, Federal Reserve/Monetary Policy, household survey, inflation, jobless claims, labor force, labor force participation rate, Labor market, Markets, newsletter, participation problem, payrolls, Unemployment Benefits, unemployment rate

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Here we are again. The labor force. The numbers from the BLS are simply staggering. During September 2021, the government believes it shrank for another month, down by 183,000 when compared to August. This means that the Labor Force Participation rate declined slightly to 61.6%, practically the same level in this key metric going back to June.

Last June. These millions, yes, millions (see: below), are being excluded from the official labor force therefore unemployment rate because they admit to the government’s data collectors they haven’t looked for work at any time during the last four weeks. The simplest, most intuitive reason to explain why is that those keeping themselves out of the labor force – like in 2017-18 – understand the macro situation in a way that central bankers and Economists (therefore the media) refuse. |

|

| There’s no point in seeking a job because there aren’t enough or enough good enough jobs available. Why bother wasting their time? Recent employment “growth” hasn’t been legit growth at all, just reopening of the last parts of the US which had remained closed the longest.

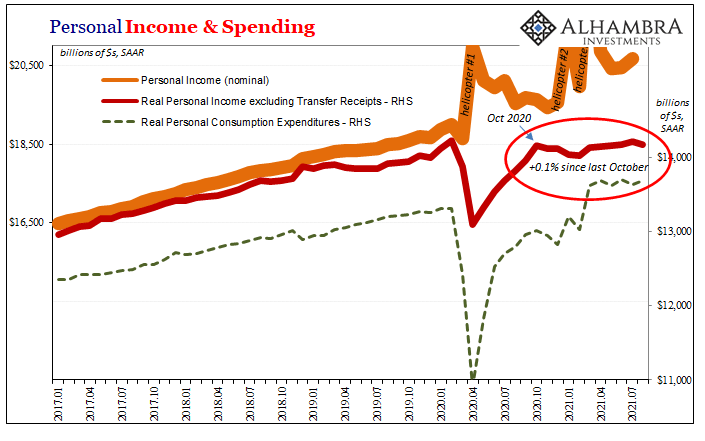

No. No. No, the media assured us. These weren’t really workers, they were lazy Americans sitting idle on government-funded vacations, fattened by extra-generous transfer receipts as well as unemployment benefits. And those who weren’t lazy had been parents stuck home babysitting their own children with so many schools shuttered by lawyers. Everyone says the job market is somewhere between outright awesome and indescribably terrific. |

|

| Positively overheated. Once the benefits ran out, and schools all open, they’d surely flood back into the labor picture.

That just so happens to have been September 2021; the same month when, as stated at the outset, the labor force dropped another nearly 200k. Maybe the employment situation – in reality – isn’t quite so rosy? Before even pondering the possibility, the next benign “explanation” has already been cued up and readied for print: vaccine mandates (though it’s left intentionally unclear why being unable to meet these new corporate policies would convince so many of the formerly employed to exit the labor force entirely, but we’re not meant to think too hard on this stuff, just trust that the labor market is about to set inflationary fire to the economy). |

|

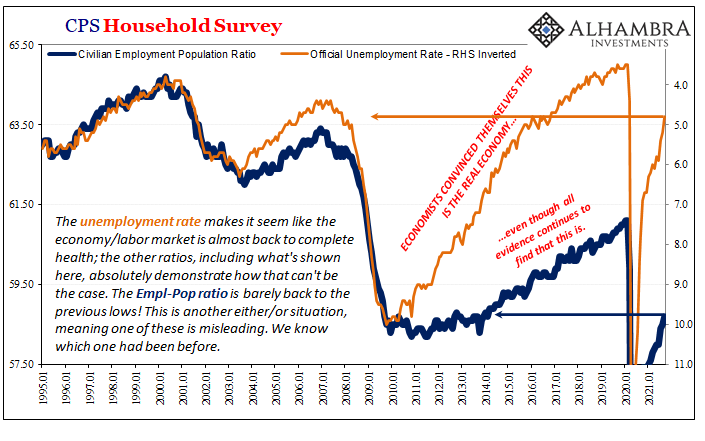

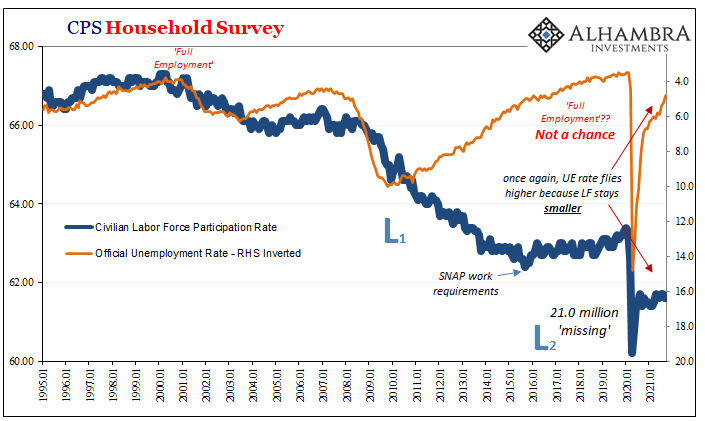

| It’s always something, isn’t it? Cursed American non-workers had been slandered as lazy and drug addicted for years and years before anyone heard of COVID if only to avoid facing up to dismal policy failure. Once again, the participation problem “flourishes” while the unemployment rate drops like a rock. Without so many millions in the labor force, the latter now stands at just 4.8% after having declined by 0.6 points in only the past two months.

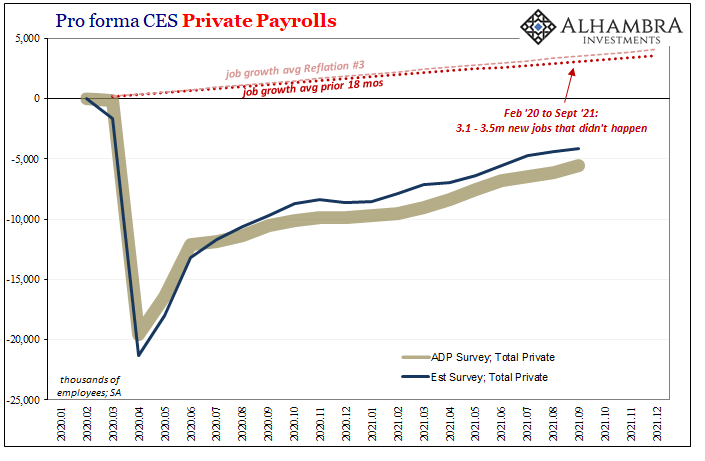

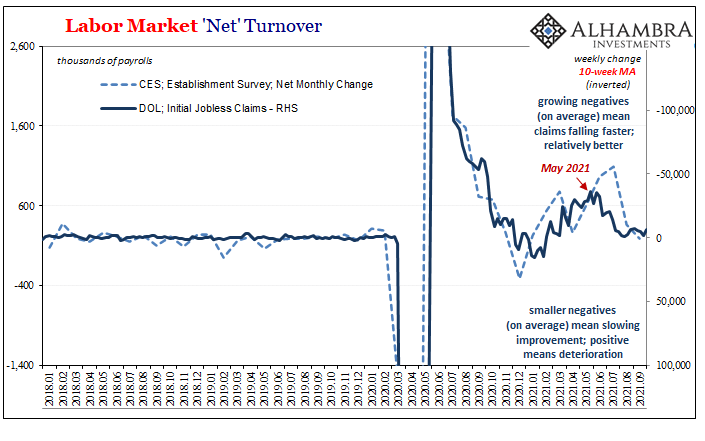

These are the same two months, August now September, when the Establishment Survey underwhelmed, to put it kindly. Though the previous month, August, was revised up by more than a 100k, the net purported gain for headline payrolls even after is just 366,000; barely a decent number for pre-2020. |

|

| In light of both the huge existing jobs deficit (compared to February 2020) as well as the absolute need to catch up on the 3.1 to 3.5 million jobs which never happened in that same timeframe, a timeframe which today stretches more than a year and a half, American workers really do need million-payroll months one after another. Anything less than that and…

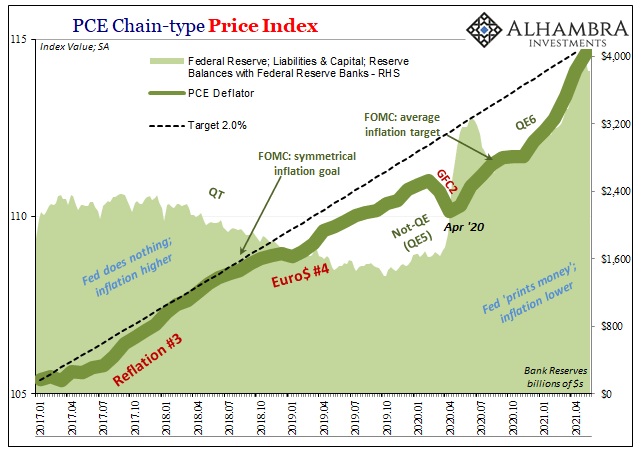

Therefore, this latest payroll gain for September, only 194,000, makes two in a row nowhere near that pace which was supposed to have convinced Federal Reserve policymakers to taper their (irrelevant) QE6. |

|

| I seriously doubt, however, that after having so publicly committed to tapering on so many recent occasions Jay Powell and his confused group will change course now. They can’t. Since “monetary” policy is non-monetary, its true purpose is to manipulate emotions like confidence. Tapering QE, therefore, projects Fed confidence in a way those at the Fed believe leads to real confidence in the real economy (people theoretically just believe what they are told).

Without the anticipated massive headline payroll gains each of the last two months, policymakers will simply fall back anyway to what’s always been their first love: the unemployment rate. At just 4.8% for September, it again loves them equally since it gives officials an easy and relatable number to point to which they’ll say justifies tapering QE leading quickly thereafter to rate hikes. This low of a UE rate is supposed to be in the range of max employment therefore labor market tightness meaning inflation pressures. You know, the very same argument the very same people all made using the very same suspect statistic just three years ago. In case anyone forgot, it didn’t work out the way anyone might’ve hoped then. |

|

| This is why the labor force drop has to be explained in some other way. For one, unable to do so back in 2018 revealed that it really had been “hidden macro slack” holding the economy back, to borrow Janet Yellen’s a-little-too-honest-for-the-Fed phrase.

More importantly, confidence. If this stubbornly lower level of labor force participation really is due to the same conditions and problems as the last time, lack of sufficient economic recovery, then this effectively undercuts the entire idea and purpose of tapering QE; the Fed wants to project confidence in the labor situation and overall economy when the changes to the labor force itself allude to clear and serious doubts about those same things, and more than that discouraged workers are acting on those doubts as they drop out and continue to stay out. |

|

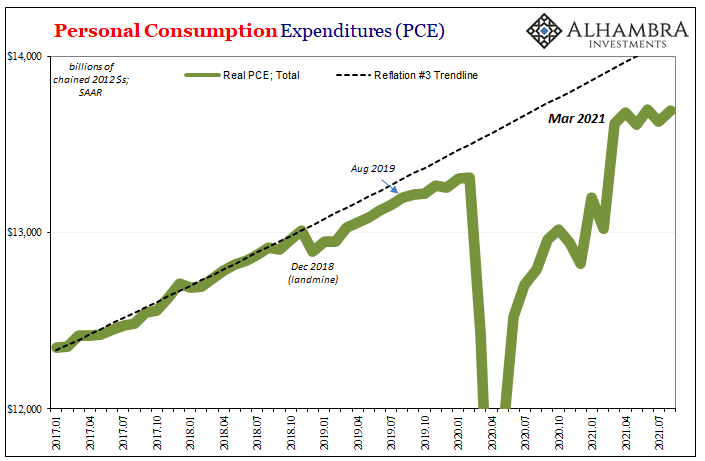

| These past few payroll “misses” were, at the very least, previously suggested by jobless claims; our simple labor market “model”, more of a back-of-the-envelope doodle, had previously warned that employment growth had very likely dropped off significantly for whichever reasons. I believe, even more so with the September payroll report and its variety of consistent data, the outlined soft patch in Q3’s economy a product of the same situation plaguing the rest of the global system since around April.

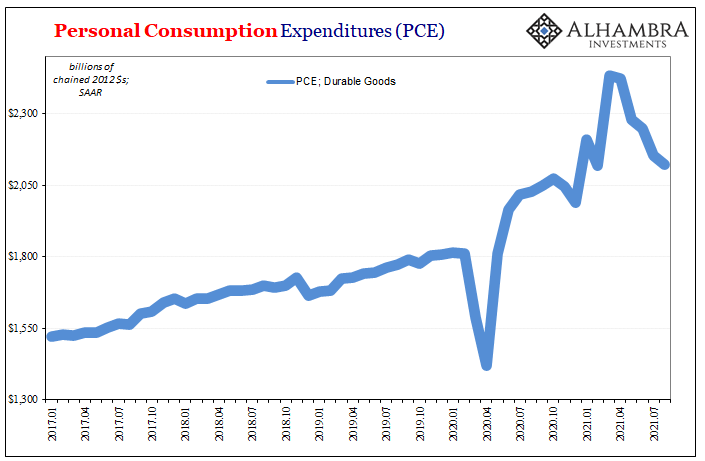

A looming global slowdown, to start. The US, in particular, had been juiced up to the max by government transfers, of several kinds including unemployment benefits. This merely created the illusion that the economy was on track to fully recover if not go further into inflation, real inflation, territory. Neo-Keynesians always, always assume government “stimulus” is effective and long-lasting, assigning each instance it is used a multiplier greater than one (sometimes far greater). Another reason to deny labor force performance. |

|

| History has instead proved, beyond doubt (see: Bush helicopter, as one germane example), at best a short run impact which leaves no lasting positive impression upon either labor or general economic circumstances. With the last batch of helicopter “stimulus” fading further into increasingly ancient history, we are left with the same economic deficiencies as those when the economy began the helicopter period.

In terms of the labor force, especially those millions upon millions outside of it, there’s reopening and then there’s economic growth. These are two very different factors; one non-economic, the other highly macro. As we’ve been writing since the very first month of reopening, back in May 2020, the former has happened even as the latter continues to be absent. The public has been confused and misled as reopening combined with, and coincident to, the government-fueled goods frenzy made a recovery appear plausible – even made it seem like it was already taking place – when the behavior of the labor force itself displayed this tremendous difference. It truly is 2018 all over again. The unemployment rate will give Jay what he wants, everything else necessarily excluded. History repeats because hawks need to f(lie). |

|

Tags: civilian non-institutional population,currencies,economy,employment,establishment survey,Featured,Federal Reserve/Monetary Policy,household survey,inflation,jobless claims,labor force,labor force participation rate,Labor Market,Markets,newsletter,participation problem,payrolls,Unemployment Benefits,unemployment rate