American consumers were back in action in January 2021. The “unemployment cliff” along with the slowdown and contraction in the labor market during the last quarter of 2020 had left retail sales falling backward with employment. Seasonally-adjusted, total retail spending had declined for three straight months to end last year. The latest updated estimates from the Census Bureau, released today, show that December’s drawback, in particular, was much larger than previously figured – small wonder given just how many unemployed Americans ended up falling off that “cliff.” Revised downward by an unusually large -.4 billion, it really had been the weakest holiday season since 2009’s. Uncle Sam, however, came riding to the rescue at the end of last year. Fixing (at

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, consumer spending, currencies, economy, employment, Featured, fiscal aid, Government spending, Labor market, Markets, newsletter, Retail sales, stipends

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

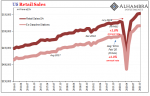

| American consumers were back in action in January 2021. The “unemployment cliff” along with the slowdown and contraction in the labor market during the last quarter of 2020 had left retail sales falling backward with employment. Seasonally-adjusted, total retail spending had declined for three straight months to end last year.

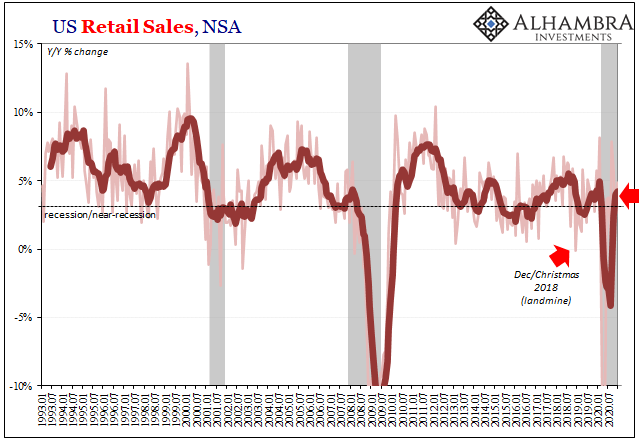

The latest updated estimates from the Census Bureau, released today, show that December’s drawback, in particular, was much larger than previously figured – small wonder given just how many unemployed Americans ended up falling off that “cliff.” Revised downward by an unusually large -$3.4 billion, it really had been the weakest holiday season since 2009’s. Uncle Sam, however, came riding to the rescue at the end of last year. Fixing (at least reupping) first the unemployment insurance mess, in behind was a series of $600 payments that put digital cash money into most American pockets (who needs the Fed, asks MMTers). The injection of stipends account for the boosted spending in January 2021. By just how much, it’s not clear. For one thing, spending activity has become highly volatile given what’s driving it. Government and politics together are not a good way to produce a solid, straight-line recovery. As retail sales had peaked back in September 2020, and then fell back, the exceedingly large margins of consumer economic activity get bounced around for these non-economic reasons. |

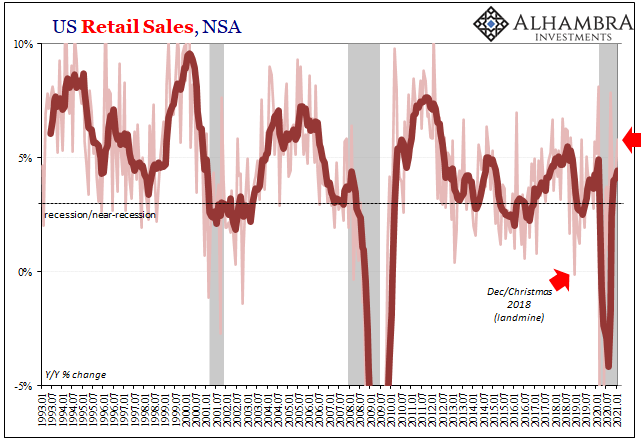

US Retail Sales, NSA 1993-2021 |

| Аnd then for January, for reasons that aren’t clear, the Census Bureau applied a much larger seasonal adjustment than otherwise seems warranted (residual seasonality?) Unadjusted, total retail sales rose 5.80% year-over-year last month. While somewhat better than the pre-COVID figures which had been closer to recessionary 3% levels, this is still it’s nowhere near “V” shaped even with all the $600 payments floating around.

Seasonally-adjusted, however, that series indicates instead a 7.3% gain in January 2021 when compared to January 2020. Typically, a discrepancy that large between adjusted and unadjusted is easily attributable to holiday differences. In this case, outside of New Year’s Day being on a Friday, and thus subtracting activity from the first weekend being overly revelrous, there’s no obvious reason for a higher seasonally-adjusted estimate. Using it anyway, what we find is simply that consumer spending which didn’t happen during the final three months of 2020 was made up in the first one of 2021. Using a crude baseline (off Reflation #3), we can estimate that retail sales starting October through January “would” have been about $2.207 trillion had there been no recession. Today’s estimates, including the sharp downward revision to December, put total spending during those four months at $2.205 trillion. |

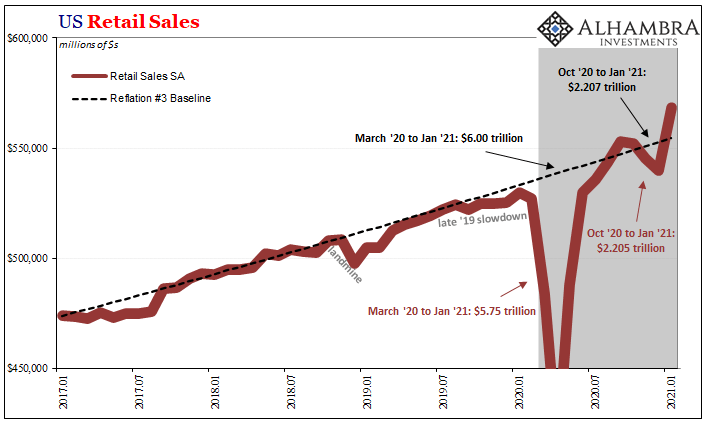

US Retail Sales, 2017-2021 |

| In other words, it appears that after being unable to keep up while negative factors weighed on everything from jobs to sentiment, with the federal government filling in at the end of December consumers could and might have made up the difference in one month; postponed spending.

Going further back to the start of the recession in March, total retail sales “would” have been just a touch over $6 trillion during those eleven months up to and including January. They actually came in at $5.75 trillion, or $250 billion short of the COVID-less baseline trajectory. While a good deal of it has been due to stipends and entitlement-type aid, some of it has been from American consumers foregoing – or being unable – to spend on services. Savings are up, services remain down, and activity in goods somewhere in the middle. And that middle is obviously influenced mostly by those federal government checks rather than the all-too-large margins of official and hidden unemployment. |

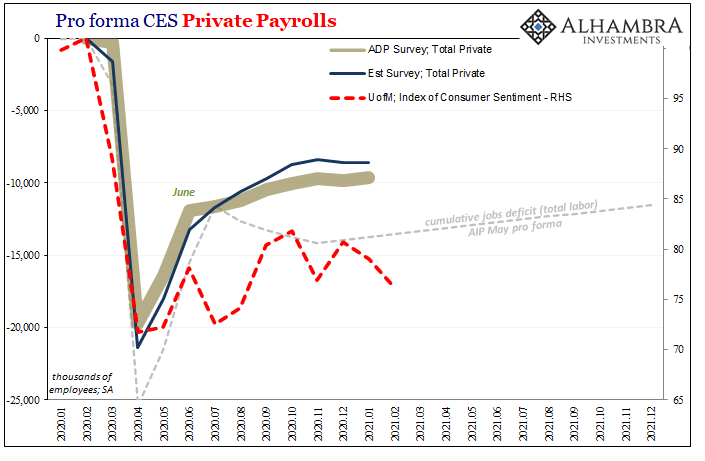

Pro forma CES Private Payrolls, 2020-2021 |

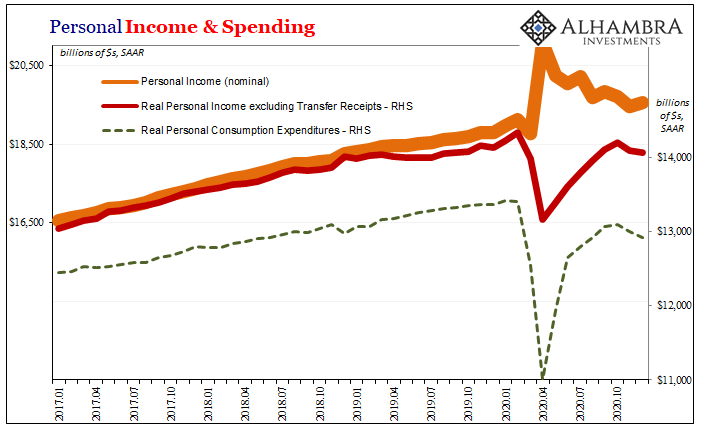

| That’s how we reconcile retail sales overall with the wider PCE figures (which include services) and then consumer confidence which remains like employment much closer to the lows/trough. Americans spent in January what the couldn’t to close out December, but clearly weren’t thrilled about why that had been.

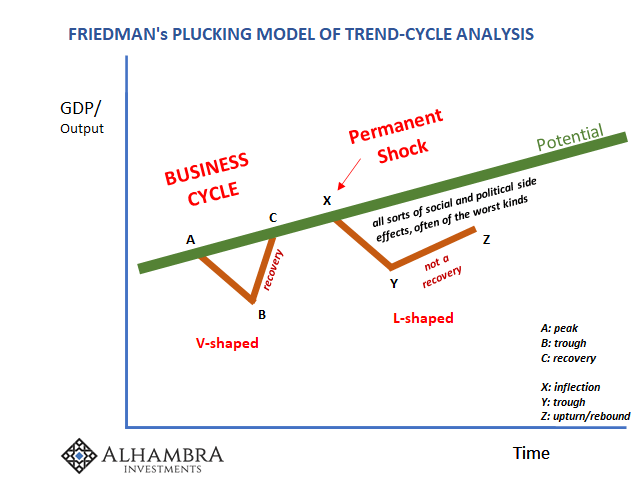

This is, in fact, this year’s entire hope-filled sentiment in a nutshell; that the government can continue to keep things moving along, or appear to be doing enough, so that given enough time actual recovery mechanics can take up the slack (literally), leaving the economy free to get itself back to normal. The question is whether or not that’s even possible; is the primary issue one of time, or has it become now one related to potential and capacity? If the only thing holding the system back still up through January 2021 is still the pandemic, then the combination of federal government aid and vaccines creates is so much better than the alternative. However, if the employment market is a more reliable assessor of the situation, and longer run potential has truly been harmed (so many particularly small businesses closed for good), then that would mean continuing forward sort of in this same situation where Uncle Sam rather than hiring determines the outward appearance of economic health. |

Personal Income & Spending, 2017-2020 |

| Can the government buy a recovery? It is going to try, that’s for sure.

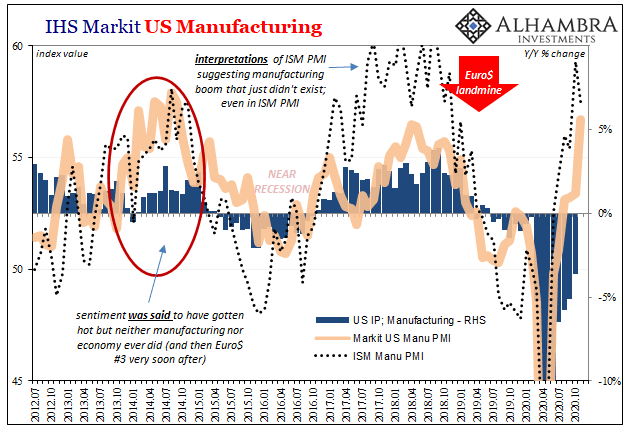

While it seems like Treasury did at least for January (seasonally adjusted), it had also seemed that way in September, too, but, importantly, it didn’t stick that way. There remain the more volatile swings in activity which do have negative impacts beyond simply the permanent income hypothesis. As noted here, while the BLS has yet to update its labor numbers for this series beyond the second quarter’s deep contraction, what the alternative labor data shows is how crushing even the temporary disruption to the economy had been. Of the 16.4 mm jobs lost, on net, in the private economy during the first half of 2020, 6.8mm (41% of net losses) of those were at small businesses (those with between 1 and 99 employees) despite this category having employed just 34.7% of all employees during Q1 last year. Large businesses (1,000 employees or more) shed “only” 5.7 mm (35%), though these had accounted for more than 41% of all workers. |

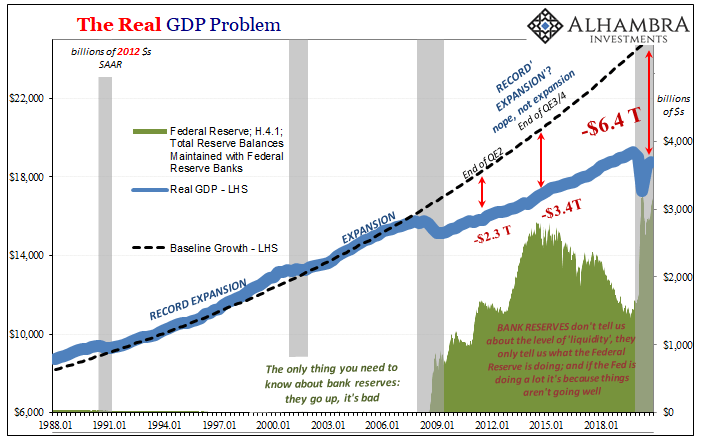

The Real GDP Problem, 1988-2021 |

Small businesses just can’t afford to withstand wild swings in actual business, even those that made it through last year’s first half. This lost capacity (and we don’t yet know how each class has fared during the rebound, though we can reasonably presume which class has come back relatively better) is why the labor market – rather being from COVID alone – has struggled so much, therefore why spending and economic activity (and remember GDP was only 4% in Q4) didn’t come out with a “V.”

The government can (because of overwhelming demand in the Treasury market, even as long end yields rise) and should aid workers and especially small businesses where even remotely possible. This is not, and has not been, “stimulus.” And if what’s holding back the economic rebound is much more than the pandemic panic, Uncle Sam’s payments will have to continue being the largest marginal factor.

Tags: consumer spending,currencies,economy,employment,Featured,fiscal aid,government spending,Labor Market,Markets,newsletter,Retail sales,stipends