On one hand, UBS seems hell bent on keep its new Gen Z employees who have recently been promoted to associate positions. After all, it was just hours ago that we wrote about how the bank was showering some newly promoted employees with one-time ,000 bonuses. Yet on the other hand, UBS apparently isn’t as determined to hang on to certain other employees. The bank has reportedly re-started its “Reduction in Force” job cut plan this week, according to Bloomberg, who cited Inside Paradeplatz. Inside Paradeplatz, citing unidentified people familiar with the matter, said that the bank has “started giving notice to employees” of the layoffs. The bank reportedly pointed to “planned savings” for its reasoning, without identifying further details about the planned

Topics:

Tyler Durden considers the following as important: 1.) Zerohedge on SNB, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

On one hand, UBS seems hell bent on keep its new Gen Z employees who have recently been promoted to associate positions. After all, it was just hours ago that we wrote about how the bank was showering some newly promoted employees with one-time $40,000 bonuses.

Yet on the other hand, UBS apparently isn’t as determined to hang on to certain other employees. The bank has reportedly re-started its “Reduction in Force” job cut plan this week, according to Bloomberg, who cited Inside Paradeplatz.

Inside Paradeplatz, citing unidentified people familiar with the matter, said that the bank has “started giving notice to employees” of the layoffs. The bank reportedly pointed to “planned savings” for its reasoning, without identifying further details about the planned layoffs. The bank also didn’t comment to Bloomberg, when asked.

The action seems to stand at odds with the bank’s recent push to retain its global banking analysts when they are promoted. Recall, we wrote this week that the bank was going to pay a one time $40,000 bonus to its global banking analysts when they are promoted – reportedly double what some of the bank’s competitors are offering.

The bank is planning on paying the bonus to analysts who are promoted to associates, on top of regular salary increases. It marks a bonus that is about 30% of the base pay of a newly promoted associate, we wrote, citing BNN Bloomberg.

Recall, last month, junior bankers at Goldman Sachs spoke out about long hours worked during the SPAC boom. Their public outcry catalyzed a trend of other banks and employers rushing to kiss the ass of their respective employees to avoid turnover, and (likely more important) a PR crisis.

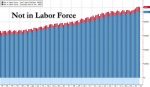

We have also noted at length the ongoing labor shortage that has developed as a result of the government paying the unemployed more to stay home than they would make in the labor force. Trillions in Biden stimulus has incentivized workers to not seek gainful employment, but rather to sit back and collect the next stimmy check for doing absolutely nothing in what is becoming the world’s greatest “under the radar” experiment in Universal Basic Income.

Even more amazing: a stunning 91% of small businesses surveyed by the NFIB said they had few or no qualified applicants for job openings in the past three months, tied for the third highest since that question was added to the NFIB survey in 1993.

UBS told Zero Hedge: “This bonus was announced weeks ago as part of overall changes implemented for junior bankers that focus on improving their wellbeing. It coincided with moving the timeline of our Analyst performance and reward cycle to mid-year to bring us in line with general market practice.”

The company employs about 73,000 staff across 50 countries.

Tags: Featured,newsletter