In the third quarter of 2020, the current account surplus amounted to CHF 9 billion, CHF 3 billion less than in the same quarter of 2019. This decline was particularly due to the lower receipts surplus in trade in goods and services. In the case of the goods trade, the decline was attributable to gold trading. This decrease was curbed by the expenses surplus for primary and secondary income, which decreased compared to Q3 2019. In the financial account, reported transactions in the third quarter of 2020 showed a net acquisition of financial assets (CHF 40 billion) and a net incurrence of liabilities (CHF 27 billion). The acquisition on the assets side was the result of intragroup lending (direct investment) and the SNB’s purchases of foreign currency (reserve

Topics:

George Dorgan considers the following as important: 1) SNB and CHF, 1.) SNB Press Releases, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

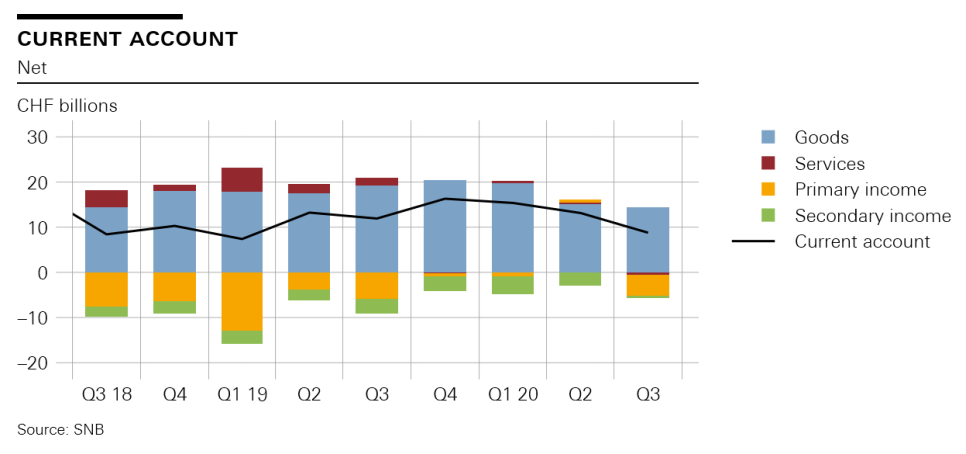

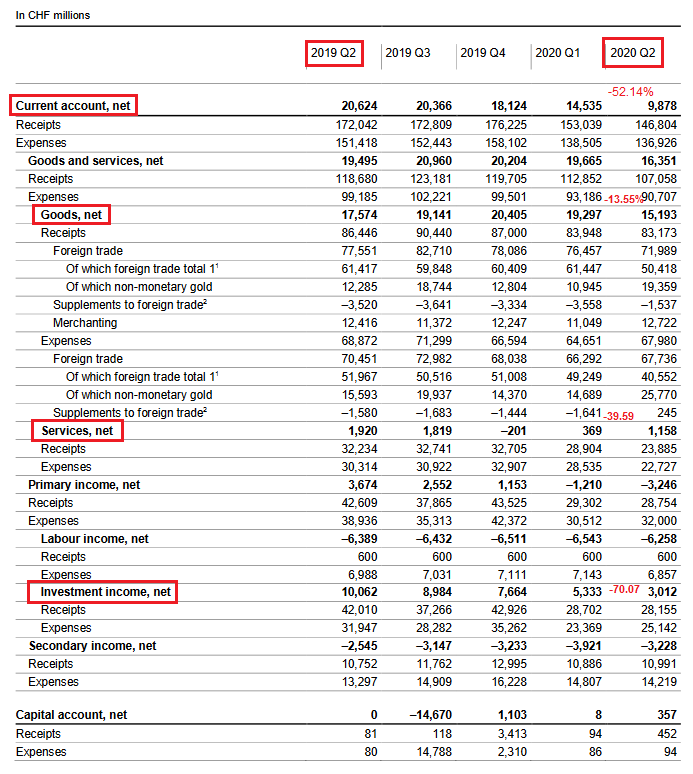

| In the third quarter of 2020, the current account surplus amounted to CHF 9 billion, CHF 3 billion less than in the same quarter of 2019. This decline was particularly due to the lower receipts surplus in trade in goods and services. In the case of the goods trade, the decline was attributable to gold trading. This decrease was curbed by the expenses surplus for primary and secondary income, which decreased compared to Q3 2019.

In the financial account, reported transactions in the third quarter of 2020 showed a net acquisition of financial assets (CHF 40 billion) and a net incurrence of liabilities (CHF 27 billion). The acquisition on the assets side was the result of intragroup lending (direct investment) and the SNB’s purchases of foreign currency (reserve assets). On the liabilities side, the net incurrence was attributable in part to the takeover of resident companies by nonresident investors (direct investment). There was also a net incurrence in the case of other investment; while the SNB reduced its liabilities towards non-residents, commercial banks recorded an increase in their cross-border liabilities towards banks (interbank market) and customers alike. Including derivatives, the financial account showed a balance of CHF 10 billion. |

Current Account Q3 2018-Q3 2020(see more posts on Switzerland Current Account, Switzerland Financial Account, ) |

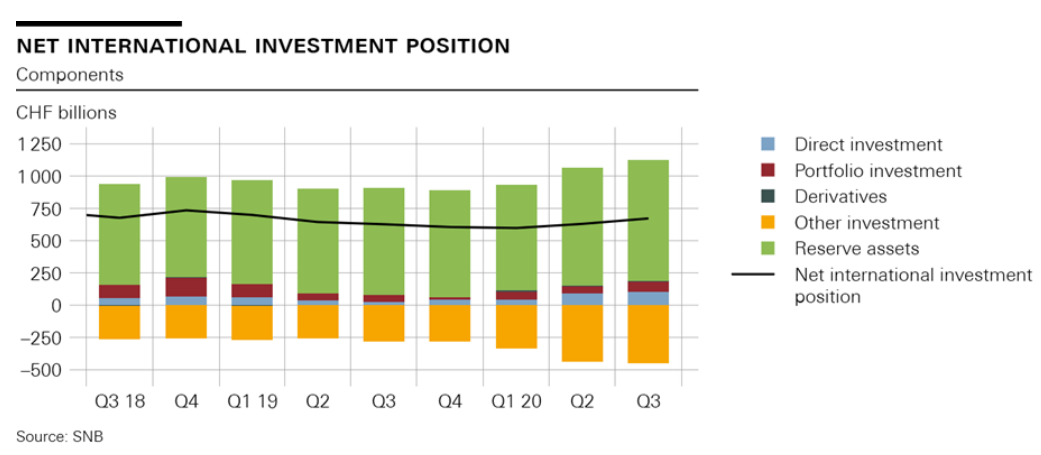

| The net international investment position rose by CHF 42 billion quarter-on-quarter to CHF 672 billion. Stocks of assets were up by CHF 56 billion to CHF 5,255 billion in the third quarter of 2020, while stocks of liabilities increased by CHF 14 billion to CHF 4,583 billion.

On both sides, this increase was a result of the same factors: the transactions reported in the financial account and the valuation gains due to higher prices on the stock exchanges in Switzerland and abroad. Exchange rate-related valuation losses resulting from the weakness of the US dollar against the Swiss franc had the opposite effect. |

Net international investment position, Q3 2018-Q3 2020 |

Data revisions

The data on the balance of payments and international investment position take into account revisions, some of which go back to the year 2000. These revisions have arisen as a result of closing a data gap, and newly available information from reporting institutions. This has led to a sharp decrease in the net international investment position and the primary income balance in the current account. More detailed information on the revisions can be found on the SNB data portal.

New data available on merchanting

The SNB is expanding the range of data it provides on Switzerland’s current account. Two new tables are now available on merchanting: Goods sales, by goods category and Goods purchases/sales, by country. The data go back to the year 2012.

Tags: Featured,newsletter