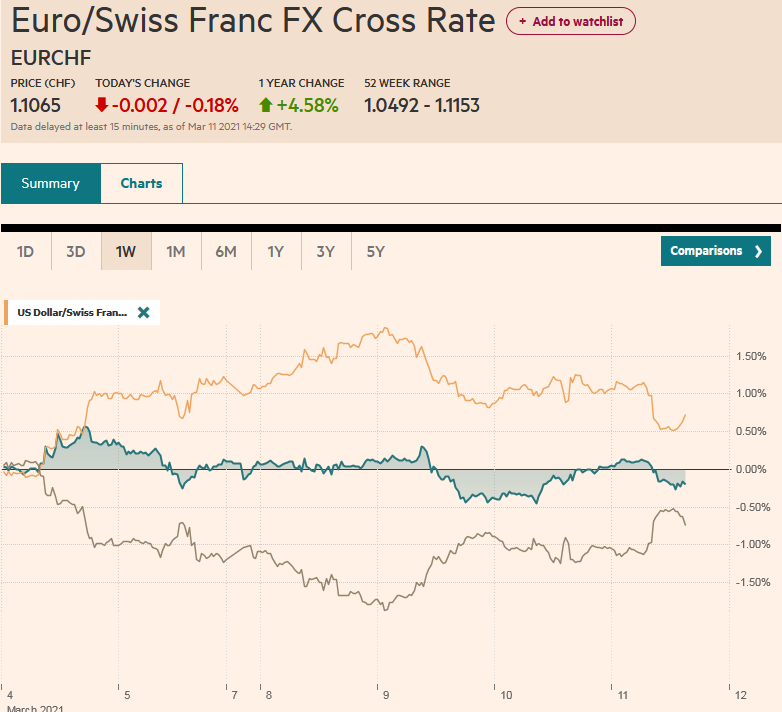

Swiss Franc The Euro has fallen by 0.18% to 1.1065 EUR/CHF and USD/CHF, March 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Even though the NASDAQ closed lower yesterday and the reception of the 10-year Treasury auction did not excite, market participants are growing more confident. Led by China, the major markets in the Asia Pacific region rallied. The Shanghai Composite’s 2.35% gain not only snaps a five-session slide but is the largest rally since last October. Europe’s Dow Jones Stoxx 600 is stretching its advance into a fourth session and is up around 3.5% this week. US futures are pointing to a gap higher opening. Meanwhile, benchmark yields are softer, and the US 10-year note yield is below 1.50%

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, bonds, Currency Movement, ECB, Featured, JPY, newsletter, Oil, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.18% to 1.1065 |

EUR/CHF and USD/CHF, March 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

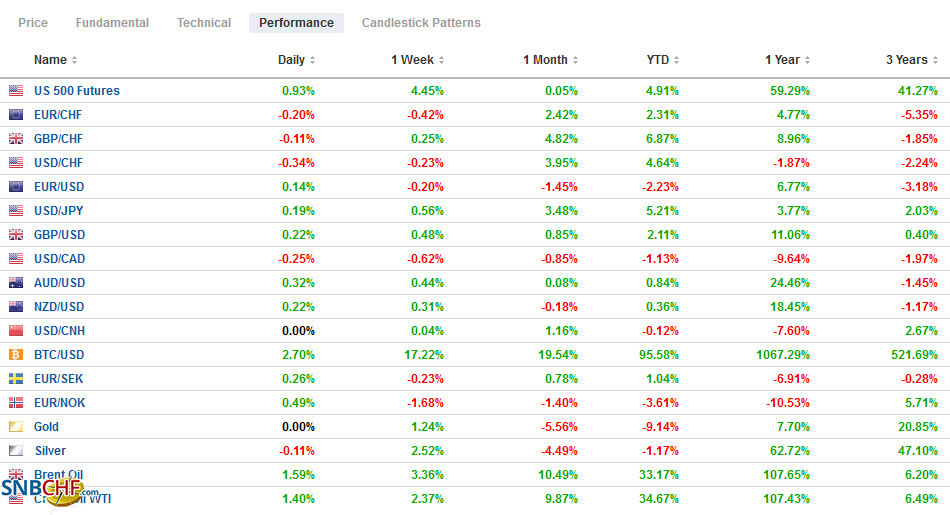

FX RatesOverview: Even though the NASDAQ closed lower yesterday and the reception of the 10-year Treasury auction did not excite, market participants are growing more confident. Led by China, the major markets in the Asia Pacific region rallied. The Shanghai Composite’s 2.35% gain not only snaps a five-session slide but is the largest rally since last October. Europe’s Dow Jones Stoxx 600 is stretching its advance into a fourth session and is up around 3.5% this week. US futures are pointing to a gap higher opening. Meanwhile, benchmark yields are softer, and the US 10-year note yield is below 1.50% for the first time since the middle of last week. European yields are 1-3 basis points lower ahead of the ECB meeting. Australian and New Zealand bond yields, which had risen the most, are now leading on the downside with another 6-8 bp pullback today. The US dollar is trading lower against nearly all the majors but the Japanese yen. Emerging market currencies are also mostly higher, and the JP Morgan index is extending its gains after yesterday’s advance of a little more than 1%, which was the largest since early November. Gold rose $10.6 yesterday and tested the $1740 level today, its highest level since the middle of last week. It bottomed on Monday near $1677. Oil prices are higher. April WTI bottomed yesterday near $63.15 and is testing the $65.50 area in Europe. |

FX Performance, March 11 |

Asia PacificThe dollar has risen by about 6.5% against the yen since the bottom on January 6, near JPY102.60. It has moved up alongside the US 10-year yield. The rolling 60-day correlation between the yield and the exchange rate reached a high since June 2019 (~0.92). This should not be dismissed as a dog-bites-man observation. The correlation was negative from October 20 through early last month. In some ways, if the co-movement is so robust, it shifts the question about the yen to what is driving yields. Grand narratives are told about the vast fiscal stimulus ($5.4 trillion in the past 12-months) and the Fed’s balance sheet’s discovery and dramatic expansion. However, if there is a single quantifiable variable, at the risk of being reductionistic is the price of oil. The rolling 60-correlation of the US 10-year yield and the price of the front-month WTI futures contract is at its highest level since the Great Financial Crisis (~0.96). The correlation was negative from mid-July 2020 through mid-November. Japanese investors sold a record amount of foreign bonds in the last two weeks of February (~JPY3.6 trillion or about $31 bln) but returned to the buy-side in the week ending March 5 (small at JPY99 bln), according to the weekly MOF data. In the first eight weeks of the year, Japanese investors bought an average of JPY49.5 bln a week. In the same period in 2019, they purchased an average of JPY631 bln of foreign bonds, and in 2018, JPY815 bln. Foreign investors also bought Japanese after having sold in two of the past three weeks. In the first eight weeks of the year, foreign investors sold an average of JPY79 bln of Japanese bonds a week. In both 2019 and 2020, their purchases were averaging over JPY500 bln a week. |

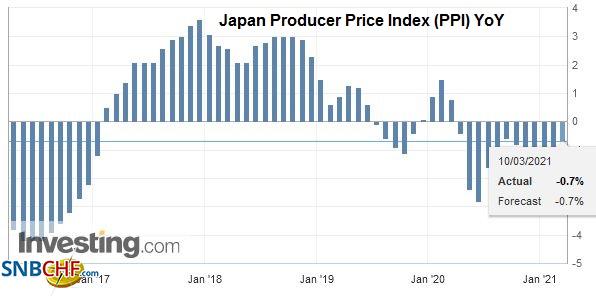

Japan Producer Price Index (PPI) YoY, February 2021(see more posts on Japan Producer Price Index, ) Source: investing.com - Click to enlarge |

The yen is on the sideline. The dollar is consolidating in this week’s range (~JPY108.25-JPY109.25). It is in a tighter range still (~JPY108.35-JPY108.80). The Australian dollar is rising for a third consecutive session. It has met the initial retracement objective of the pullback since poking above $0.8000 on February 25 that came in around $0.7765. The next retracement target (50%) is near $0.7815. The $0.7740-$0.7760 area offers initial support. The greenback is also lower against the Chinese yuan for the third consecutive session, the longest pullback in a month. The PBOC set the dollar’s reference rate at CNY6.4970, a bit weaker than the Bloomberg bank survey’s median (CNY6.4988). With today’s move, the US dollar is back within the range that has dominated since the start of the year.

Europe

When officials talk to the press off the record, it always makes sense to ask why or who benefits. Less than 24 hours before the ECB announces its new staff forecasts, one or more people told the press that the estimates will justify the stimulus efforts and does not see a sustained rise in price pressures. This is not surprising and could have been surmised by careful observers of the public record. The near-term GDP forecast is expected to be shaved, reflecting the vaccine’s slow rollout, and this year’s inflation forecast may be increased a little, mostly reflecting the rise in energy prices. If there is a consensus among major central banks, it is precisely that base-effect, and some supply bottlenecks as the economies begin re-opening will lift measured inflation. There is nearly mathematical certitude that CPI will rise.

The judgment made by officials is that inflation will not run very high and will not be sustained. There will be much discussion of financial conditions and how they are best measured. Ensuring accommodative financial conditions is the key to transmitting the central bank’s policy stance. That is the purpose of bond purchases, not targeting an interest rate per se (which is also essentially what Powell said last week about the Fed’s purchases). The Pandemic Emergency Purchase Program was designed purposely to maximize operational flexibility. It seems unreasonable to expect the ECB to now voluntarily move to limit this flexibility in any meaningful way. It appears that about half of the PEPP’s 1.85 trillion (~$2.2 trillion) line (“envelope”) has been used. The facility has been extended through March of next year, and there is talk that it may be extended, though it seems premature for such a decision today.

The euro tested the 200-day moving average (~$1.1835) on Tuesday and pushed to almost $1.1970 in last Asia. The $1.1975-$1.2000 holds retracement objectives and chart resistance. Initial support is seen in the $1.1920-$1.1940 area. We have noted that despite the general dovishness of the ECB, the euro has advanced on days of its meeting four of the past six times. It is not much better than 50/50, but one might have expected a downside bias. Sterling is also rising for its third session in a row that ends a four-session slide. It has moved above the 20-day moving average (~$1.3950) for the first time since reversing lower (outside down day) a week ago. Retracement targets are found near $1.3980 and $1.4030.

America

US February headline CPI was in line with expectations rising to 1.7% year-over-year. A little more than half of the increase was to gasoline prices, which seem to have little to do with monetary or fiscal policy. The core rate increase was less than expected, rising 0.1% for a 1.3% year-over-year rate. The cost of medical care increased, but the cost of pharmaceuticals fell. Ower-occupied costs rose sharply, while rents rose at a sub-2% pace for the first time since 2011. The deflation that hit with the pandemic’s onset last year means that the next three CPI reports may pose some “sticker shock” headlines.

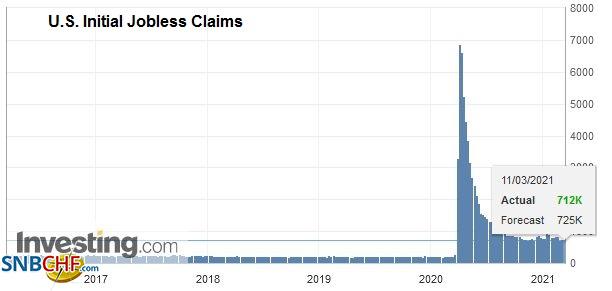

| Today, attention turns to the weekly jobless claims and the Q4 household net worth report. Weekly initial jobless claims are expected to continue to trend lower, helped, and a number in line with the median in the Bloomberg survey (725k) would be the lowest since early November. The early call is for another strong non-farm payroll report for this month. American household net worth plunged by $6.9 trillion in Q1 20, which is roughly equivalent to a year’s output of Germany and France together. It was completely recouped in Q2 20 when household net worth rose by $8.3 trillion. It rose by another $3.8 trillion in Q3. In addition to personal income, the wealth may be driven by the equity market (the S&P 500 rose by 11.7% in Q4 20) and house prices (Case-Shiller house price index rose by about 4.2%. in Q4 20). |

U.S. Initial Jobless Claims, March 11 2021(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

The most important takeaway from the Bank of Canada meeting is that the forward guidance is in transition, and the next meeting on April 21 will offer greater clarification. Its statement cited the January projections, and these are increasingly dated. The economy is proving more resilient than expected, and rather than contract, the central bank now anticipates expansion. A full recovery in the labor market will take a long time. The critical change is taking place in confidence about the recovery. With its biggest trading partner stepping on the fiscal accelerator in a big way, Governor Macklem and the central bank will feel more confident about the Canadian economic outlook. A slowing of the Bank of Canada’s C$4 bln a week of bond purchases would be the first move in recognition of that confidence. Meanwhile, speculation that Prime Minister Trudeau, who heads up a minority government, will take advantage of the stronger economy and vaccine progress to call for an early election. The speculation ebbs and flows and appears to have risen again, with a June timetable suggested.

The US dollar is approaching the month’s low against the Canadian dollar (~CAD1.2575). It is also a retracement objective of the two-day bounce on February 25-26 that saw it recover from the multiyear low near CAD1.2470 to CAD1.2750. The intraday momentum studies are stretched, but rising equities, falling yields, and firm commodity prices could make for only a shallow greenback bounce. Resistance may be found in the CAD1.2600-CAD1.2620 area. Meanwhile, the US dollar continued to unwind its gains against the Mexican peso. It is the third day the dollar is falling, and near MXN20.75, it has shed around 3.4%. Yesterday’s pullback almost met the (38.2%) retracement of the gains since the MXN19.55 low was recorded on January 21. That retracement was near MXN20.84. The 50% retracement is closer to MXN20.53.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$JPY,Bank of Canada,Bonds,Currency Movement,ECB,Featured,newsletter,OIL