The dollar has gotten some limited traction despite the dovish FOMC decision; the FOMC delivered no surprises We are seeing some more movement on fiscal stimulus; August retail sales disappointed yesterday Fed manufacturing surveys for September will continue to roll out; weekly jobless claims will be reported; Brazil left rates unchanged at 2.0% but introduced some additional dovish guidance BOE is expected to deliver a dovish hold; UK government reached a compromise with rebel Tory MPs by giving them a major concession; ECB gave regional lenders more regulatory relief BOJ remained on hold but upgraded its economic assessment; Australia reported strong August jobs data; Indonesia kept rates on hold at 4.0%, as expected The dollar has gotten some limited traction

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The dollar has gotten some limited traction despite the dovish FOMC decision; the FOMC delivered no surprises

- We are seeing some more movement on fiscal stimulus; August retail sales disappointed yesterday

- Fed manufacturing surveys for September will continue to roll out; weekly jobless claims will be reported; Brazil left rates unchanged at 2.0% but introduced some additional dovish guidance

- BOE is expected to deliver a dovish hold; UK government reached a compromise with rebel Tory MPs by giving them a major concession; ECB gave regional lenders more regulatory relief

- BOJ remained on hold but upgraded its economic assessment; Australia reported strong August jobs data; Indonesia kept rates on hold at 4.0%, as expected

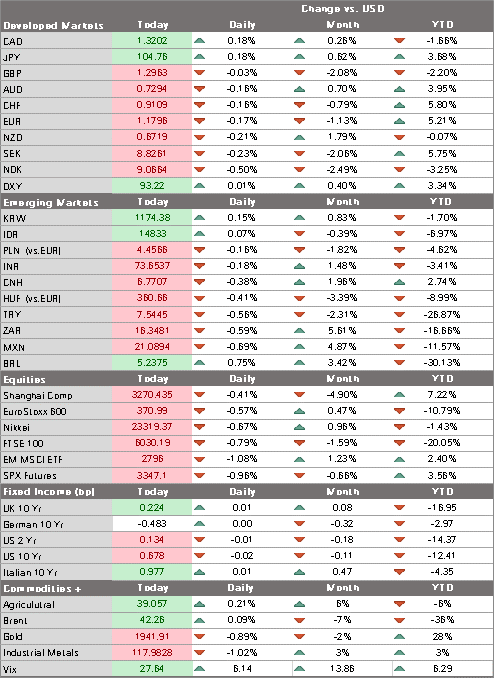

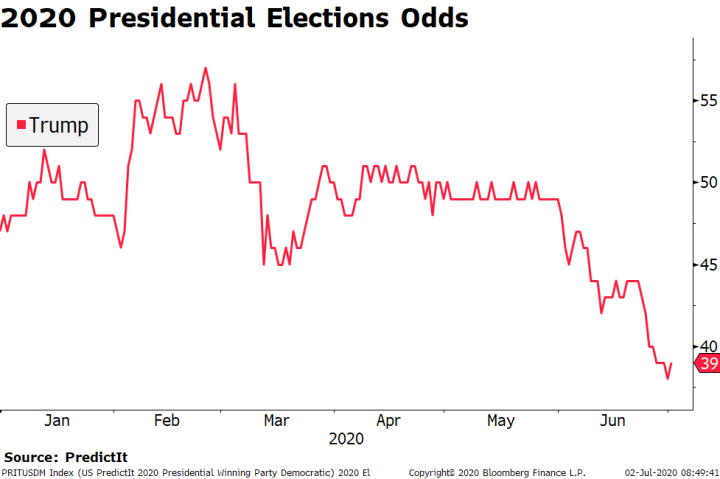

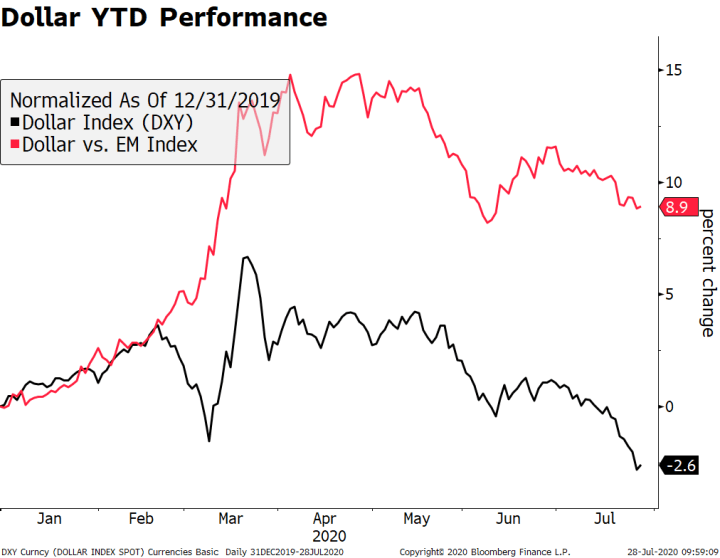

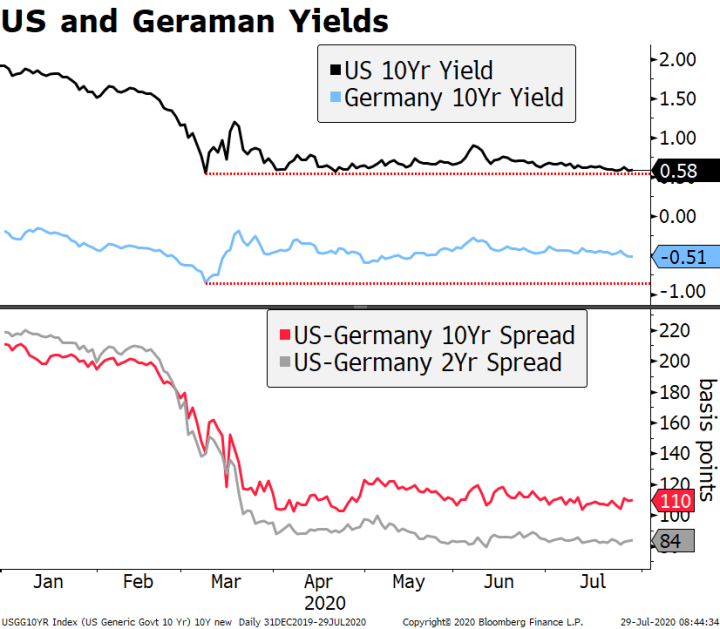

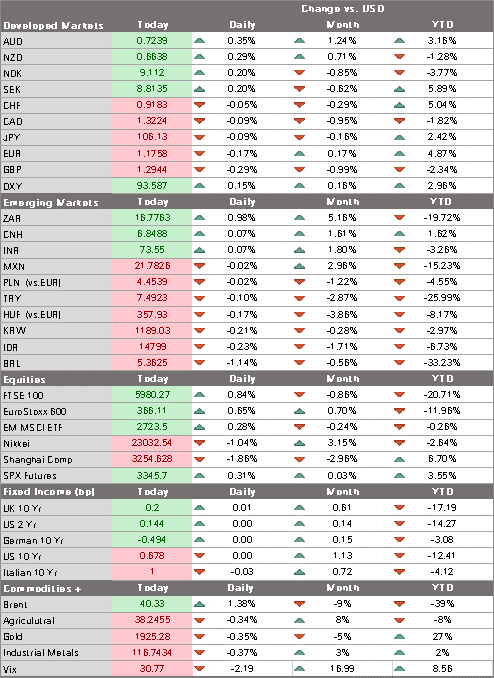

The dollar has gotten some limited traction despite the dovish FOMC decision. DXY is up today for the second straight day but has so far been unable to break the key 94.00 area, the top of its recent 92-94 trading range. The euro traded today at the lowest level since August 12 near $1.1740 but has since recovered to trade near $1.18. We need to see a break above the $1.1910 area to set up a test of its recent high near $1.2010. We remain negative on the dollar, as Powell’s dovish message from Jackson Hole was clearly reiterated at his post-FOMC decision press conference yesterday. Weak retail sales data (see below) underscore that dovish message and confirms our view that the US economy will continue to underperform.

| AMERICAS

The FOMC delivered no surprises. Policy settings were kept unchanged, as expected. Powell stressed that the Fed is not out of ammo and that there is plenty more it can do to stimulate the economy. He stressed that the Fed is prepared to adjust its asset purchases as appropriate. He admitted that its Main Street Lending Program needs tweaking to make loans more available, adding that it can be scaled up if appropriate. Powell said that more fiscal support is likely to be needed and that Fed officials expect it. The Fed updated its forward guidance to incorporate its new policy framework. “The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.” This is about as explicit as outcome-based forward guidance can get and yet it still leaves the Fed with a lot of wiggle room. The phrases “moderately exceed” for “some time” are suitably vague and so it’s not a mechanical Taylor Rule by any stretch. That’s good news, in our view. The Fed released its updated Summary of Economic Projections. 2023 was added to the forecast horizon and the Dot Plots see steady policy for another year. Growth forecasts were also updated and are pretty much in line with OECD forecasts released earlier today. Of note, the new projections see core PCE at 2% in 2023. We think that’s way too aggressive and risks hurting the Fed’s credibility on the new framework before it even gets started. Think about the BOJ, who has to keep pushing out its timeframe for hitting its 2% target year in and year out. The only thing we can think of is that the forecast is meant to portray the new framework. That is, the Fed is saying it won’t hike in 2023 even though it sees inflation hitting the target that same year. |

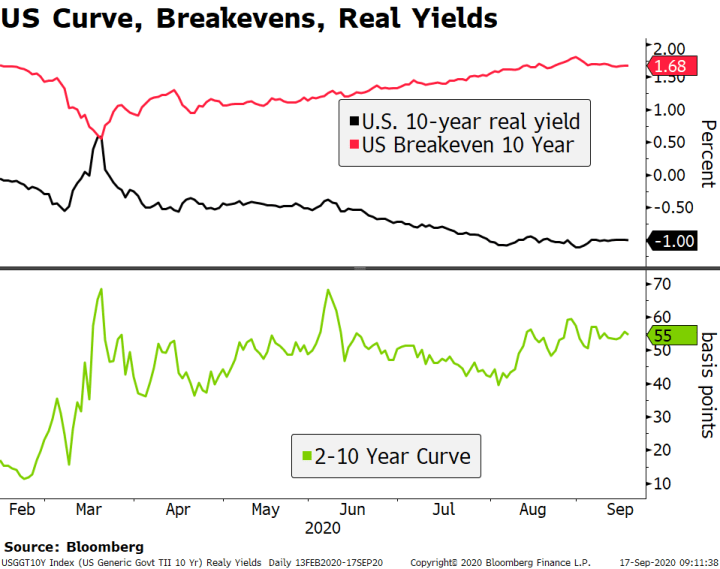

US Curve, Breakevens, Real Yields, 2020 |

| We are seeing some more movement on fiscal stimulus. After the group of 50 moderates from both parties presented a compromise plan earlier this week, President Trump weighed in yesterday with a call for a stimulus package with “much higher numbers.” Republican Whip Thune said “I’m not sure what higher numbers, what that means. That probably needs to get translated for us. But I know kind of what the threshold is for what we can get Republican votes for in the Senate, and I think if the number gets too high anything that got passed in the Senate would be passed mostly with Democrat votes and a handful of Republicans, so it’s going to have to stay in sort of a realistic range.”

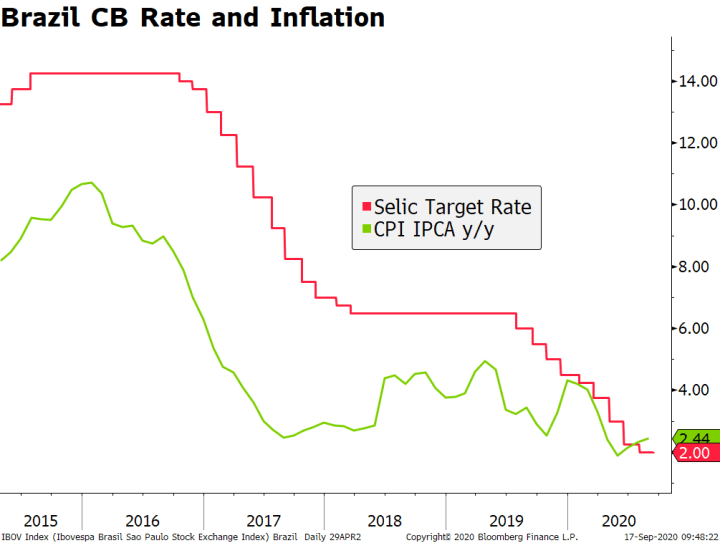

It’s worth noting that August retail sales disappointed yesterday. Headline sales rose 0.6% m/m vs.1.0% expected and a revised 0.9% (was 1.2%) in July, while ex-autos rose 0.7% m/m vs. 1.0% expected and a revised 1.3% (was 1.9%) in July. The so-called control group used to calculate GDP fell -0.1% m/m vs. an expected gain of 0.3% and a revised 0.9% (was 1.4%) in July. With enhanced jobless benefits running out in July, this really can’t be a huge surprise and is likely the beginning of the weakness that we’ve been warning about. Enhanced benefits extended by executive order in August are starting to run out now. Consumption makes up two thirds of the US economy. Fed manufacturing surveys for September will continue to roll out. Philly Fed business outlook is expected at 15.0 vs. 17.2 in August. Empire survey was reported Tuesday and came in at 17.0 vs. 6.9 expected and 3.7 in August. These are the first snapshots for September and will help set the tone for other manufacturing data. August IP was also reported Tuesday and rose 0.4% m/m vs. 1.0% expected and a revised 3.5% (was 3.0%) in July. August building permits and housing starts (+2.0% m/m and -0.9% m/m expected, respectively) will be also reported today. Weekly jobless claims will be reported. Initial claims are expected at 850k vs. 884k the previous week, while continuing claims are expected at 13.0 mln vs. 13.385 mln the previous week. Adding regular and PUA initial claims shows nearly 2 mln are newly filing for unemployment every week and that’s not so good. Similarly, regular continuing claims have stabilized around 13 mln but PUA continuing claims have risen sharply to almost 15 mln, the highest ever. The total of the two is approaching 28 mln and also points to trouble. The August jobs data were solid, but the 1.371 mln jobs gain continues the sequential loss of momentum seen across most US economic indicators. Brazil central bank left rates unchanged at 2.0% but introduced some additional dovish guidance. The bank said that it “does not intend to reduce the monetary stimulus unless inflation expectations, as well as its baseline scenario inflation projections, are sufficiently close to the inflation target.” It also sees the current rise in inflation as temporary. The communique reaffirmed the bank is not in any rush to hike rates, while also making it clear that “the remaining space for monetary policy stimulus, if it exists, should be small.” It also made it clear that fiscal trajectory will be a key variable for any adjustment to the current level of stimulus – as it should be. The bank has delivered 450 bp of cuts since mid-2019, on top of the previous cycle of 775 bp of cuts between late 2016 and 2018. The yield curve continued to steepen with rates rising as much as 10 bp yesterday. |

Brazil CB Rate and Inflation, 2015-2020 |

| ASIA

The Bank of Japan left its policy settings unchanged but upgraded its economic assessment. The bank said the economy “has started to pick up with economic activity resuming gradually,” though adding conditions remain severe vs. what it described as “extremely severe” previously. Despite recognizing the recovery, it’s pretty clear that the BOJ will keep on the current policy track until the 2% comes into sight. According to its July forecasts, that target won’t be reached until well after FY2022 (where it sees inflation at 0.7%). The bank will release updated macro forecasts at the next meeting October 29. The bank reiterated that the focus now will remain on working with the government to ensure the private sector continues to rebound. At this point, the bank is letting fiscal stimulus carry the load and so we are in a wait and see period in terms of monetary policy. Indeed, we suspect that incoming Prime Minister Suga will look to shore up his credentials with another round of fiscal stimulus before year-end. We note that the yen tends to gain on BOJ decision days. Of the six held this year before today, it has gained on four of them and now looks to tack on a fifth. UDF/JPY is trading at the lowest level since July 31 and is on track to test that day’s low near 104.20. |

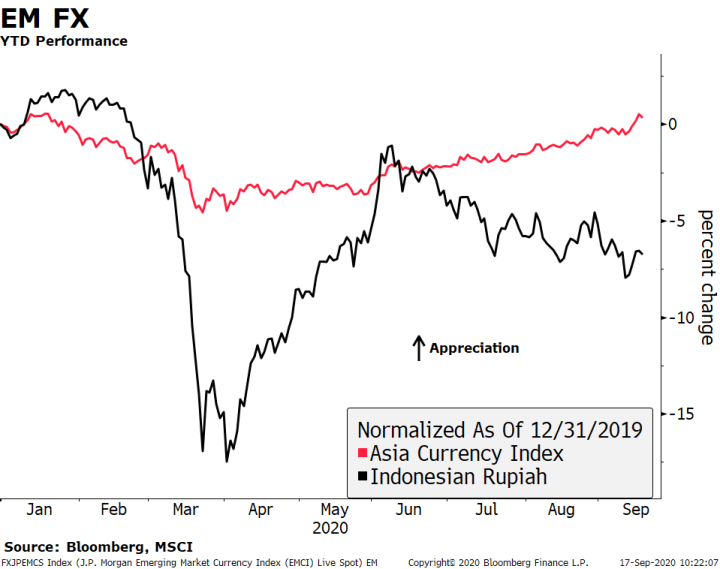

EM FX YTD Performance, 2020 |

| Australia reported strong August jobs data. There were 111.0k jobs added vs. -35.0k expected and a revised gain of 119.2k (was 114.7k) in July. As a result, the unemployment rate fell to 6.8% vs. 7.7% expected and 7.5% in July. The reading is particularly heartening as it comes after the lockdown of Victoria. Half of the jobs lost during the pandemic have now been regained. The RBA will be pleased, as it forecast unemployment rising to around 10% later this year. The only caveat is that job growth the past two months has been heavily weighted towards part-time positions, which rose 74.8k in August and 80.3k in July.

Bank Indonesia kept rates on hold at 4.0%, as expected. Perhaps the most interesting development was the Governor Warjiyo’s defense of the bank’s independence, amid political pressure to change its mandate (please see our recent report on EM Central Bank independence). We now believe that the threat to the bank’s credibility, along with the recent depreciation of the rupiah, raises the bar for any further easing by the BI. Local assets were little changed. |

EUROPE/MIDDLE EAST/AFRICA

Bank of England is expected to deliver a dovish hold. With the government’s fiscal stance unknown at this time, the BOE will likely opt to adopt a wait and see stance today. That said, we expect the bank to set the table for potential easing by year-end as it sees headwinds building in the coming months. There will likely be several dissents in favor of immediate easing, and markets will react accordingly to a higher number here. Please see our BOE preview for a deeper dive into what the bank may or may not do.

Sterling has a mixed record on BOE decision days. Of the seven this year so far, it has risen against both the dollar and the euro on four and fallen on three. While we remain skeptical that the BOE will go negative, the subdued interest rate outlook and no-deal Brexit risks should continue to weigh on sterling.

The UK government reached a compromise with rebel Tory MPs by giving them a major concession.

Prime Minister Johnson agreed to amend the Internal Market Bill to grant a parliamentary vote if the measures break international law. We see this as a wise attempt by No. 10 to gain some degrees of freedom after what might have been a miscalculation in its brinkmanship game against Brussels. However, reports suggest the bill faces a tough time in the House of Lords. Former Tory leader Michael Howard predicted a “rough passage” for the bill in that chamber and said his fellow Lords are “highly likely” to block it just on principle. Note that the Tories do not have a majority in the House of Lords.

Also of note, US presidential candidate Biden chimed in by criticizing Johnson. He said that peace in Northern Ireland shouldn’t “become a casualty of Brexit. Any trade deal between the US and UK must be contingent upon respect for the Agreement and preventing the return of a hard border. Period.”

The European Central Bank gave regional lenders more regulatory relief. Banks will be allowed to exclude certain assets held at the ECB when calculating their so-called leverage ratios. In turn, this would allow the banks to hold less capital and increase lending activity. These leverage limits were already relaxed back in April but it appears policymakers may be getting a bit nervous and want to introduce more backdoor stimulus. Eurozone reported final August CPI steady from the preliminary reading of -0.2% y/y.

Tags: Articles,Daily News,Featured,newsletter