The dollar continues to soften as risk-off sentiment ebbs; the first presidential debate will take place tonight House Democrats have staked out their latest position at .2 trln; there is a fair amount of US data out today; Brazil has come under renewed pressure from fiscal concerns The pound continues to outperform as comments from the latest Brexit talks remain skewed to the positive side; latest eurozone CPI and retail sales readings have started coming out Japan reported September Tokyo CPI; it appears that calls for a policy review are growing within the BOJ The dollar continues to soften as risk-off sentiment ebbs. DXY traded Friday at the highest level since July 24 near 94.742 but has since fallen two straight days to the lowest level since September

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The dollar continues to soften as risk-off sentiment ebbs; the first presidential debate will take place tonight

- House Democrats have staked out their latest position at $2.2 trln; there is a fair amount of US data out today; Brazil has come under renewed pressure from fiscal concerns

- The pound continues to outperform as comments from the latest Brexit talks remain skewed to the positive side; latest eurozone CPI and retail sales readings have started coming out

- Japan reported September Tokyo CPI; it appears that calls for a policy review are growing within the BOJ

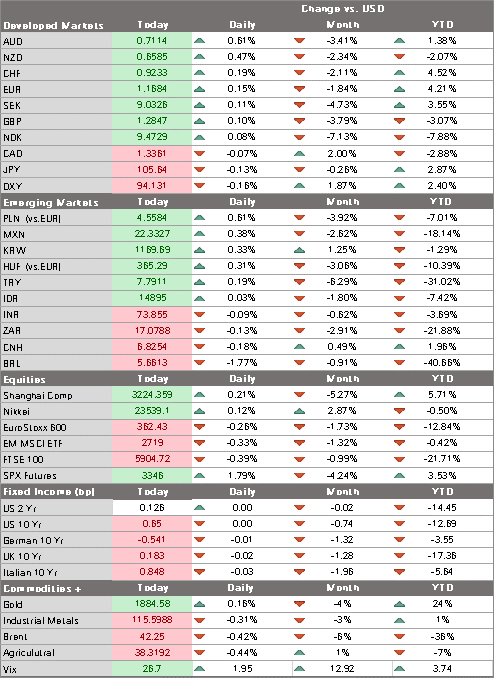

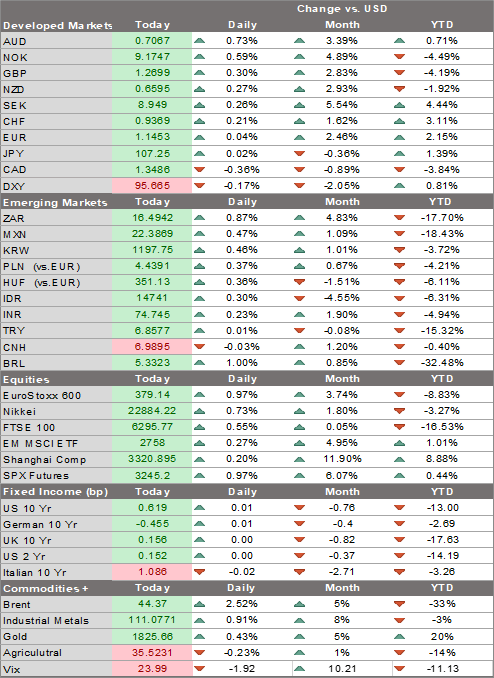

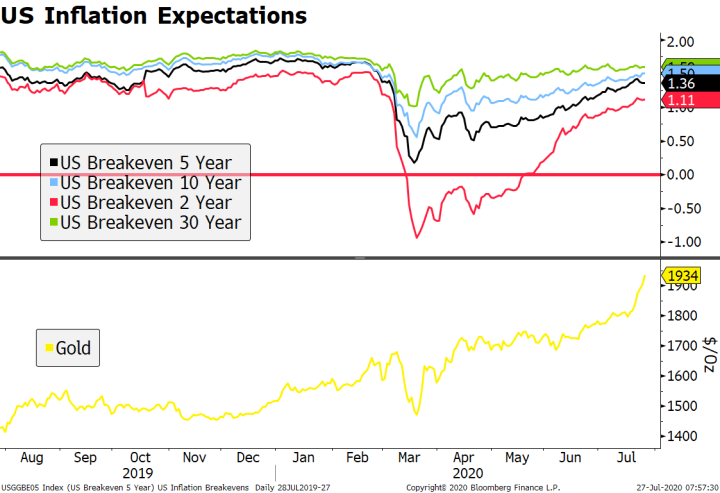

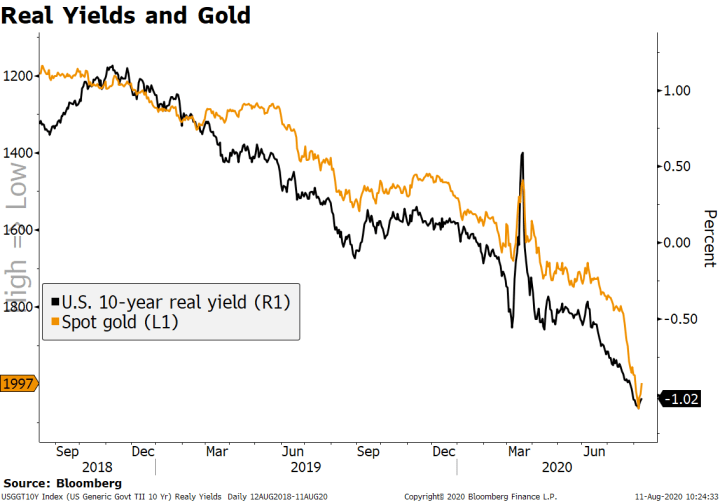

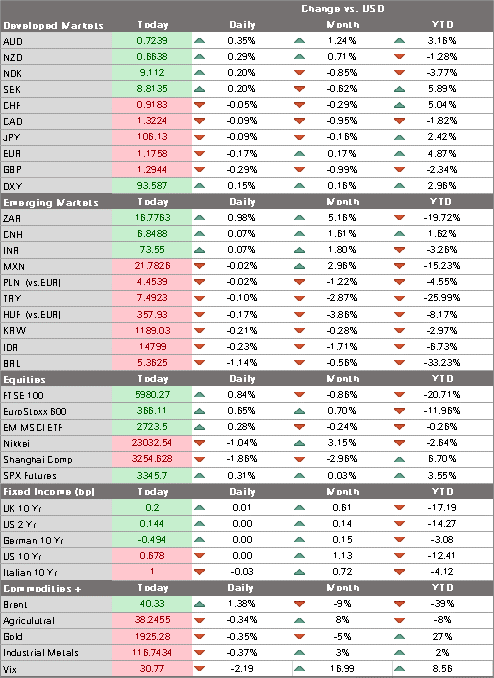

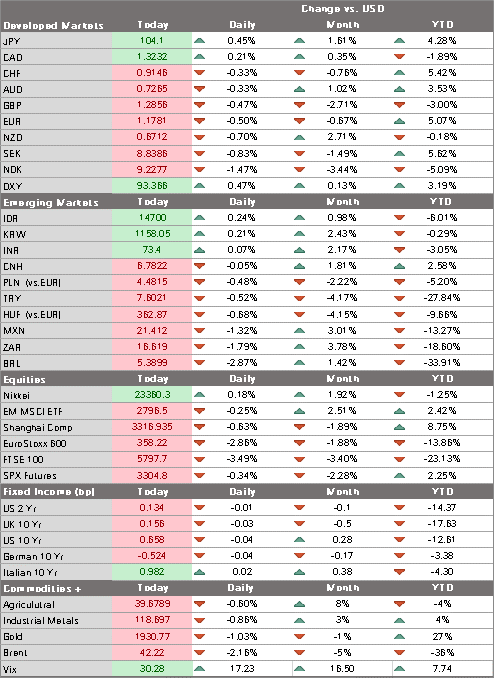

The dollar continues to soften as risk-off sentiment ebbs. DXY traded Friday at the highest level since July 24 near 94.742 but has since fallen two straight days to the lowest level since September 23. We need to see a break of the 93.51 area to set up a deeper correction for DXY to the September 21 low near 92.749. The equivalent objective for the euro comes in near $1.1775. Sterling remains bid from ongoing Brexit optimism and is likely to test the $1.30 area, while USD/JPY is trading in the upper end of its recent 104-106 range. We continue to view the recent dollar bounce as a positioning adjustment rather than a trend change. The broad-based weak dollar trend should remain in place due to the now-familiar combination of an ultra-dovish Fed and softening US economic data.

AMERICAS

The first presidential debate will take place tonight at Case Western University in Cleveland. The two candidates will meet face to face for a 90-minute debate moderated by Chris Wallace. It’s too early to say how reports of President Trump’s leaked tax returns will play out in terms of voting intentions but it’s hard to see how it’s anything but a net negative for the incumbent. Poll results after the debates will be closely watched but the race has been remarkably stable throughout the year, suggesting that the much has already been baked in the cake.

House Democrats have staked out their latest position at $2.2 trln, down from the $3.4 trln package passed in May. This includes $1,200 in direct payment to individuals, along with help for schools and the service and hospitality industry (including airlines). Still, this figure from the Democrats is still far from the Republican’s latest $500 bln proposal. House Speaker Pelosi said the White House will have to agree to “much more” spending if there is to be any compromise deal. Pelosi is supposedly in close contact with Treasury Secretary Mnuchin. This is the last week to get something passed ahead of month-long recess, though Pelosi has pledged in the past to stay in Washington until a package is passed. A deal is certainly possible but still very unlikely, in our view.

There is a fair amount of US data out today, though of the minor variety. August advance good trade (-$81.8 bln expected), wholesale and retail inventories (-0.1% m/m and 1.1% m/m expected, respectively), S&P CoreLogic house price index, and September Conference Board consumer confidence (90.0 expected) will all be reported. The top tier data start to pick up tomorrow with ADP and Chicago PMI. Williams, Harker, Clarida, and Quarles all speak today.

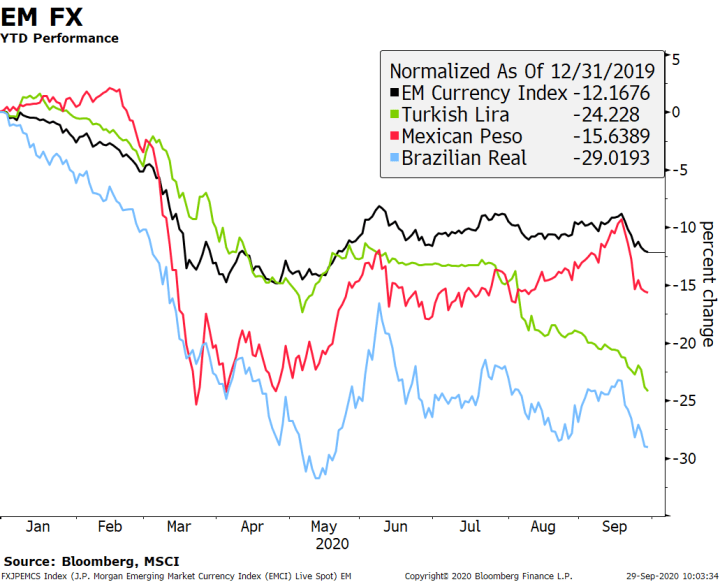

| Brazilian assets have come under renewed pressure on concerns of weakening of the country’s fiscal anchor. In short, the local media was filled with reports that the government is considering some “creative accounting” to keep up spending and fund a new social program while cosmetically maintaining the fiscal cap. The proposals under discussion still have a long and difficult way to go before materializing and will probably never come to pass. Still, this is emblematic of the dilemma that Brazil (and many countries) will face in the post-pandemic world, threatening both fiscal and monetary policy anchors (see our discussion about EM central Bank independence). The real came off sharply yesterday to the weakest level since May, the Bovespa (-2.4%) was the clear underperformer on the day, and local yields were up as much as 30 bp across the swap curve. BCB sold dollars at a spot auction for the first time since August 21. After initial knee-jerk gains, the real close nearly 2% weaker. |

EM FX YTD Performance, 2020 |

| EUROPE/MIDDLE EAST/AFRICA

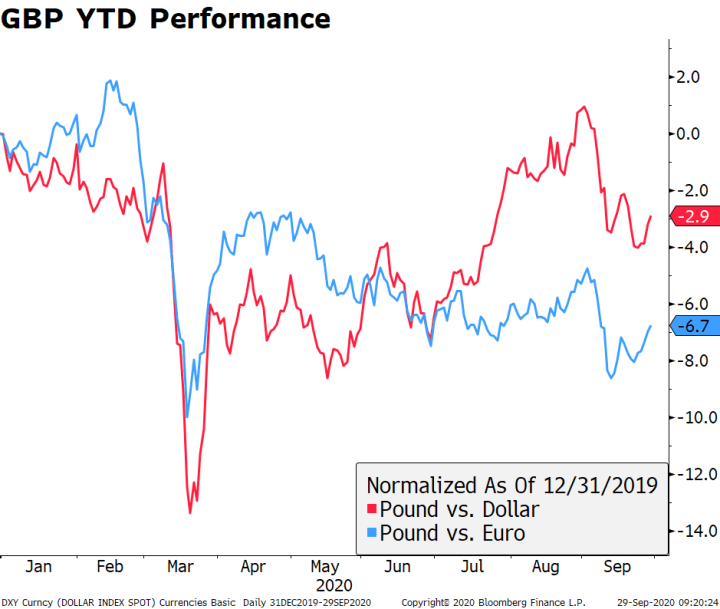

The pound continues to outperform as comments from the latest Brexit talks remain skewed to the positive side. We still think nothing will be decided until the last minute, especially now with the complicating factor of the Internal Markets Bill. Yet we wouldn’t stand in the way of the near-term rebound in sterling. We also received some favorable reports about the internal conflict within the Tory party over the PM’s emergency pandemic response power. The pound is still about 7% weaker against the euro and 3% weaker against the dollar on the year. |

GBP YTD Performance, 2020 |

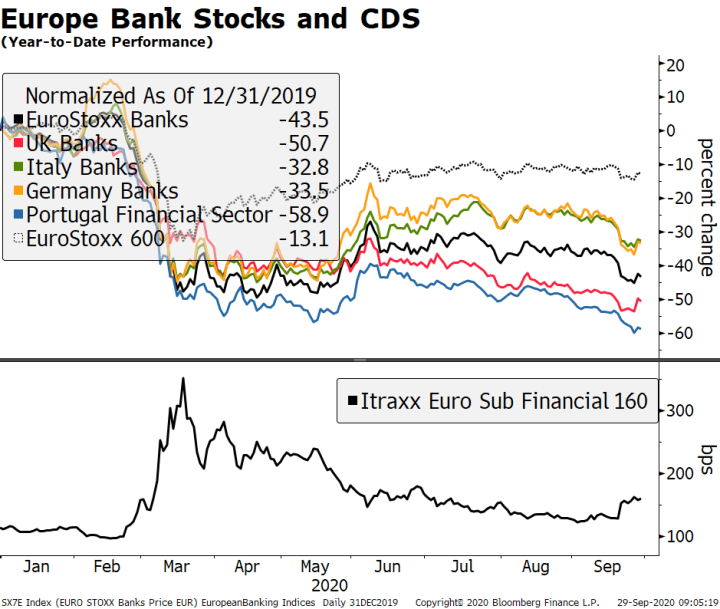

| The reprieve in negative sentiment towards the European banking sector seems to have quickly faded. The EuroStoxx banking index is down 1.7% this morning after being up 5.3% yesterday. That bounce was underpinned by positive news for HSBC and, we suspect, a function of positioning in a sector that has been underperforming for a long time. The index is -43% on the year compared to a -13% performance of the broad EuroStoxx 600. The UK banking index has done even worse, down -50%. The prospects for the sector remain bleak. Higher rates on the back end and a steeper yield curve would help bank margins but we don’t think this will happen just yet.

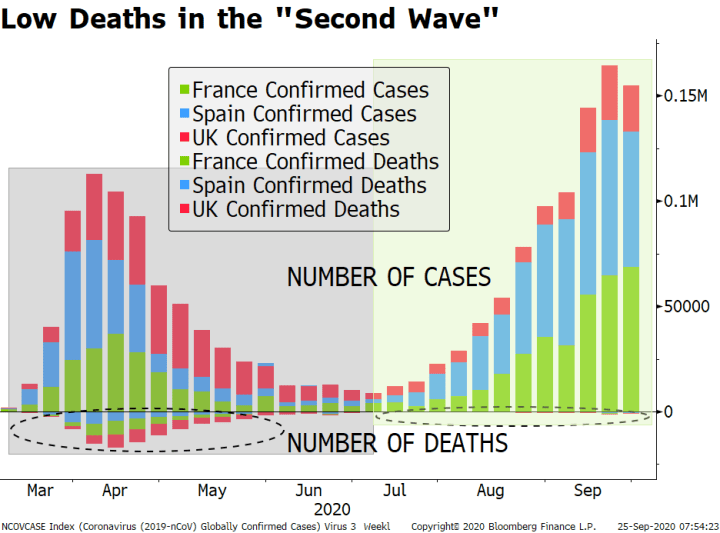

Eurozone CPI readings for September will start coming out. Germany reports later today, with the EU Harmonized measure expected to show deflation remaining steady at -0.1% y/y. German state data out already today point to downside risks to the national reading. Spain reported earlier today (-0.6% y/y). France (0.2% y/y expected) and Italy (-0.4% y/y expected) will report tomorrow. Eurozone CPI will be reported Friday and headline deflation is expected to remain steady at -0.2% y/y while core inflation is expected to remain steady at a very low 0.4% y/y. Elsewhere, August retail sales data have started to trickle out of Europe. Spain sales contracted a weaker than expected -4.6% y/y and will be followed by Germany tomorrow (0.4% m/m expected). Like the US, Europe is facing downside risks to spending as the virus numbers have risen and are already seeing a sequential slowing of momentum. The ECB is widely expected to increase its PEPP by year-end in response to weaker economic momentum and rising deflation risks. |

Europe Bank Stocks and CDS, 2020 |

| ASIA

Japan reported September Tokyo CPI. Headline fell a tick to 0.2% y/y while ex-fresh food rose a tick to -0.2% y/y. This points to mixed risks to the national data out October 23. In August, national headline inflation came in at 0.2% y/y while core (ex-fresh food) came in at -0.4% y/y, well below the 2% target. There are some deflationary forces ahead, including calls for lower cell phone fees and discounted restaurant prices from a government campaign. Current BOJ forecasts from July show it does not expect to reach the 2% target until FY2023 or later, with core inflation of 0.3% seen in FY2021 and 0.7% seen in FY2022. Updated forecasts will be released at the October 29 meeting. Meanwhile, it appears that calls for a policy review are growing within the Bank of Japan. The minutes from the September meeting show some MPC member saying that a review is needed in the current Covid era. One noted that “It will be necessary to reconsider the strategy toward achieving the target comprehensively” given that 2% inflation is out of sight and there have been significant changes in the economy. Another said, “There is a possibility that the bank will need to discuss appropriate monetary policy conduct from a new viewpoint of achieving both containment of the spread of Covid-19 and improvement in economic activity during the Covid-19 era.” It’s too early to say where this goes, but we would not be surprised to see the BOJ tweak its operational forward guidance like the Fed did. |

Tags: Articles,Daily News,Featured,newsletter