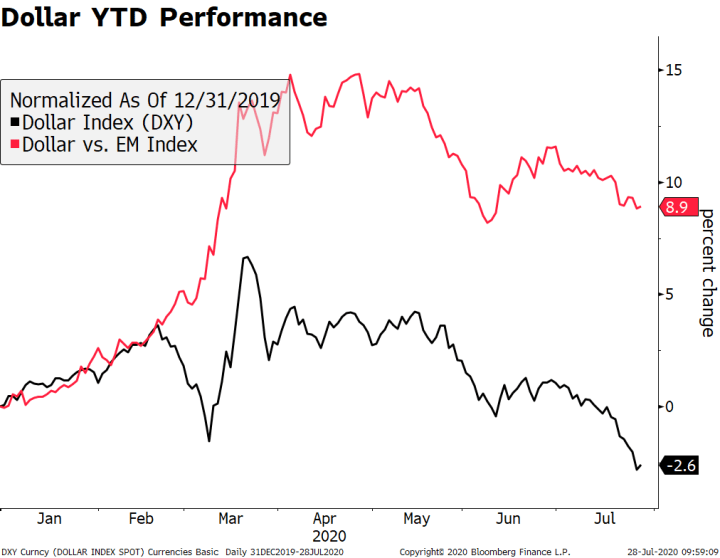

The dollar rally ran out of steam; US Senate will hold a vote today on its proposed “skinny” bill US reports August PPI and weekly jobless claims; US will sell bln of 30-year bonds today after a sloppy 10-year auction yesterday BOC delivered a hawkish hold yesterday; Peru is expected to keep rates steady at 0.25% ECB is expected to keep policy steady; there were some eurozone IP readings; UK published its so-called Internal Market Bill Japan may go to the polls this fall; Indonesia announced an unexpected return to lockdown for Jakarta; Malaysia kept rates steady at 1.75%, as expected The dollar rally ran out of steam. DXY traded yesterday at the highest level since August 12 but could not break above the key 94.00 area and is back near 93.00 today. The euro

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The dollar rally ran out of steam; US Senate will hold a vote today on its proposed “skinny” bill

- US reports August PPI and weekly jobless claims; US will sell $23 bln of 30-year bonds today after a sloppy 10-year auction yesterday

- BOC delivered a hawkish hold yesterday; Peru is expected to keep rates steady at 0.25%

- ECB is expected to keep policy steady; there were some eurozone IP readings; UK published its so-called Internal Market Bill

- Japan may go to the polls this fall; Indonesia announced an unexpected return to lockdown for Jakarta; Malaysia kept rates steady at 1.75%, as expected

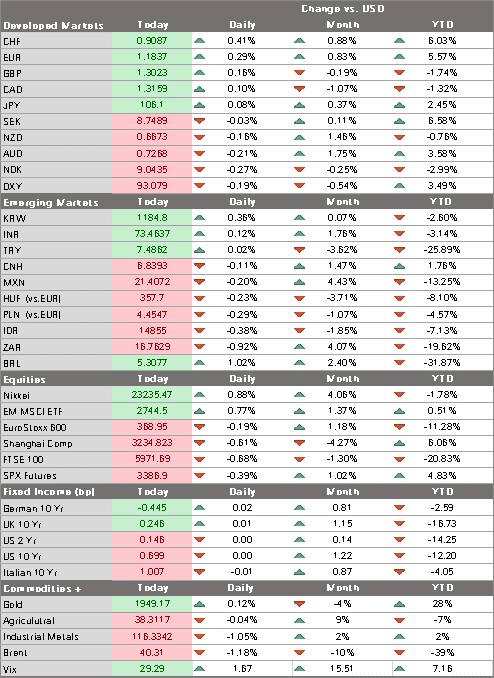

The dollar rally ran out of steam. DXY traded yesterday at the highest level since August 12 but could not break above the key 94.00 area and is back near 93.00 today. The euro found support below $1.18, likewise for sterling below $1.30. Much still depends on whether US equity markets can get more traction. If not, continued stock market losses could morph into a more broad-based risk-off trading environment that gives the dollar another boost higher.

AMERICAS

The Senate will hold a procedural vote today on its proposed “skinny” bill. While the point is rather moot in light of Democratic opposition, the vote will nevertheless be a test of Republican unity. The bill is an attempted intra-party compromise between the so-called deficit hawks and the vulnerable Senators that are up for reelection. As it is, reports suggest that some key proposals from the vulnerable Collins (Maine), Ernst (Iowa), and McSally (Arizona) didn’t even make it into McConnell’s bill. Senate Minority Leader Schumer said it won’t get to a floor vote, suggesting Democratic unity will be maintained. Press reports suggest the White House is looking into other executive orders to try and funnel some more stimulus into the economy, but past efforts have so far been very limited.

The major US data releases this week center around inflation. Or the lack thereof. August PPI will be reported today, with headline expected to rise a tick to -0.3%% and core to remain steady at +0.3% y/y%. CPI will be reported tomorrow, with headline expected to rise a couple ticks to 1.2% y/y and core to remain steady at 1.6% y/y. We would not make too much of the stronger than expected 4.7% y/y gain in average hourly earnings reported for August. When nearly 30 mln are out of work from mostly lower wage positions, average hourly earnings are mechanistically pushed higher. No one can argue with a straight face that wage pressures are an issue.

The US Treasury will sell $23 bln of 30-year bonds today after a sloppy 10-year auction yesterday. In that $35 bln sale, the bid to cover ratio fell to 2.30 from 2.41 last month, while the high yield rose to .704% from .677% last month. Indirect bidders were awarded 58.3% vs. 65.4% last month , the lowest since June and signifying weaker foreign demand. As a result, primary deals were forced to take 27.1% of the paper sold, up from 19.8% last month.

Weekly jobless claims will be reported. Initial claims are expected at 850k vs. 881k the previous week, while continuing claims are expected at 12.904 mln vs. 13.254 mln the previous week. However, the caveat going forward is that the BLS just changed its seasonal adjustment methodology last week, making it more difficult to compare changes going forward. Still, when all is said and done, recent data suggest the labor market is still healing, albeit slowly. The August jobs data were solid, but the 1.371 mln jobs gain continues the sequential loss of momentum seen across most US economic indicators. July wholesale trade sales will also be reported today.

Bank of Canada delivered a hawkish hold yesterday. The bank kept all policy settings the same, but removed language that it is prepared to add more stimulus if needed. While promising to continue QE at its current pace, the bank said it would be “calibrated.” That suggests the bank is considering some sort of tapering as the economy improves. USD/CAD is finding strong support near the 1.30 area, just above the December 31 low near 1.2950. Break below those levels would set up a test of the October 2018 lows near 1.2915 and then 1.2785.

Peru central bank is expected to keep rates steady at 0.25%. The bank has been on hold since its last 100 bp cut April 9. CPI rose 2.14% y/y in August, near the center of the 1-3% target range. Congressional committees will debate draft legislation this week allowing a second round of withdrawals from pension savings, bypassing a motion to have the bill go straight to a full floor vote.

EUROPE/MIDDLE EAST/AFRICA

The European Central Bank is expected to keep policy steady. Macro forecasts may be tweaked modestly and there are some risks of jawboning against the stronger euro, but it should otherwise be an uneventful meeting. The euro generally tends to weaken on ECB decision days. In 2018, the euro weakened on 7 of the 8 ECB meeting days. In 2019, the euro strengthened on 5 of the 8 ECB meeting days, though 3 of those days saw gains less than 0.1%. So far in 2020, the euro has weakened on 3 of the 5 scheduled ECB meeting days and also on the emergency meeting March 18. For an in-depth look, please see our ECB preview.

Ahead of the ECB decision, there were some July IP readings out. France reported a 3.8% m/m gain vs. 5.0% expected, while Italy reported a 7.4% m/m gain vs. 3.5% m/m expected. This comes after Germany reported a weaker than expected 1.2% gain Monday. Spain (3.5% m/m expected) reports tomorrow and the full eurozone IP will be reported September 14. Germany and France are by far the largest economies in the eurozone and so we see some downside risks to the headline reading then.

The UK published its so-called Internal Market Bill. As expected, it would allow the UK government to override parts of the Withdrawal Agreement so that companies in Northern Ireland have “unfettered access” to the UK market, potentially throwing up barriers to trade with the rest of Ireland. According to the EU, this would be a “clear breach of substantive provisions” of the Withdrawal Agreement and thus “would open the way to the legal remedies available under the withdrawal agreement.” Indeed, reports suggest the EU is already considering legal action against the UK.

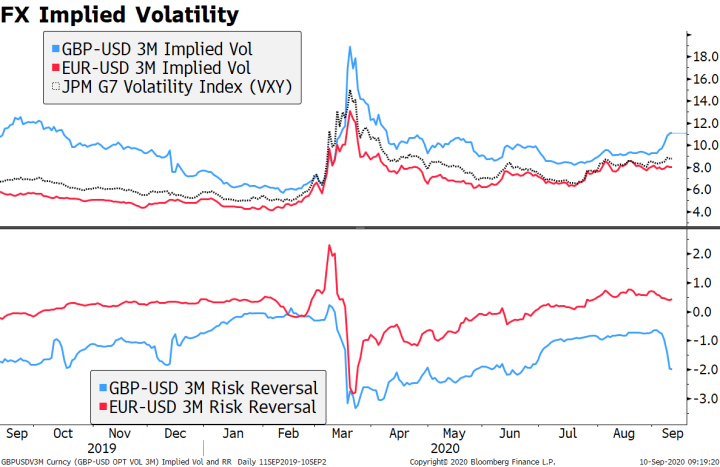

| FX options markets are telling a very different story for euro and sterling. Implied volatility and risk reversals continue to reflect the growing discomfort with Brexit risk that has built up over the last few sessions as Boris Johnson doubled down on brinkmanship tactics. Implied volatility for the euro, in contrast, has been stable since the start of August. But the 3-month measure is trading around 8%, which is about double the rate seen pre-pandemic. With markets still very much in flux and so many risk events out there (US elections, Brexit, vaccine, etc.), we doubt that we will return to the old world of extremely low implied volatility any time soon.

Norway’s inflation figures surprised on the upside in August, supporting the possibility of another adjustment to the Norges Bank’s rate path. Headline CPI came in at 1.7% y/y, while core inflation accelerated a couple ticks to 3.7% y/y. This was the highest since July 2016 and moves further above the 2% target. The increase was in part due to higher import prices, as well as energy prices and household items. At its last meeting August 20, Norges Bank noted the improved pace of the economic recovery, which we agree with despite the somewhat downbeat July GDP print. This means that the bank could start to reign in its dovish language about keeping rates at current levels “over the next couple of years.” At the June 18 meeting, the bank adjusted its expected rate path to show the policy rate rising to 0.5% in 2023 from 0% currently. Next policy meeting is September 24. |

FX Implied Volatility, 2019-2020 |

| ASIA

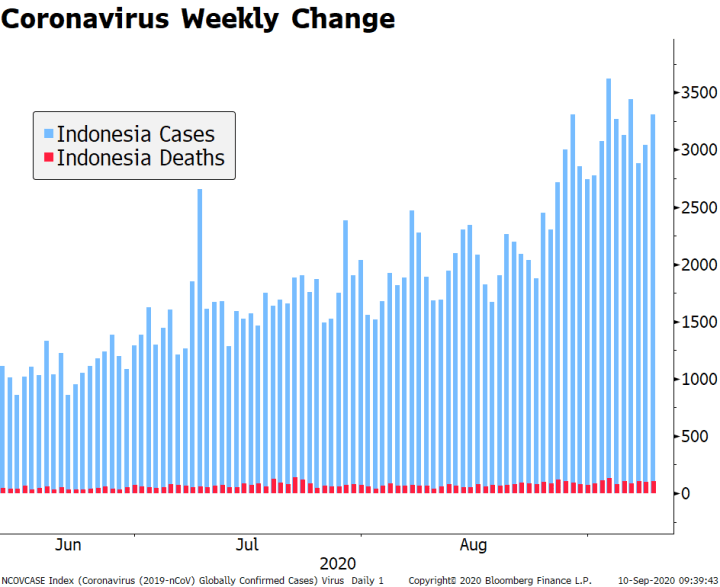

Japan may go to the polls this fall. Defense Minister Kono said he expects a general election in October. Yoshihide Suga is likely to become Prime Minister next week but has said that elections would come later rather than sooner due to the pandemic. Virus numbers have been falling recently, which may explain why Kono is sending up some trial balloons for Suga. Elections don’t have to be called until 2021, and opinion polls suggest the public opposes a vote before the end of 2020. Whatever the timing is, the ruling LDP is widely expected to hold on to power. Lastly, July core machine orders rose 6.3% m/m vs. 2.0% expected. Indonesian assets sold off after the government announced an unexpected return to lockdown for Jakarta. The move is a reaction to rising virus numbers and reports of hospital capacity reaching its limit. Non-essential workers will have to work from home as of September 14. The capital city accounts for about 20% of Indonesia’s GDP. The country’s main equity index hit the limit down of 5% overnight and the rupiah continues to depreciate. The news adds to our already bearish view towards the country’s assets, triggered in part by the recent discussion about weakening the central bank’s independence. |

Coronavirus Weekly Change, 2020 |

| Bank Negara Malaysia kept rates steady at 1.75%, as expected. It broke the streak of rate cuts at all four previous policy meetings this year totaling 125 bp of easing. Some analysts saw a 25 bp cut to 1.5%. The bank sees GDP contracting by -3.5% to -5.5% this year, with the worst seen in H1. The recovery is seen continuing next year, but the bank noted that “The pace of recovery will be uneven across sectors, with economic activity in some industries remaining below pre-pandemic levels, and a slower improvement in the labor market.” It stressed that its outlook was still subject to downside risks, suggesting the door remains open for further easing if needed. |

Tags: Articles,Daily News,Featured,newsletter