China is on the edge of recession — excluding Covid, for the first time since 2008 — as new data showed all-important manufacturing contracted for the fourth month in a row with particular weakness in new orders.In other words, what they’ve got is a backlog, then it’s a cliff.Manufacturing makes up a third of China’s economy — much more than the US. The collapse of China’s property — another third of China’s economy — is adding further fuel to the fire.Offices Emptier than CovidLondon’s Financial Times reports that office buildings in China are emptier than they were during the Covid lockdowns. FT notes that work-at-home hasn’t taken off in China, implying the main driver of empty offices is layoffs.In Shanghai, office vacancies are at 21%. In Shenzhen, China’s

Read More »Articles by Peter St. Onge

Canada’s “Worst Decline in 40 Years”

July 26, 2024Canada’s standard of living is on track for its worst decline in 40 years, according to a new study by Canada’s Fraser Institute.The study compared the three worst periods of decline in Canada in the last 40 years — the 1989 recession, the 2008 global financial crisis, and this post-pandemic era.They found that unlike the previous recessions, Canada is not recovering this time. Something broke.In fact, according to the Financial Post, since 2019, Canada’s had the worst growth out of 50 developed economies. Inflation-adjusted Canadian wages have been flat since 2016.So, yes, something broke.And it’s nowhere near over: Canada’s per-person real GDP is still falling, and with a looming US recession — the US is 75% of Canada’s exports — Canada could crash again before

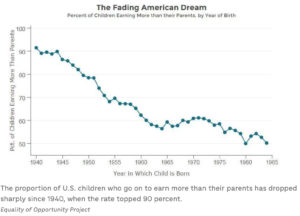

Read More »Killing the Golden Goose: Millennials Earn Less Than Their Parents Did

May 6, 2024For the first time in our nation’s history, 30 year olds are doing worse than their parents.In other words, we killed the golden goose.Last week, Professor Scott Galloway went on an epic rant on MSNBC laying out for his well-heeled hosts exactly what young people are going through right now.Rattling off the numbers, for Americans born in 1951 — that’s baby boomers — fully 80% were earning more than their parents. By Gen X that was down to 60%. For Millennials it’s barely 50%. We can only imagine what’s coming for the Zoomers.I’ve talked a lot in videos about what’s happening to the young, from being shut out of housing to being stuck cobbling together shifts to make ends meet instead of building a proper career.In short, they’re spending their evenings eating

Read More »Javier Milei Ended a DC-Sized Deficit in…Nine Weeks

February 24, 2024Argentina’s Javier Milei is racking up some solid wins, with the fiscal basket case seeing its first monthly budget surplus in 12 years.

Apparently, it took Milei just nine and a half weeks to balance a budget that was projected at 5% of GDP under the previous government. In US terms, he turned a 1.2 trillion-dollar annual deficit into a 400 billion surplus. In 9 and a half weeks.

How did he do it? Easy: he cut a host of central government agency budgets by 50% while slashing crony contracts and activist handouts.

For perspective, if you cut the entirety of Washington’s budget by 50%, you’d save a fast 3 trillion dollars and start paying off the national debt.

It turns out it can be done, and the world doesn’t collapse into chaos.

Sovereign Debt is Eating the World

November 11, 2023Sovereign debt is eating the world. Lining up a financial crash that could make 2008 look like a picnic.

How did we get here?

In short, governments and central banks deluded themselves into thinking that unlimited deficit spending financed by unlimited money printing won’t do what they’ve done for literally millennia — plunge the economy into stagflation.

They are, of course, wrong. And we’re seeing the catastrophe unfold before our eyes.

From Nixon to $33 Trillion in Debt

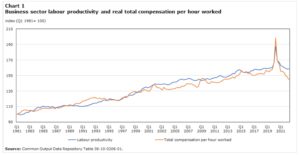

The story begins in the 1970s when Nixon broke the global gold standard, unleashing permanent deficits worldwide. But the latest chapter starts in 2008 when central banks bailed out the financial system by effectively printing trillions of dollars.

At the time, everybody knew that much printing

Voters Hate CBDCs. Why Do Governments Keep Pushing Them?

June 17, 2023Governments worldwide are trying to replace cash with CBDCs, and people worldwide are starting to wake up, but we need a lot more.

A CBDC is a government-run crypto-token that replaces the national currency with a tracking ledger—a list of who owns what—that lets government surveil, control, and mandate every dollar you spend.

They could prevent you from buying the wrong thing, whether raw milk or gas stoves, or self-defense. They could stop you from donating to the wrong person, as we saw with the Canadian Truckers. They could even force you to buy whatever a government bureaucrat tells you to.

On top of the Soviet-style surveillance state, a CBDC is an existential threat to the banking system, to the US dollar and would give central planners push-button

What If the Dollar Falls?

April 14, 2023The past few weeks, major countries have been moving away from the US dollar, raising doubts about the dollar’s long-dominant role in the world. Eight weeks ago, it was just pariah nations like Iran or Russia trying to de-dollarize. Now it’s Brazil, France, even Saudi Arabia—the lynchpin of the decades-long “petrodollar” arrangement.

If the dollar does lose its position as the global reserve currency, it will be catastrophic for the American economy. Catastrophic for the American people on whose backs 80 years of reserve status were built. And it will subject billions of foreigners, for whom the dollar has meant decades of being bullied, to history’s greatest bait and switch.

Dollar at Risk

In late March, Saudi Arabia announced it will price oil in Chinese yuan.

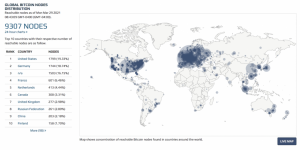

Critics Claim Bitcoin Is a Threat to the Environment. They’re Wrong.

April 14, 2021One popular critique of bitcoin is energy cost per transaction. This doesn’t begin to capture bitcoin’s massive energy savings compared to fiat currency.

Bitcoin’s cost per transaction is well known, and often critiqued; one article in Wired magazine called bitcoin “[a] big middle finger to earth’s climate.” This is because bitcoin’s security, redundancy, and architecture are more energy intensive than traditional payments relying on a single point of failure.

Comparing the energy of a single transaction barely scrapes the surface of the dollar’s carbon footprint, which includes the entire financial infrastructure supporting fiat—8.4 percent of GDP in the US alone, slightly behind manufacturing. This includes 80,000 bank branches, 470,000 ATMs in the US alone, and

The Fed Has Gone Nuts. And It Can Get Worse.

April 29, 2020With its $700 billion bond-buying expansion in response to the COVID crisis, the Federal Reserve has thrust itself into the limelight. Like a sixteen-year-old with a credit card, the Fed is salivating over what money-printing powers it shall seize next. How is the prudent investor to respond?

First, what the Fed’s already done: pushed interest rates to zero and expanded into “unlimited” buying of assets, now reaching to corporate bonds and local government bonds. These bring the same concerns we had in 2008: trillions in new money to dilute the spending power of current savers, along with the risk of “moral hazard” where government covers the losses for corporate, and government, irresponsibility.

What’s more concerning is what the Fed might do next. Proposals are