Who doesn’t know them: the blood-sucking vampires, the eerie undead, immortalized in countless films, and inspired primarily by Bram Stoker’s novel Dracula (1897). Just think of iconic movies like the silent film Nosferatu – A Symphony of Horror (1922), Dracula (1958) with Christopher Lee, Roman Polanski’s parody The Fearless Vampire Killers (1967), or Nosferatu – Phantom of the Night (1979), starring Klaus Kinski as Count Dracula. Vampires are demons who rise from their graves at night, seeking to drain the blood of innocent victims. Not only do they steal the life force that sustains them, but they also spread their curse. Many victims, bitten by vampires, are “turned,” becoming undead themselves, thus joining the vampire’s dark domain.The enemies and hunters of

Read More »Articles by Thorsten Polleit

The Euro Is a Frankenstein-Currency

August 29, 2024In 1818, the English writer Mary W. Shelly (1797-1851) published her gruesome novel Frankenstein: The Modern Prometheus, which became world famous. In the story, the scientist Dr. Victor Frankenstein pieces together a human-like creature from cadaver parts in his laboratory and succeeds in breathing life into its body. But Frankenstein would immediately like to eliminate the monster he has created. He sees it as a demon, calling it a “disgusting monster,” a “cursed Satan.” The monster immediately realized that it is excluded, outcast from human society. It becomes bitter and vengeful, bringing great misfortune, death, and destruction.Shelly’s Frankenstein has undergone many interpretations over the years. One is that the transgression of boundaries—such as

Read More »The Achilles Heel of the Fiat Money System

June 8, 2024The fiat money system will not disappear just like that. Any expectations or hopes to that end should be tempered. Yes, the fiat money system could collapse; yet there is a significant likelihood it will persist longer than most people might think. This prolonged existence may come at a cost: a fascist state encroachment on the freedoms of citizens and entrepreneurs would be more profound than most people realize.Much ink has been spilt about the impending collapse of the international fiat money system. It is a debate that naturally gains momentum in times of crisis—as witnessed in the aftermath of the 2008/9 global financial market debacle or the politically dictated global lockdown crash of 2020/21.At the same time, however, it is entirely justified to harbor

Read More »The Economic Wisdom of Antony C. Sutton’s The War on Gold

January 9, 2024Economist Antony C. Sutton understood one of the most fundamental economic truths: gold is money. Thorsten Polleit reviews Sutton’s classic book, The War on Gold.

Original Article: The Economic Wisdom of Antony C. Sutton’s The War on Gold

[embedded content]

Tags: Featured,newsletter

Read More »The Interest Rate Shock Will Blow Up the Government’s Ponzi Game

November 23, 2023As the federal government continues its Ponzi scheme of issuing debt to pay for past debts, interest rates will increase to the point where this no longer is a tenable strategy—if it ever was.

Original Article: The Interest Rate Shock Will Blow Up the Government’s Ponzi Game

[embedded content]

Tags: Featured,newsletter

Read More »The Interest Rate Shock Will Blow Up the Government’s Ponzi Game

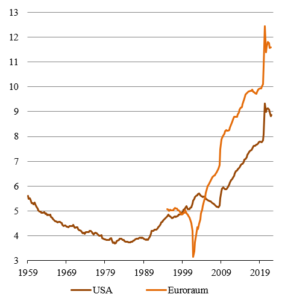

November 6, 2023In the international fixed-income markets, interest rates are rising, and the decades-long trend of declining bond yields has undoubtedly been broken. On August 2, 2022, the ten-year United States Treasury yield was 0.5 percent; on October 9, 2023, it had risen to 4.8 percent. Long-term interest rates in Europe, Asia, and Latin America have also risen sharply. The key reason for the rise in capital market interest rates is the central banks’ interest rate hikes—a direct response to sky-high inflation (caused by the central banks themselves, following a huge increase in the quantity of money).

Figure 1: Ten-year US Treasury bond yield with constant maturity from January 1981 to October 11, 2023 (percent)

picture1.png

Read More »What the Central Bank Cartel has Planned for You

August 31, 2023The Austrian(TA): What is the global currency plot, and who benefits most from the success of this effort?

Thorsten Polleit (TP): The global currency plot denotes a rather inconvenient truth: the existence of states (as we know them today) sets into motion a dynamic process toward creating a single world fiat money controlled by a world central bank, and most likely a central world government. The beneficiaries will be the very few—the “elite”—in charge of running the state and those few privileged by the state, such as big business, big banking, Big Pharma, and Big Tech. However, the great majority of the people will suffer a very great disadvantage. In fact, a single world fiat currency would most likely entail tyranny.

TA: The first half of the book is largely

The BRICS Currency Project Picks Up Speed

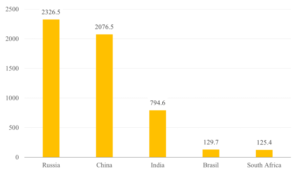

July 17, 2023On Friday, July 7, 2023, news broke in the financial market media that the “BRICS” (that is, Brazil, Russia, India, China, and South Africa) will implement their plan to create a new international currency for trading and financial transactions, and that this new currency will be “gold-backed”.

Most recently, on June 2, 2023, the foreign ministers of the BRICS – as well as representatives from more than 12 countries – met in Cape Town, South Africa (interestingly at the “Cape of Good Hope”). Among other things, it was emphasized that they wanted to create an international trading currency. Undoubtedly, this is an undertaking that could have consequences of epic proportions.

After all, the BRICS countries represent about 3.2 billion people, approximately 40 per

The Fed Is Overindebted, Isn’t It?

May 24, 2023By any conventional measures of finance, the Federal Reserve has negative equity. In the long run, cooking the books only puts off the day of reckoning.

Original Article: "The Fed Is Overindebted, Isn’t It?"

[embedded content]

Tags: Featured,newsletter

Read More »The Fed Is Overindebted, Isn’t It?

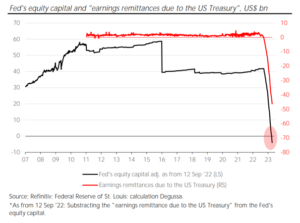

May 8, 2023Behind closed doors, the report is already making the rounds in expert circles: if you follow the rules of sound commercial accounting, the United States Federal Reserve (Fed) has lost its equity and is, as common language would have it, bankrupt. What happened?

During spring 2020 (i.e., in a period of extremely low interest rates), the Fed purchased large amounts of government bonds and mortgage bonds to support the economy and financial markets during the covid crisis.

The Fed paid for the purchases by issuing vast amounts of new central bank money. This has created an enormous “money surplus” in the US interbank market, where banks lend money to one another. It is exactly in this market where the interest rates for all other credit markets are determined.

No, the Financial Crisis Is Not Over

April 28, 2023As markets settle down after the last set of bank failures, political elites claim the crisis is behind us. But it is not over, not by a long shot.

Original Article: "No, the Financial Crisis Is Not Over"

This Audio Mises Wire is generously sponsored by Christopher Condon.

[embedded content]

Tags: Featured,newsletter

Read More »The Road to a Single Fiat World Currency

April 27, 2023What if the world’s states were to come together and create a single world currency? From a purely economic point of view, there would be significant advantages if every nation didn’t operate with its own money but with the same currency. Not only for an individual economy, but for the world economy as a whole, the optimal number of currencies is one. Let’s take a look.

The decisive factor is how this single world currency comes about, and who issues it. In a free market for money—in a natural process—a single world currency would emerge from the voluntary agreements of the market participants: the money demanders would decide which commodity they want to use as money. It is impossible to predict with certainty what the outcome of the free choice of currency would

No, the Financial Crisis Is Not Over

April 17, 2023The collapse of California-based Silicon Valley Bank (and Signature Bank in New York) on March 10, 2023, sent shock waves through the international financial system. It not only made bank stocks and bank bonds fall sharply but also finally brought ailing banking giant Credit Suisse to its knees. The Swiss bank had to be rescued and was bought by UBS on March 19, 2023. In another wave of market fear, Deutsche Bank, another global systemically important bank, came under pressure: its share price fell sharply, and credit default swap spreads on its liabilities skyrocketed.

In the meantime, however, market stress seems to have subsided. It is fair to say that the Federal Reserve (Fed) and the US Treasury have pulled it off. The Fed opened its funding spigots for

Odds Are Rising That the Fed Will Trigger the Next Bust

March 8, 2023From March 17, 2022, to the end of January 2023, the US Federal Reserve (Fed) increased its federal funds rate from practically zero to 4.50–4.75 percent. The rise in lending rates came in response to skyrocketing consumer goods price inflation: US inflation rose from 2.5 percent in January 2022 to 9.1 percent in June. Notwithstanding inflation falling to 6.4 percent in January 2023, the Fed continues to signal to markets that it will continue to hike rates to bring down consumer price inflation.

This is understandable. The Fed wants to maintain its inflation-fighting credentials; it wants people to believe it is really determined to bring inflation back to 2 percent. It is presumably well aware that the US dollar’s world reserve currency status needs to be

The Global Currency Plot

February 19, 2023—from the Summary …

Democratic socialism—the ideology that dominates the world today—aspires to become a world state. The route toward it requires a single world currency to be created. That would undoubtedly create a dystopia. Might this become a reality? And if so, how can it be averted? This book aims to find answers to these questions.

Part 11. Concerning Right Thinking: Logic

The arguments in this book claim to be strictly logical. For a better understanding, a few basics of logic—the doctrine of correct thinking—are presented. These show the possibility of making use of the incorruptible power of judgment.

2. What We Know for a Fact: Humans Act

The phrase “humans act” is logically undeniably true; it applies a priori. From it further true statements can be

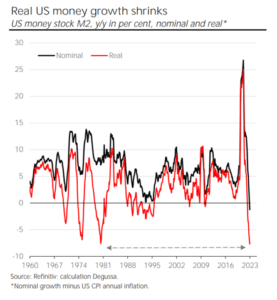

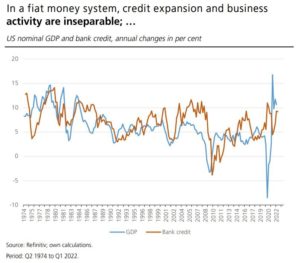

You Think the Global Economy Is Brightening? Beware: The Big Hit Is Yet to Come

February 6, 2023Relief is spreading among economic analysts and stock market experts. Energy prices are decreasing noticeably. The energy supply this winter seems secure; in Europe, government support for consumers and producers is available if needed. China is turning away from its zero-covid policy, and production is ramping up again. High goods price inflation is still a major concern for consumers and producers, but central banks are delivering at least some interest rate hikes to hopefully reduce currency devaluation. So should we bid farewell to crisis and recession worries? Unfortunately, no.

Because there is an overall economic development that is tantamount to a storm but remains unnamed by many experts and investors. And that is the global contraction of the real

Objection, Professor Harari! Logic Proves the Existence of Free Will

December 27, 2022Yuval Noah Harari, professor of history at Hebrew University in Jerusalem, is not only a best-selling author but also a top advisor to Klaus Schwab, founder and front man of the World Economic Forum (WEF).

In 2018, Harari wrote: “Unfortunately, ‘free will’ isn’t a scientific reality. It is a myth inherited from Christian theology.”

And, in a 2019 interview, Harari said:

Humans today are a hackable animal—an animal that can be hacked. . . . Hacking a person means understanding and seeing through them better than they can themselves. . . . The consequences are obvious: Anyone who knows people’s inner feelings can anticipate their actions. And, of course, manipulate their desires. Ultimately, these institutions (companies and states are meant here, TP) will make more

Can the Dollar Once Again Be Anchored by Gold? One Congressman Believes It Can

November 1, 2022Sorry, I’ve looked everywhere but I can’t find the page you’re looking for.

If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page:

Search

Searching for the terms %3Futm+source%3Drss%26utm+medium%3Drss%26utm+campaign%3Dpolleit+dollar+again+anchored+gold+one+congressman+believes …

Read More »Inflation, High Inflation, Hyperinflation

October 11, 2022The word “inflation” is heard and read everywhere these days.

However, since different people sometimes have very different understandings of inflation, here is a definition:

Inflation is the sustained rise in the prices of goods across the board.

This definition conveys that inflation means that the increase in prices of goods is not just a one-off but permanently; and that not just some goods prices go up, but all.

How does inflation arise? The economists have two explanations ready. The first explanation is the “nonmonetary” explanation of inflation. According to this theory, sharply rising energy prices lead to inflation. This is referred to as cost-push inflation.

Or inflation is caused by excess demand: the demand for goods exceeds the supply, causing prices

Everything You Wanted to Know about Money, but Were Afraid to Ask

September 8, 2022Introduction

With my talk, I would like to accomplish three goals:

First, I want to explain some sound and time-tested basics of monetary theory.

Second, I would like to point out why it is important to have a free market in money; that the battlefront of our time is not between, say, bitcoin, stable coins, gold, and silver, but between government-monopolized fiat monies and a free market in money.

And third, I hope to strengthen your conviction that we need a free market in money! Unless we succeed in ending governments’ money monopolies, I fear we might end up in the most sinister tyranny the world has ever seen.

On the Subject of Money

Let me ask you: What is money? The answer is: Money is the universally accepted means of exchange.

As such, money is a good

Über das Bestreben, Bargeld abzuschaffen und digitales Zentralbankgeld einzuführen

July 6, 2022[Der folgende Beitrag wurde Mitte Mai 2022 als Vortrag auf der Gottfried Haberler Konferenz in Liechtenstein gehalten.]

Gleich zu Beginn möchte ich Ihnen die Schlussfolgerungen meiner Überlegungen mitteilen:

Das Bargeld zurückzudrängen oder aus dem Verkehr zu ziehen und digitales Zentralbankgeld auszugeben, sind äußerst problematisch, weil

(1.) die Missbrauchsmöglichkeiten und Fehlentwicklungen des staatlichen Fiat-Geldmonopols gewaltig erhöht werden, ohne dass sich dagegen wirksame Abwehrmechanismen aufbieten ließen; und weil

(2.) der Weg in den digitalen Überwachungs- und Lenkungsstaat befördert wird (Stichworte „Great Reset“ und „Große Transformation“), eine Entwicklung, die das freiheitliche, friedvolle und produktive Zusammenleben der Menschen auf dieser

On the Digital Future of Markets and Money

June 18, 2022Thank you very much for the invitation. I am delighted to have the opportunity to share some thoughts with you on a topic I am very much interested in and that I believe is of the utmost importance to people around the globe—and that is “the digital future of markets and money.”

So let us dive right in!

When I was your age, dear students, there were no cell phones, no internet, no Google, no Amazon, no Facebook, no Twitter, no TikTok, no YouTube. People did not have Apple Pay, PayPal, Alipay, or WeChat Pay.

Luckily, however, we already had money. Purchases were paid for with cash—coins and bills—with writing checks and with electronic money by wiring sight deposits from one bank account to another. As online banking didn’t exist, people were pretty busy filling

Interest Rates Are Rising, but the Fed Continues to Be Reckless

June 14, 2022The crushing issue of high inflation caused by central banks can no longer be downplayed. Public displeasure at the increasing currency devaluation has now forced monetary policy makers to act.

The US Federal Reserve (Fed) has raised its key interest rate to 1 percentage point. Many other central banks have also reacted—such as the Bank of England, the Central Bank of Australia, and the Central Bank of Sweden. Even the ponderous European Central Bank (ECB) now plans to raise interest rates at the beginning of the third quarter.

Does all this mean that there will be an “interest rate reversal”?

The answer begins with a look at the fiat money system that is ubiquitous today. In the fiat money system, interest rates are not established in a “free market.” Rather, the

Freedom and Sound Money: Two Sides of a Coin

May 17, 2022It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of right.

So wrote Ludwig von Mises in The Theory of Money and Credit in 1912. And further:

The sound-money principle has two aspects. It is affirmative in approving the market’s choice of a commonly used medium of exchange. It is negative in obstructing the government’s propensity to meddle with the currency system.

Against this backdrop, modern day monetary systems appear to have been drifting farther and farther away from the sound money principle in the last

Berliners in 2021 Want to Expropriate Private Housing

October 16, 2021The Berlin “housing crisis” has, of course, many causes. But most, if not all of them, are government made. Unfortunately, however, people blame “capitalists” for their plight.

Original Article: “Berliners in 2021 Want to Expropriate Private Housing”

On September 6, 2021, the city-state of Berlin, Germany’s capital, held a referendum: voters in Berlin had to decide whether thousands of housing units owned by “large real estate firms” should be nationalized. 56.4 percent voted yes, 39 percent no. While the referendum is not binding, it forces Berlin’s incoming city government to debate the expropriation measure. However, whichever way you look at it, it certainly is an expropriation attempt: the term “expropriation” is even openly stated in the name of the

Read More »Berliners in 2021 Want to Expropriate Private Housing

October 6, 2021On September 6, 2021, the city-state of Berlin, Germany’s capital, held a referendum: voters in Berlin had to decide whether thousands of housing units owned by “large real estate firms” should be nationalized. 56.4 percent voted yes, 39 percent no. While the referendum is not binding, it forces Berlin’s incoming city government to debate the expropriation measure. However, whichever way you look at it, it certainly is an expropriation attempt: the term “expropriation” is even openly stated in the name of the grassroots campaign, “Expropriation Deutsche Wohnen and Co,” and it suggests a compensation of the properties “well below market value.”

Housing is scarce in Berlin, and rents continue to rise. This already led the city government to declare a freeze on rent

Fiat Money Economies Are Built on Lies

July 21, 2021Now and then, it pays to take a step back to get a broader perspective on things, to look beyond the daily financial news, to see through the short-term ups and downs in the market to find out what is really at the heart of the matter. If we do that, we will not miss the fact that we are living in the age of fiat currencies, a world in which basically everything bears their fingerprints: the economic and financial system, politics—even people’s cultural norms, values, and morals will not escape the broader consequences of fiat currencies.

You may not notice it in your daily use of fiat currencies—that is, for instance, when receiving wages, buying goods and services, paying down mortgages, depositing money with the bank for saving purposes—that something is

Das staatliche Geldmonopol und der „Große Reset“

March 15, 2021Das ungedeckte Papiergeldgeldsystem – man kann es auch als Fiat-Geldsystem bezeichnen – ist wirtschaftlich und sozial äußerst problematisch. Es verursacht Schäden, die vermutlich weit über die Vorstellungen der meisten Menschen hinausgehen. Beispielsweise ist das Fiat-Geld inflationär; es begünstigt einige wenige auf Kosten vieler; es verursacht Konjunkturzyklen („Boom-und-Bust“); es korrumpiert das Moral- und Wertesystem der Gesellschaft; es führt zur Überschuldung; und es läuft Gefahr, letztendlich in einem großen Desaster zu enden.

Das Institute of International Finance (IIF) schätzt, dass die globale Verschuldung bis Ende 2020 auf 277 Billionen Dollar angestiegen ist – und das entspräche einem Schuldenstand von 365 Prozent des weltweiten

Read More »„Hayek und die Pandemie“: Das irreführende Narrativ des Neo-Keynesianismus in der F.A.Z.

February 8, 20218. Februar 2021 – von Philipp Bagus und Thorsten Polleit

Was sagt Hayeks Liberalismus dazu?

Philipp Bagus

Am 5. Februar 2021 hat der Ökonom Arash Molavi Vasséi den Aufsatz „Hayek und die Pandemie“ in der F.A.Z. veröffentlicht. Er will darin aufzeigen, wie seiner Meinung nach Friedrich August von Hayek (1899–1992) die Politiken, zu denen die Staaten in der Coronavirus-Pandemie greifen, vor dem Hintergrund „liberaler Prinzipien“ beurteilen würde. Nach Lektüre des Aufsatzes kommt man zum Schluss: Der freie Markt, der Liberalismus, kann nicht die Lösung sein, vielmehr muss der Staat es richten, und darin ist sich Hayek einig mit den Neo-Keynesianern; und dort, wo Hayek Bedenken anmeldet – bei der Geldpolitik, die die elektronische Notenpresse anwirft und Null- und

Read More »Absolute Eigentumsrechte als ökologischer Imperativ

January 19, 202118. Januar 2021 – von Thorsten Polleit

[Ein Vortrag gehalten auf der 8. Jahreskonferenz des Ludwig von Mises Institut Deutschland am 10. Oktober 2020 im Hotel Bayerischer Hof in München.]

In diesem Vortrag argumentiere ich, dass (1) Eigentum und Umwelt- beziehungsweise Ressourcenschutz keine Gegensätze sind; dass (2) man vielmehr auf das Eigentum setzen muss, wenn Umwelt und Ressourcen wirksam geschützt und ein tyrannischer Weltstaat verhindert werden sollen; und dass (3) der Staat (wie wir ihn heute kennen) der eigentliche Grund für Umwelt- und Ressourcenschäden ist.

Damit spreche ich mich gegen die herrschende Meinung aus, der Staat müsse Klimapolitik betreiben – indem er beispielsweise C02-Emissionen begrenzt und/oder besteuert. Diese vom Konsens abweichenden