There are three things the markets have going for them right now, and none of them have anything to do with the Federal Reserve. More and more conditions resemble the early thirties in that respect, meaning no respect for monetary powers. This isn’t to say we are repeating the Great Depression, only that the paths available to the system to use in order to climb out of this mess have similarly narrowed. That’s what’s ultimately going to matter the most, not what comes next but what comes after what’s next. This is why it is paramount to pay close attention to longer term indications (and stocks are not among this group). Those three positive factors begin with the intense buying interest in stocks including short covering. US Treasury Curve, 2018-2020 -

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, currencies, economy, eurodollar system, Featured, Federal Reserve/Monetary Policy, fiscal stimulus, GFC1, GFC2, interest rate swaps, Liquidity, Markets, newsletter, quarter-end bottleneck, stocks, swap spreads, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

There are three things the markets have going for them right now, and none of them have anything to do with the Federal Reserve. More and more conditions resemble the early thirties in that respect, meaning no respect for monetary powers. This isn’t to say we are repeating the Great Depression, only that the paths available to the system to use in order to climb out of this mess have similarly narrowed. That’s what’s ultimately going to matter the most, not what comes next but what comes after what’s next. This is why it is paramount to pay close attention to longer term indications (and stocks are not among this group). Those three positive factors begin with the intense buying interest in stocks including short covering. |

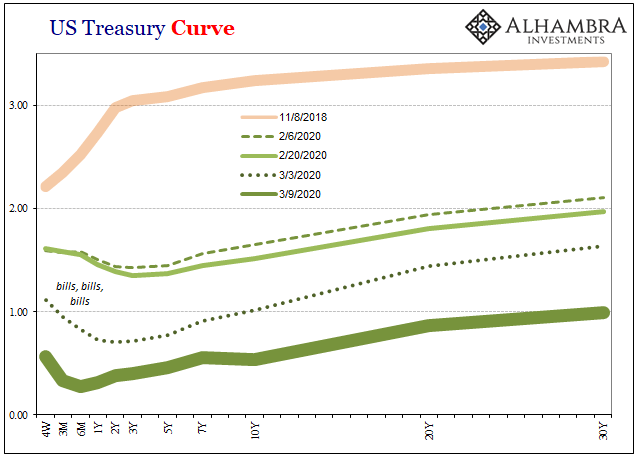

US Treasury Curve, 2018-2020 |

| Apparently, the sharp drop on Wall Street has left many especially in this profession just itching to get back in and make back what was, they hope, only temporarily lost. Typical dead cat stuff, it takes a couple of rounds for these investors to learn things have changed before capitulation.

Second, the most obvious, is the fiscal bazooka. It’s big and they are calling it stimulus when in truth it’s not much more than aid, and a band-aid at that. It’s as if the ARRA never happened; “stimulus” is always viewed with tremendous positivity when there’s nothing but an abyss staring back. Hope more than rational and honest analysis. The third factor is, in my view, the most important. The mid-March bottleneck, that insidious, otherwise insipid seasonal quirk that lies in wait two weeks before these particular quarter-ends, we might’ve made it passed this one. Bear Stearns was mid-March 2008 announcing the full and complete presence of GFC1, and GFC2 shows up mid-March 2020. It’s not random. Over the short run, that will take some of the pressure off liquidity and collateral (which the Fed will, if it lasts, take full credit for – just as they did twelve years ago in financing JP Morgan’s “rescue” of Bear). In that sense, history repeats a little too closely; some are already declaring this GFC at an end right at what looks to be the same point when many of the same people had incorrectly declared the last one finished, too. |

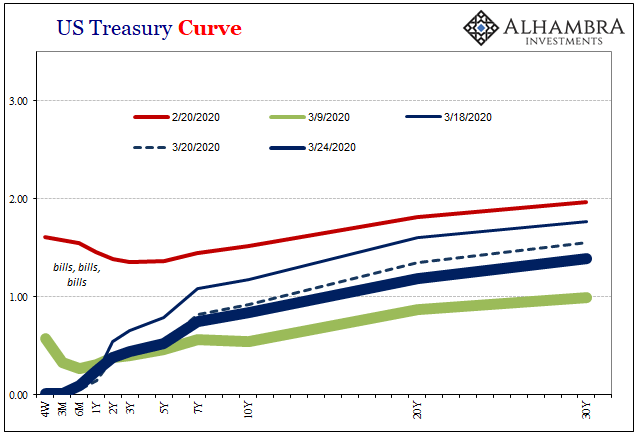

US Treasury Curve, 2020 |

| Having survived the bottleneck, the long end selloff in Treasuries, a definitive sign of the amplified liquidity pressures through this period, seems to have run off. That doesn’t mean there isn’t more volatility to come in this space, just that for now the bond market is back to functioning in the opposite way as stocks.

The yield curve, like others, isn’t looking favorably upon either short covering/equity buying interest nor the prospects for this coming fiscal intervention. Bonds are seeing it as strictly aid, probably insufficient, rather than effective stimulus, too. The key reason is almost certainly a current survey of the carnage. |

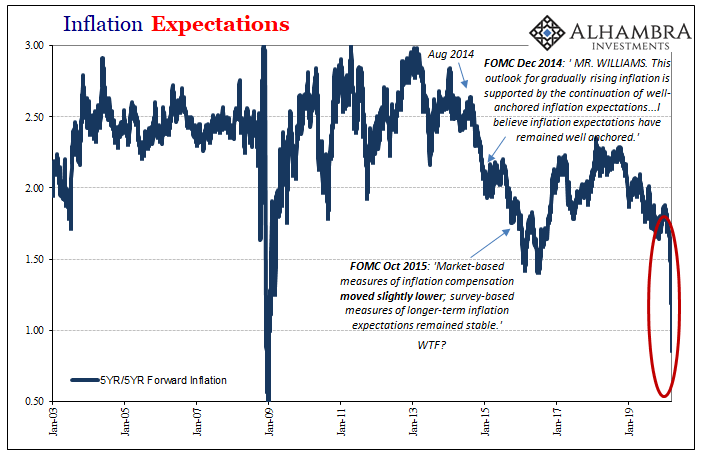

Inflation Expectations, 2003-2020 |

| I’ll give you two big ones right now: |

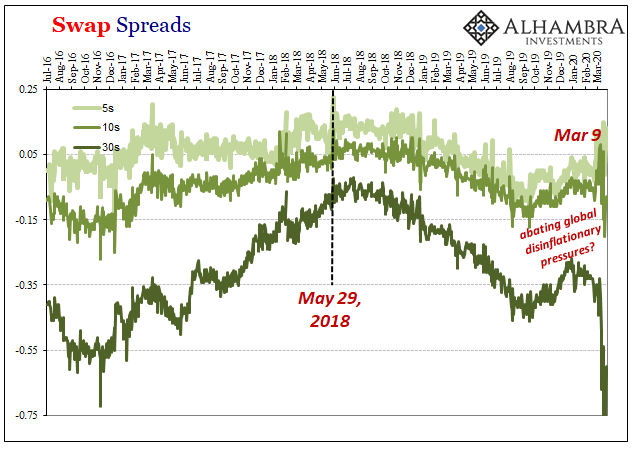

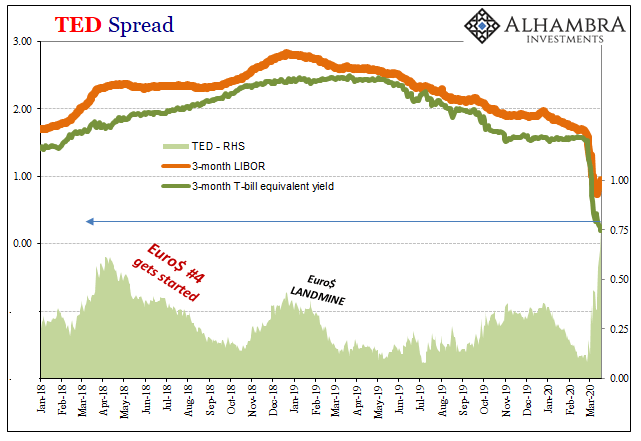

Swap Spreads, 2016-2020 |

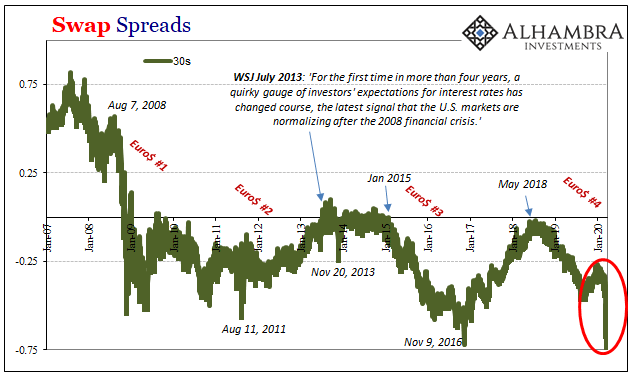

Swap Spreads, 2007-2020 |

|

| The low point in the 30-year swap spread is literally off the chart above, the recent record low set on March 19 at -85 bps. If you remember much about GFC1 you’ll recall the sudden drop in swap rates toward the end of October 2008 – another point at which the crisis was declared fixed by combined fiscal (TARP) and monetary interventions (bailouts and dollar swaps).

Instead, that plunge which had produced negative swap spreads for the first time signaled only more problems to come. Which is just what ended up happening; there was another devastating leg to play out starting in December 2008 and lasting for months until March 2009, all during which the Fed declared bank reserves “abundant”, global dollar swaps open for business, and QE bidding for bonds some of which global markets actually still needed. In other words, like right now these longer run, deeper capacity indications back then weren’t at all impressed by the Fed nor the ARRA fiscal “stimulus.” These market prices and spreads are not about the coronavirus; that’s the short run. They are about looking ahead to what comes afterward, the prospects big or small for a real recovery. The markets are saying here that they don’t look good and no wonder because the first peek at the short run is turning out closer to worst case. |

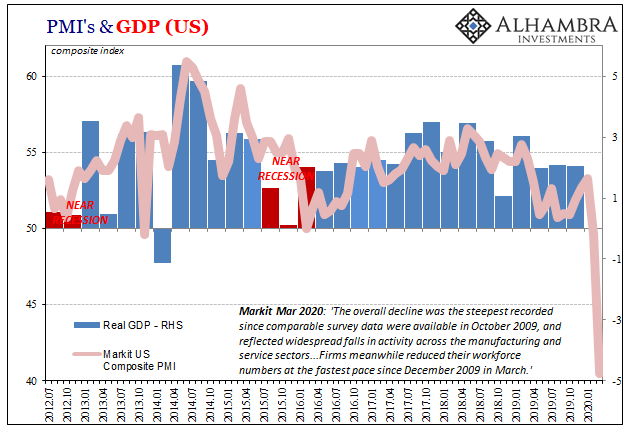

US PMI's & GDP, 2012-2020 |

That was the big error, as I wrote earlier today, authorities thinking the economy and monetary system was in good enough shape to go full-blown, indiscriminate shutdown. It wasn’t in good shape, the monetary system disastrously frail, as the repo market tried to warn everyone last September, so the damage being done by the contraction on top of GFC2 isn’t going to be short run, either.

Outside of the NYSE, all of a sudden the hashtag #reopenamerica is trending today for “some” reason.

We might have made it through March’s quarter-end bottleneck (and even that’s not completely assured yet), maybe a temporary and partial reprieve. But what about the next one? Or, remembering all those past Septembers, the one after that?

Tags: Bonds,currencies,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,fiscal stimulus,GFC1,GFC2,interest rate swaps,Liquidity,Markets,newsletter,quarter-end bottleneck,stocks,swap spreads,U.S. Treasuries,Yield Curve