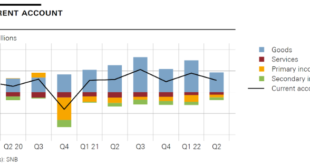

Overview In the second quarter of 2022, the current account surplus was CHF 11 billion, almost CHF 1 billion lower than in the same quarter of 2021. The receipts surplus in goods trade, especially merchanting and traditional goods trade (foreign trade total 1), declined. The expenses surpluses in services trade, primary income and secondary income were each lower than in the same quarter of 2021. . In the financial account, reported transactions recorded a net...

Read More »Swiss Balance of Payments and International Investment Position: Q1 2020

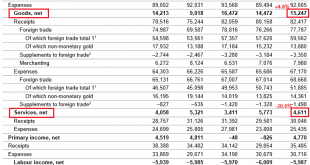

Current Account Key figures: Current Account: Down 13.72% against Q1/2019 to 17.4 bn. CHF of which Goods Trade Balance: Plus 8.05% against Q1/2019 to 17.4 bn. of which the Services Balance: Minus 53.84% to 3.02 bn. of which Investment Income: Minus 0.54% to 6.3 bn. CHF. Current Account Switzerland Q1 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch...

Read More »Swiss Balance of Payments and International Investment Position: Q4 2019 and review of the year 2019

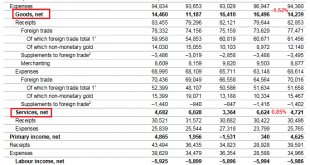

Key developments in 2019 The current account surplus for 2019 was CHF 86 billion, CHF 29 billion more than the previous year. This increase was principally due to growth in primary income (labour and investment income). In the year under review, receipts exceeded expenses by CHF 14 billion, whereas in the two previous years, expenses had significantly exceeded receipts. The main contributors to this development had been finance and holding companies, which had...

Read More »Swiss Balance of Payments and International Investment Position: Q2 2019

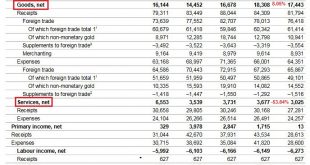

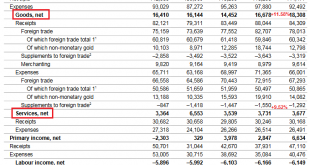

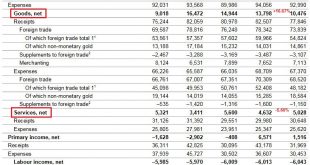

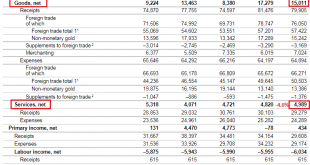

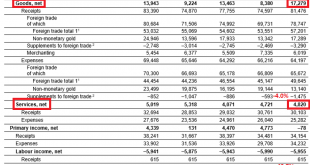

Current Account Key figures: Current Account: Down 2.07% against Q2/2018 to 21.3 bn. CHF of which Goods Trade Balance: Minus 1.52% against Q2/2018 to 14.24 bn. of which the Services Balance: Plus 0.85% to 4.72 bn. of which Investment Income: Minus 1.67% to 10.61 bn. CHF. Current Account Switzerland Q2 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch...

Read More »Swiss Balance of Payments and International Investment Position: Q1 2019

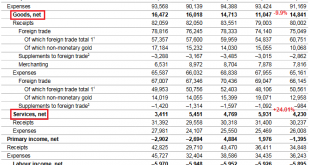

Current Account Key figures: Current Account: Up 2.35% against Q1/2018 to 17.2 bn. CHF of which Goods Trade Balance: Minust 0.62% against Q1/2018 to 15.9 bn. of which the Services Balance: Plus 21.1% to 6.8 bn. of which Investment Income: Plus 5.8% to 3.5 bn. CHF. Current Account Switzerland Q1 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account,...

Read More »Swiss Balance of Payments and International Investment Position: Q4 2018 and review of the year 2018

Key developments in 2018 The current account surplus for 2018 was CHF 71 billion, CHF 26 billion more than in the previous year. Changes in primary income (labour and investment income) had the greatest impact: Whereas one year earlier an expenses surplus of CHF 9 billion was recorded, owing to exceptionally large expenses for direct investment receipts in 2017, in the year under review there was a receipts surplus...

Read More »Swiss balance of payments and international investment position: Q3 2018

Current Account Key figures: Current Account: Down 35.7% against Q3/2017 to 14.6 bn. CHF of which Goods Trade Balance: Down 23.9% against Q3/2017 to 10.5 bn. of which the Services Balance: Plus 8.7% to 5.0 bn. of which Investment Income: Minus 39.7% to 7.6 bn. CHF. Current Account Switzerland Q3 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account,...

Read More »Swiss Balance of Payments and International Investment Position: Q2 2018

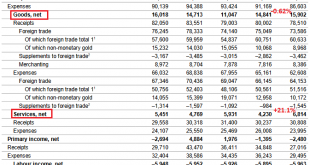

Current Account Key figures: Current Account: Up 27.0% against Q1/2018 to 22.1 bn. CHF of which Goods Trade Balance: Up 4.8% against Q1/2018 to 15.2 bn. of which the Services Balance: Minus 20.6% to 4.6 bn. of which Investment Income: Plus 107.7% to 10.7 bn. CHF. Current Account Switzerland Q2 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account,...

Read More »Swiss Balance of Payments and International Investment Position: Q1 2018

Current Account The current account surplus amounted to CHF 18 billion, a CHF 5 billion increase over the year-back quarter. It was calculated as the sum of all receipts (CHF 149 billion) minus the sum of all expenses (CHF 131 billion). Key figures: Current Account: Up 41% against Q1/2017 to 18.1 bn. CHF of which Goods Trade Balance: Up 62.7% against Q1/2017 to 15.1 bn. of which the Services Balance: Minus 6.2% to...

Read More »Swiss Balance of Payments and International Investment Position: Q4 2017 and review of the year 2017

Q4 2017 In the fourth quarter of 2017, the current account surplus amounted to CHF 20 billion, or CHF 2 billion less than the year -back quarter. Lower receipts from investment income resulted in a slight expenses surplus on primary income (labour and investment income), which had shown a receipts surplus in the corresponding quarter of 2016. Moreover, the expenses surplus on secondary income (current transfers) rose....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org