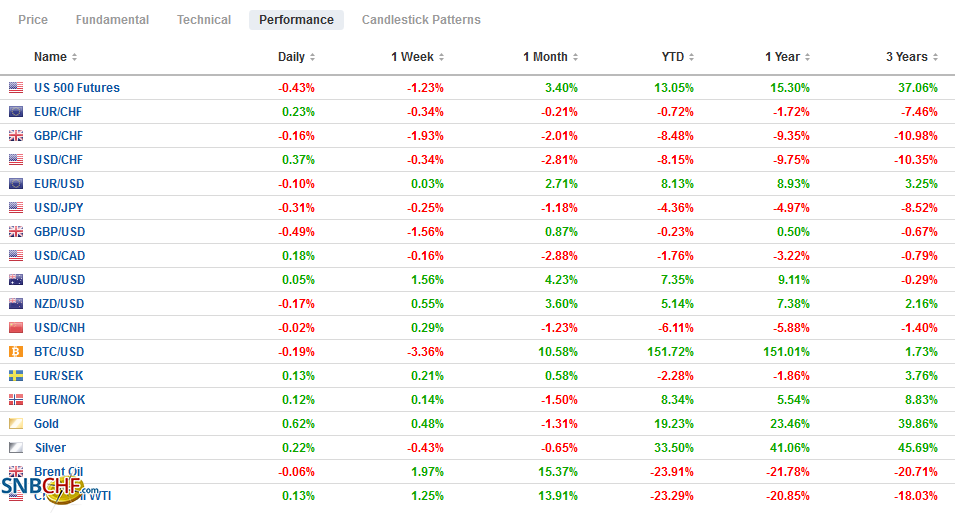

Swiss Franc The Euro has risen by 0.21% to 1.0773 EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The odds of a UK-EU agreement and new stimulus before year-end in the US have faded and are sapping risk appetites ahead of the weekend. Although most Asia Pacific equity markets gained, China and Australia were notable exceptions, European shares are heavy, and the Dow Jones Stoxx 600 is near three-week lows. It is set to end a five-week rally. US shares are also trading heavily. Bond markets are bid. In fact, yields in several countries, core as well as periphery, are at new record lows. The US benchmark is at a nearly two-week lows below 0.90%. The dollar is mostly higher.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Canada, Currency Movement, ECB, Featured, newsletter, South Korea, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.21% to 1.0773 |

EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

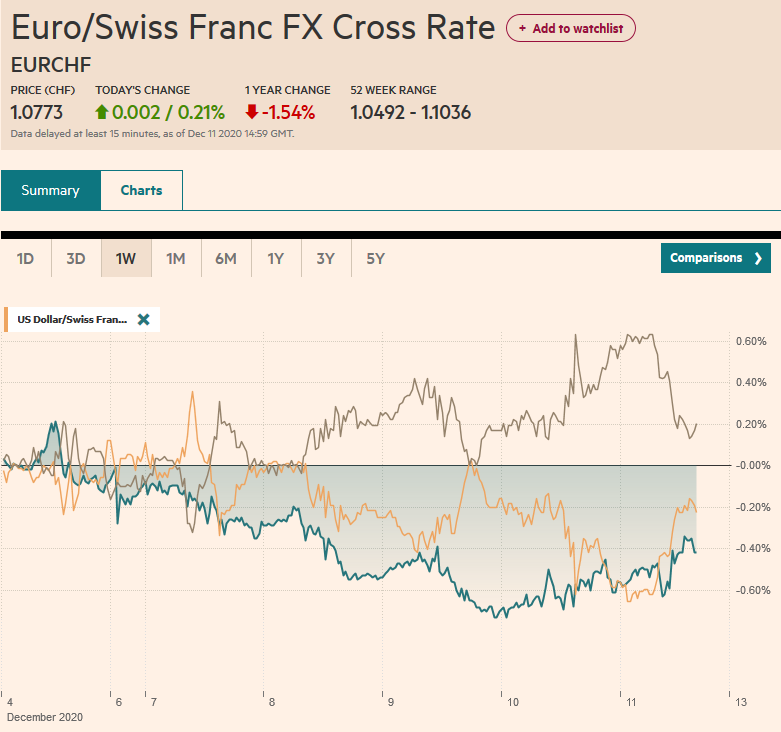

FX RatesOverview: The odds of a UK-EU agreement and new stimulus before year-end in the US have faded and are sapping risk appetites ahead of the weekend. Although most Asia Pacific equity markets gained, China and Australia were notable exceptions, European shares are heavy, and the Dow Jones Stoxx 600 is near three-week lows. It is set to end a five-week rally. US shares are also trading heavily. Bond markets are bid. In fact, yields in several countries, core as well as periphery, are at new record lows. The US benchmark is at a nearly two-week lows below 0.90%. The dollar is mostly higher. Among the majors, sterling is bearing the brunt and is trading below $1.3200. The yen is proving more resilient. With US and EU sanctions coming, the Turkish lira is leading the emerging markets currency complex lower. The dollar traded above TRY8.0 for the first time in a few weeks. The JP Morgan Emerging Market Currency Index is paring this week’s gains, which are the sixth in a row. Gold is pinned near the mid-week trough and is trading inside yesterday’s range. A close above $1840 would lift the technical tone. Oil prices are consolidating lower after yesterday’s surge that lifted Brent to $50 and January WTI to almost $48. |

FX Performance, December 11 |

Asia Pacific

South Korean exports surged in the first ten days of December. The 26.9% year-over-year jump follows a 4% gain in November. The fewer working days skew the report, but South Korean exports still rose a strong 11.9% when adjusted. Semiconductor exports surged at 53%, and exports of cell phones and autos also recovered. Exports to China, the EU, and the US rose. This captures two important investment themes. The first is the recovery in East Asia, which seemed to be leading the world. The second that trade flows appear to be recovering faster than many expected.

New Zealand house sales surged by 30% in November, and prices rose by about 15%. The central bank pushed back against proposals for parliament to include house prices in its formal mandate. The RBNZ argued that it would lead to below target levels of employment. Separately, it proposed that it be allowed to take debt/income ratios into account in setting macro-prudential policies. Low-interest rates fuel higher house prices in many countries, and the housing market is one of the leading sectors in many recoveries. As the pandemic eases, the elevated prices may begin impacting policy outlooks.

One of the reasons Asia exports its surplus savings is that many countries have under-developed their own capital markets. This is gradually changing as the local corporate bond market broadens and deepens. Yesterday, Japan’s NTT sold JPY1 trillion of bonds (~$9.6 bln), which is the largest offering in the local market. Four tranches were offered, and demand was strong.

The dollar had held above JPY104 for the past two sessions, but yesterday recorded a bearish shooting star candlestick, and the greenback is set to snap a three-day, albeit small advance. Follow-through selling saw it dip below JPY103.95 to test the week’s lows. Resistance is now seen near JPY104.20. Note that the dollar has settled between JPY104.05 and JPY104.25 for the past five sessions. The Australian dollar’s gains were extended to a little more than $0.7570 today. Recall it closed at $0.7425 last week. It is the strongest of the majors, with a nearly 1.5% gain this week. It is the sixth consecutive weekly gain. Support was found in early European activity near $0.7520. Additional support is seen near $0.7480. The PBOC’s reference rate for the dollar was set at CNY6.5405, a little stronger than expected. The yuan has softened by about 0.2% this week as it consolidates its recent gains. It is only the fourth weekly decline here in Q4. It slipped in two weeks in Q3. Note that money-market rates (e.g., overnight repo and seven-day repo rates) jumped higher today, and the PBOC will likely address the funding squeeze next week.

Europe

European officials have succeeded in securing the EU budget and recovery plan. Italy successfully navigated through some dissent in the governing coalition over the planned ESM reform. A trade deal with the UK, however, continues to prove elusive. Both sides are preparing for no deal. Although the UK Prime Minister Johnson calls it the Australian deal, the fact is that Australia is seeking closer ties with the EU. Negotiations ostensibly continue through the weekend, but unless Merkel or Macron (less likely) directly intervenes, it is difficult to see a breakthrough. On the other side of Brexit, the UK and EU would likely negotiate some industry-specific deals (like Australia has), but it is a small consolation at this point.

The ECB did what it was expected to do with some modest modifications. The PEPP was boosted by 500 bln euros, and the operation extended for nine months instead of six. New generous TLTROs will be offered, and banks will be able to borrow up to 55% of the eligible loans rather than 50%. The TLTRO terms were extended to June 2022, while the PELTRO was extended through March 2022. Lagarde noted that the full capacity of the PEPP (1.85 trillion euros) may not be utilized, which seemed to be a nod to the more hawkish members.

Lagarde’s remarks on the exchange rate were, well, unremarkable. She restated the obvious. The ECB does not target the exchange rate, but it monitors it closely, and the euro appreciation exerts downward pressure on prices. The euro reached session highs (~$1.2160) shortly after the press conference ended and settled in the upper end of the range. Little effort was made to knock it back. Although the eurozone is weaker than it was at the start of September and the downside risks have materialized, as the depth and duration of the virus surge is more than expected, there was not nearly the hoopla seen when the euro first probed the $1.20 area.

The ECB staff revised their forecasts. This year’s contraction is put at 7.3% rather than 8%. Next year’s growth was cut to 3.9% from 5%. The OECD’s lastest forecast was for a little lower at 3.6%. In 2022, the economists at the ECB were more optimistic and revised up their forecasts to 4.2% from 3.2%. The CPI forecast was trimmed to 0.2% from 0.3% for this year, and next year’s forecast was unchanged at 1%. Inflation in 2022 may be a smidgeon higher at 1.1%, down from the earlier forecast of 1.3%.

The euro is trading quietly at little changed levels in late European morning turnover. So far, it is the first time this week that the single currency is holding above $1.21 (where a 920 mln euro option is set to expire today). It approached the high of the week, set on Monday, just above $1.2165. Last week’s high, after the disappointing US jobs report, was almost $1.2180. Still, it settled near $1.2120 last week, which was the third consecutive weekly advance. It appears to be more of a consolidative phase than a correction. A break of the $1.2060 area could signal a correction. A week ago, sterling was probing the air above $1.35 and reached its best level in more than two years. Today is the fourth decline this week. It is has fallen to $1.3175 in Europe. The next chart support below there is seen near $1.3115. The euro has climbed around 1.75% against sterling this week, the most in three months to approach GBP0.9200. Recall, it had dipped below GBP0.9000 in the middle of the week. The next important target is the September 11 high near GBP0.9300.

AmericaThe US federal government’s spending authorization is exhausted at midnight. The House has passed a one-week stop-gap. The Senate has not, but likely will today. If not, there may be some maneuvering to minimize the weekend disruption. There was hope to fold the stimulus efforts into the omnibus spending bill. However, limiting Covid-related liabilities for businesses, and to a less extent, aid to state and local businesses is reportedly blocking an agreement. |

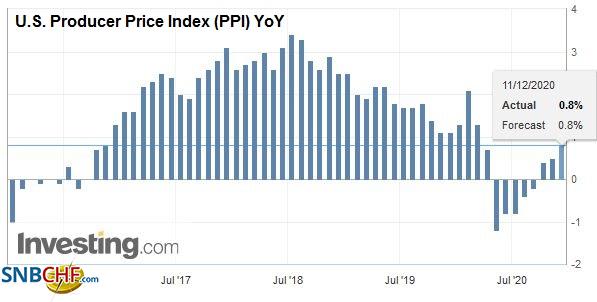

U.S. Producer Price Index (PPI) YoY, November 2020(see more posts on U.S. Producer Price Index, ) Source: investing.com - Click to enlarge |

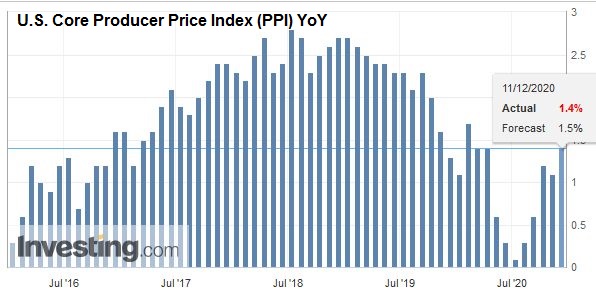

| The US reports November producer prices today. A 0.2% gain on the headline and core rates is expected, and that would lift the year-over-year rate to 0.7% and 1.5%, respectively. Yesterday’s slightly firmer than expected CPI kept the headline and core rates steady at 1.2% and 1.6%, respectively. Many observers are playing up the risk of higher inflation next year, which can be seen in various market measures. The University of Michigan’s survey of long-term (5-10 years) inflation expectations will be reported with the preliminary December sentiment survey results. It was at 2.3% in February and March and hit 2.7% in June, August, and September. It fell back to 2.4% in October and was at 2.5% in November. Given this backdrop, the results of yesterday’s 30-year bond auction were unexpectedly strong: the re-opening issue, the record-size, and the reflation meme notwithstanding. |

U.S. Core Producer Price Index (PPI) YoY, November 2020(see more posts on U.S. Core Producer Price Index, ) Source: investing.com - Click to enlarge |

It looks like a blunder in Canada may prevent it from rolling-over the EU trade agreement with the UK. It appears that Prime Minister Trudeau should have secured unanimous consent from the opposition parties to expedite the approval process. With Canada’s House of Commons to start its winter break, some remedial action is needed as some disruption will ensue. While most UK exports to Canada would be duty-free under the WTO, some Canadian exports to the UK would be subject to a levy. These include trucks and other vehicles, lobster, beef, and, of course, maple syrup. Meanwhile, Trudeau seeks to modify election rules to allow three days for voting and expanded mail-in choices, and special opportunities for long-term care facilities. This is fueling speculation that the minority Liberal government is preparing for an election next year, ideally timed for after the vaccine is widely available and the government’s fiscal stimulus is felt.

While Canada’s economic calendar is light, Mexico reports October industrial production figures. A modest 0.6% gain is expected, which more than offsets the slight decline in September. It would leave output off by about 5.5% year-over-year. Manufacturing is expected to be down 2.1% year-over-year, rather than the 3.1% contraction in September. Mexico’s central bank meets next week, and although inflation fell back into the target range in November, the central bank is likely to wait for confirmation that it is sustained before easing. In the meantime, the 4.25% yield of Mexican T-bills makes it an attractive place to park funds over the holiday period.

The US dollar fell to almost CAD1.27 yesterday, a new 2.5 -year low. It is consolidating today within yesterday’s range. Initial resistance is being approached in the European morning near CAD1.2780. The intraday technicals favor a recovery for the Canadian dollar in North America today. The Mexican peso is weaker for the third consecutive session, as its proxy-status for emerging markets more broadly takes a toll. The US dollar found support in the middle of the week near MXN19.70 and closed above MXN20.00 for the first time in more than a week yesterday. Follow-through dollar buying (short-squeeze?) lifted it to nearly MXN20.20 today. The intraday technicals are stretched, suggesting that the greenback’s upside momentum may stall, and the peso may recover ahead of the weekend. Initial support is now seen near MXN20.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Canada,Currency Movement,ECB,Featured,newsletter,South Korea