Despite the CNY’s recent fall, we believe the People’s Bank of China will refrain from competitive devaluation Following US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD. The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the...

Read More »Real Estate Perfectly Sums Up The Rate Cuts

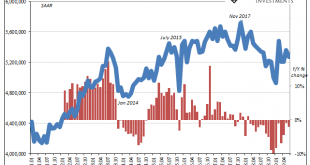

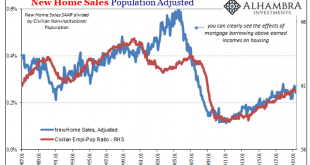

It’s only a confusing when you just accept the booming economy of the unemployment rate. From this perspective, 2018 was, and more so 2019 is, a downright conundrum. By all mainstream accounts, this just shouldn’t be happening. Home sales are running at a pace similar to 2015 levels – even with exceptionally low mortgage rates, a record number of jobs and a record high net worth in the country. Not only that, 2015...

Read More »What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org