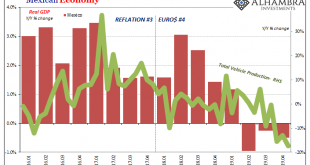

Earlier today, Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) confirmed the country’s economy is in recession. Updating its estimate for Q4 GDP, year-over-year output declined by 0.5% rather than -0.3% as first thought. On a quarterly basis, GDP was down for the second consecutive quarter which mainstream convention treats as a technical recession. On a yearly basis, it was actually the third straight. Nothing seems to have changed as 2019 drew to...

Read More »The Big And Small of Leading Japan

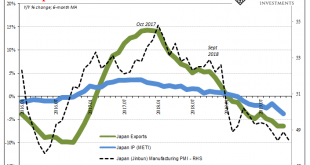

In the middle of 2018, Japan, they said, was riding so high. Gliding along on the tidal wave of globally synchronized growth, Haruhiko’s courage and more so patience had finally delivered the long-promised recovery. The Japanese economy had healed to a point that its central bank officials believed it time to wean the thing off decades of monetary “stimulus.” They even publicly speculated on just when QQE would be terminated. At least that was the story, one which...

Read More »A Sour End To The 2010’s Doesn’t Have To Spoil The Entire 2020’s

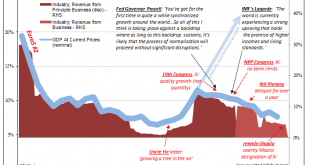

It has been perhaps the most astonishing divergence in the first two decades of 21st century history. In late 2017, Western economic officials (mostly central bankers) were taking their victory laps. They took great pains to tell the world it was due to their profound wisdom, deep courage, and, most of all, determined patience, that they had been able to see their policies through to the light of day (no thanks to voters around the world). This set up the third...

Read More »European Economy: A Time Recession

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before. The real question, though, is whether the business cycle approach means anything in this day and age. I don’t think it does, and that’s a big part of why...

Read More »The Scientism of Trade Wars

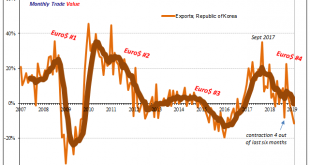

One year ago, last October, the IMF published the update to its World Economic Outlook (WEO) for 2018. Like many, the organization began to talk more about trade wars and protectionism. It had become a topic of conversation more than concern. Couched as only downside risks, the IMF still didn’t think the fuss would amount to all that much. Especially not with world’s economy roaring under globally synchronized growth. Even though there were warning signs already by...

Read More »Globally Synchronized…

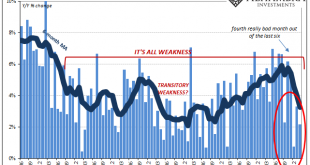

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death. What that meant in the context of globally synchronized growth, 2017’s repeatedly dominant narrative, wasn’t the end of synchronized as many tried to...

Read More »Retail Sales In Bad Company, Decouple from Decoupling

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks. There had been noises overseas, troubling indications that had gone on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org