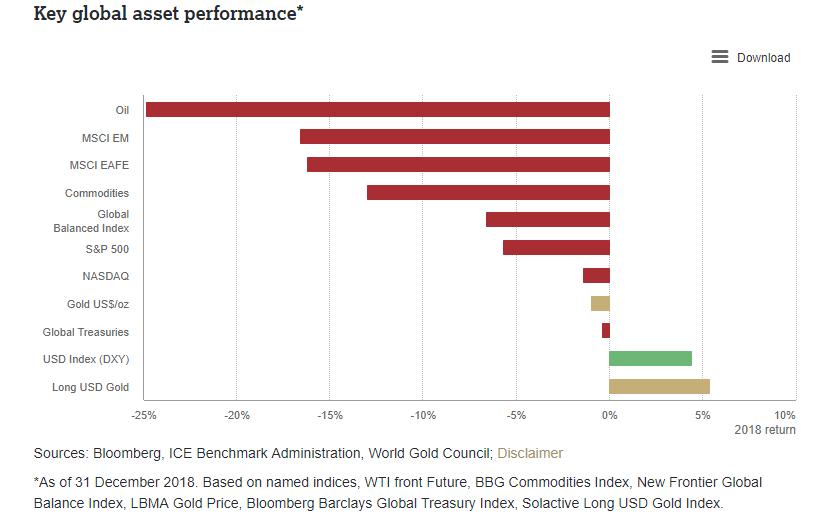

Gold Outlook 2019 – World Gold Council As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance: financial market instability monetary policy and the US dollar structural economic reforms. Against this backdrop, we believe that gold has an increasingly relevant role to play in investors’ portfolios. Gold Outperformed Most Assets In 2018 - Click to enlarge Why gold why now Gold’s performance in the near term is heavily influenced by perceptions of risk, the direction of the dollar, and the impact of structural economic reforms. As it stands, we believe that these

Topics:

Mark O'Byrne considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Gold Outlook 2019 – World Gold CouncilAs we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance:

Against this backdrop, we believe that gold has an increasingly relevant role to play in investors’ portfolios. |

Gold Outperformed Most Assets In 2018 |

Why gold why nowGold’s performance in the near term is heavily influenced by perceptions of risk, the direction of the dollar, and the impact of structural economic reforms. As it stands, we believe that these factors likely will continue to make gold attractive. In the longer term, gold will be supported by the development of the middle class in emerging markets, its role as an asset of last resort, and the ever-expanding use of gold in technological applications. In addition, central banks continue to buy gold to diversify their foreign reserves and counterbalance fiat currency risk, particularly as emerging market central banks tend to have high allocations of US treasuries. Central bank demand for gold in 2018 alone was the highest since 2015, as a wider set of countries added gold to their foreign reserves for diversification and safety. More generally, there are four attributes that make gold a valuable strategic asset by providing investors:

‘Outlook 2019: Global economic trends and their impact on gold’ – Full report from World Gold Council here |

|

Tags: Daily Market Update,Featured,newsletter