It looks like the year-end repocalypse that was predicted by Credit Suisse strategist Zoltan Pozsar is taking a raincheck. Today’s Term Repo saw .25BN in security submissions (.75BN in TSYs, .5BN in MBS), below the BN in total availability. This was the first “turn” repo that was not fully subscribed (on Monday, there was .25BN in demand for BN in repos maturing on Jan 17). As such, for the second day in a row, the Fed’s term repo operation was undersubscribed, but what was notable about today’s “temporary” liquidity injection is that this was the first term repo since the start of the Fed’s emergency repo program that covered the year-end “turn” with a maturity of Jan 2, and was not fully overalotted. . As shown in the chart below, the first

Topics:

Tyler Durden considers the following as important: 3.) Swiss Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| It looks like the year-end repocalypse that was predicted by Credit Suisse strategist Zoltan Pozsar is taking a raincheck.

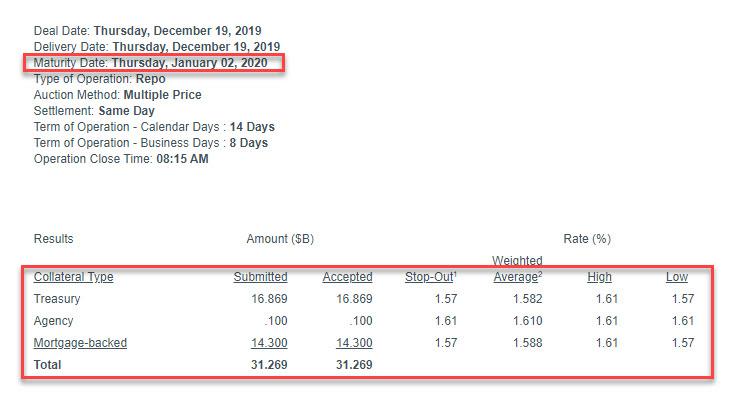

Today’s Term Repo saw $26.25BN in security submissions ($15.75BN in TSYs, $10.5BN in MBS), below the $35BN in total availability. This was the first “turn” repo that was not fully subscribed (on Monday, there was $54.25BN in demand for $50BN in repos maturing on Jan 17). As such, for the second day in a row, the Fed’s term repo operation was undersubscribed, but what was notable about today’s “temporary” liquidity injection is that this was the first term repo since the start of the Fed’s emergency repo program that covered the year-end “turn” with a maturity of Jan 2, and was not fully overalotted. |

|

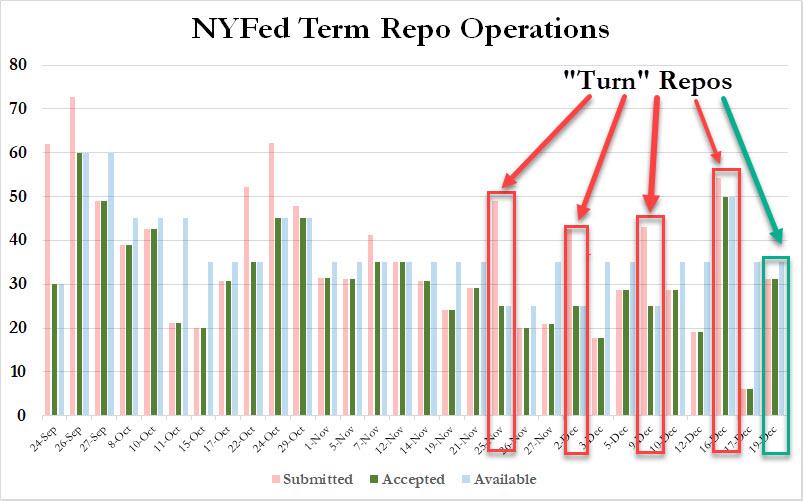

| As shown in the chart below, the first four “turn” term repos were all oversubscribed (boxed in red), but today’s was the first “turn” repo that saw a less than full allotment.

As such, it now appears that banks finally have their fill of what they believe will be sufficient year-end liquidity, and all subsequent “turn” repos will likely see a lower allotment as the Fed’s $500BN liquidity backstop bazooka ends up being underutilized. In his latest comment on the repo market, Curvature’s Scott Skyrm noted that “once the term RP operations switch to being undersubscribed, it either means most of the Street’s year-end funding need is fulfilled, or banks are close to their balance sheet limits.” His full comment below:

|

NY Fed Term Repo Operations |

| The Primary Dealers might not take all of the cash the Fed is offering. Either they won’t need it or they won’t want it. So there are two scenarios as we get close to the end of the month. Either Primary Dealer banks do not take all of the Fed cash because their balance sheets are full or because they don’t need the cash. Wrightson estimates that only $300 billion to $350 billion* of the ~$500 billion will be taken by the Primary Dealers. We can see whether the Fed RP ops are oversubscribed or undersubscribed by watching the results. Back on November 25, the $25 billion term RP operation to January 6 was oversubscribed by $24 billion. The $50 billion operation to January 17 on Monday was only oversubscribed by $4.25 billion. Once the term RP operations switch to being undersubscribed, it either means most of the Street’s year-end funding need is fulfilled, or banks are close to their balance sheet limits.

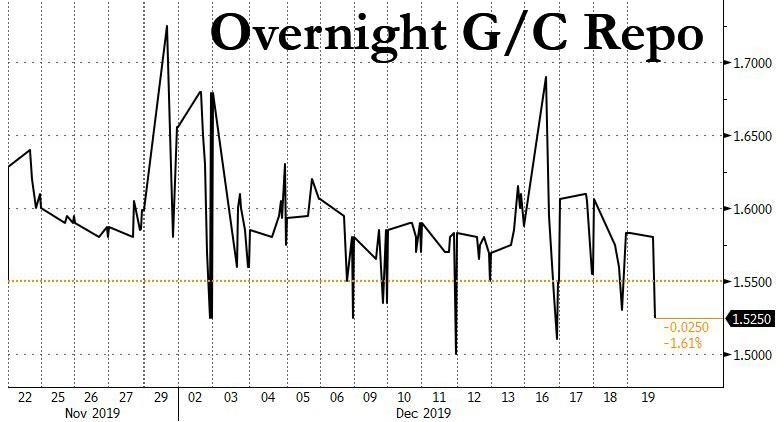

This means that today’s repo is either good news, or bad news: good news if banks don’t need any additional liquidity for year end, but bad news if they are simply prevented from seeking more Fed reserves due to balance sheet limitations (and how many securities they can pledge), even as the overall funding in the repo market remains insufficient. As usual, keep a track on the overnight repo rate for confirmation if things are getting better or worse. Incidentally, today the rate dropped 6bps to 1.525%… |

Overnight G/C Repo, 2019 |

… which suggests that all else equal, the tempest in the repo market – and the Fed’s expansion of QE4 as Pozsar predicted – may not happen after all.

Tags: Featured,newsletter