We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields. Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant...

Read More »Core sovereign bond yields – update

We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields.Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant monetary policy backdrop.Four consecutive disappointing US inflation prints have...

Read More »Sovereign yields to rise as reflation takes hold

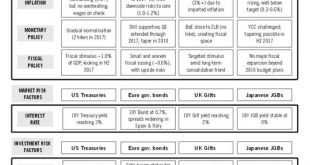

Total returns from government bonds could come under pressure in 2017.Our central scenario for developed markets sovereign bond yields in 2017 is based on our in-house risk-factor analysis, which is leading us to conclude that there is a 65% probability that 2017 will be a year of reflation (see table).Underpinning the economic environment will be the following three macroeconomic factors:Inflation, which should accelerate in the US, the euro area, the UK and Japan.Monetary policy, which...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org