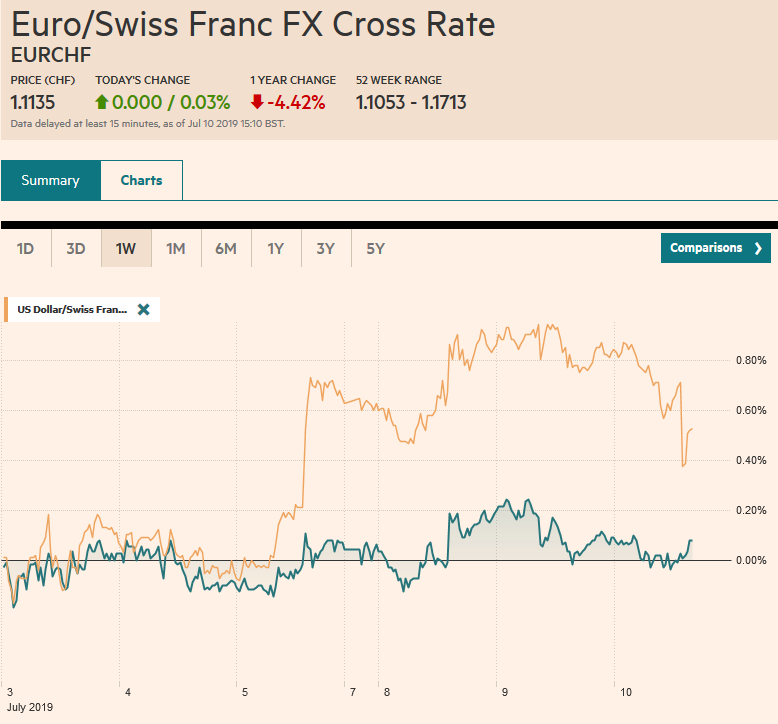

Swiss Franc The Euro has risen by 0.03% at 1.1135 EUR/CHF and USD/CHF, July 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell’s testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less. The small gain in the S&P 500 yesterday failed to help global equities. Large markets in Asia–Japan, China, and Indian

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Bank of Canada, China Consumer Price Index, Featured, Federal Reserve, FX Daily, MXN, newsletter, Oil, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.03% at 1.1135 |

EUR/CHF and USD/CHF, July 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell’s testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less. The small gain in the S&P 500 yesterday failed to help global equities. Large markets in Asia–Japan, China, and Indian equities fell, while South Korea, Taiwan, Australia, and Singapore markets rose. Europe’s Dow Jones Stoxx 600 is threatening to advance its slide for a fourth session, while US shares are also trading with a slightly lower bias. The dollar is mostly softer, though the Australian and New Zealand dollar have joined the yen with small losses. The dollar continues to knock on JPY109, while the euro was holding above $1.12 after dipping below briefly yesterday. The Mexican peso has steadied after yesterday’s shellacking, and the Turkish lira has given back yesterday’s minor gains and more today. |

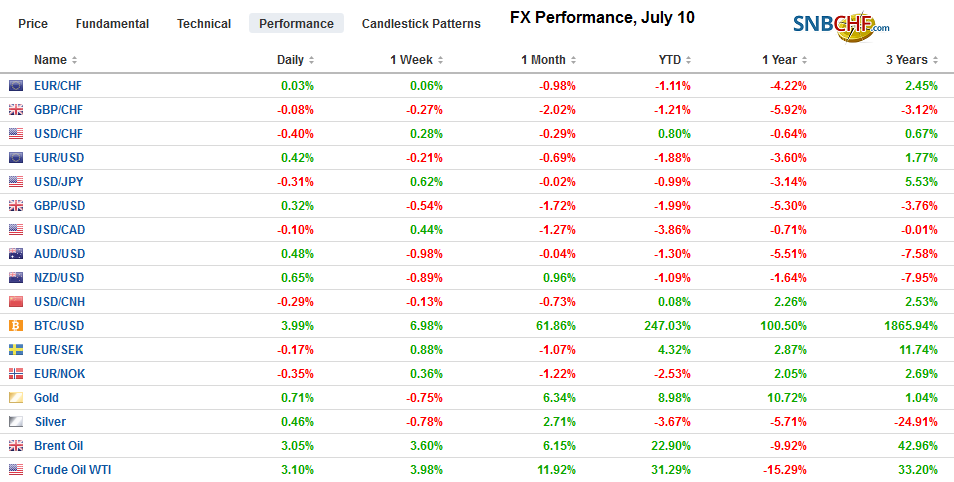

FX Performance, July 10 |

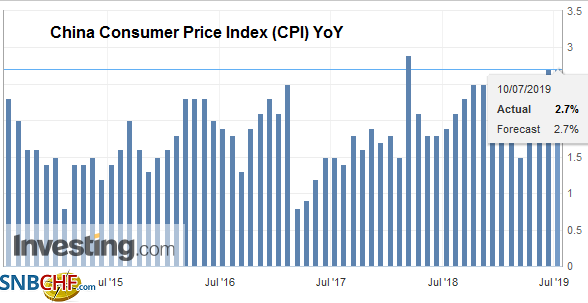

Asia PacificChina ‘s CPI was in line with expectations, unchanged at 2.7% year-over-year pace. However, this overstates inflation. Food prices were distorted by the nearly 43% rise in fresh fruit prices due to poor weather in the south. This sparked an 8.3% rise in food prices. Non-food prices rose 1.4%, which is the third consecutive month of easing pressures. |

China Consumer Price Index (CPI) YoY, Jun 2019(see more posts on China Consumer Price Index, ) Source: investing.com - Click to enlarge |

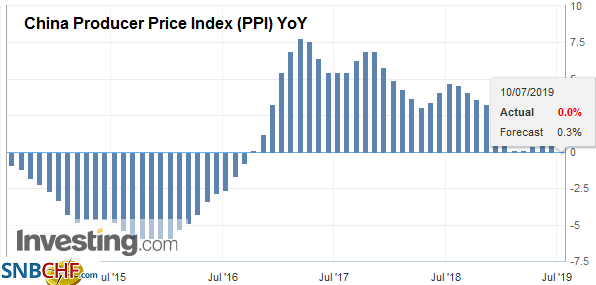

| The disinflationary thrust, or possibly deflationary forces, were evident in the Producer Price Index, which was flat in June from a year ago. It is the weakest report since September 2016. Today’s price data reinforces ideas that the PBOC will ease policy in the period ahead. |

China Producer Price Index (PPI) YoY, June 2019(see more posts on China Producer Price Index, ) Source: investing.com - Click to enlarge |

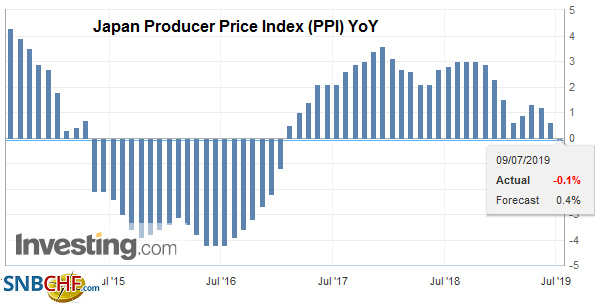

| Deflationary forces were also evident in Japan. The 0.5% decline in producer prices in June is the second negative print in a row and the third in H1. It was sufficient to drag the year-over-year rate into negative territory for the first time since 2016. Recall that last week, the BOJ adjusted its bond-buying program to help steepen the yield curve, but weak price pressure and the 38% (year-over-year) plunge in machinery orders (June) undermines such efforts. The drop leaves machine orders at their lowest level in three years. Of Japan’s total orders, around 62% come from abroad, suggesting the sensitive of Japan to the global environment, even though it exports about 15% of GDP. |

Japan Producer Price Index (PPI) YoY, June 2019(see more posts on Japan Producer Price Index, ) Source: investing.com - Click to enlarge |

Rising US yields appear to have sapped the demand for the yen and Australian dollar. Both currencies are lower for the fifth consecutive session, but the downside momentum may be stalling near key chart points. The dollar is absorbing offers around JPY109. Not only is there a $1.7 bln option struck there that expires today, but it roughly corresponds to the neckline of a technical pattern that could potentially lift the dollar back toward JPY111, which has not been seen in a couple months. The Australian dollar slipped below $0.6915, an important retracement of its recovery from the mid-June lows. A close above $0.6930 today would boost the chances that a near-term low is in place. China’s yuan was confined to yesterday’s ranges in quiet turnover.

Europe

France and Italy surprised with stronger than expected industrial output data today. It is important because of the contrast with survey data. On Monday, for example, France reported the sentiment among manufacturers fell to its lowest level in six years. Today, it reported a 1.6% surge in manufacturing (vs. 0.3% median forecast in the Bloomberg survey), which fueled a 2.1% rise in industrial output, the largest monthly gain in 2 1/2 years. Pharma, chemicals, and autos, led the surge, helping to lift the year-over-year rate to an impressive 4%. Italy’s industrial output jumped 0.9% in May, well above the 0.2% median forecast, and offsets the revised 0.8% decline in April. The year-over-year decrease was halved to -0.7%.

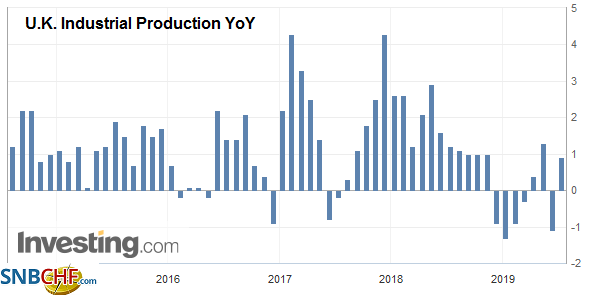

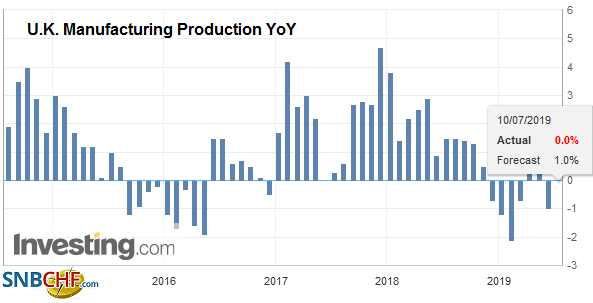

| The UK reported solid economic data too. A (1.4%) rise in May industrial output, helped by a recovery in the auto sector, and (0.6%) in construction overcame no increase in services production to lift the May monthly GDP print to 0.3% (-0.4% in April). The trade deficit fell to its lowest level since last September. Separately, the amendment that seeks to prevent the suspension of Parliament to ostensibly push through a no-deal Brexit passed by the slimmest of margins yesterday (294-293). |

U.K. Industrial Production YoY, May 2019(see more posts on U.K. Industrial Production, ) Source: investing.com - Click to enlarge |

| Still, the UK’s approach to Brexit does not appear particularly politically realistic. It resists the backstop, which seems to be necessary under the Good Friday Agreement, and wants Dublin to reconsider its position some UK officials argue that Ireland is more vulnerable to a no-deal exit than it. |

U.K. Manufacturing Production YoY, May 2019(see more posts on U.K. Manufacturing Production, ) Source: investing.com - Click to enlarge |

The euro, which slipped a little below $1.1195 yesterday has held above $1.12 today, but the high in the European morning near $1.1230 may around the most until fresh direction is provided by Powell’s testimony. Above there, resistance is seen in the $1.1270-$1.1280 area. Sterling was sold to a marginal new low for the year yesterday (~$1.2440) and has stabilized today, but unable to resurface above previous support near $1.25. There is a roughly GBP265 mln option at $1.25 that rolls off today.

America

Mexico’s finance minister and long-time ally of President AMLO shocked the market by resigning yesterday, and the peso dropped to its lowest level in a month. The dollar rose a little through MXN19.38. Finance Minister Urzua was quickly replaced by this deputy, Herrera, which seems to signal continuity of policy. Still, Urzua’s complaints, which were aired on Twitter, were similar to the latent fears of investors, who remain skeptical of AMLO. Urzua complained about public policy decisions and appointments. On the one hand, these gripes are standard fare against a new administration that has not held national office previously. On the other, a competent government is an essential part of the robust investment climate. Even if it is not sufficient, it is necessary.

Some tried to link the peso’s drop to the US tariffs on Mexico’s fabricated structural steel imports, but the peso was firm, and the dollar had dipped back below MXN19.00 in early North American hours after the tariffs were announced and did not jump until after Urzuaa’s resignation. The tariffs are run-of-the-mill stuff as opposed to the steel and aluminum tariffs imposed on national security grounds or the 5% tariff on all imports from Mexico over a dispute about refugees and asylum-seekers. The US Commerce Dept investigation found it (along with China) was unfairly subsidizing fabricated structural steel. Mexico exported around $622 mln of its steel to the US last year, and imports from China were around $900 mln. Mexican officials were quick to say that the tariffs would not hamper approval of the new NAFTA and US and Chinese negotiators are meeting this week. But, with NAFTA in effect still, it would seem that unilateralism is not called for, and the tariffs on China would appear to violate the spirit if not the letter of the tariff truce.

The focus today is on heads of the two other central banks in North America. The Bank of Canada meets, and there is practically no chance of a move. However, comments from Governor Poloz will be closely scrutinized for the conviction behind the neutrality and any misgivings about the strength of the Canadian dollar. The Fed’s Powell will begin his two-day trip to the Hill to testify before Congress. The market is pricing in the near certainty of a cut later this month. Even if he does not push back against those expectations, the key to the dollar’s reaction may be how he characterizes easing the may be necessary. An insurance policy to extend the record-long business expansion may encourage the market to continue to move away from three cuts here in H2 that began with the employment data. Bloomberg’s model has a nearly 48% chance of three or more cuts this year while the CME’s model puts it closer to 42%.

The US dollar is in the upper end of its two-week range against the Canadian dollar, which we see as roughly CAD1.3040-CAD1.3150. The technical indicators suggest the greenback this may be a bottoming pattern, but continued sideways movement can also ease the overextended readings. Initial support today is pegged near CAD1.31, and there is a roughly $565 mln option at CAD 1.3075 that expires today. On the upside, a $1.2 bln option at CAD1.3200 rolls-off tomorrow. The Mexican peso slump yesterday carried the dollar to its 200-day moving average (~MXN19.38). The dollar finished the session near MXN19.15 and is slightly firmer today. Support is seen near MXN19.10. Separately, oil prices are jumping today, extending its gains for a fifth consecutive session. A sharp drop (8.1 mln barrels) in the API estimate of US oil inventories is helping extend the rally. The EIA’s estimate, due out later today, is expected to show a 3 mln barrel decline. Tension with Iran over its enrichment program and the UK seizure of an Iranian ship seemingly poised to violate the sanctions against Syria is also thought to be bolstering oil prices. A week ago, WTI for August delivery was near $56 a barrel, and today it is straddling $59.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of Canada,China Consumer Price Index,Featured,Federal Reserve,FX Daily,MXN,newsletter,OIL