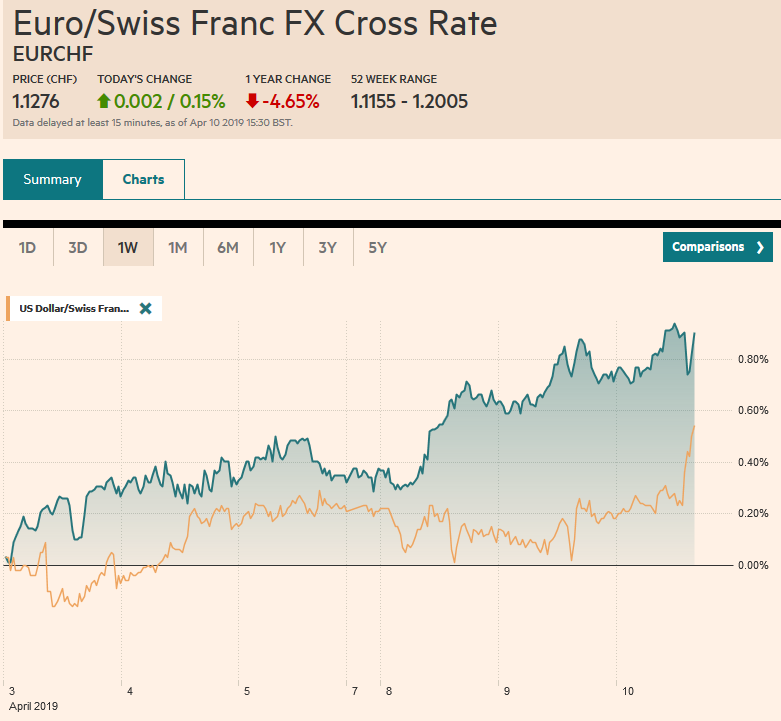

Swiss Franc The Euro has risen by 0.15% at 1.1276 EUR/CHF and USD/CHF, April 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There were only a few formal disputes under NAFTA 1.0. It says more about the adjudication process than the underlying issues. It was not binding. The Democrats want stronger enforcement provisions in what the NAFTA 2.0. It is understandable. Still, without opening up the agreement, which had been already agreed to by three heads of state, it is difficult to see how this will happen. Trump Administration officials claim that it can punish violations by using trade legislation that has been deployed against China (and possibly Airbus). This is

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China, EU, Featured, NAFTA, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.15% at 1.1276 |

EUR/CHF and USD/CHF, April 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

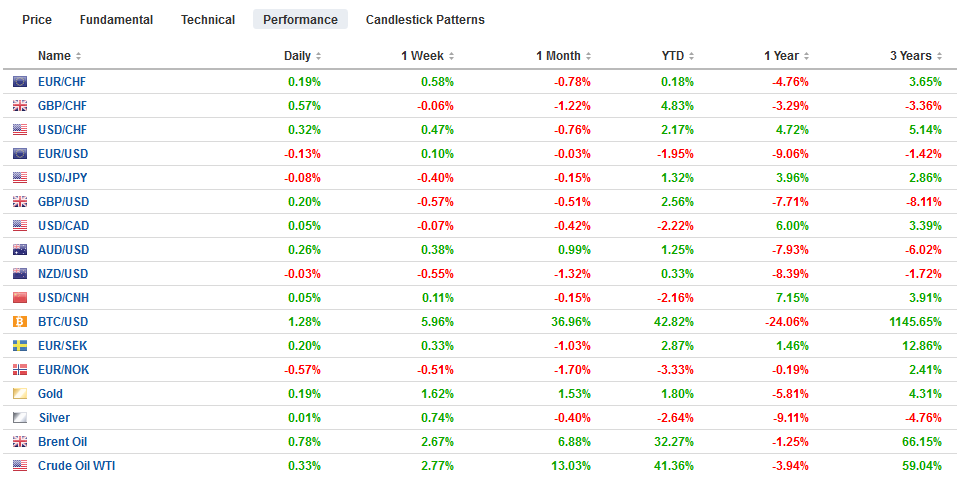

FX RatesThere were only a few formal disputes under NAFTA 1.0. It says more about the adjudication process than the underlying issues. It was not binding. The Democrats want stronger enforcement provisions in what the NAFTA 2.0. It is understandable. Still, without opening up the agreement, which had been already agreed to by three heads of state, it is difficult to see how this will happen. Trump Administration officials claim that it can punish violations by using trade legislation that has been deployed against China (and possibly Airbus). This is naïve. It assumes that disputes arise from Canada or Mexico’s behavior. However, the US sometimes is in the wrong. In fact, the last dispute under NAFTA was brought by Mexico against the US for its sugar subsidies. The US refused to appoint panelists to adjudicate the case, and it died an ignoble death. And the sugar subsidies remain. It is reminiscent of Matt Ridley (former science editor of The Economist)’s argument in the “Origin of Virtue” that that moral precepts, including the Ten Commandments, are not the metric one wants to be judged by, but what we want our neighbors to do. The US does not really want NAFTA 2.0 to be enforceable. Oh, it wants to be the judge and jury of others’ violations, but it will still see any effort to enforce the rules on it as an unacceptable erosion of its sovereignty. A similar scenario will likely play out with China. The Trump Administration and many investors and observers fear that China will devalue the yuan, either to ease the tariff burden the US has imposed or to boost its exports. It appears China has agreed not to do this and instead maintain a stable yuan. This is a victory; we are assured by the best and brightest. |

FX Performance, April 10 |

They are mistaken. It is a pyrrhic victory at best. China will feel the sting of US tariffs, though we have argued that given the import-intensity of China’s manufactured exports, and the relatively limited value-added, the yuan would need to depreciate by a lot more than it had in order to offset the tariff increase or boost Chinese exports.

The reason Chinese officials so readily accept this US demand was that a stable yuan was already policy. A stable yuan is a Trojan Horse. Many Chinese officials know this. They fear that the US will do to it what it did to Japan and Germany.

Beginning in the early 1960s, if not a little earlier, the US sought the Deutschemark and Japanese yen (and other currencies) appreciation. It did not want to devalue the dollar against gold under Bretton Woods. The way exchange rates work, a dollar depreciation or foreign currency appreciation is tantamount to the same thing. The exchange rates chosen at Bretton Woods may have reflected the economic reality at the time, but it was fleeting.

Aid, such as the Marshall Plan, and private capital flows (direct investment) quickly put Europe on the mend, for example. Bretton Woods was not supposed to be a fixed exchange rate system, but the political costs of adjustment were seen as too great. It would take a crisis to compel action.

The US is the world’s largest debtor. It has a history (before 1995 and the “strong dollar policy”) of forcing others to re-value their currencies or to devalue the dollar. Chinese officials are well aware of the way the US treated Europe and Japan long before Trump’s election in 2016. Chinese officials I have spoken with were quite clear that these US tactics were unacceptable.

China owns more than a trillion dollars of US government bonds. It has billions of dollars of other dollar-denominated assets. It competes with US producers in third markets. By accepting a stable yuan, China is blocking the US traditional strategy in the face of a rising economic power. A stable yuan may prevent China from devaluing now, but it prevents the US from devaluing against it later.

Over time, pressure on the yuan to appreciate will increase. One of the long-term drivers of exchange rates appears to be per capita income. Slower population growth and an expanding economy translate into stronger per capita income. More immediate pressure for yuan appreciation may come from the inclusion of China’s stocks and bonds into global indices, which the era of passive investing, is a major windfall.

A US-China trade agreement, for which many in the media seem content on repeating the spin from US officials, apparently is seeing progress on nearly on a daily basis. Speculation that a meeting between Xi and Trump, which would be a signal that an agreement has in fact been reached, was going to be announced last week proved wide of the mark. Still, many expect a deal to be announced later this quarter.

Trump initially wanted the last details of an agreement to be worked out in a meeting with Xi at one of his properties in the US. However, Xi could not brook the possibility that Trump would do to him what he did to the Kim Jong-Un and simply walked away. It appears China’s position of an agreement prior to the two presidents meeting won out. When they meet, it will be a signing ceremony. It must also be seen as a victory for China if that meeting is not held in the US. It need not be held in China. A ceremony in a third country would also deny Trump something he wanted.

The US thinks that a stable yuan blocks China, but our analysis suggests economic and financial pressure will exert upward pressure on the yuan. China’s now legitimate commitment to a stable yuan will allow it to resist this pressure, seemingly with the US blessings.

At the same time, the stable yuan regime blocks the US from devaluing the dollar against the yuan. The US post-WWII behavior in the face of rising economic powers and erosion of competitiveness, coupled with its large debtor status, shows it has the inclination and financial interest to seek a devaluation (and abandon the strong dollar policy). China appears to have insulated itself and neutralized this go-to American tactic.

America has lost its way. It thinks it wants an agreement that guarantees China buys a certain amount of US soy, or energy, and/or other goods. In policy, floors often become ceilings. US interest does not lie in taking market share based on political concessions from others. Traditionally, the US sought a level playing field; having confidence that it such conditions, its economic prowess would carry the day.

Making the conflict resolution process binding as a key reform for NAFTA 2.0 seems to make sense. Few officials and fewer observers recognize that this is a double-edged sword. It would be binding on the US too, which is perhaps why the Trump Administration did not insist on it in the negotiations.

China’s commitment to a stable yuan may appear to be a concession to the US. But it was easily made, we suspect because a stable yuan means a stable dollar-yuan exchange rate. It prevents the US from seeking yuan appreciation. It neutralizes the re-weaponization of the dollar. Any advantage the US sought through devaluing the dollar would not come at China’s expense.

The transactional focus of the Trump Administration leaves it vulnerable to those who play the long game. China is gradually outflanking the US. Trump’s threat of levies on $11 bln of EU goods for damage that the WTO has recognized in unfair subsidies to Airbus succeeded in breaking a log-jam at the EU-China summit. Early indications suggested differences would prevent a statement at the conclusion of the summit.

Within 12-hours of Trump’s threat, a joint statement was issued, and a trade and investment agreement optimistically could be reached by the end of the year. Half of the EU members have signed memorandums of understanding with China on its Belt-Road Initiative. They balked at banning Huawei. Many joined China’s Asian Infrastructure Investment Bank. The estrangement of Europe and the US is very much in China (and Russia’s) interest.

US protectionism and demand that its allies not only pay the cost of US bases but also a 50% tribute on top of it pushes Europe away as much as China’s initiatives pull Europe toward it.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: China,EU,Featured,NAFTA,newsletter