Summary President Trump canceled the planned summit with North Korea’s Kim Jong Un. Malaysia’s new Finance Minister Lim was sworn in along with 13 other cabinet ministers. Philippine central bank cut reserve ratios for commercial banks by one percentage point to 18% effective June 1. The United Arab Emirates opened up its economy to more foreign investment. Brazil state-run oil company Petrobras cut the price of diesel fuel by 10% for two weeks. Brazil President Temer dropped his reelection bid and endorsed former Finance Minister Henrique Meirelles. The US tightened sanctions on Venezuela following President Maduro’s controversial election victory. Stock Markets In the EM equity space as measured by MSCI,

Topics:

Win Thin considers the following as important: 5) Global Macro, Brazil, emerging markets, Featured, Malaysia, newsletter, North Korea, Philippine, Turkey, United Arab Emirates, Venezuela, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

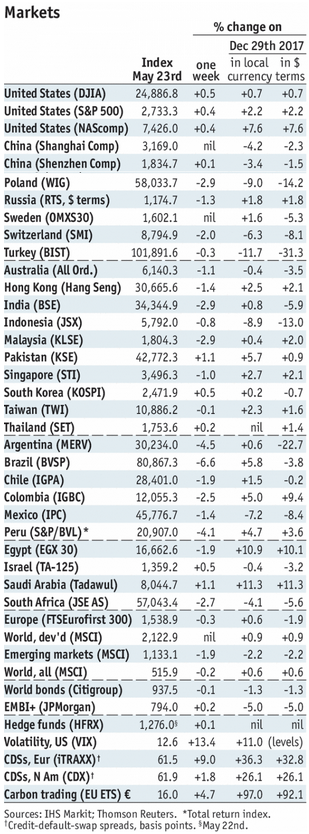

Stock MarketsIn the EM equity space as measured by MSCI, Indonesia (+5.0), UAE (+3.5%), and Qatar (+1.7%) have outperformed this week, while Hungary (-4.5%), Malaysia (-2.4%), and Egypt (-2.3%) have underperformed. To put this in better context, MSCI EM fell -0.1% this week while MSCI DM fell -0.5%. In the EM local currency bond space, Turkey (10-year yield -40 bp), Russia (-19 bp), and South Africa (-18 bp) have outperformed this week, while Brazil (10-year yield +24 bp), Peru (+14 bp), and Czech Republic (+10 bp) have underperformed. To put this in better context, the 10-year UST yield fell 19 bp to 2.93%. In the EM FX space, ZAR (+2.1% vs. USD), BRL (+1.9% vs. USD), and CLP (+1.6% vs. USD) have outperformed this week, while TRY (-4.7% vs. USD), ARS (-0.7% vs. USD), and EGP (-0.6% vs. USD) have underperformed. To put this in better context, MSCI EM FX rose 0.3% this week. |

Stock Markets Emerging Markets, April 23 Source: economist.com - Click to enlarge |

North KoreaPresident Trump canceled the planned summit with North Korea’s Kim Jong Un. It was scheduled for June 12 in Singapore, but Trump called it off due to “tremendous anger and open hostility” in recent statements from Pyongyang. Trump added that the US military is “ready if necessary” to respond to any hostilities. MalaysiaMalaysia’s new Finance Minister Lim was sworn in along with 13 other cabinet ministers. Azmin Ali was chosen to run the newly created economic affairs portfolio. Lim promptly revealed that the federal government’s debt and liabilities had been inflated to over MYR1 trln ($250 bln) due to 1MDB. As the debt numbers are updated, we think there is growing downgrade risks for Malaysia. PhilippinePhilippine central bank cut reserve ratios for commercial banks by one percentage point to 18% effective June 1. This was the second cut since March, but bank officials said it doesn’t signal a change in the monetary policy stance. With the central bank now in a tightening cycle, the cut does seem to be at odds with tighter policy since liquidity will be boosted. The United Arab EmiratesThe United Arab Emirates opened up its economy to more foreign investment. The new rules allow foreigners to control UAE companies outright in industries deemed “essential” by the government. Those industries have not been named yet, however. UAE will also offer residency of up to 10 years to specialists in medical, scientific, research, and technical fields. TurkeyTurkey’s central bank hiked rates 300 bp at an extraordinary intra-meeting move. Furthermore, exporters are now allowed to repay some dollar-denominated debt (so-called rediscount credit) in liras at an exchange rate of 4.20. This is just a slice of corporate debt, and is likely to have limited impact overall. Officials also increased the size of the FX swap auctions. We firmly believe that more action is needed to stabilize investor confidence. BrazilBrazil state-run oil company Petrobras cut the price of diesel fuel by 10% for two weeks. This did not halt the strike but it has now been called off for 15 days after the government later fixed the price of diesel for 30 days. Finance Minister Guardia said the government would create a subsidy for diesel fuel and also compensate Petrobras for any losses. The deal doesn’t include gasoline. Brazil President Temer dropped his reelection bid and endorsed former Finance Minister Henrique Meirelles as the centrist candidate. Temer had sent up some trial balloons regarding re-election, but he eventually got the message that no one wanted him to run. Still, polls are showing Temer and Meirelles support both in single digits, while Lula holds a huge lead. The big question is where Lula’s supporters will go. VenezuelaThe US tightened sanctions on Venezuela following President Maduro’s controversial election victory. Purchases of government debt and that of state-owned companies like PDVSA are now prohibited. In response, Maduro expelled the top two senior US diplomats from the country, claiming they interfered in the election process. |

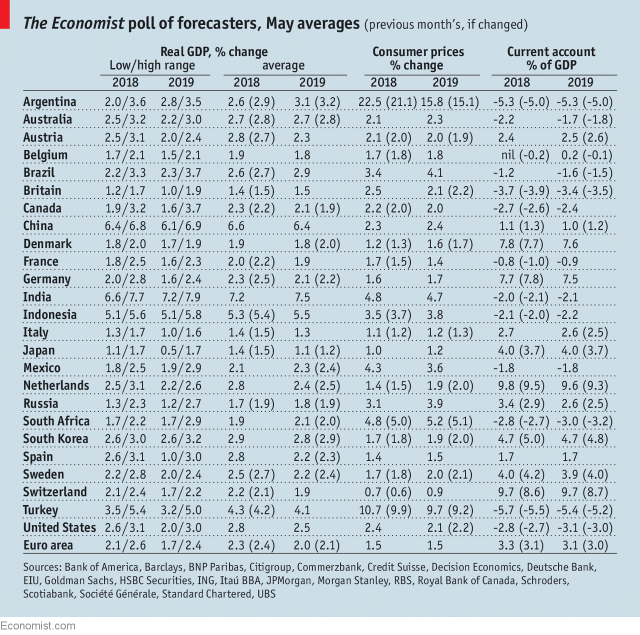

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, May 2018 Source: economist.com - Click to enlarge |

Tags: Brazil,Emerging Markets,Featured,Malaysia,newsletter,North Korea,Philippine,Turkey,United Arab Emirates,Venezuela,win-thin