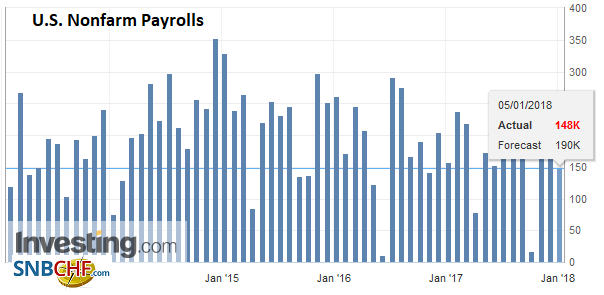

United States The headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story. The headline miss is not really made up for by the upward revision in the November series from 228k to 252k as the October series was revised lower, leaving the two-month revision 9k lower. Still, despite the miss, economists generally expect slower job growth. U.S. Nonfarm Payrolls, Dec 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge The unemployment rate

Topics:

Marc Chandler considers the following as important: CAD, Canada participation rate, Canada Trade Balance, Canada unemployment rate, Featured, FX Trends, jobs, newsletter, U.S. Average Weekly Hours, U.S. Nonfarm Payrolls, U.S. participation rate, U.S. unemployment rate, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

United StatesThe headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story. The headline miss is not really made up for by the upward revision in the November series from 228k to 252k as the October series was revised lower, leaving the two-month revision 9k lower. Still, despite the miss, economists generally expect slower job growth. |

U.S. Nonfarm Payrolls, Dec 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

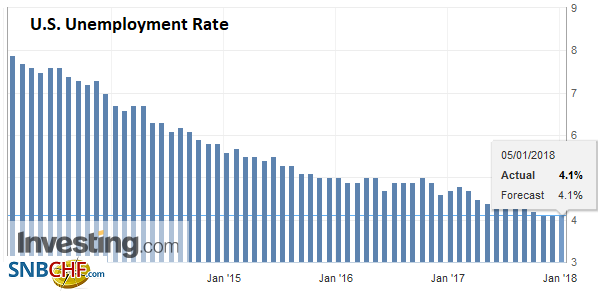

| The unemployment rate was unchanged at 4.1% and the underemployment rate rose to 8.1% from 8.0%. In December 2016, the unemployment rate stood at 4.7% and the underemployment rate was at 9.1%. |

U.S. Unemployment Rate, Dec 2017(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

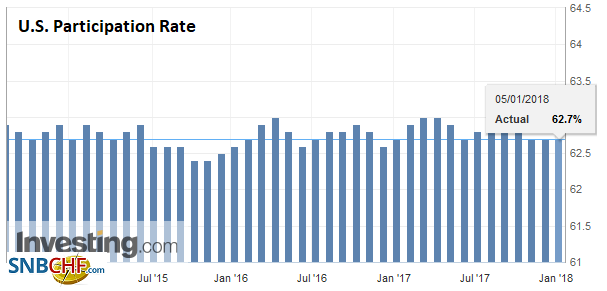

| The participation rate was unchanged at 62.7%. |

U.S. Participation Rate, Dec 2017(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

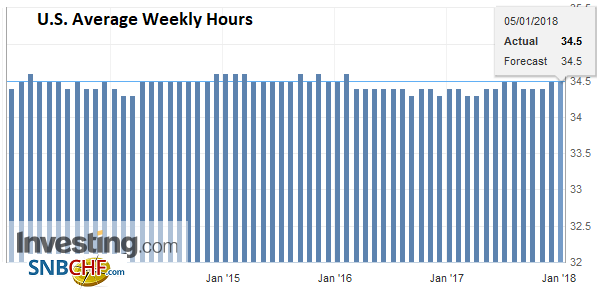

| Hourly earnings rose 0.3%, but the November series was revised to 0.1% from 0.2%. The year-over-year pace is 2.5%. Lastly, of note, the average weekly hours remained at 34.5. This is the first back-to-back reading at 34.5 hours in two years. Separately, the US reported a slightly wider November trade deficit ($50.5 bln from $48.9 bln in October). It was the biggest in six years.

Although the market used the jobs data to sell the dollar, we are concerned that sharp advance in recent weeks has left the greenback stretch, and poised to likely consolidate/correct in the coming days. However, without a change in perceptions of Fed’s pace or terminal rate, the underlying dynamics are unlikely to change. |

U.S. Average Weekly Hours, Dec 2017(see more posts on U.S. Average Weekly Hours, ) Source: Investing.com - Click to enlarge |

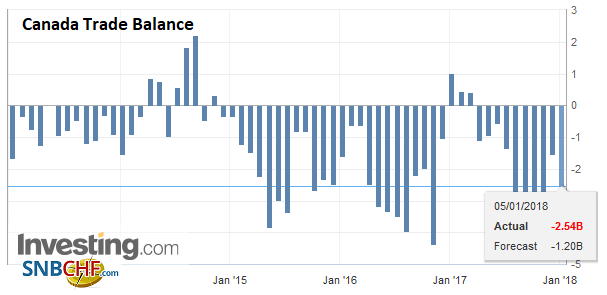

| Canada reported a trade deficit twice as large as expected. However, the market shrugged this off and focused instead on the stellar jobs report and the implication that the central bank may hike rates when it meets toward the middle of the month. Canada created 78.6k jobs. The Bloomberg median expected 2k. Of the jobs created 23.7k were full-time positions. |

Canada Trade Balance, Nov 2017(see more posts on Canada Trade Balance, ) Source: Investing.com - Click to enlarge |

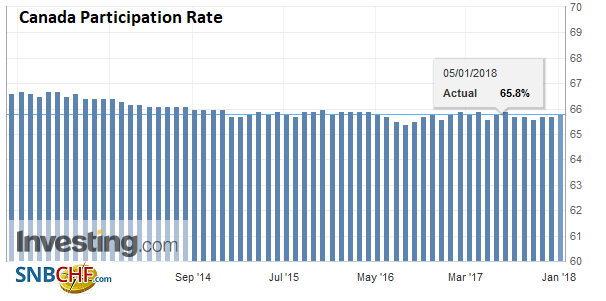

| The participation rate ticked up to 65.8 from 65.7. |

Canada Participation Rate, Dec 2017(see more posts on Canada Participation Rate, ) Source: Investing.com - Click to enlarge |

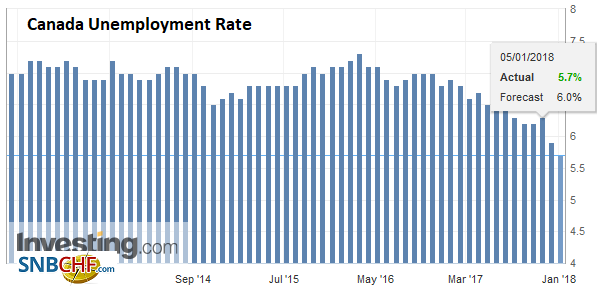

| Unemployment rate fell to 5.7% from 5.9%. The median had anticipated an increase to 6.0%. |

Canada Unemployment Rate, Dec 2017(see more posts on Canada Unemployment Rate, ) Source: Investing.com - Click to enlarge |

The Canadian dollar surged on the news, and the US dollar fell through CAD1.24 like a warm knife in butter. The CAD 1.23909 area is the 61.8% retracement of the US dollar rally from the early September low near CAD1.2060. At the end of last year, the OIS implied about a 45% chance of a hike when the at the January 17 Bank of Canada meeting. The odds have increased and now stand just shy of 70%.

Tags: #USD,$CAD,Canada Participation Rate,Canada Trade Balance,Canada Unemployment Rate,Featured,jobs,newsletter,U.S. Average Weekly Hours,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate