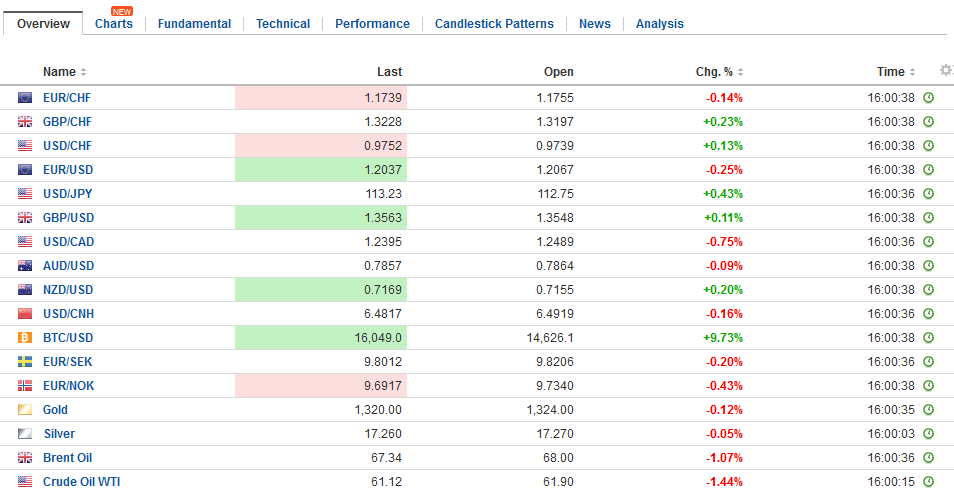

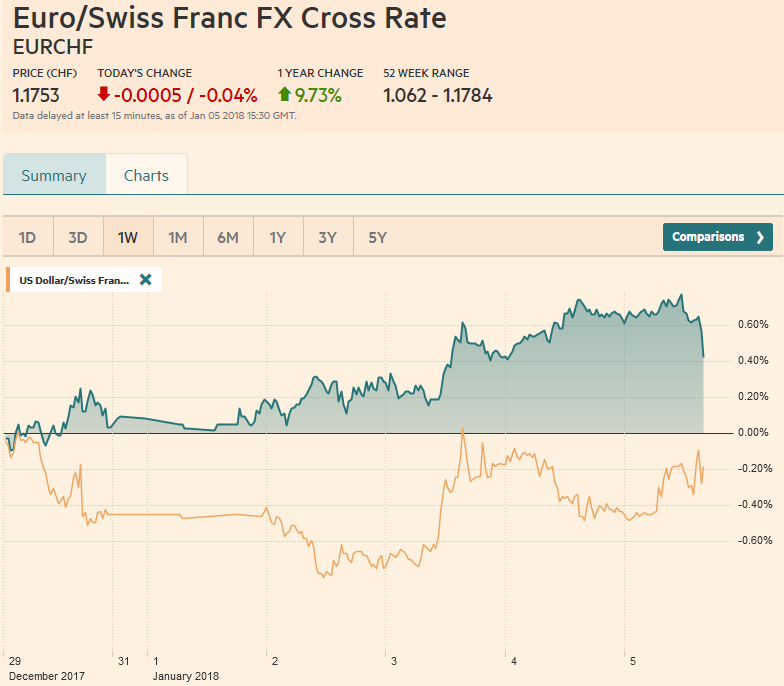

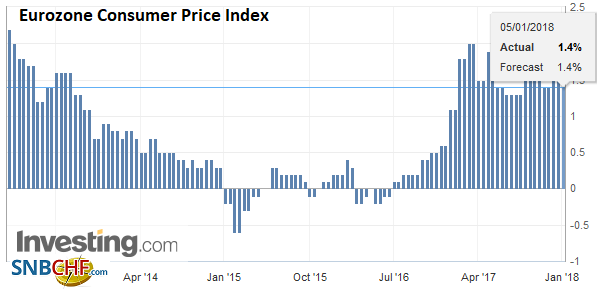

Swiss Franc The Euro has risen by 0.04% to 1.1753 CHF. EUR/CHF and USD/CHF, January 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to have helped the dollar to move off the mat. Quickly summarized, these considerations are a larger than expected Australian trade deficit, slippage in Japan’s service sector PMI, a larger than expected drop in the UK’s BRC price index, and the lack of improvement in the flash eurozone December core CPI.

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Eurozone Producer Price Index, Eurozone Retail PMI, Featured, France Consumer Confidence, France Consumer Price Index, FX Trends, GBP, Germany Retail Sales, Italy Consumer Price Index, JPY, newsletter, SPY, TLT, U.S. Average Weekly Hours, U.S. Core Durable Goods Orders, U.S. ISM Non-Manufacturing PMI, U.S. Nonfarm Payrolls, U.S. participation rate, U.S. Trade Balance, U.S. unemployment rate, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.04% to 1.1753 CHF. |

EUR/CHF and USD/CHF, January 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

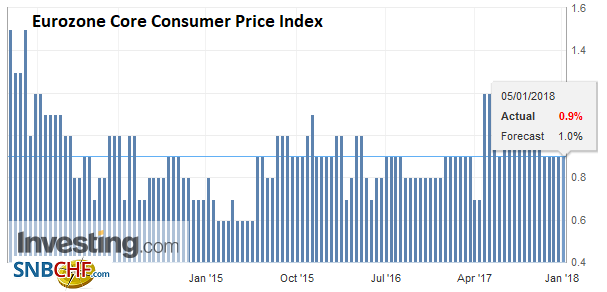

FX RatesAs the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to have helped the dollar to move off the mat. Quickly summarized, these considerations are a larger than expected Australian trade deficit, slippage in Japan’s service sector PMI, a larger than expected drop in the UK’s BRC price index, and the lack of improvement in the flash eurozone December core CPI. The US dollar is firmer against all the major currencies. That said, it is more likely sideways in its trough than a bounce, and is wholly unimpressive for bull and bear alike. |

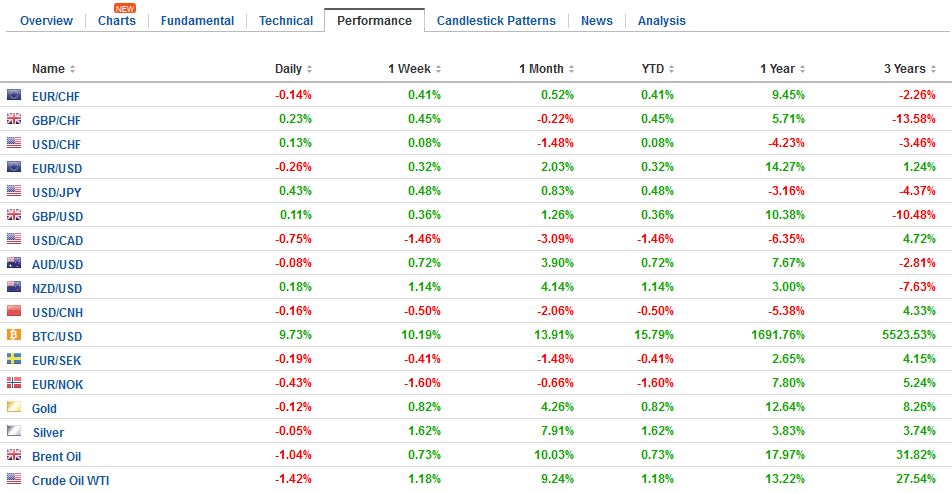

FX Daily Rates, January 05 |

| To signal something of importance, we suspect the euro would need to finish the week below $1.20 and sterling below $1.35. The dollar held support near JPY112 at the start of the week and has steadily moved higher. It has now approached a downtrend line drawn off the high in early November near JPY114.75 and the high from H2 December near JPY113.65. It is found today around JPY113.30.

The employment reports for the US and Canada are the last points of interest ahead of the weekend. Canada. Canada jobs growth has been impressive. It has averaged 41.6k jobs a month over the last three-months, compared with the average for 2016 of 19k and the 2017 average through November of 31k. A subdued report is expected. The Bloomberg survey median of 2k would be the smallest increase since November 2016. Separately, Canada will also report it merchandise trade balance (November) at the same time as the employment report. The Ivey PMI is reported ninety minutes later. |

FX Performance, January 05 |

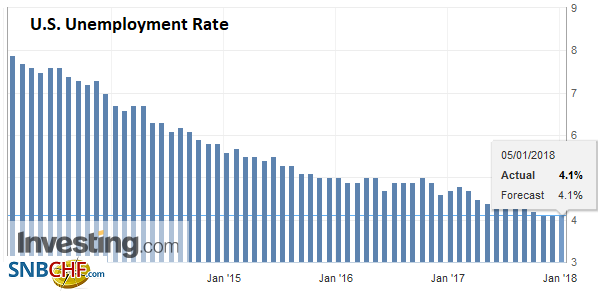

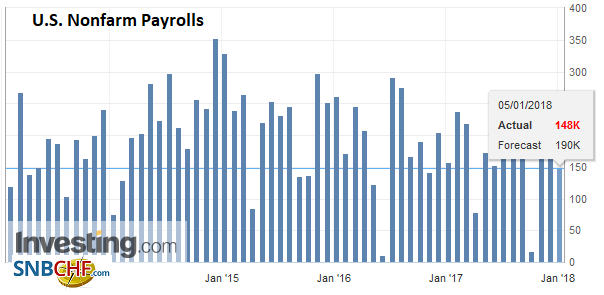

United StatesThe US has created more than 200k jobs in three of the past four months through November. Part of the rise in October and November were related to the storm-induced problems in September, when the world’s largest economy created 38k net new jobs. |

U.S. Unemployment Rate, Dec 2017(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

| The three-month average of 170k matches the year-to-date average of 174k. Economists are still looking for 180k-200k. There are few inputs for the report and none point to any deterioration. |

U.S. Nonfarm Payrolls, Dec 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

| The market will focus on earnings, though a tick lower in the unemployment rate to 4.0% would surprise. |

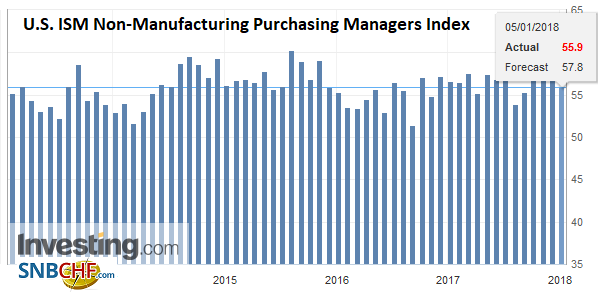

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), Dec 2017(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

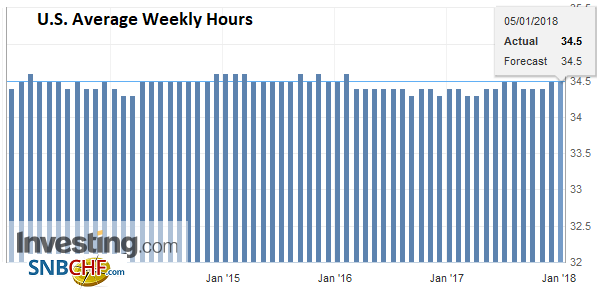

| Due to the base effect, average hourly earnings must rise by at least 0.3%, otherwise the year-over-year rate will slip from November’s 2.5% pace. |

U.S. Average Weekly Hours, Dec 2017(see more posts on U.S. Average Weekly Hours, ) Source: Investing.com - Click to enlarge |

| Any disappointment will likely quickly be transmitted to the dollar through the interest rate market, but will unlikely deter expectations for a March Fed hike. It appears that a little more than an 80% chance has been discounted after the FOMC minutes compared with about 69% at the end of 2017. |

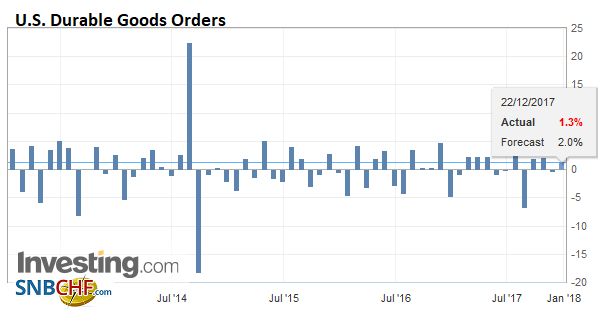

U.S. Durable Goods Orders, Dec 2017(see more posts on U.S. Durable Goods Orders, ) Source: Investing.com - Click to enlarge |

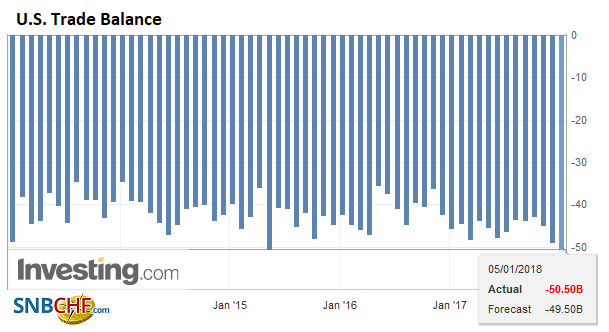

| The US will also report the November trade balance, the ISM non-manufacturing survey and factory and durable goods. The key assessment of the US economy is unlikely to change. |

U.S. Trade Balance, Nov 2017(see more posts on U.S. Trade Balance, ) Source: Investing.com - Click to enlarge |

| The pace of growth has increased in recent quarters and still appears running near a 3% quarterly annualized pace. Regardless of how one sees the medium and longer-term consequences of the tax changes, most seem to agree it will help boost growth in the near-term (as in this year). |

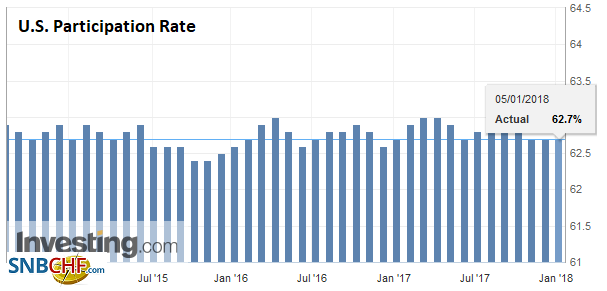

U.S. Participation Rate, Dec 2017(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

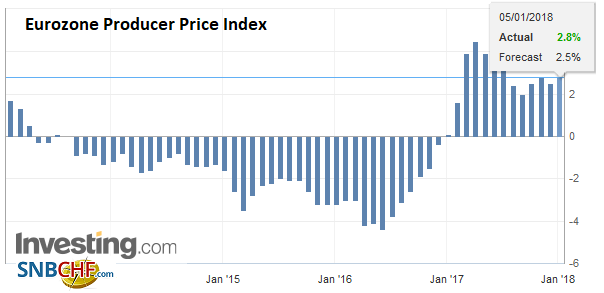

Eurozone |

Eurozone Producer Price Index (PPI) YoY, Nov 2017(see more posts on Eurozone Producer Price Index, ) Source: Investing.com - Click to enlarge |

Eurozone Consumer Price Index (CPI) YoY, Dec 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

Eurozone Core Consumer Price Index (CPI) YoY, Dec 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

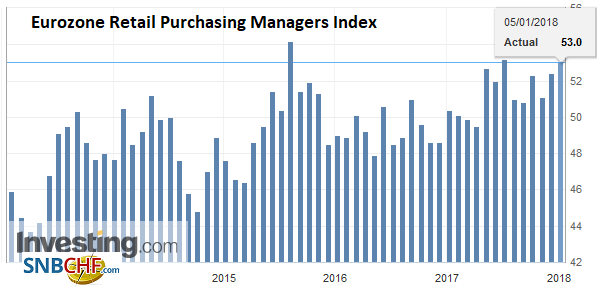

Eurozone Retail Purchasing Managers Index (PMI), Dec 2017(see more posts on Eurozone Retail PMI, ) Source: Investing.com - Click to enlarge |

|

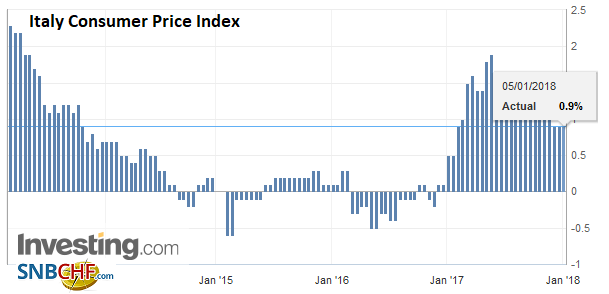

Italy |

Italy Consumer Price Index (CPI) YoY, Dec 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

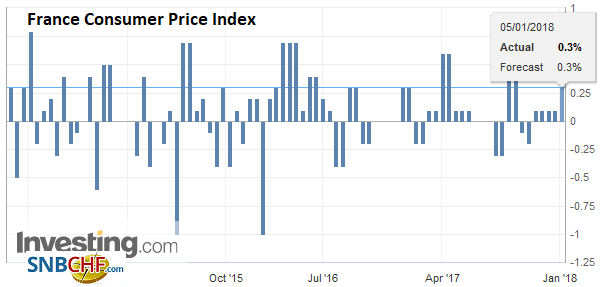

France |

France Consumer Price Index (CPI), Dec 2017(see more posts on France Consumer Price Index, ) Source: Investing.com - Click to enlarge |

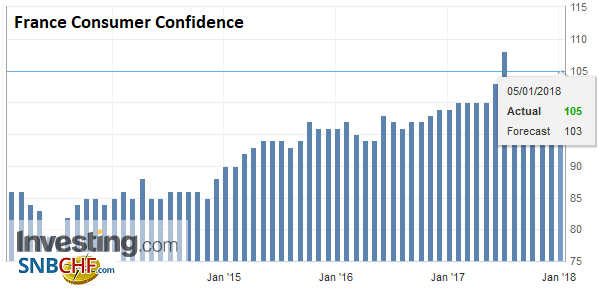

France Consumer Confidence, Dec 2017(see more posts on France Consumer Confidence, ) Source: Investing.com - Click to enlarge |

|

Germany |

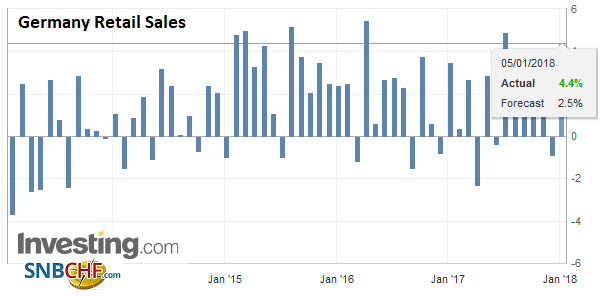

Germany Retail Sales YoY, Nov 2017(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

The US trade deficit is deteriorating more than it may appear as the dramatic improvement in the energy balance is concealing the worsening of the non-oil trade balance. It is something that we suspect will be increasingly in the news this month as several trade issues comes to a head and NAFTA and US-South Korea talks resume.

Global equities have begun the New Year with impressive rallies. The MSCI Asia Pacific Index extended its record high by another 0.5% today. If one doesn’t count New Year’s Day and Boxing Day, this benchmark has not fallen since December 21. It rose 3% this past week, the most since July. European bourses are also in rally mode. German, Italian, and Spanish markets are also up more than 3% this week, while the Dow Jones Stoxx 600 is up 1.8%. Today’s 0.6% rise is broad based with all sectors participating. Health care, consumer discretion, and utilities are leading the way. US shares are trading higher in Europe, and barring a significant surprise with the employment data, the S&P 500 is ready to build on its 1.9% gain this week coming into today.

In contrast, the bond markets are quiet with core 10-year yields flat, while European peripheral yields slip, as did Asian yields. Commodities are consolidating this week’s advance.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Producer Price Index,Eurozone Retail PMI,Featured,France Consumer Confidence,France Consumer Price Index,Germany Retail Sales,Italy Consumer Price Index,newsletter,SPY,U.S. Average Weekly Hours,U.S. Core Durable Goods Orders,U.S. ISM Non-Manufacturing PMI,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Trade Balance,U.S. Unemployment Rate,USD/CHF