A year ago, the Dutch and French elections signaled that UK referendum to leave the EU and the US election of Trump did not usher in a populist-nationalist epoch, such as the one that proceeded the last great financial crisis. The euro gapped higher and did not look back. We have contended that Macron’s victory, in particular, sparked a correction to the euro’s decline that began in mid-2014. Using technical tools, we had identified several different retracement targets. Contrary to our expectations, the euro pushed through a number of these targets. However, the last corrective one, where a decade-old monthly trend line and a 61.8% retracement of the euro’s decline converged (~.26), was approached and held. As the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Bank of England, ECB, EUR, Featured, Federal Reserve, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

A year ago, the Dutch and French elections signaled that UK referendum to leave the EU and the US election of Trump did not usher in a populist-nationalist epoch, such as the one that proceeded the last great financial crisis. The euro gapped higher and did not look back.

We have contended that Macron’s victory, in particular, sparked a correction to the euro’s decline that began in mid-2014. Using technical tools, we had identified several different retracement targets. Contrary to our expectations, the euro pushed through a number of these targets. However, the last corrective one, where a decade-old monthly trend line and a 61.8% retracement of the euro’s decline converged (~$1.26), was approached and held.

As the dollar fell, two main narratives were offered to explain and also to justify an extension of the move. The first was that a new convergence had superseded the divergence theme. Europe and Japan were exiting the extraordinary policies. We were skeptical and did not anticipate peak divergence until at least the middle of 2019 (on policy rates) and even longer in terms of the trajectory of the central bank’s balance sheet.

Second, was the twin deficit problem. The larger trade and budget deficits needed to be financed. The Federal Reserve is not fully reinvesting the proceeds of maturing issues ($450 bln less in 2018 and $600 bln less in 2019), and that buying needs to be replaced. Higher interest rates and a weaker dollar were offered as TINA (There Is No Alternative), even though the first half of the 1980s demonstrated that the twin deficits need not prevent dollar appreciation.

The widening of the interest rate differentials in the dollar’s favor makes is costly to be short the dollar or to use it as a funding currency, unless greenback is falling. The forward points make it expensive to hold a short dollar position against many currencies, even if it is going sideways. Since the start of the month, the weakest currencies have been the Swedish krona (-3.6%), the Swiss franc (-3.4%) and the Japanese yen (-2.5%). Indicative prices suggest one may be paid nearly 300 bp to hedge euro exposure into dollars for a year and more than 250 bp to hedge yen exposure into dollars.

United StatesThe rising US interest rates may also eclipse the appeal of the traditional high yielders. The New Zealand dollar, for example, where the cash rate is 1.75%, the same as the rate the Fed pays on reserves (both required and excess), has fallen 2.2% against the dollar. The Canadian dollar and Australian dollar, which are also backed by relatively high interest rates (1.5% and 1.25% overnight rates respectively), have been among the best performers this month. The Canadian dollar is the only major currency to gain against the dollar. It is up a little more than 0.5%. The Australian dollar’s 1.3% decline is the least among the major currencies. Although the dollar surged last week, it has been trending higher for several weeks. Ironically, now that it has percolated into the mainstream, with even some of the perma-bears are changing their tune, there is a risk of a near-term consolidative or corrective phase. However, the combination of sentiment and market positioning means that buying pullbacks will be preferred to selling into dollar rallies. It warns that downside corrections in the dollar may be shallower than technical analysis may suggest. Trade tensions have receded in the past couple of weeks but will return in the coming days. The most important event that is not on most traders’ calendar is May 1. It is when the exemptions from the steel and aluminum tariffs expire. While many countries have already staked out their responses, no doubt there will be fresh cries of anguish and bemoans of the end of free trade, though we have been done this path before. Macron and Merkel apparently did not win any concessions on their trips to the US. The day after the exemptions end, the US makes its refunding announcement and European investors have been important buyers of US securities in recent months. |

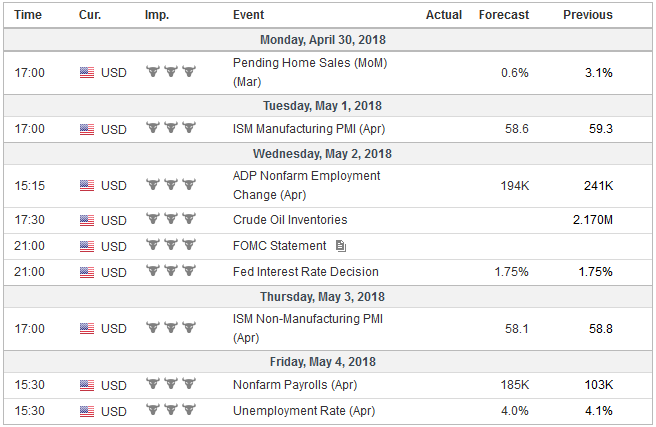

Economic Events: United States, Week April 30 |

ChinaMeanwhile, a team of the White House’s senior economic team will be visiting China for high-level trade talks. We see China as having a three-prong strategy to address the challenges presented by the US Administration. First, take some retaliatory action. If pushed, show a willingness to match the level of escalation (see the difference in China’s reaction to steel and aluminum tariffs and intellectual property sanctions). Second, strengthen the very multilateral rules-based system that the US was instrumental in constructing and may now be defecting. This is to challenge the US actions at the World Trade Organization. Third, there are some actions that the US is demanding that are in China’s self-interest, like reduced tariffs, more competition in financial services, more robust protection of intellectual property rights. China is picking some low hanging fruit. It seems that too many observers are dismissing Chinese President Xi as a reformer because term limits have ended for the head of state. Indeed, some have suggested his commitment to economic reform led to the “synchronization” of terms: as head of party and head of the military have no formal term limits. NAFTA negotiations have reportedly been making substantial progress. A window for a deal extended until around the middle of May. If some commitment is not reached, the talk may be delayed until after the July 1 Mexican election. In the US, Trade Promotion Authority will be extended on June 1 unless either the House of Senate voice an objection. |

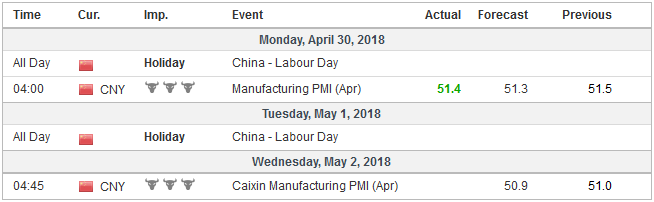

Economic Events: China, Week April 30 |

EurozoneSeveral central banks, most recent the ECB, have recognized the uncertainty and risks posed by the heightened trade tensions. While the Fed recognizes some downside risks posed by a disruption of trade, Draghi seemed more forceful and attributed some of the erosion of confidence and investment to fears of a resurgence in protectionism. The Federal Reserve seems strikingly more confident that its targets can be achieved than the ECB, BOE, and Bank of Japan. And for good reason. Two economic data points next week are key. First, the PCE core deflator, which is the measure the Fed targets, is going to rise to at least 1.9% and possibly reaching the Fed’s 2.0% objective for the first time in half a dozen years. Second, at the end of the week, the BLS reports April jobs data. After a weather-distorted weak report in March, when only 103k net new jobs were created, economists forecast a return to trend. The 12 and 24-month averages converge just below 190k. The unemployment rate has been stuck at 4.1% since the end of Q3 17. It can finally slip through it to a new cyclical low. The underemployment rate is matched the cyclical low from last year in March at 8.0%, and it too may have eased in April. However, average hourly earnings growth is barely accelerating. A 0.2% increase will keep the year-over-year pace at 2.7% compared with 2.5% last April. At his second meeting as Chair, Powell is unlikely to deliver another rate hike at back-to-back meetings and without a pre-scheduled press conference. We argue it is in the Fed’s interest to maximize its degrees of freedom and that one straightforward way so is to have a press conference after every meeting as the ECB, BOJ, and other central banks already do. Under the current practice, only four of the eight meetings are live. The benefits of hindsight raise questions about a tightening cycle under Greenspan that was 25 bp rate hike at every meeting? Besides being slower, doesn’t a hike at every other meeting create some of the same issues? The Federal Reserve will look past any near-term economic weakness. Although data from Q1, including the GDP figures, suggest that the recent tax cuts have not bolstered consumption or capital investment, it is still expected. US corporate earnings have been stronger than even the upwardly revised expectations implied. The Fed’s confidence will likely be reflected in the statement. Investors should be prepared for a hawkish hold. The market is pricing in a little more than a 90% chance of a June hike. Draghi tried to put a brave face on it. Tempering his caution with confidence strikes a markedly different note. Here is the general picture that next week’s data will depict: April inflation is likely to have slowed with the headline CPI easing to 1.3% from 1.4% and the core rate slipping to 0.9% from 1.0%. Growth downshifted from the 0.6% expansion in Q4 17 to 0.4% in Q1 18, with risks on the downside. The April PMI suggests little improvement after the passing of the weather and labor disputes that Draghi noted. The April flash composite was unchanged from March at 55.2. That is down from 58.8 in January. If the region is experiencing a stronger cyclical development, a downward revision would be a confirming indicator. |

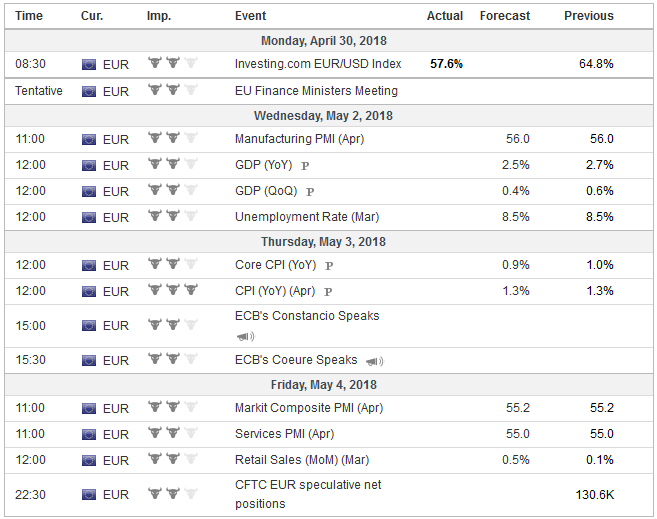

Economic Events: Eurozone, Week April 30 |

United KingdomOver the past fortnight, the odds of a May hike by the Bank of England have fallen nearly 90% to less than 25%. Soft data and Governor Carney’s comments spurred a dramatic shift in market expectations. The data in the run-up to BOE meeting on May 10 might not be of sufficient gravitas to sway opinion. The construction and service PMIs are expected to bounce back and offset whatever weakness there may have been in the manufacturing sector. An uptick in the composite lends credence to our view that some of the Q1 weakness (and Europe) may have been exaggerated by off-factors but that there was also some genuine economic slowing. Italy’s regional election today (April 29) is not a market factor, but it is the last test before it can be determined if a government can be forged. In what seems to be a replay to some extent of the German political drama, the center-left reject working with the party that won a plurality to form a government and only later did so. Talks between the Five-Star Movement and the center-right broke down, and exploratory discussions have begun with the center-left, which is divided on the issue. The UK holds local election on May 3. The Conservatives are widely expected to lose council seats. The question is how many. Many reports are citing 75 seats. This suggests that a small defeat may not change party politics but significant losses more than expected could spur speculation of a leadership challenge. With efforts to force the government to negotiate to stay in the customs union seemingly becoming a force to reckon with, the hardliners do not want a clean and total break to elude them. |

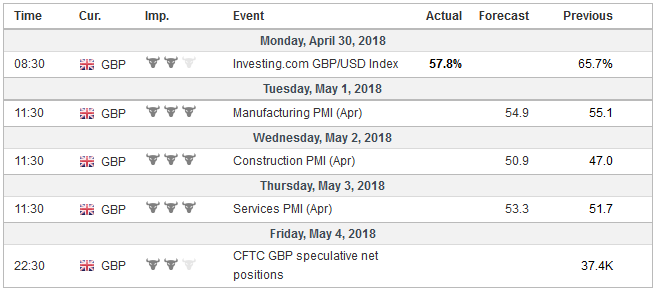

Economic Events: United Kingdom, Week April 30 |

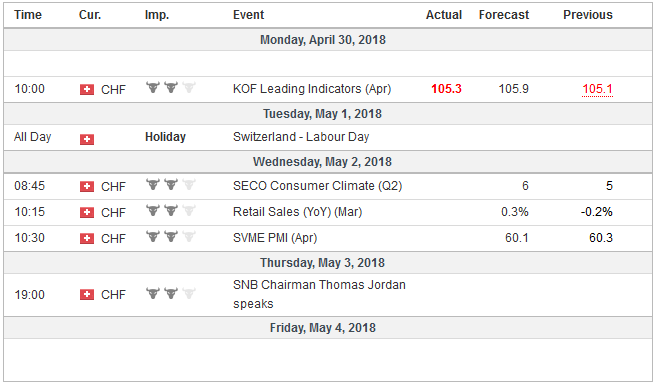

Switzerland |

Economic Events: Switzerland, Week April 30 |

The possibility of formally ending the war between North and South Korea is appealing. The market seems broadly skeptical that this time will prove different in substance and outcome of previous summits between the two. We worry that recent international developments, including the missile strike on Syria for using chemical weapons, and the threats to Iran, have increased the value of having nuclear weapons. Foreign investors were substantial sellers of South Korean equities last week (~$1.3 bln, matching the amount sold in the year up to that point).

The prospect of the Trump Administration reimposing sanctions on Iran on May 12 appears to be one of the factors supporting oil prices. US companies would not be as impacted as Europe. Similarly, European officials are also chaffing under the last sanctions against Russian oligarchs. Some observers play up another deadline around two months later that involve more significant sanctions.

Tags: #USD,$EUR,Bank of England,ECB,Featured,Federal Reserve,newsletter