Swiss Franc The Euro has fallen by 0.32% at 1.135 EUR/CHF and USD/CHF, October 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is rising against most of the major and emerging market currencies. The Swiss franc and the Japanese yen are the exceptions and are holding their own. Global equities are mixed. Asia, excluding Japan, was mostly lower, with 1.2% losses in Taiwan and South Korea and 2.5% drop in Hong Kong and in the H-shares that trade there. Core 10-year bond yields, including US, Germany, and the UK are off three-four basis points, while peripheral European bond yields are being dragged higher by the new surge in Italian yields.

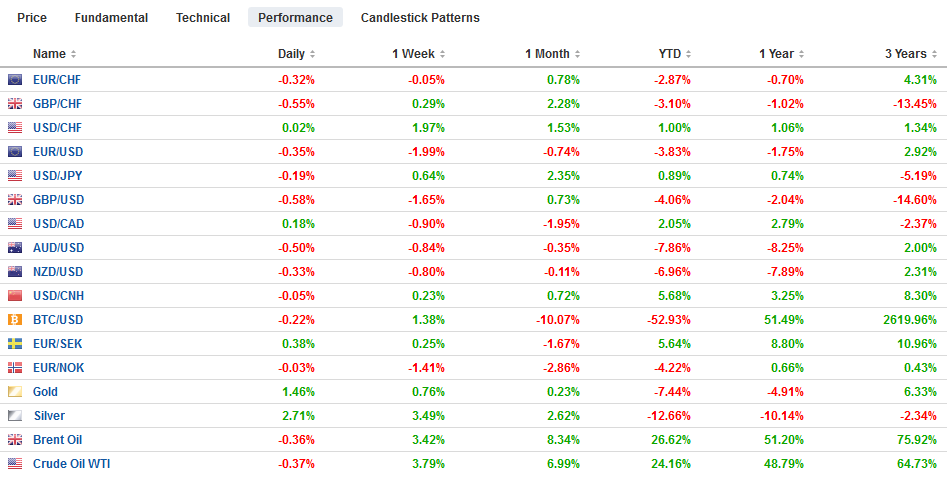

Topics:

Marc Chandler considers the following as important: $INR, $TRY, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

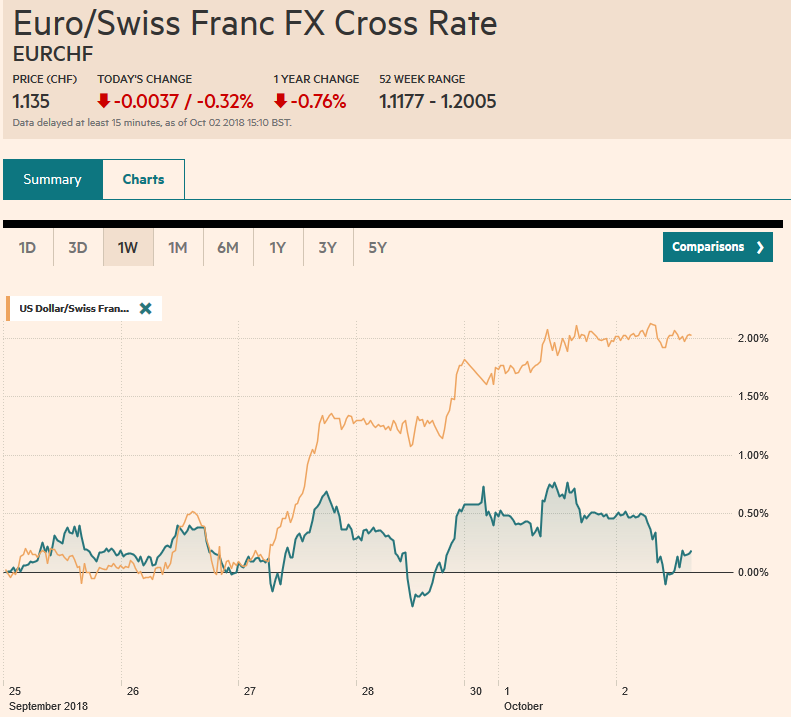

Swiss FrancThe Euro has fallen by 0.32% at 1.135 |

EUR/CHF and USD/CHF, October 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar is rising against most of the major and emerging market currencies. The Swiss franc and the Japanese yen are the exceptions and are holding their own. Global equities are mixed. Asia, excluding Japan, was mostly lower, with 1.2% losses in Taiwan and South Korea and 2.5% drop in Hong Kong and in the H-shares that trade there. Core 10-year bond yields, including US, Germany, and the UK are off three-four basis points, while peripheral European bond yields are being dragged higher by the new surge in Italian yields. Italy’ 10-year yield is up 11 bp at 3.40%. It was at 2.80% five days ago. The two-year yield is up 25 bp to 1.56%, more than twice the 71 bp that was seen five days ago. EC President Juncker rejected Italian Finance Minister’s arguments and warned of a Greek-style crisis. USD: After consolidating yesterday, the Dollar Index is pushing higher today. It is approaching the highs from early September near 95.65, and the 95.80 area is a retracement objective of the decline since mid-August. The euro is testing support near $1.1525 and then $1.15. A 1.1 bln euro option at $1.15 expires tomorrow. The dollar found sellers lurking above JPY114.00. Initial support is pegged at JPY113.55 and then JPY113.25. There is a $370 mln option at JPY113.20 that will be cut today. Sterling is has slipped through $1.30 for the first time since September 12. There are two options that are in play that expire today. There are about GBP230 mln at $1.2970 and around GBP220 mln at $1.3015. The next significant chart point is near $1.29. |

FX Performance, October 02 |

Dollar-Bloc Currencies: The Canadian dollar is still drawing support from the successful conclusion of NAFTA 2.0. It is consolidating the 1.75% gain recorded last Friday and Monday. The Coalition Avenir Quebec won an outright majority, dealing Trudeau’s Liberals another defeat on the provincial level (fourth) and the worst showing for the Parti Quebecois (PQ) in its history. The Australian dollar had been testing support at $0.7200 in recent days, and it finally yielded today. Not surprising anyone, the Reserve Bank of Australia left the cash rate unchanged at 1.5%. Falling property prices are offset the modest strength of the economy and the improved labor market. House prices have fallen across the country for the past 12 months and are off a little more than 6% (annual) in Sydney. The next technical target is near $0.7140 and then $0.7085-$0.7100. A fall in New Zealand business confidence to a nine-year low encouraged the break of $0.6600 for the New Zealand dollar. There look to be little chart support ahead of $0.6500.

Brexit: The news stream is light today, with little in the economic calendars. The UK construction PMI was softer than expected (52.1 from 52.9 in August and expectations for an unchanged reading). The ongoing Tory Party Conference is more impactful. Johnson, who may be gearing up for a leadership challenge to May speaks today, followed by the Prime Minister tomorrow. The rhetoric comparing the EU to a Soviet Gulag illustrates how extreme the debate has become after all the UK wanted to join the EU and helped shape its rules. Its strategy of a broader rather than a deeper union meant that over time, the unanimity is decision-making could not continue. The UK’s own strategy, successfully implement necessitated the loss of its veto. Reports suggest May is prepared to make two more concessions to the EU. First, she may offer to limit Britain’s ability to strike free-trade agreements after Brexit. Second, she may offer to stay in the customs union until a deal can be worked out for the Irish border.

Emerging Market Highlights: The Turkish lira and South African rand are leading the emerging market currencies lower today with losses of 1.7% and 1.1% respectively. The Indonesian rupiah’s loss of 0.9% was enough to take it to a level not seen since 1998 with the dollar rising above IDR15000. Higher oil prices and Fed tightening are difficult for many emerging markets even if investor-friendly policies are pursued. The Indian markets are closed, but the government took over IL&FS as its financial problems were causing systemic concerns. Lastly, the Mexican peso has given back most of the past two days worth of gains. The dollar is trading around MXN18.86. Last week’s high was a little below MXN19.00.

Oil: Supply concerns continue to drive oil prices higher. The 2.8% rally for November light sweet crude yesterday was half of the 5.6% advance recorded all last month. Investors are more persuaded that the US sanctions on Iran will be more effective than the lobbying efforts to get Saudi Arabia and Russia to boost output further, as Trump’s call to the Saudi King over past week ostensibly sought (especially given the recent tweets and complaints at the UN). According to Bloomberg’s data, Iranian oil shipments have fallen to a 2 1/2 year low last month, two months ahead of the US initiation of the US oil embargo. Iranian oil and condensate shipments have fallen by 1.1 mln barrels a day since April to about 1.72 mln bpd. Many observers made a big deal about the EU proposal to establish a special purpose vehicle that would insulate companies from the US wrath for breaking the embargo, but several countries, including France and the Netherlands, did not buy any oil from Iran last month. Italy apparently bought less Iranian oil as did the UAE. Oil supply from Venezuela and Libya remains tentative. Some investors may have also been spooked by the decline in US drilling rigs for two consecutive weeks. That said, the four rig decline is likely noise and with 863 oil rigs in operation at the end of September, it is still the most at the end of any month since February 2015. That said, the trend higher rig count from earlier this year through May has leveled off in recent months. The $76.50 area is the next technical target. It corresponds with a retracement of the slide in prices from the mid-2014 high.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$INR,$JPY,$TRY,Featured,newsletter