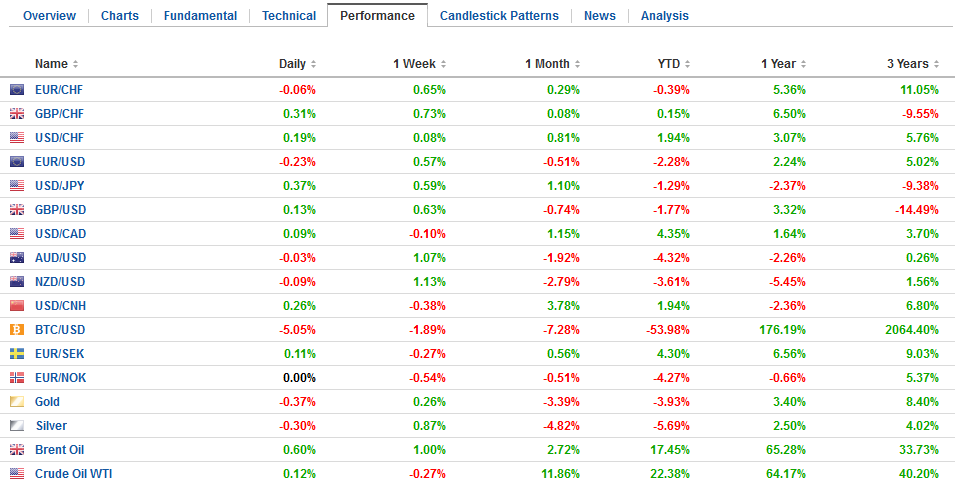

Swiss Franc The Euro has fallen by 0.13% to 1.1632 CHF. EUR/CHF and USD/CHF, July 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro was already trading with a heavier bias, having been turned back after approaching the .18 level yesterday. The disappointing Geman survey data encouraged some late longs to be cut, driving the euro to the session low near .1715, the five-day moving average. The .1690 area corresponds to the 38.2% retracement of the leg up since the June 28 low. The 50% retracement is found near .1660, just above the 20-day moving average. Firmer stocks and yields are encouraging the market to push the greenback higher against the yen. The

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Brexit, CAD, EUR, Featured, FX Daily, GBP, Germany ZEW Economic Sentiment, JPY, newslettersent, SPY, TLT, U.K. industrial production, U.K. Manufacturing Production, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.13% to 1.1632 CHF. |

EUR/CHF and USD/CHF, July 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe euro was already trading with a heavier bias, having been turned back after approaching the $1.18 level yesterday. The disappointing Geman survey data encouraged some late longs to be cut, driving the euro to the session low near $1.1715, the five-day moving average. The $1.1690 area corresponds to the 38.2% retracement of the leg up since the June 28 low. The 50% retracement is found near $1.1660, just above the 20-day moving average. Firmer stocks and yields are encouraging the market to push the greenback higher against the yen. The dollar made a marginal new high against the yen near JPY111.20. This is the highest level since May 21. The high then, which was the best level since mid-January, was near JPY111.40. Today there is a $575 mln option expiring at JPY111.55. |

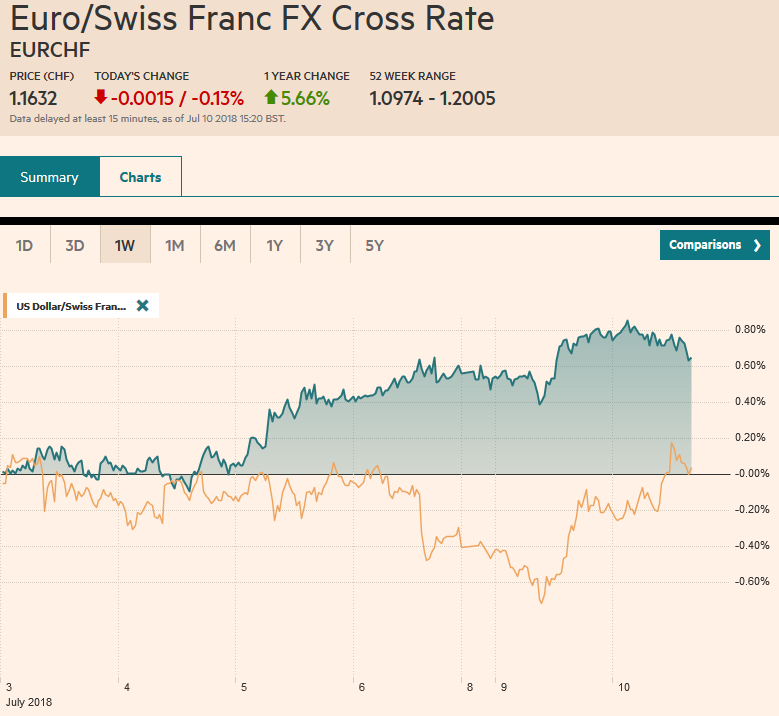

FX Performance, July 10 |

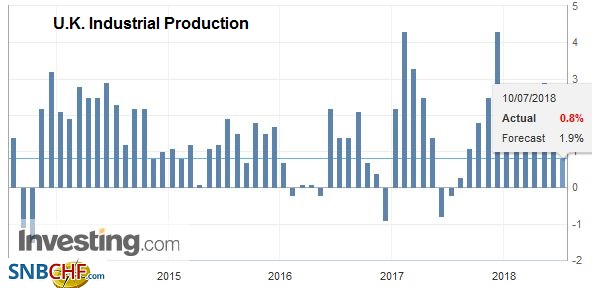

United KingdomThe political obituary of UK’s May, who many see as an “accidental” Prime Minister, has been written many times in the past year and a half only to be withdrawn. Again, it looked like the resignation of two ministers, and a couple of junior ministers was going to spur a leadership challenge. While this still may come to pass, the hard Brexit camp, which has huffed and puffed, simply does not appear to represent a majority of the Tory Party, and possibly the broader electorate. The prevailing thought now is that even if a leadership challenge can be mounted, May would likely survive it. In some ways, recent polls suggest that the referendum in 2016 was a bit of a catharsis. Simmering anger at the EU, and more broadly, at the economic angst post-Great Financial Crisis, found outlet in the referendum. Moreover, as we had argued at the time, the Remain camp ran a weak campaign, and the complexity and costs are Brexit have been made clearer over the past couple of years. Recent surveys also show an improved attitude toward immigrants. We thought the market exaggerated the negativity for sterling from the political drama. Sterling recovered a cent from yesterday’s lows below $1.3200 to today’s high. It looked as if it wanted to push toward $1.3350. But its stalled at $1.33, where a GBP554 mln option is struck, which expires today. However, the market pushed lower after the disappointing industrial output figures. May industrial production was to have risen by 0.5% after a 0.8% decline in April. However, the report showed that it fell 0.4% and the April contraction was revised to -1.0%. |

U.K. Industrial Production YoY, Aug 2013 - Jul 2018(see more posts on U.K. Industrial Production, ) Source: investing.com - Click to enlarge |

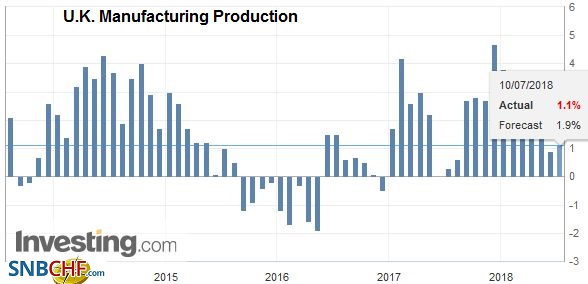

| Manufacturing itself performed better. It rose 0.4%, and April was revised to -1.3% from -1.4%. However, this disappointed expectations too, which had looked for nearly twice the gain in manufacturing output. Other economic data points were also not as poor as the optics of the slide industrial output. The trade deficit was smaller than expected at GBP2.79 bln instead of GBP3.4 bln and April’s GBP3.09 bln. The smaller deficit with non-EU countries accounts for the improvement. May’s construction output jumped 2.9%, well above median forecasts for a little more than 0.5%, though it borrowed from April, which was revised to flat from 0.5%.

The UK introduced its monthly GDP report. It rose 0.3% in May, in line with expectations, and its three-month rolling estimate rose to 0.2% from flat. Separately, the index of services rose 0.3% in May after a revised 0.4% rise in April (initially 0.3%). Taken as a whole, the data lends credence to BOE Governor Carney’s assessment that the UK economy has improved after the soft patch earlier in the year. A rate hike next month is still the most likely scenario. |

U.K. Manufacturing Production YoY, Aug 2013 - Jul 2018(see more posts on U.K. Manufacturing Production, ) Source: investing.com - Click to enlarge |

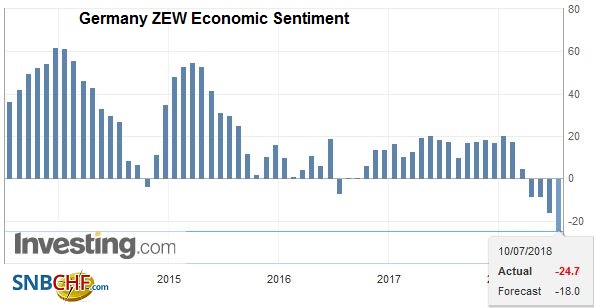

GermanyThe string of good German data-from the PMI through the factory orders and industrial output figures–ended today with the disappointing July ZEW survey. The assessment of the current situation fell to 72.3 from 80.6 in June. It continues the decline that began in February after the index reached 95.2 in January. It has fallen every month since, and the fall in the July reading is the largest in index points and in percentage terms. It is at its lowest level since December 2016. The expectations component also fell sharply. It stands at -24.7 after the June reading of -16. It too peaked in January (20.4) and has worked its way lower, though it had appeared to stabilize in May. The July reading is the lowest since August 2012. |

Germany ZEW Economic Sentiment, Jul 2013 - Jul 2018(see more posts on Germany ZEW Economic Sentiment, ) Source: investing.com - Click to enlarge |

In the US, the S&P 500 and Dow Industrials posted their strongest gains in a month yesterday. The S&P 500 gapped higher, and that gap appears on the weekly bar charts as well, giving added technical significance. However, the coattails have proven short. Although the MSCI Asia Pacific Index initially posted gains, it reversed and settled on its lows, leaving a potential bearish shooting star candle in its wake. That said, most markets, except Australia and Hong Kong, posted small gains. European shares are faring better, and the Dow Jones Stoxx 600 is extending the advancing streak into a sixth consecutive session. The 0.2% gain is being led by energy and information technology. Telecomms, utilities, consumer staples, and materials are on the downside.

Benchmark 10-year bond yields are most 1-2 bp firmer, with the exception of Spain and Portugal that are a touch lower. The UK Gilt yield is up four basis points today after slipping lower yesterday. Canada’s 10-year yield is also up nearly four basis points today. Canada reports June housing starts and May building permits. Both are expected to have improved. The Bank of Canada is widely expected to hike rates tomorrow. We expect the usual cautions, but with a clear signal that the removal of accommodation is not complete. We anticipate another rate hike late this year. As the market came around to this week’s rate hike, the US dollar fell from almost CAD1.34 on June 27 to a low yesterday of nearly CAD1.3065. It is consolidating amid some last minute position squaring. Initial resistance is seen in the CAD1.3160-CAD1.3180 area.

The US JOLTS report is the only government data on tap. Given the conflicting inventory data recently, the API estimate later today will draw interest. Oil prices are extending yesterday’s gains. Brent is up another 1%+ after a similar rise yesterday. WTI for August delivery is posting more mild gains (~0.6%) but is rising for the third consecutive sessions. OPEC is pushing back against US pressure, arguing it is not responsible for the increase and it has taken some measures to offset the loss of output elsewhere. August WTI recorded a high near $75.25 on July 3.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,$JPY,$TLT,Brexit,Featured,FX Daily,Germany ZEW Economic Sentiment,newslettersent,SPY,U.K. Industrial Production,U.K. Manufacturing Production