The US policy mix gets a privileged place in our understanding of what is the dollar. Tighter monetary policy and looser fiscal policy could be the closest thing to an elixir for currencies. It is the policy mix that the US is pursuing. The idea is that such a policy mixed draws capital inflows. This is exactly what is happening. The June TIC data was reported yesterday, and there was a net purchase of 4.5 bln of US assets. It was the third month this year that the inflows surpassed 0 bln, matching the number in all of 2017 and exceeding the number of months in 2016. According to this authoritative even if not comprehensive report, foreign investors bought 7.4 bln of US assets in Q2, the most in any quarter

Topics:

Marc Chandler considers the following as important: 4) FX Trends, capital flows, Featured, newsletter, tic, U.S. Treasuries, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The US policy mix gets a privileged place in our understanding of what is the dollar. Tighter monetary policy and looser fiscal policy could be the closest thing to an elixir for currencies. It is the policy mix that the US is pursuing.

The idea is that such a policy mixed draws capital inflows. This is exactly what is happening. The June TIC data was reported yesterday, and there was a net purchase of $114.5 bln of US assets. It was the third month this year that the inflows surpassed $100 bln, matching the number in all of 2017 and exceeding the number of months in 2016. According to this authoritative even if not comprehensive report, foreign investors bought $417.4 bln of US assets in Q2, the most in any quarter for a decade. That brings the first half inflow to $538 bln, also the most since 2008 and sufficient to cover the entire year’s current account deficit.

| The market pays particular attention to the Treasury holdings of various countries. Chinese holdings of Treasuries slipped $4.4 bln, which seems little more than a rounding error given its $1.183 trillion in May. China holdings fell $6.2 bln in H1 18. The 10-year yield rose 45 bp in H1, and the five-year yield rose almost 55 bp in the same period.

Japan’s Treasury holdings fell more. They fell $18.4 bln in June and $31 bln since the end of last year. Japan’s Treasury holdings peaked in November 2014 near $1.242 trillion and have been trending lower for the past few years. Japan’s Treasury holdings stood at $1.030 trillion in June. We suspect that Japan. More broadly, Japan’s reserves peaked in early 2012 a little over $1.3 trillion. Japanese institutional investors, who often hedge out the currency risk of foreign bond exposure, have reportedly been discouraged from buying US bonds due to the high costs of hedging (speaks to the flatness of the yield curve). Russia’s holdings of US Treasuries, or indeed the lack thereof, has garnered attention recently. They fell $6 bln in Q1 to $96.1 bln in March. The holdings apparently were halved in April to $48.7 bln and then to $14.9 bln in May, where they remained in June. We hypothesized that this might not have been as much liquidation as it may appear. Instead, we suspect, given the alternatives, that Russia likely shifted custodians outside of the US TIC data purvue. One such would be Belgium-based Euroclear. Treasury holdings in Belgium have risen by nearly $30 bln in Q2. Belgium’s Treasury holdings have increased in eight of the last 10 months and by about $50 bln of this period to stand at almost $155 bln at the end of June. In the most recent past, analysts attributed the change in Belgium Treasury holdings to China, and this would complicate the picture. |

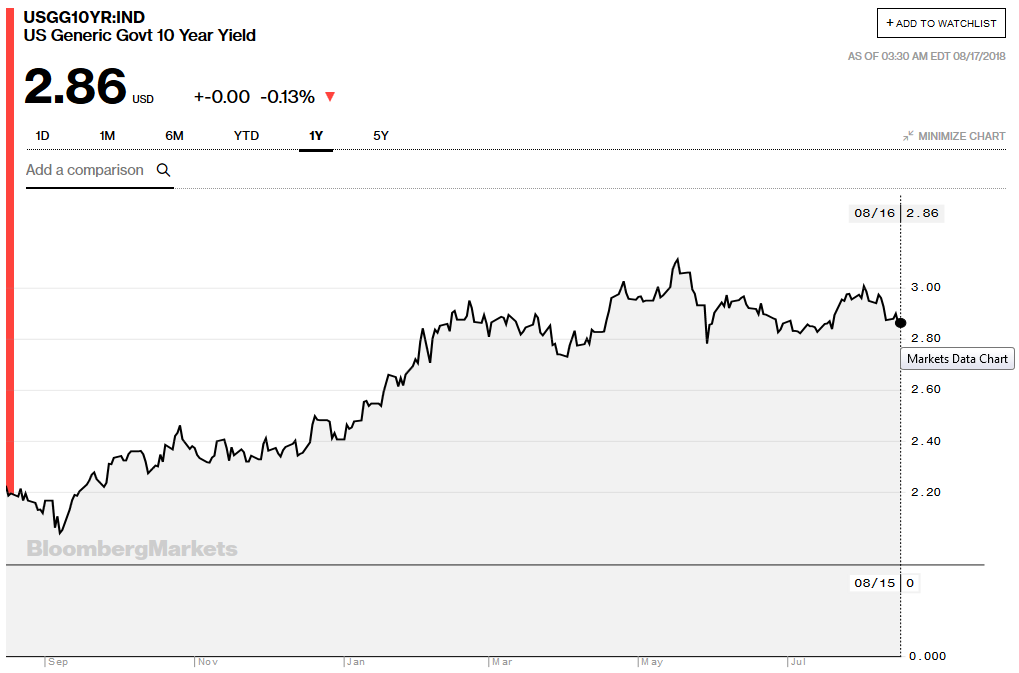

Yield US Treasuries 10 years, Sep 2017-Aug 2018(see more posts on U.S. Treasuries, ) Source: bloomberg.com - Click to enlarge |

Another place some suggest Russia may have shifted its Treasury holdings are the Cayman Islands. This is possible, but it does not strike us a particularly likely. There may be a simpler explanation for the $32 bln accumulation in Q2 of Treasuries attributed to the Cayman Islands. Hedge funds may be offsetting part of what appears to be a large short in the futures market with a long cash position. There has also been a campaign to attract foreign money, including Japanese institutional funds, into private equity and real estate investment trusts. That said, not that from a year ago, Treasury holdings attributed to the Cayman Islands are off about $50 bln.

All told, according to the US TIC data, foreign investors held $6.211 trillion of US Treasuries at the end of June. This represents a $1.1 bln decline from May and a $2.6 bln increase since the end of last year. Despite the increase in US supply, due to the drop in revenue related to the tax cuts and high spending, foreign investors as a whole have not stepped up their purchases.

Nearly half the Treasuries owned by non-residents are held by foreign central banks at the Federal Reserve itself. Its custody holdings fell by $52 5 bln in Q2 after increasing by $69.6 bln in Q1. That leaves the Treasury holdings in the Fed’s custody account at $3.038 trillion or nearly $17 bln less than at the end of last year. Part of what is going on here is a shift to agency securities, which the Fed also holds for foreign officials. Agency holdings have risen by nearly $26 bln this year.

Tags: #USD,capital flows,Featured,newsletter,tic,U.S. Treasuries