Overview: Escalating tensions in Europe and comments from Bank of Japan Ueda that spurred speculation of a December hike are the main drivers of the foreign exchange market today. The yen is the strongest of the G10 currencies, up about 0.65%, while the euro is the weakest, off a little more than 0.25%, and sterling is down almost as much. Most of the other G10 currencies are little changed. Led by central European currencies, most emerging market currencies are...

Read More »Higher Yields Help Extend the Dollar’s Gains

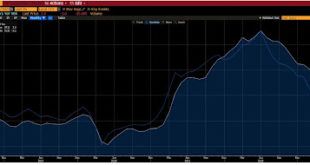

Overview: The dollar continues to ride high. It is up 0.20%-0.50% today against the G10 currencies. Most pairs have extended last week's moves. The Dollar Index, which was near 100 in late September is approaching 106.00. Emerging market currencies are all weaker, as well. The dollar is being helped by higher US yields. After yesterday's holiday, the US 10-year yield is up five basis points to near 4.36%. The two-year yield also is five basis points higher to almost...

Read More »Disappointing US Data Followed by Better Japanese Wages and Stronger German Factory Orders Weigh on the Greenback

Overview: The one-two punch of the disappointing US job opening report and the downbeat Beige Book weighs on the US dollar, which is softer against all the G10 currencies. The Canadian dollar is a notable exception. Prime Minister Trudeau's minority Liberal Party lost key support and the Bank of Canada affirmed expectations for more rate cuts. Japan's wage growth was stronger than expected, underscoring the divergence of policy and the dollar was sold to almost...

Read More »Dollar Comes Back Bid

Overview: The dollar fell alongside US rates yesterday after the softer than expected CPI. The move on both rates and the dollar were pared after the FOMC meeting which held rates steady as widely expected, but the median dot now anticipated one cut this year rather than three. The dollar has recovered more ground today and is trading with a slightly firmer bias G10 currencies. However, trading is quiet and mostly narrow ranges have dominated. North American...

Read More »Dollar Pulled Back in Europe. New Buying Opportunity?

Overview: The dollar initially extended yesterday's North American recovery but unwound most of the gains in the European morning. As North American dealers return, the greenback is lower against most of the G10 currencies. After approaching levels believed to have been where the BOJ last intervened, profit-taking pushed the dollar back to a marginal new low for the week (~JPY156.55). The yen's recovery arguably helped the Chinese yuan rise for the first time since...

Read More »Quiet End to a Busy Week

Overview: The US dollar is winding down this week on a quiet note. Most of the G10 currencies are trading within yesterday's ranges. On the week, only the Scandis are set to close with gains, though with a little effort, the Australian dollar could too. The Japanese yen and Swiss franc are the laggards off 0.65%-0.75% this week. Most emerging market currencies outside of central Europe are firmer. The South African rand is the strongest this week, followed by four...

Read More »Food Prices Drive China’s CPI Lower while the Greenback is Mostly Firmer in Narrow Ranges

Overview: The dollar is mostly firmer against the G10 currencies and has been confined to tight ranges through the European morning. Outside of the China's deflation and Japan's monthly portfolio flow data that showed Japanese investors bought the most amount of US Treasuries (~$22 bln) in six months in September, the news stream is light. Most emerging market currencies are trading with a softer bias today. The Philippine peso is the strongest among the emerging...

Read More »The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Overview: The deluge of Treasury supply is nearly over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year bonds to finish the quarterly refunding. The sales will come after the July CPI print that is expected to see the first year-over-year increase since last June. The market is going into the report with about a 15% chance of a Fed hike next month discounted. Meanwhile, September crude oil extended its recover from $80 seen on Tuesday to a...

Read More »RBNZ Delivers a Dovish Hike and UK Inflation Surprises to the Upside

Overview: Equities in the Asia Pacific region and Europe are being led lower by the sell-off in the US yesterday. All the large Asia Pacific markets fell with Hong Kong and mainland shares setting the pace. Europe's Stoxx 600 is off nearly 1.5%, which would be the largest loss in two months. Consumer discretionary, financials and real estate sectors are off nearly 2%. US equity futures have a softer bias. European 10-year yields are mostly 2-3 bp lower, but the UK...

Read More »Equities Retreat while the Dollar is Confined to Narrow Ranges

Overview: Equities are mostly lower, while bonds have risen. The dollar is trading in narrow ranges and mixed against the G10 currencies and emerging markets. Most Asian bourses were lower. The Nikkei (though not the Topix) and Hong Kong were the chief exceptions. Europe's Stoxx 600 is off for the second consecutive day, in what looks like the first back-to-back loss since early this month. US equity futures are lower, with the NASDAQ, which eked out a small gain...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org