See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Mathematics of Frexitology This was also a holiday-shorted week. As we write this, the big news comes from the election in France. The leading candidate is a banker named Emmanuel Macron, with about 24% of the vote in a 4-candidate race. The anti-euro Marine Le Pen came in second with just over 21%. From the sharp rally in the euro, which was up about 2% at one point, we assume that observers believe the odds of France leaving the euro have just gone down. Of course, France (and the other European countries) faces a false alternative (well they ought to consider Keith’s gold bonds proposal, but that is not on the table). Staying with the euro means ongoing wealth destruction, and a downward slope that leads to nowhere good. However, that raises the question. What would happen if they were to try to leave? We believe that no matter which theory prevails, and what measures are taken by les dirigistes (central planners), all roads lead to an accelerated default of trillions in bad credit. To understand why, consider the balance sheets of the banks and other financial intermediaries in France.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

The Mathematics of FrexitologyThis was also a holiday-shorted week. As we write this, the big news comes from the election in France. The leading candidate is a banker named Emmanuel Macron, with about 24% of the vote in a 4-candidate race. The anti-euro Marine Le Pen came in second with just over 21%. From the sharp rally in the euro, which was up about 2% at one point, we assume that observers believe the odds of France leaving the euro have just gone down. Of course, France (and the other European countries) faces a false alternative (well they ought to consider Keith’s gold bonds proposal, but that is not on the table). Staying with the euro means ongoing wealth destruction, and a downward slope that leads to nowhere good. However, that raises the question. What would happen if they were to try to leave? We believe that no matter which theory prevails, and what measures are taken by les dirigistes (central planners), all roads lead to an accelerated default of trillions in bad credit. To understand why, consider the balance sheets of the banks and other financial intermediaries in France. Suppose the new French franc goes down relative to the euro (we won’t address here whether it is likely to go up or down). This means that any French entity who had borrowed from a bank in Germany or Italy or Spain now sees its liabilities spike up relative to its assets which are now re-denominated in francs. It would not take that much leverage or a very large decline in the franc to cause some major bankruptcies. The initial round of bankruptcies could cascade causing yet other bankruptcies in a highly interconnected financial system. |

The political program of Emmanuel Macron: ”Hamon is lost – Fillon is burned – It’s either me, or the blonde of the FN” – “Obviously, if you look at it like that…” - Click to enlarge A concise summary of how one becomes president in France these days – provided the polls are not in error. It wouldn’t be the first time – don’t forget the “Bradley Effect”, which is probably even stronger in Le Pen’s case than it was in Trump’s. [PT] |

| On the other hand, suppose the franc rises. Then the French banks get hit the other way. Their euro-denominated assets outside France are going down, but their domestic liabilities to depositors and bondholders are firm.

A regime of floating currencies sounds good in Milton Friedman’s argument about being an easy way to adjust wages downwards which are otherwise sticky. However, an actual currency revaluation means a wealth transfer from parties A, B, and C to parties X, Y, and Z. That may seem to be good for the latter, until you realize that they are creditors of the former. And the former were already leveraged, and already surviving on thin margins compressed after decades of falling interest rates. There is scant capital to absorb such a shock. Then there is the question of who will buy French government or corporate bonds? No matter how you slice it, inserting a new currency into a block that currently has just one adds friction, which means trade and production will slow further. The market will shrink (and this could in itself push some marginal corporations under). And there are other serious problems. One is the intra-euro balances. Will these be re-denominated? Another is the political response by the European Central Bank and the members of the European Union. What will they do? Will they try to shut off funds flowing to and from France? It would be naïve to assume there will be no response, and France will get away with it free of consequences. The euro patient may have cancer, and the cancer may be terminal. But that does not mean blowing up the patient with dynamite is going to help. Of course, traders want to know how this will affect gold and silver. As we write this, we see that silver went down 30 cents before rallying back up to where it closed on Friday. Gold went down about $20, and then half way back up. At this point, we are not sure if the metals are supposed to go up because of more printing. Or go down because the euro constrains France from printing. Or silver at least should go up because the economy is going to be better with France remaining in the euro zone. Or go down because the ongoing malaise will only progress as it has been. Or some other logic… and the price gyrations this evening show that traders don’t agree either. Of course in an actual credit default (i.e. deflation), one may choose to hold paper, as there is a shrinking quantity of it. But the problem is that one may find that the shrink comes out of your balance! We think it may be better to sell the paper and hold money (gold or silver), as money cannot default, unlike credit. |

The sum of all fears. In reality, it is not so easy for a French president to arrange for France to leave the euro zone or the EU, unless he or she is supported by a significant majority of representatives in parliament. - Click to enlarge Without such a majority, a French president cannot even call for a referendum if the outcome could potentially result in a change to the constitution. France’s EU membership is indeed enshrined in the French constitution. We conclude it would be virtually impossible for Marine Le Pen to exit the EU or the euro, and we would suggest she is actually aware of that fact. Exiting the euro would be such a huge pain in practice, she probably doesn’t really want to do it anyway… (as an aside: she is a dirigiste as well). [PT] |

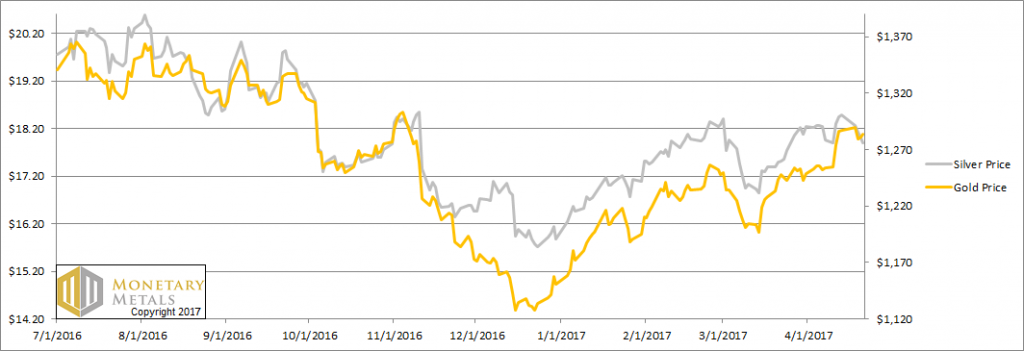

Fundamental DevelopmentsIn any case, we are interested in watching what the fundamentals of the metals are doing. We will take a look at the graphs below, but first, the price and ratio charts. Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It had a major move up this week. That is, the price of gold didn’t change much, but that of silver fell from $18.49 to $17.91. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

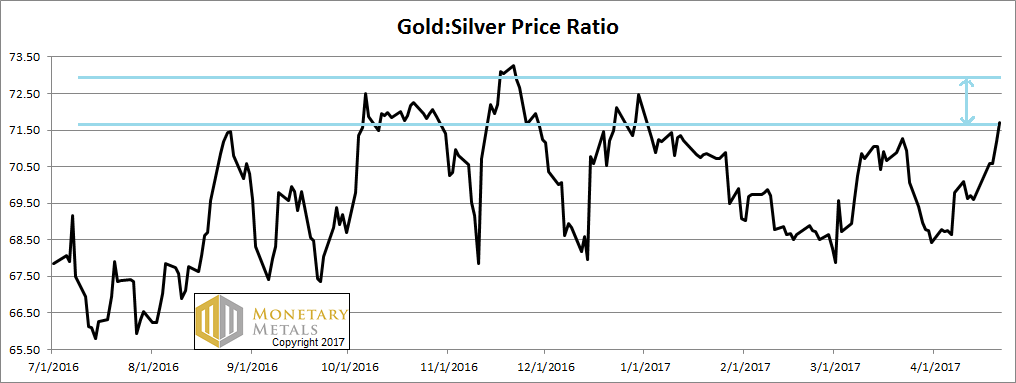

Gold:Silver RatioThe ratio made a fresh high (you would have to go back to before the new year to see this level). So we drew in a line showing this level going back many months. We are not too focused on charts, preferring to understand the fundamentals, but in a case like this we think it’s worth looking. The fundamentals are well above the current market level. If prior peaks are an indication, there may be a spot of resistance at 72.5 (+0.8 above Friday’s close) and another at 73.25. If the ratio should go over these levels, then it may go all the way to its fundamental level (discussed below).

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

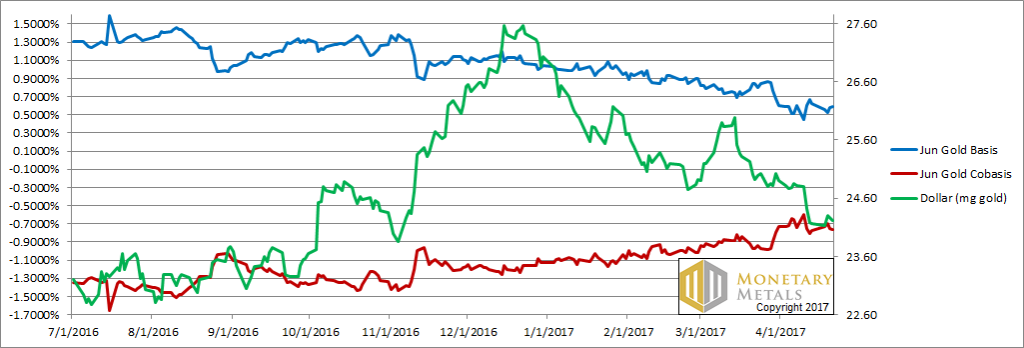

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph. The scarcity (i.e. the co-basis, the red line) fell slightly this week. This occurred as the price of gold fell a few dollars (i.e., the price of the dollar, which is the mirror image, rose). Therefore, it should be no surprise that our calculated fundamental price fell a few bucks, to just under $1,290. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

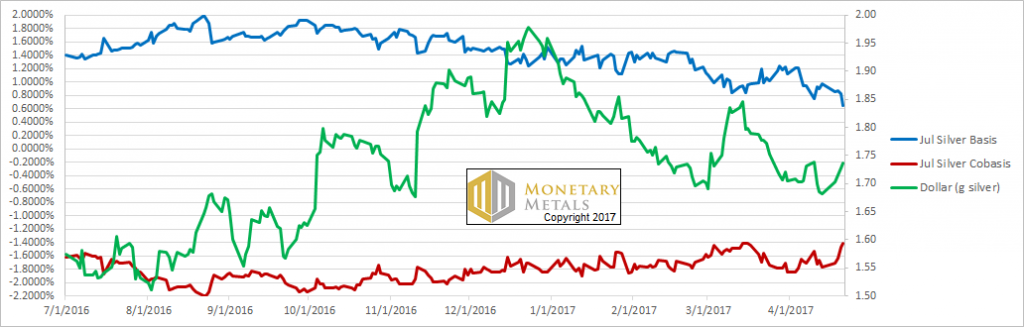

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, the price fell a lot. So we are not surprised to see that the basis fell and co-basis rose (i.e., abundance dropped and scarcity increased). Some speculators definitely got flushed. However, the question is, how many and by how much? Our calculated fundamental price of silver fell over 50 cents, down to $15.92. This is quite a lot in two weeks (recall that it had been over $16.80 on April 7). Our calculated fundamental gold-silver ratio is now up to about 81. Frexit or no Frexit, is not the question. The question is ratio to hit or not to hit 80. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Tags: dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver basis,Silver co-basis,silver price