The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS consumption indicator registered at 1.50 points in March, indicating private consumption growth around the long-term average. Solid automotive demand drove this figure. Domestic tourism, on the other hand, took a breather after a strong start in 2017. Pessimism still prevails in retail. Zurich, 26 April 2017 – The UBS Consumption Indicator stood at 1.50 in March, and the February figure was revised downwards slightly to 1.45. Following strong growth at the beginning of the year (5.5%), domestic tourism fell by 0.8% in February compared with the same month in the previous year. New car registrations, on the other hand, increased by 4.8% compared with the previous year. A sour mood prevails among retailers, according to a survey conducted by the Swiss Economic Institute (KOF) at ETH Zurich. The sentiment index traded at –9 in March and was below the long-term average of 4.5 for the 32nd month in succession. It seems that the hoped-for adjustment by the retail sector to the new exchange rate realities is only taking place very slowly.

Topics:

UBS Switzerland AG considers the following as important: Featured, newsletter, Swiss Macro, Switzerland Private Consumption, Switzerland UBS Consumption Indicator

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

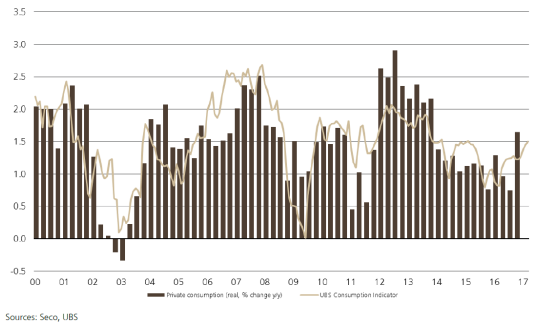

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator registered at 1.50 points in March, indicating private consumption growth around the long-term average. Solid automotive demand drove this figure. Domestic tourism, on the other hand, took a breather after a strong start in 2017. Pessimism still prevails in retail.

Zurich, 26 April 2017 – The UBS Consumption Indicator stood at 1.50 in March, and the February figure was revised downwards slightly to 1.45. Following strong growth at the beginning of the year (5.5%), domestic tourism fell by 0.8% in February compared with the same month in the previous year. New car registrations, on the other hand, increased by 4.8% compared with the previous year. A sour mood prevails among retailers, according to a survey conducted by the Swiss Economic Institute (KOF) at ETH Zurich. The sentiment index traded at –9 in March and was below the long-term average of 4.5 for the 32nd month in succession. It seems that the hoped-for adjustment by the retail sector to the new exchange rate realities is only taking place very slowly. The strong franc and the associated price disadvantage compared with competitors from border countries is not the only challenge facing the retail sector. The spread of online shopping is also pressuring Swiss retailers, so UBS economists are not expecting retailers’ mood to brighten soon.

Private consumption vs. UBS Consumption IndicatorUBS predicts GDP growth for the Swiss economy of 1.4% in the current year. Even if economic growth is not likely to rise much, it should be more broad-based than last year. UBS economists are expecting solid consumption growth. A slight fall in Swiss unemployment should support consumption, whereas the increase in inflation will exert a braking effect as rising consumer prices will lead to lower growth in real income. |

Switzerland Private Consumption and UBS Consumption Indicator, April 2017(see more posts on Switzerland Private Consumption, Switzerland UBS Consumption Indicator, ) Source: ubs.com - Click to enlarge |

How the UBS Consumption Indicator is calculated

The UBS Consumption Indicator signals private consumption trends in Switzerland with a lead time of one to three months on the official figures. At more than 50%, private consumption is by far the most important component of Swiss GDP. UBS calculates this leading indicator from six consumer-related parameters: new car registrations, business activity in the retail sector, the number of domestic overnight hotel stays by Swiss residents, the consumer sentiment index, employment figures and credit card transactions made via UBS at points of sale in Switzerland. With the exception of the consumer sentiment index and employment figures, all of this data is available monthly.

Tags: Featured,newsletter,Switzerland Private Consumption,Switzerland UBS Consumption Indicator