Stock Markets EM FX got some limited traction as the week closed, helped by stabilizing commodity prices. However, oil, copper, and iron ore have all broken important technical levels that suggest further weakness ahead. We also think the FOMC and jobs data support our view that the next Fed hike will be in June. This backdrop should keep EM on the defensive this week. Stock Markets Emerging Markets, May 06 Source: economist.com - Click to enlarge China China reports April trade figures on Monday. Exports are expected to rise 11.3% y/y and imports by 18.0% y/y. China reports April CPI and PPI Wednesday. The former is expected to rise 1.1% y/y while the latter is expected to rise 6.7% y/y. For now, markets are digesting signs of slowing in China’s economy. Turkey Turkey reports March IP Monday, which is expected to rise 2.5% y/y vs. 1.0% in February. It then reports March current account data Thursday, which is expected at -.20 bln vs, -.53 bln in February. If so, the 12-month total would fall slightly to -.2 bln. External accounts are in good shape, but mostly due to sluggish growth. Taiwan Taiwan reports April trade Monday. Exports are expected to rise 10.9% y/y and imports by 18.0% y/y. EM trade data has come in largely stronger than expected in April, and Taiwan should be no exception.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX got some limited traction as the week closed, helped by stabilizing commodity prices. However, oil, copper, and iron ore have all broken important technical levels that suggest further weakness ahead. We also think the FOMC and jobs data support our view that the next Fed hike will be in June. This backdrop should keep EM on the defensive this week. |

Stock Markets Emerging Markets, May 06 Source: economist.com - Click to enlarge |

ChinaChina reports April trade figures on Monday. Exports are expected to rise 11.3% y/y and imports by 18.0% y/y. China reports April CPI and PPI Wednesday. The former is expected to rise 1.1% y/y while the latter is expected to rise 6.7% y/y. For now, markets are digesting signs of slowing in China’s economy. TurkeyTurkey reports March IP Monday, which is expected to rise 2.5% y/y vs. 1.0% in February. It then reports March current account data Thursday, which is expected at -$3.20 bln vs, -$2.53 bln in February. If so, the 12-month total would fall slightly to -$33.2 bln. External accounts are in good shape, but mostly due to sluggish growth. TaiwanTaiwan reports April trade Monday. Exports are expected to rise 10.9% y/y and imports by 18.0% y/y. EM trade data has come in largely stronger than expected in April, and Taiwan should be no exception. Yet the economy remains sluggish and price pressures are low. We see the central bank on hold at its next quarterly policy meeting in June. ChileChile reports April CPI and trade Monday. CPI inflation is expected to remain steady at 2.7% y/y. This would be below the 3% target and well within the 2-4% target range. As such, we expect the easing cycle to continue. Next policy meeting is May 18, and another 25 bp cut to 2.5% seems likely as the bank seems to be front loading its rate cuts. Czech RepublicCzech Republic reports March retail sales Tuesday, which are expected to rise 7.2% y/y vs. 1.1% in February. It then reports April CPI (2.3% y/y expected) and March industrial (9.5% y/y expected) and construction output Wednesday. The central bank left policy unchanged last week, but issued a dovish statement suggesting no near-term rate hikes. Next policy meeting is June 29, no change expected then. HungaryHungary reports March trade Tuesday. It then reports April CPI Wednesday. Inflation is expected to ease to 2.3% y/y vs. 2.7% in March. The central bank will also release minutes Wednesday. At that meeting, the bank did nothing. The next meeting is May 23, and no action is likely either. At this point, the bank has been adjusting its unconventional measures on a quarterly basis and so some action is possible at the June 20 meeting. South Africa South Africa reports Q1 unemployment Tuesday, which is expected to rise to 27.0% from 26.5% in Q4. It then reports manufacturing production Thursday, which is expected at -2.4% y/y vs. -3.6% in February. The economy remains weak, but high inflation is preventing the SARB from cutting rates. Next policy meeting is May 25, no change expected then. MexicoMexico reports April CPI Tuesday, which is expected to rise 5.76% y/y vs. 5.35% in March. If so, this would be the highest rate since May 2009, and further above the 2-4% target range. While further tightening would seem warranted, we think Banxico will remain on hold at its May 18 meeting. If the Fed hikes in June and price pressures are still rising, then a hike at its June 22 meeting seems likely. Mexico then reports March IP Friday. BrazilBrazil reports April IPCA consumer inflation Wednesday, which is expected to rise 4.11% y/y vs. 4.57% in March. If so, this would be the lowest rate since July 2007 and below the 4.5% target for the first time since 2010. It then reports March retail sales Thursday, which are expected at -1.1% y/y vs. -3.2% in February. MalaysiaMalaysia reports March IP and manufacturing sales Thursday. Bank Negara meets Friday and is expected to keep rates steady at 3.0%. CPI rose 5.1% y/y in April. While the central bank does not have an explicit inflation target, we suspect it is tilting more hawkish. Next policy meeting after this is July 13. While no action seems likely then, a lot can happen in the interim and another high inflation reading would surely test the central bank’s patience. PhilippinesPhilippines central bank meets Thursday and is expected to keep rates steady at 3.0%. Inflation was 3.4% y/y in April, the cycle high but still within the 2-4% target range. We think the bank is on hold for now, but tightening is possible in H2 if inflation continues to rise. PeruPeru central bank meets Thursday and is expected to keep rates steady at 4.25%. Inflation unexpectedly eased to 3.7% y/y in April, but remains above the 1-3% target range. We think easing is possible in H2 if disinflation continues. IndiaIndia reports April CPI and March IP Friday. Price pressures are rising and the economy remains robust, so the RBI started a tightening cycle with a 25 bp hike at its April 6 meeting. Next meeting is June 7, and another 25 bp seems likely. ColombiaColombia central bank releases its minutes Friday. At that policy meeting, the bank surprised markets with a 50 bp cut to 6.5%. As such, minutes will be studied for hints about the next move. April CPI was reported late Friday at 4.66% y/y, slightly higher than expected. Still, inflation is moving closer to the 2-4% target range. Next policy meeting is May 26, and another 50 bp cut seems likely then. |

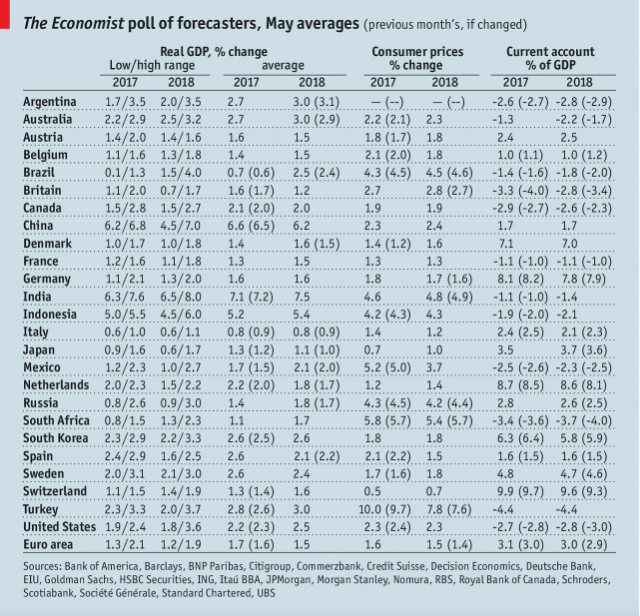

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, May 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin