– Geopolitical risk highest “in four decades” should push gold higher – Citi – Elections, political and macroeconomic crises and war lead to gold investment – Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank– “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank – Reduce counter party risk: own safe haven allocated and segregated gold - Click to enlarge The geopolitical case for gold investment has been emboldened due to heightened and ongoing geopolitical risk, according to Citi analysts. In every continent, there appears to be major political upset and geopolitical risk against a

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, Gold, gold prices, GoldCore, newsletter, U.S. Consumer Price index

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| – Geopolitical risk highest “in four decades” should push gold higher – Citi – Elections, political and macroeconomic crises and war lead to gold investment – Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank – “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank – Reduce counter party risk: own safe haven allocated and segregated gold |

|

| The geopolitical case for gold investment has been emboldened due to heightened and ongoing geopolitical risk, according to Citi analysts.

In every continent, there appears to be major political upset and geopolitical risk against a background of growing economic uncertaintly and turmoil. Just this week we have seen the US declare North Korea’s leader a ‘sponsor’ of terrorism, Angela Merkel seemingly lose her political dominance in Germany and the EU and the Gulf countries ramp up fear mongering regarding Iran. What does this mean for gold? Quite simply its role as a safe haven is now at its strongest point in four decades according to Citigroup. Commerzbank concur and this week their analysis concluded that the political uncertainty in Germany means “gold is likely to remain in good demand as a safe haven.” “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history,” according to Commerzbank. Given the fragile state of the European Union and the monetary union this does not bode well for the EU or indeed the euro. The geopolitical case for gold investment today is not just because of current geo-political risks including Germany, but because there is no let up on the horizon. It seems with each political, financial or humanitarian disaster more problems swiftly follow. Investors are no longer considering the downside risks to gold investment to be as great as geo-political and macro risks pose to risk assets such as equities and bonds. We have seen this in recent World Gold Council figures. Demand for physical gold bars and coins climbed by 17% in the last quarter. This, say Citi, is the new normal.

What are the geopolitical risks today? |

|

| If an extra-terrestrial being was carrying out a risk-assessment on landing on earth, they would be struggling with where to start. The fact is, you can’t assess risk reasonably right now as there are so many unknowns.

We seem to a have a planet that is blowing up both physically (see Nigeria and Yemen, to name a few), politically (EU, anyone?) and economically (personal debt, student debt, car debt, mortgage debt, corporate debt, pensions timebomb to name just a few). Of course, we have had tough times before. What is concerning about today’s issues is that the emerging risks appear to be political, financial, economic and indeed environmental and all of them at the same time. This creates new, unappreciated risks for financial markets. When problems are economic the talking heads and think-tanks like to roll out the models and theories they have so closely built for these very situations. This gives them (and the markets) the ill-founded confidence that they have the ability to predict the future and can therefore price in the risks. Today the problems are as much political as economic. This is worrying for those who like a good financial model. You cannot predict how political tensions will carry-out. Just ask the many pollsters who messed up Brexit and the Trump election. Once you have serious political issues then you also have economic ones, unpredictable ones. N.B. You also can’t predict economic outcomes as they relate as much to human behaviour as political ones do, but this fails to occur to the econometricians out there and that’s for another blog. The Citi analysts recognised ‘Elections and political votes, military attacks and macroeconomic crises’ as some of the key geopolitical events that would positively influence gold investment. Looking back over the last four decades they were able to conclude that prices rallied more frequently during these periods of uncertainty. As a result Citigroup expects to see safe haven demand push prices above $1,400 an ounce “for sustained periods through 2020.” Interestingly, a quick glance at the 2017 price chart might suggest that gold has been more susceptible towards monetary policy sentiment than geopolitical risk. So far this is likely to be because buyers like to believe that escalation in certain areas such as North Korea or the Middle East is unlikely to happen. But whilst the gold price might not have been climbing against this uncertainty, the number of people holding onto gold has. Sales of coins and bars or ETF liquidations have not been increasing despite the boring price climb, and there has been little indication of people getting rid of their gold. Perhaps the tides are turning and the reality of what various uncertainties mean is beginning to take hold in investors’ strategies. What is a safe haven? Gold is frequently referred to as a safe haven. If (like me once) you imagine a safe haven to be somewhere with no signal, a good book and an invisibility cloak then you might be a bit confused. Gold is a financial safe haven that protects an investor from geopolitical risk and during uncertain and difficult economic times – financial crashes, recessions and depressions. Investopedia define a safe haven as:

This opinion is reflected in the gold buying activities of individual investors, institutional investors and governments alike. All have been increasing their physical gold purchases in recent months and years in order to line their portfolios with some serious financial insurance. The precious metal has repeatedly shown its mettle during times of currency crises, something which is very likely on the horizon.

We will no doubt start to see the demand for a safe haven increase as investors become increasingly wary of the growing number of uncertainties that are around today and those on the horizon. Whether this will affect the price as Citigroup expects, who knows but one would expect it to. Gold’s price and its value are tricky concepts. For most gold’s value is reflected in its anonymity and portability. Plus, its very low or negative correlation with the majority of other asset classes and as an inflation hedge, makes it a valuable component in a portfolio.

|

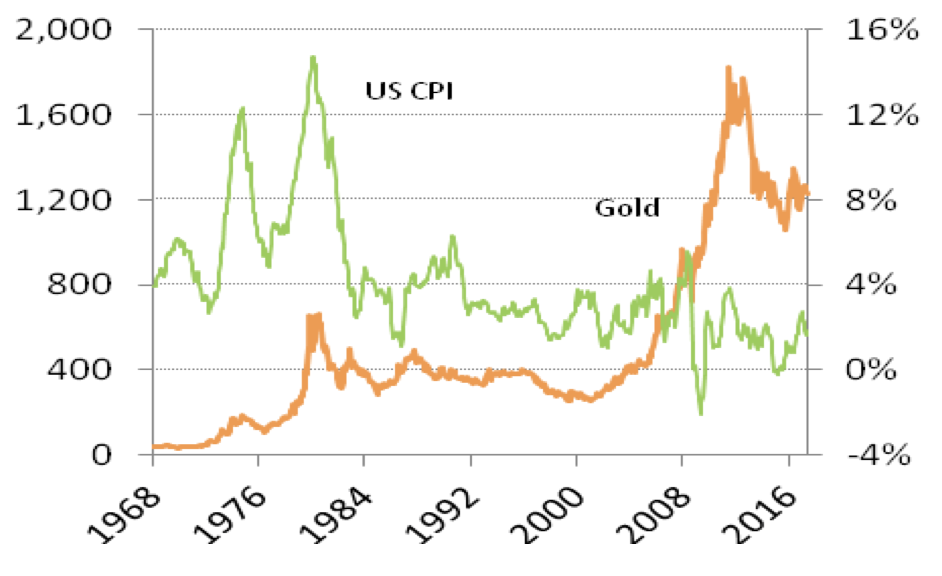

US Consumer Price Index and Gold, 1968 - 2017(see more posts on Gold, U.S. Consumer Price Index, ) |

At the moment however Citigroup believes we are looking at increased demand for gold thanks to geopolitical risk a series of black swan events, i.e. those we cannot foresee. This is something that gold is an excellent hedge against, as we discovered when doing an analysis of academic research into safe havens:

Gold investment is the old normal, geopolitical risk is the new normal Our mission statement since 2003 has been to ‘Protect and Grow Our Clients Wealth’. For hundreds, indeed thousands of years people have held gold in order to protect and grow their wealth. At first this was because it was money, then it was because it no longer was money but a safe haven, store of value. Today for many people it is because something inside them tells them physical gold is a good thing to own as a diversification and a hedge. Some try to tell us that allocated, physical gold coins and bars is something old-fashioned, almost provincial in its simplicity. something for those crazy preppers. However research shows us that is has an important role to play in protecting us against a variety of risks. Increasingly research tells us those risks are the ‘new normal’. Much of the media will only consider this report with interest in regard to the price prediction, but in truth this is pretty irrelevant. Especially when considered against the reasons for gold’s expected price climb: turbulence, uncertainty and upset are going to become commonplace. Investors need to add the safe haven of physical gold to their portfolios. Whilst the Citigroup analysis does consider what will happen to the price of gold in the coming years due to geopolitical risk, the truth is that is shouldn’t matter all that much. If an investor is looking to reduce the counterparty risk and protect their portfolio, it doesn’t matter what price is paid for the gold because over time it acts as hedge against currency devaluations. This can only be the case if you choose to invest in allocated and segregated physical gold coins and bars. This allows you to own gold in your name, without counterparty risk. The whole financial and economic system is on a knife edge thanks to the exposure to counterparty risks on all sides. Investors would be wise to reduce their exposure and get used to the ‘new normal’. |

Gold Price, 2011 - 2017(see more posts on Gold prices, ) |

Tags: Daily Market Update,Featured,Gold,Gold prices,newsletter,U.S. Consumer Price Index