The Los Angeles Times today asked the question only the mainstream would ask. “Wages are growing and surveys show consumer confidence is high. So why are motor vehicle sales taking a hit?” Indeed, the results reported earlier by the auto sector were the kind of sobering figures that might make any optimist wonder. Across the board, and for the fourth straight month, there was almost all negatives, some still large. Given what Q1 GDP just related, a bad month of auto sales to start Q2 is not a good sign. The details almost do not matter at this point. Ford, as usual, led the declines, with sales falling again 7.1% in April year-over-year. GM sales were down nearly 6%, after analysts were figuring a milder 2% decline. FCA (Fiat Chrysler) saw its comp down 7%, too. And weakness abounded from the imports. Honda like FCA and Ford experienced a 7% decline, while Toyota sales were down 4.4%. Even the Koreans were hit, with Hyundai reporting an 11.7% decline. Year-to-date, total unit sales among all manufacturers are off 3.1%. Given the high of auto sales last year, it is being spun as not all that bad. A little less than record highs can’t be too concerning? Such analysis, however, ignores the secondary effects of flagging sales.

Topics:

Jeffrey P. Snider considers the following as important: Auto Sales, automobiles, consumer spending, currencies, depression, economy, Featured, Federal Reserve/Monetary Policy, fiat chrysler, ford motor, General Motors, GM, Inventory, jd power, jobs, Labor market, lmc automotive, manufacturing, Markets, motor vehicle sales, newsletter, Recession, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The Los Angeles Times today asked the question only the mainstream would ask. “Wages are growing and surveys show consumer confidence is high. So why are motor vehicle sales taking a hit?” Indeed, the results reported earlier by the auto sector were the kind of sobering figures that might make any optimist wonder. Across the board, and for the fourth straight month, there was almost all negatives, some still large. Given what Q1 GDP just related, a bad month of auto sales to start Q2 is not a good sign.

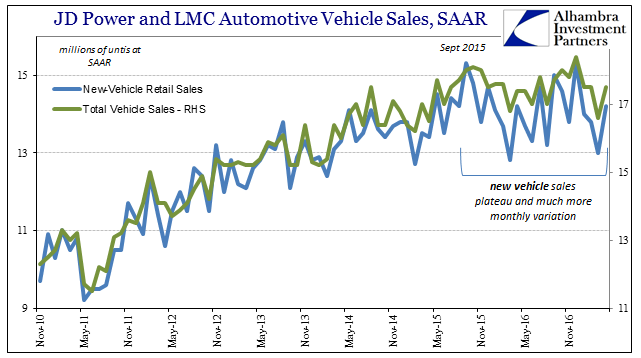

The details almost do not matter at this point. Ford, as usual, led the declines, with sales falling again 7.1% in April year-over-year. GM sales were down nearly 6%, after analysts were figuring a milder 2% decline. FCA (Fiat Chrysler) saw its comp down 7%, too. And weakness abounded from the imports. Honda like FCA and Ford experienced a 7% decline, while Toyota sales were down 4.4%. Even the Koreans were hit, with Hyundai reporting an 11.7% decline. Year-to-date, total unit sales among all manufacturers are off 3.1%. Given the high of auto sales last year, it is being spun as not all that bad. A little less than record highs can’t be too concerning? Such analysis, however, ignores the secondary effects of flagging sales. Inventories remain elevated, meaning that production must at most continue to be a significant economic drag. Worse, the risk of an actual and sustained downturn for the auto industry would continue to be very high. Thus, those for the economy as a whole would, too, since the auto sector, once its lone bright spot, continues to subtract this year whereas there is at least minor improvement in the rest of the US industrial sector. These risks are very real given the level of incentives that carmakers are employing just to keep sales even close to the pace of 2016. JD Power reported at the end of April:

They had projected using sales data for the first 13 selling days of last month total sales would actually rise 1.3% in April for new cars, and 1.8% for all vehicles (adjusted upward for one fewer selling day in April 2017 vs. April 2016). |

JD Power And LMC Automotive Vehicle Sales, November 2010 - November 2016 |

The more troubling set of implications relates to auto financing, which some have proposed as somehow the lesser evil of interpretations.

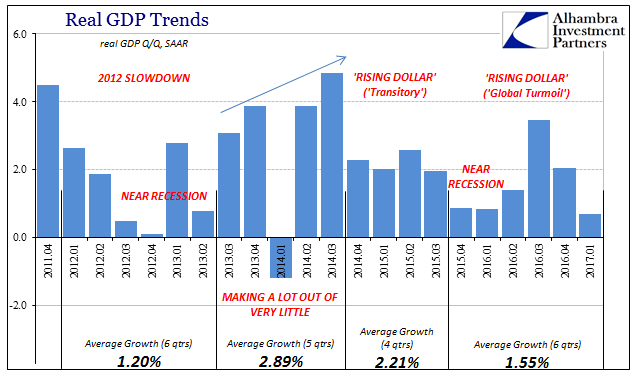

We know instead that there is a concerted slowdown in consumer spending as even the GDP report picked up on it. To add the possibility of a cyclical debt turn to the weight of no growth is of much more concern than is being presented here. As I wrote with regard to Industrial Production:

|

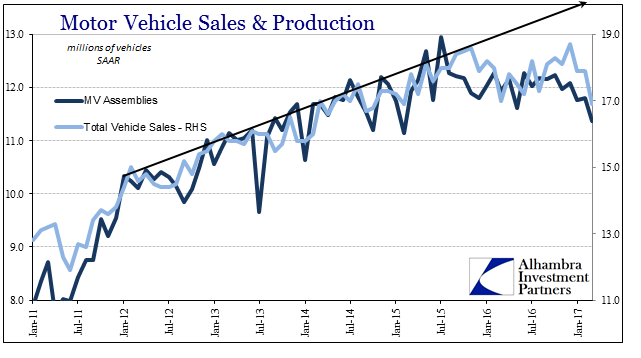

Motor Vehicle Sales And Production, January 2011 - May 2017 |

So we find manufacturing weakness to the point of a manufacturing recession starting in late 2014 that only by early 2016 disturbs the labor market, and the whole of that time with strong auto production; and now that labor market disturbance might be contributing to, along with financial factors, further weakness in auto production that keeps a lid on overall manufacturing as it might otherwise improve. It is nothing like the typical cyclical pattern even if there are cyclical forces embedded within these trends.

It adds up to a constant state of weakness, where growth continues to be absent despite positive numbers in the various economic accounts. Their meaning is therefore not those plus signs but rather how they aren’t significantly different from either zero or the shallow contraction of the last few years. It’s almost like the various economic pieces are taking turns at the bottom, so that the result is they never all align (or enough of them) sufficiently far into the plus column so as to ignite the kind of real growth typically found during, and associated with, actual recovery. There are also potential feedback effects to consider particularly if production is further strained in autos, sentiment as well as directly related activity (including labor). Auto sales may still be high so far this year, but that really doesn’t count for much. After all, they rose sharply all throughout the “rising dollar” and the economy slid under anyway. They mean far more on the downside than they did on their sustained upturn. |

Real GDP Trends, April 2011 - January 2017 |

Tags: Auto Sales,automobiles,consumer spending,currencies,depression,economy,Featured,Federal Reserve/Monetary Policy,fiat chrysler,ford motor,General Motors,gm,Inventory,jd power,jobs,Labor Market,lmc automotive,manufacturing,Markets,motor vehicle sales,newsletter,recession