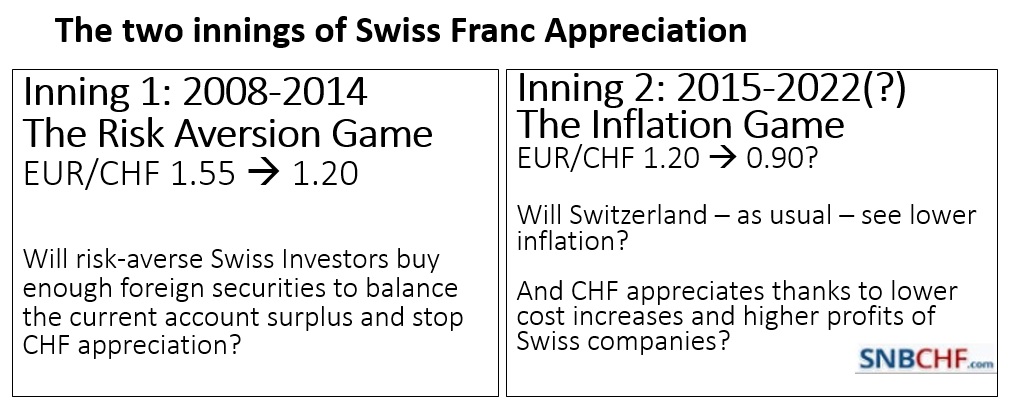

Headlines Week February 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand Speculators increase their dollar shorts against Euro and reduce them against CHF. FX week until February 27 The EUR/CHF fell to new lows. The average rate in the week was 1.0648. The SNB is apparently ready to let the pair slowly descend. A big Swiss bank bets on EUR/CHF 1.10 as soon as the ECB ends their bond buying program. But to our view, the EUR/CHF will touch parity first or come close to it. For us, it will take at least 2-3 years until the ECB normalizes rates. Euro/Swiss Franc FX Cross Rate, February 27(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge SNB sight deposits An increase in SNB sight deposits means that the central bank has intervened (for the full details see here). Last week’s data: Once again a massive SNB intervention and a post Trump election record: 4.5 billion CHF at a EUR rate of 1.0648. We should remind that this is clearly higher than the 0.90 that we expect in a couple of years in the case of a combination of inflation and recession. Interventions at this high exchange rate (Buying euros at 1.06 or dollars at 1.

Topics:

George Dorgan considers the following as important: currency reserves. intervention, Featured, minimum reserves, monetary data, negative interest, newsletter, Reserves, sight deposits, SNB

This could be interesting, too:

investrends.ch writes Der Franken und die Grenzen der Geldpolitik

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

Headlines Week February 27, 2017

We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons:

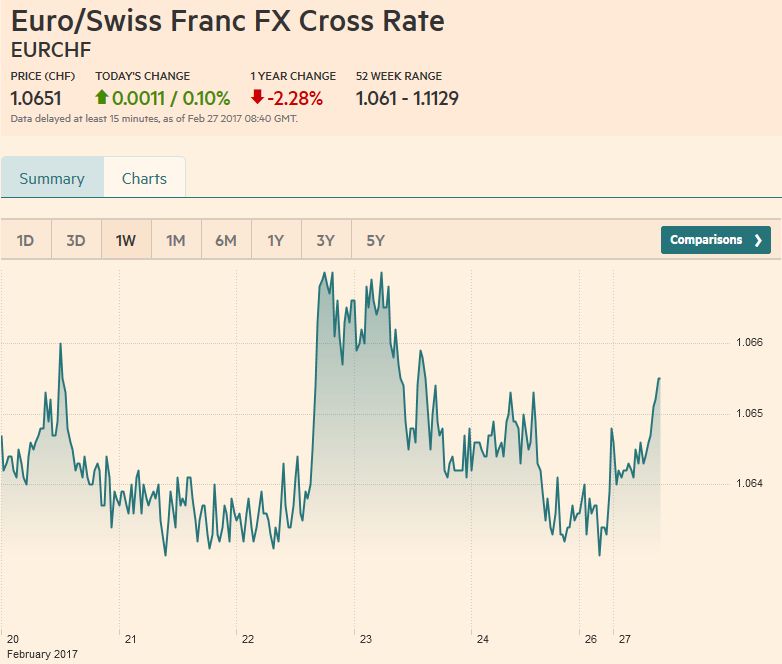

FX week until February 27 The EUR/CHF fell to new lows. The average rate in the week was 1.0648. The SNB is apparently ready to let the pair slowly descend. A big Swiss bank bets on EUR/CHF 1.10 as soon as the ECB ends their bond buying program. But to our view, the EUR/CHF will touch parity first or come close to it. |

Euro/Swiss Franc FX Cross Rate, February 27(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge |

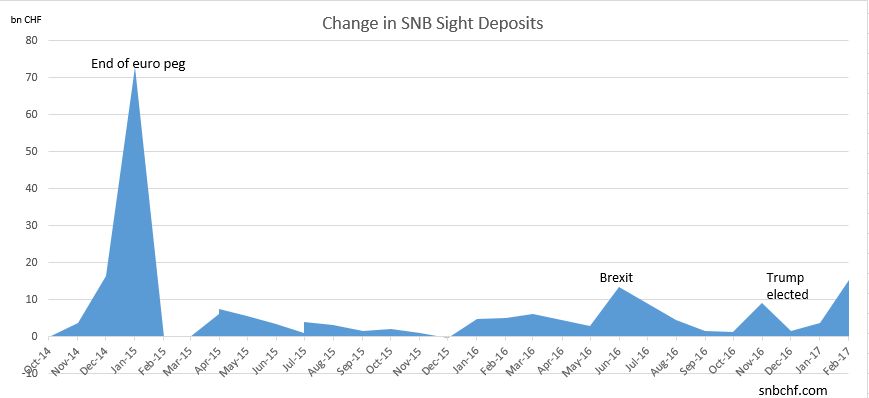

SNB sight depositsAn increase in SNB sight deposits means that the central bank has intervened (for the full details see here). Last week’s data: Once again a massive SNB intervention and a post Trump election record: 4.5 billion CHF at a EUR rate of 1.0648. We should remind that this is clearly higher than the 0.90 that we expect in a couple of years in the case of a combination of inflation and recession. Interventions at this high exchange rate (Buying euros at 1.06 or dollars at 1.00) |

Change in SNB Sight Deposits February 2017(see more posts on sight deposits, ) Source: SNB - Click to enlarge Two Innings of Swiss Franc Appreciation |

Speculative PositionsSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. Last week’s data: Speculators increased their EUR net short position against the dollar, but lowered their CHF net shorts. This tendency confirms our view that EUR/CHF will move towards parity. |

Speculative Positions

source Oanda |

| Date of data (+ link to source) | avg. EUR/CHF during period | avg. EUR/USD during period | Events | Net Speculative CFTC Position CHF against USD | Delta sight deposits if >0 then SNB intervention | Total Sight Deposits | Sight Deposits @SNB from Swiss banks | “Other Sight Deposits” @SNB (other than Swiss banks) |

|---|---|---|---|---|---|---|---|---|

| 24 February | 1.0648 | 1.0570 | New record in Swiss trade surplus | -8936X126K | +4.7 bn. per week | 548.2 bn. | 470.2 bn. | 78.0 bn. |

| 17 February | 1.0648 | 1.0613 | Improving Swiss consumer climate | -11484X125K | +4.5 bn. per week | 543.5 bn. | 468.0 bn. | 75.5 bn. |

| 10 February | 1.0659 | 1.0685 | Good US jobs report. | -14621X125K | +3.8 bn. per week |

539.0 bn.

|

464.5 bn.

|

74.5 bn.

|

| 03 February | 1.0681 | 1.0761 | US creates 227K new jobs. | -17140X125K | +2.4 bn. per week |

535.2 bn.

|

462.3 bn.

|

72.2 bn.

|

| 27 January | 1.0718 | 1.0725 | US Q4 GDP only +1.9% | -13644X125K | +0.5 bn. per week |

532.8 bn.

|

466.7 bn.

|

66.1 bn.

|

| 20 January | 1.0726 | 1.0663 | USD correction continues. | -13683X125K | +0.9 bn. per week | 532.3 bn. | 464.3 bn. | 68.0 bn. |

For the full background of sight deposits and speculative positions see

SNB Sight Deposits and CHF Speculative Positions

Tags: currency reserves. intervention,Featured,minimum reserves,monetary data,negative interest,newsletter,Reserves,sight deposits