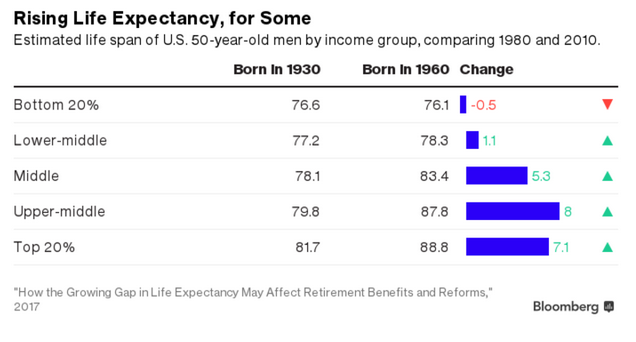

Summary: Rich people live longer than poor people in the US. This disparity undermines the progressive nature of Social Security. Disparity of income seems more important than the slowdown in growth in explaining why few US people are doing better than their parents at the age of 30. Americans do not like to talk about class. Many like to think that there are no classes in the US and that sufficient hard work and one’s socio-economic status can be raised. These days, discussions of the disparity of wealth and income are acceptable ways to talk about class. There are various studies that suggest such mobility is becoming more difficult. A college degree no longer guarantees a secure middle-class living and lifestyle. Moreover, household income is a strong indicator of a range of life opportunities. In addition to consumption patterns, the location of residence, and marriage opportunities, income appears to also shape life expectancy. The above chart from Bloomberg, based on research it cites, shows that 50-year American men, whose income places them in the lowest 20%, are expected to live just past 76 years. This is six months less than the previous generation.

Topics:

Marc Chandler considers the following as important: Disparity, Featured, FX Trends, Great Graphic, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

Rich people live longer than poor people in the US.

This disparity undermines the progressive nature of Social Security.

Disparity of income seems more important than the slowdown in growth in explaining why few US people are doing better than their parents at the age of 30.

| Americans do not like to talk about class. Many like to think that there are no classes in the US and that sufficient hard work and one’s socio-economic status can be raised. These days, discussions of the disparity of wealth and income are acceptable ways to talk about class.

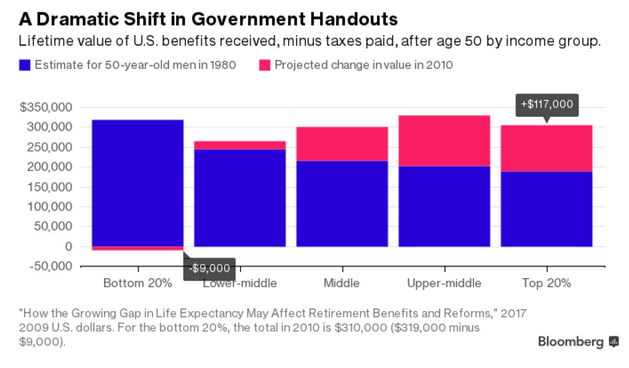

There are various studies that suggest such mobility is becoming more difficult. A college degree no longer guarantees a secure middle-class living and lifestyle. Moreover, household income is a strong indicator of a range of life opportunities. In addition to consumption patterns, the location of residence, and marriage opportunities, income appears to also shape life expectancy. The above chart from Bloomberg, based on research it cites, shows that 50-year American men, whose income places them in the lowest 20%, are expected to live just past 76 years. This is six months less than the previous generation. On the other hand, 50-year old American men who are in highest quintile in terms of income live to nearly 89, which is seven years more than the previous generation. The research Bloomberg cites is also interested in the impact of the divergence in life expectancy on the distribution of social welfare. Previously, wealthier people would get more from Social Security (actual payment plus length of collecting), while poorer people would get more assistance from Social Security disability insurance and Medicaid. Medicare did not differ much based on income. Research suggests the Social Security gap has widened considerably. When Reagan was elected President, the wealthy 50-year male could anticipate collected $103k more than his poorer neighbor. In 2010, the gap was $173k. The researchers note that due to the widening life expectancy gap, Social Security is becoming less progressive. If all government benefits are included and adjust for the taxes paid by American men after the age of 50, the lifetime value of government benefits is less skewed. However, the boost to middle and upper incomes is still significant. |

Rising Life Expectancy |

| The premature death of American men due to substance abuse, obesity and suicide are well documented, even if the underlying causes are debated. To the extent that the scarcity of health care is distributed by the price mechanism, economic inequality facilitates inequalities in health and longevity.

The widening income and wealth disparities have far-reaching ramifications. Some economists link the growing disparity to economic fragility and even as a contributing factor to the Great Financial Crisis. The disparity has grown since the crisis as equity investors, and homeowners have done considerable better than those who have limited investments and do not own a home. The disparity of income and wealth may also be both cause and effect impact the participation rate in the labor market, the still elevated levels of levels of those marginally attached to the labor force (U-6). The implications profound. A study by Stanford economists last year showed that nearly every child born in 1940 (92%) had a higher pretax income at the age of 30 than their parents at the same age. The two key explanatory variables were strong economic growth and a more equitable sharing of that growing pie. For Americans born in 1960, it had fallen to 62%, and for those born in 1980, 50%. Of note, the study found that if growth remains low, but the disparity of income was at 1970s levels, the share of 1980 cohort would out-earn their parents by 80% rather than 50%. If growth had returned to its former levels, but the income disparity remained only 62% of those born in 1980 would earn more than their parents. |

Government Handouts |

Earlier post on class and longevity, click here.

Tags: Disparity,Featured,Great Graphic,newsletter