Summary: US economic data, culminating with the employment report, should be consistent with a re-acceleration of the world’s largest economy after a typical slowdown in Q1. Eurozone price pressures likely eased considerably in May. For the UK economy, the bounce in April was a fluke, and gradual slowdown continues. Japanese investors have bought foreign bonds for three weeks in a row, which is the longest streak in six months. The US dollar has fallen against all the major currencies but the Canadian dollar so far this year. The euro is the primary beneficiary of the greenback’s slide, appreciating 6.3% since the start of the year. The divergence driver has been superseded by ideas that Europe has a

Topics:

Marc Chandler considers the following as important: EUR, EUR/GBP, Featured, FX Trends, JPY, newsletter, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Summary:

US economic data, culminating with the employment report, should be consistent with a re-acceleration of the world’s largest economy after a typical slowdown in Q1.

Eurozone price pressures likely eased considerably in May.

For the UK economy, the bounce in April was a fluke, and gradual slowdown continues.

Japanese investors have bought foreign bonds for three weeks in a row, which is the longest streak in six months.

The US dollar has fallen against all the major currencies but the Canadian dollar so far this year. The euro is the primary beneficiary of the greenback’s slide, appreciating 6.3% since the start of the year. The divergence driver has been superseded by ideas that Europe has a turned the proverbial corner.

Even before Macron dispatched Le Pen, many investment houses and journalists were talking up European equities and the euro. Sometimes it was offered as the counterpart to the unwind of the Trump trade. The apparent chaos of the White House, the clumsy and disorganized efforts to replace the Affordable Care Act, and the prevarications, increased the skepticism over the Administration’s larger economic agenda.

The dollar also weakened in the first part of last year. It bottomed against the euro in early May 2016, and its rally was primarily an H2 16 story. Only after Trump’s unexpected victory did the bullish dollar narrative include his agenda. The Federal Reserve’s removal of accommodation while the ECB and BOJ were still easing and government bond yields were still negative throughout the EMU, especially at short and intermediate term coupons, and Japan was the heart of the bullish dollar narrative. It is on top of the divergence of monetary policy that the supply-side reforms and fiscal stimulus sat, like frosting on a cake.

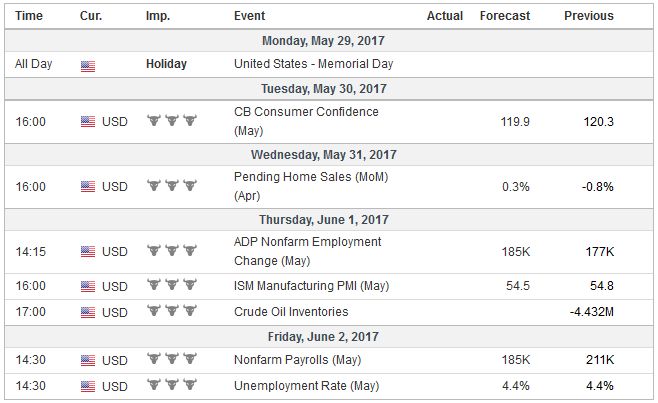

EurozoneIdeas that the rising eurozone inflation and continued above-trend growth would prompt the ECB to begin preparing the market for an exit from the unorthodox policies seems as much if not a larger part of the story as the sluggish US growth. Before the weekend, Q1 GDP was revised up from 0.7% to 1.2%, helped by a doubling of the contribution from consumption. Since 2010, growth in the first three months of the year has averaged 1.1%. The two information peaks in the week ahead address these issues head-on: The eurozone reports a preliminary, though fairly reliable, the estimate for this month’s CPI. The US reports May employment data at the end of the week. To cut to the chase, with the Easter spike unwinding, eurozone inflation likely fell back. A series of economic reports in the coming days, after the holiday at the start of the week, culminating with the employment report are expected to show improving economic activity. Personal consumption expenditure, a broader measure than retail sales, are expected to have risen by 0.4% in April. It would be the best of the year, after a Q1 average of 0.1% (subject to upward revision). Pending home sales, a leading indicator has been alternating between monthly gains and falls. April is expected to bounce back from the 0.8% decline in March. Construction spending is similarly expected to have recovered from March weakness. Then there are the May auto sales figures. Sales likely continued the recovery begun in April. Recall that December 2016 saw a strong 18.29 mln unit pace of sales, which seemingly borrowed from Q1 when sales slowed each month. The five-year monthly average is 16.43 mln, and during the slowdown in Q1, sales remained above it. The jobs report should be solid even if not spectacular. Growth around the 12-month average of 186k is expected. We suspect that the risk is on the upside given the performance of weekly initial jobless claims, the rise in withholding tax receipts point to a strong labor market. The unemployment rate fell from 4.8% in January to 4.4% in April. It probably did not fall further in May. The participation rate remains in the upper end of where it has been for the past few years (~63%). Underemployment (U-6) has continued to fall. It averaged 9.6% last year and was 9.4% at the start of the year. It has since fallen to 8.6%. It has not spent much time below 8% since 2001. Earnings growth remains modest. A 0.2% increase in May keep the year-over-year rate around 2.5%, which is the lower end of where it has been over the past 12 months. This is consistent with the likely non-accelerating prices that will likely be signaled by the core PCE deflator and the second monthly decline in the prices paid index of the ISM manufacturing. Three forces have driven up measured inflation in the eurozone, raising the tenor of the persistent low-level murmur that the ECB policy is too loose. First, and the most obvious, is higher energy prices. Second, was the poor winter crop that lifted the price of some vegetables. Third are the distortions caused by the calendar effect of Easter. These forces are unwinding. The recent gains in the headline (from 1.1% at the end of 2016 to 2.0% in February and 1.9% in April) could have been halved in May. The core rate had fallen to 0.7% in March. The cyclical low was 0.6% in Q1 2015. It jumped to 1.2% in April. It can fall back to 0.9%-1.0% in May. While eurozone unemployment is expected to have edged lower in April (9.4% from 9.5%), wage growth, including in full-employment Germany, remain subdued. This will be understood by the ECB’s staff as they finalize their new forecasts for the ECB meeting June 8. The rise in European rates and the strength of the euro would suggest that the market has already discounted as a fact the kind of risk assessment tweaks the central bank may offer. Since the ECB will not stop the asset purchases abruptly and the current purchases are projected through this year, purchases will probably continue into next year, by which time, the Fed’s balance sheet would have likely begun shrinking and a couple more interest rate hikes will probably have been delivered. |

Economic Events: Eurozone, Week May 29 |

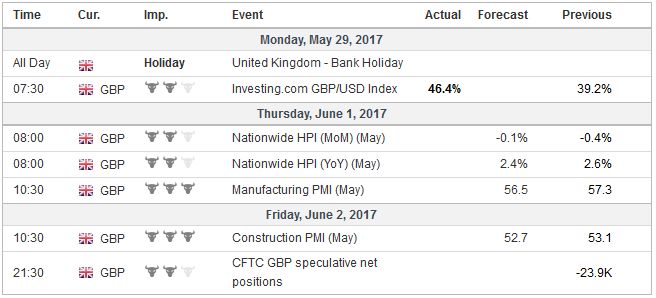

United KingdomBesides the twin peaks of US economy and eurozone inflation, there are a few other vistas for investors next weeks. In the UK, sterling ran out of steam in front of what now seems like a formidable obstacle around $1.3055. The combination of tightening polls and soft economic data took a toll on sterling and helped lift the FTSE 100 to new record highs. The June 8 election is approaching, and the polls suggest a tighter race than anyone expected, including most of all Prime Minister May. We suspect that if investors thought that Labour’s Corbyn would be next Prime Minister, sterling would be considerably lower. Still, next week will suggest that after slowing more than expected in Q1, the uptick in April was a false spring. The manufacturing and construction PMIs likely resumed their downtrend. |

Economic Events: United Kingdom, Week May 29 |

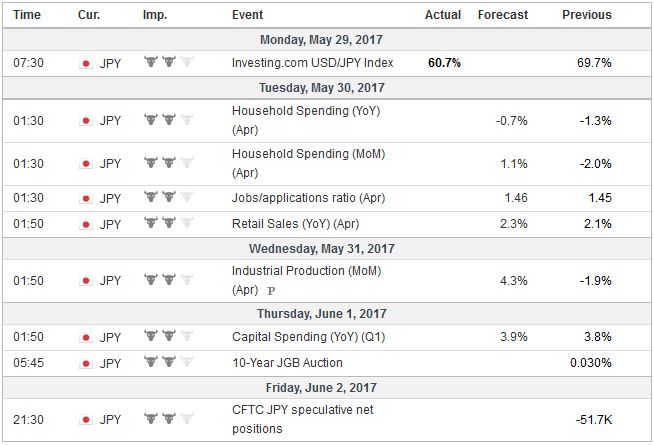

JapanJapanese economic data will suggest that growth has continued into Q2. Industrial output likely recovered the ground lost in March and more. The year-over-year rate may rise to its highest in three years. However, weakness in household consumption will remain evident. The year-over-year rate has been negative with a few exceptions since mid-2014. The last time it rose was in February 2016.We note that Japanese investors have been buyers of foreign bonds for the past three weeks. This is the longest streak since last November. Then it coincided with yen weakness against both the euro and dollar. |

Economic Events: Japan, Week May 29 |

United StatesLastly, we do not expect the G7 statement to have much impact in the capital markets. There can be no papering over the blatantly obvious fact that six of the G7 countries are still reading from the imperfect playbook as they were prior and the US, which helped forge that lose consensus on trade and the environment, appears to be possibly balking. The inability of the US President to make a decision on whether to continue to support the Paris Agreement on climate change, despite knowing full well the issue and what was going to happen at the meeting, is a bit disappointing and diplomatically awkward (must people talk about a G6?), but a decision was promised in the week ahead. The indication is that President Trump will reject the Paris Agreement and the take away image from the G7 will not be the agreement to avoid protectionism, but of the other six heads of state walking while Trump followed in a golf cart. |

Economic Events: United States, Week May 29 |

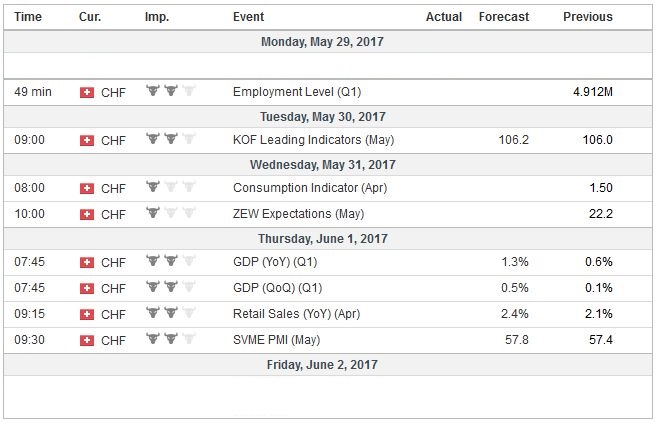

Switzerland |

Economic Events: Switzerland, Week May 29 |

Tags: #USD,$EUR,$JPY,EUR/GBP,Featured,newsletter