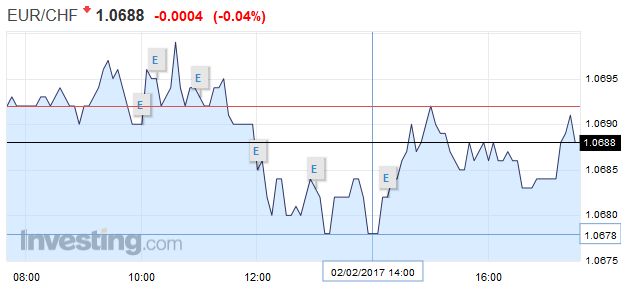

Swiss Franc EUR/CHF - Euro Swiss Franc, February 02(see more posts on EUR/CHF, ) - Click to enlarge GBP / CHF Sterling vs the Swiss Franc exchange rate remains tentative this morning with the release of the Brexit strategy due to come out later today. A white paper is going to be published later with MPs backing the European Bill by 498 vote against 114 last night. The bill will be debated further in parliament next week although hundreds of amendments have already been suggested. Theresa May will still need the agreement of parliament to trigger Article 50 and the content of the white paper is very similar to that given by May’s speech recently. Later today the Bank of England meet to discuss their latest interest rate decision. Clearly there is no chance that the central bank will change interest rates or introduce further Quantitative Easing but when Carney speaks if he is positive about the rise in inflation recently then any hints that an interest rate rise could happen later in the year could see the Pound make some small gains against the Swiss Franc.

Topics:

Marc Chandler considers the following as important: AUD, EUR, Featured, FX Trends, GBP, JPY, newslettersent, Switzerland retail sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 02(see more posts on EUR/CHF, ) |

GBP / CHFSterling vs the Swiss Franc exchange rate remains tentative this morning with the release of the Brexit strategy due to come out later today. A white paper is going to be published later with MPs backing the European Bill by 498 vote against 114 last night. The bill will be debated further in parliament next week although hundreds of amendments have already been suggested. Theresa May will still need the agreement of parliament to trigger Article 50 and the content of the white paper is very similar to that given by May’s speech recently. Later today the Bank of England meet to discuss their latest interest rate decision. Clearly there is no chance that the central bank will change interest rates or introduce further Quantitative Easing but when Carney speaks if he is positive about the rise in inflation recently then any hints that an interest rate rise could happen later in the year could see the Pound make some small gains against the Swiss Franc. However, what is clear is that we’re not likely to see any huge movements caused by economic data as the issue of Brexit is the real driver of exchange rates and as and when or if Article 50 is triggered then this is likely to be the driving force of Sterling vs Swiss Franc exchange rates. With GBP/CHF exchange rates still historically low then it may be worth considering taking advantage of these rates to sell Swiss Francs into Sterling and if you don’t have the full amount of funds available just yet then it may be worth looking at buying a forward contract which allows you to fix an exchange rate for a future date. |

GBP/CHF - British Pound Swiss Franc, February 02(see more posts on GBP/CHF, ) |

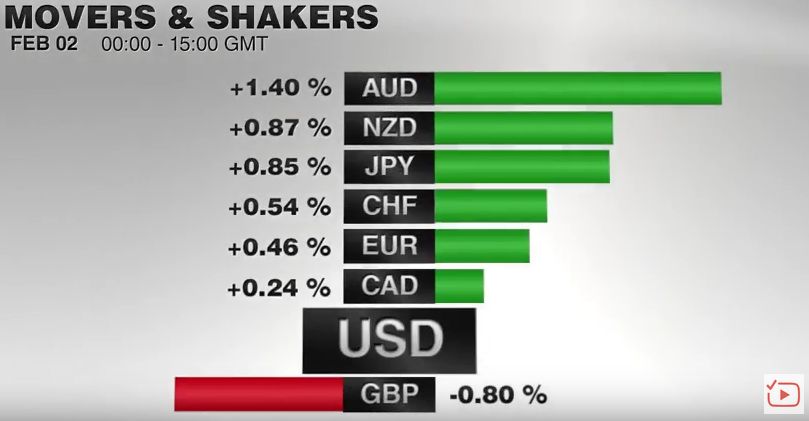

FX TrendsThe US dollar remains on its back foot despite the stronger than expected ADP job estimate and the FOMC that said nothing to dissuade investors that it will be gradually raising rates this year. Japanese equities tumbled more than 1% while the 10-year JGB yield rose above 10 bp without eliciting a response from the BOJ. The dollar failed to push above JPY114 yesterday and has been pushed back to JPY112.50. Although it has initially seemed that Japan was not in the US Administration’s cross-hairs, but recent comments suggest it too is subject to the same kind of jawboning as Germany and China. |

FX Performance, February 02 2017 Movers and Shakers Source: Dukascopy - Click to enlarge |

| The euro is confined to an exceptionally narrow range around $1.08 and is inside yesterday’s range which is inside Tuesday’s range. The $1.08 area houses the 100-day moving average and the 50% retracement of the euro’s slide since the US election (~$1.0820). |

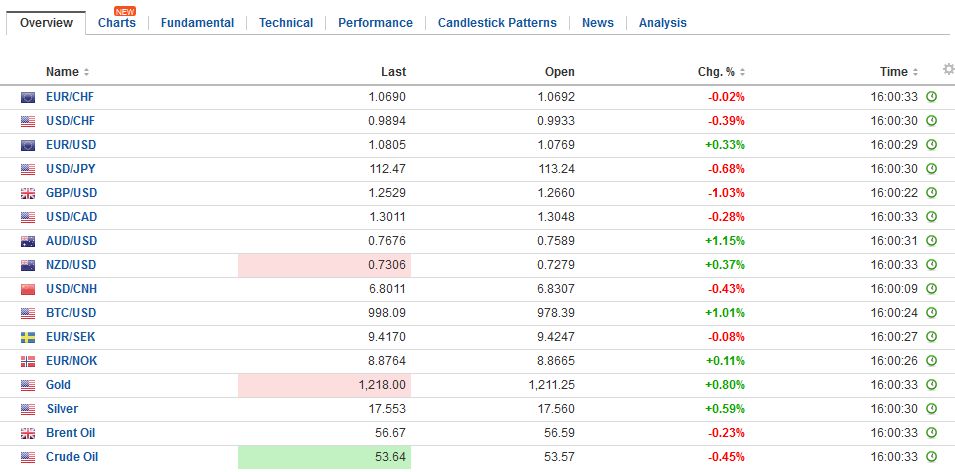

FX Daily Rates, February 02 |

| Sterling remains well bid and is at its best level since the US election near $1.27. The UK parliament easily voted to give Prime Minister May authority to trigger Article 50 to begin its divorce from the EU. She is expected to do so in the first half of next month. The focus today is on the BOE meeting and the Quarterly Inflation Report. Carney has been sounding more optimistic on the economy and this may see the economic forecasts tweaked a bit. The combination of the drop in sterling and easier monetary policy may have helped the economy weather the potential disruption. The asset purchase program is nearing completion and is not expected to be renewed. Sterling’s highs from December offer the next technical targets. These are found near $1.2720 and $1.2725.

The Australian dollar is leading the move against the US dollar today, extending its rally another 1% today. The fundamental impetus came from a record trade surplus in December and an upward revision to the November series. The December trade surplus was A$3.5 bln and the November surplus was revised to A$2.04 from A$1.24. Rising commodity exports especially coal (14%) and iron ore (10%) bolstered the trade figures. Natural gas exports are also increasing. Exports overall were up 5% in value terms. The favorable terms of trade are expected to carry into at least the start of this year. The Aussie is approaching $0.7700, which had been an important ceiling in the last few months of 2016. Although it had traded above the ceiling, it rarely closed above it and ultimately failed to establish a foothold. |

FX Performance, February 02 |

Switzerland |

Switzerland Retail Sales YoY, December 2016(see more posts on Switzerland Retail Sales, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$EUR,$JPY,Featured,newslettersent,Switzerland Retail Sales