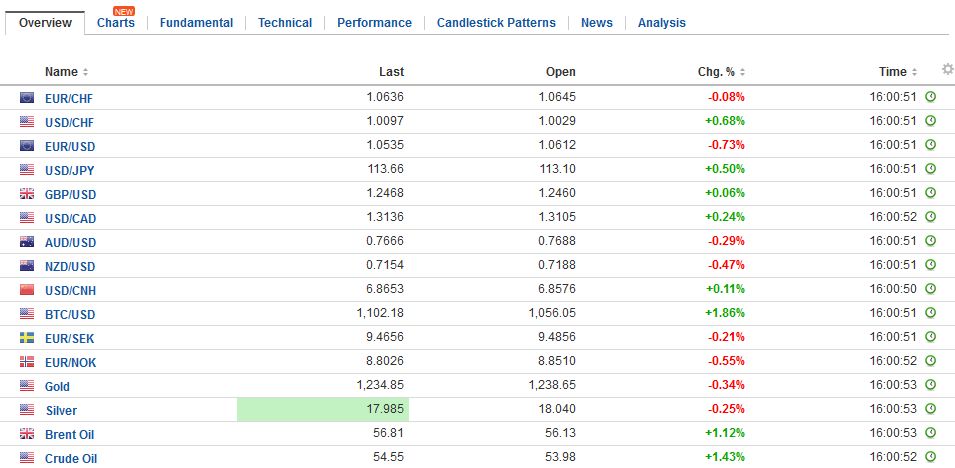

Swiss Franc Switzerland Trade Balance, Jan 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge GBP/CHF The pound to Swiss Franc rate has been in the main driven by sterling weakness which is weighing on the performance of the pound which has been in the main negative but we have lately seen the pound higher. This is mainly due to some clarity over the Brexit and just what it will mean going forward. As we approach further news and the triggering of Article 50 will the pound rise or fall? Personally I expect the rates will start to slide closer to 1.20 as political pressures build on the UK. The overall factors weighing on the pound and the rates this week will be Public Sector Net Borrowing data and also the latest UK GDP releases. Most commentators are expecting the UK data to start to take a turn for the worse as higher inflation starts to bite and we also start to see a slowdown in consumer spending. I would not be surprised to see the market fall closer to 1.20 as we approach the triggering of Article 50 but overall I just cannot expect any big improvements for the pound. If you need to buy Swiss Francs then I would probably suggest making the most of the current improvements for the pound against most currencies.

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, Eurozone Manufacturing PMI, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, France Manufacturing PMI, French Markit Composite PMI, FX Trends, GBP, GBP/CHF, Germany Composite PMI, Germany Manufacturing PMI, Germany Services PMI, Japan Manufacturing PMI, newslettersent, SPY, Switzerland Trade Balance, U.S. Manufacturing PMI, U.S. Services PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

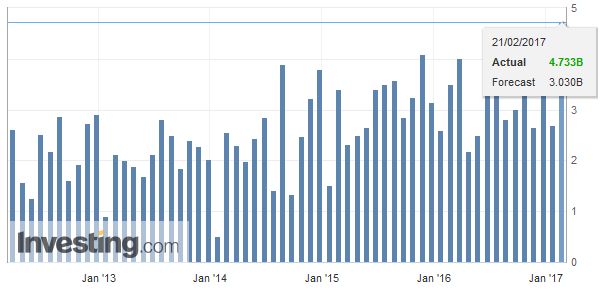

Switzerland Trade Balance, Jan 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge |

GBP/CHFThe pound to Swiss Franc rate has been in the main driven by sterling weakness which is weighing on the performance of the pound which has been in the main negative but we have lately seen the pound higher. This is mainly due to some clarity over the Brexit and just what it will mean going forward. As we approach further news and the triggering of Article 50 will the pound rise or fall? Personally I expect the rates will start to slide closer to 1.20 as political pressures build on the UK. The overall factors weighing on the pound and the rates this week will be Public Sector Net Borrowing data and also the latest UK GDP releases. Most commentators are expecting the UK data to start to take a turn for the worse as higher inflation starts to bite and we also start to see a slowdown in consumer spending. I would not be surprised to see the market fall closer to 1.20 as we approach the triggering of Article 50 but overall I just cannot expect any big improvements for the pound. If you need to buy Swiss Francs then I would probably suggest making the most of the current improvements for the pound against most currencies. The overall factors that have contributed to the weakness of the pound are not going away soon and I would expect this will become apparent in the not too distant future on exchange rates. |

GBP/CHF - British Pound Swiss Franc, February 21(see more posts on GBP/CHF, ) |

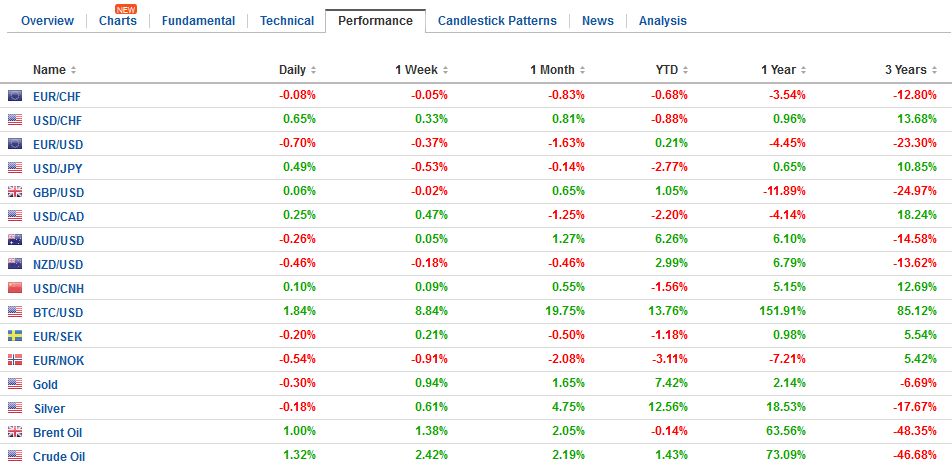

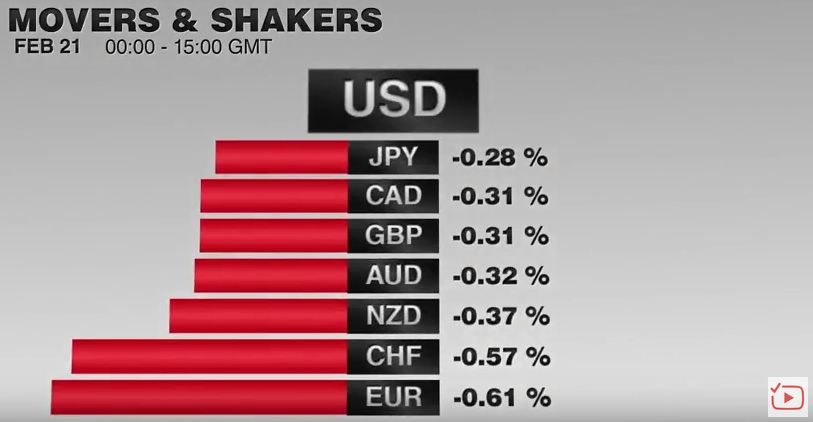

FX RatesSome profit-taking in the middle of last week pushed the dollar lower and gave rise in some quarters that the run was over. However, the greenback has come back the bid. It is gaining against all the major currencies today and most of the emerging market currencies. |

FX Performance February 21 2017 Movers and Shakers Source: Dukascopy - Click to enlarge |

| Much of the coverage attributes the gains to comments by the Philadelphia Fed President Harker. He joined the chorus of officials who have refused to rule out a March hike. Yet themarket is not biting. The Fed funds have been averaging 66 bp. The March contract implies 69.5 bp, and the April contract implies 71.5 bp. Our work suggests this is consistent with about a one-in-four chance of a hike. Bloomberg puts the odds at 36% compared with 34% a week ago. The implied yield of the March and April contractshave risen by half of a basis point over the past week.

Leaving aside the New Zealand dollar, which is being dragged lower apparently by the continued weakness in milk prices (off five consecutive sessions through yesterday) ahead of today’s auction, the euro is the weakest of the majors. We suspect the euro is an important driver of the broad dollar gains. The latest polls have support for Le Pen ticking up, while the Left continues to hampered by sectarianism, and the two main candidates Fillon and Macron appear to have lost some momentum. |

FX Daily Rates, February 21 |

| Support for the euro is near $1.0520, which corresponds to the low from last week and the 61.8% retracement objective of last month’s euro rally. Below there is potential toward $1.0450. The intraday technicals are stretched. A little short squeeze toward $1.0560 may give North American dealers a better selling opportunity. The dollar faces immediate resistance near JPY113.80, but a move above JPY114.10 is needed to suggest another run at JPY115.00. Sterling is flirting with the $1.2400 level. It has probed this shelf several times this month and has been unable to close below it.

The Australian dollar found initial support near $0.7650, a five-day low, but the $0.7670 area may cap corrective upticks. After the attempt on CAD1.30 failed in the middle of last week, the US dollar has recovered to CAD1.3160 in the European morning but has run out of steam. Recall that in the futures market, speculators are net long the dollar-bloc currencies and but net short the euro, sterling, yen and Swiss franc |

FX Performance, February 21 |

FranceThe 10-year French premium over Germany has widened to 80 bp, the most since August 2012. It has risen nearly 14 bp since the middle of last week. The two-year spread is also widening. It is at 44 bp today, the widest since May 2012. It is up about 16 bp over the last four sessions. The five-year credit-default swap was at 68 bp yesterday, up from 38 bp at the end of last year and 42 bp at the of January. The sell-off in French debt instruments has reportedly come on high volume. |

France Manufacturing PMI, January 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

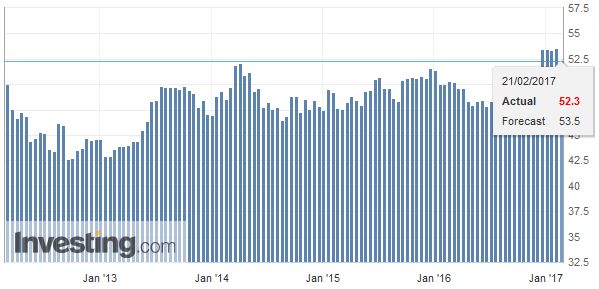

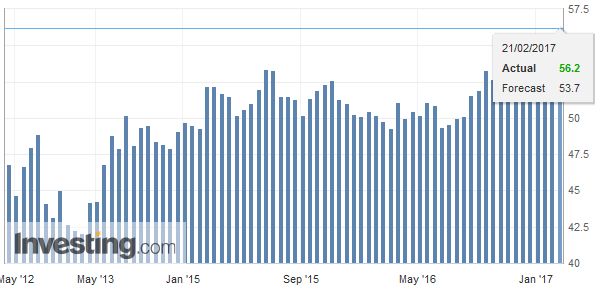

| Of note, the French composite rose above the German composite (56.2 vs. 56.1). Some observers try to draw a political implication from the recovery in the French economy. This may be mistaken. The two high income countries where the populist-nationalist agenda had electoral success, the UK and US, enjoyed among the strongest recoveries from the Great Financial Crisis, including levels of unemployment that were broadly regarded near full employment. |

French Markit Composite PMI, January 2017(see more posts on French Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

GermanyThe demand for German paper, not only emanating from flows out of France but the periphery more general, has seen the German two-year note fell to a new record low (~-88 bp). This in turn has widened the spread between the US and Germany. The US two-year premium tookout the end of last year’s high (~205 bp) today to make a new post-2000 high. The US 10-year premium is near 330 bp today, which is the widest so far this year, but still a little below peak from the end of last year near 339 bp, which is the widest since at least 1990. |

Germany Composite PMI, January 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

Germany Manufacturing PMI, January 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

Germany Services PMI, January 2017(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

|

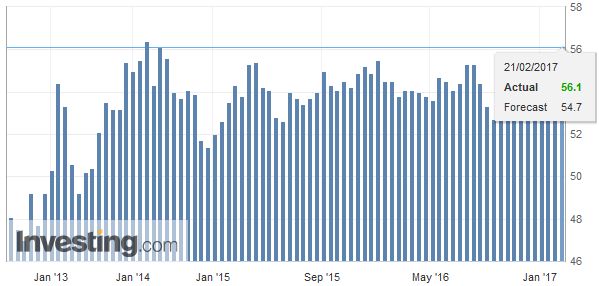

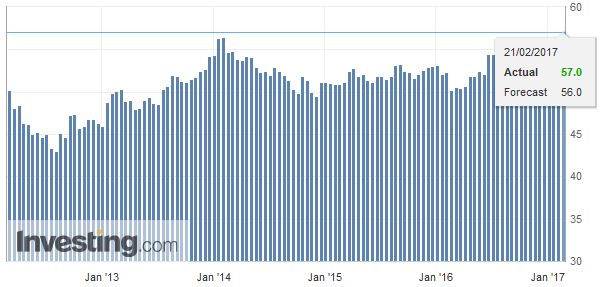

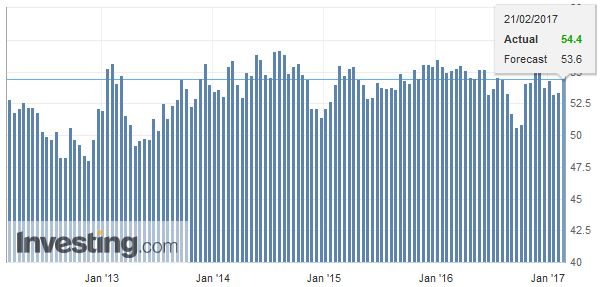

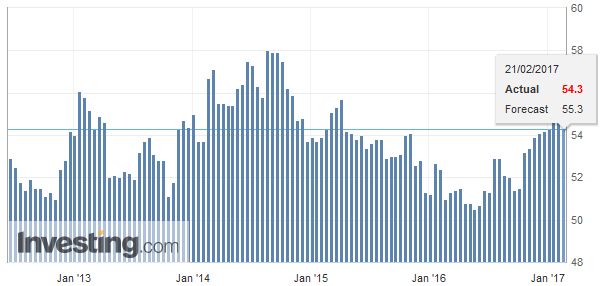

EurozoneThe euro has been sold back toward last week’s low near $1.0520. The sell-off has come in two legs. The first in Asia took the euro through $1.0580. Then Europe took it down another half cent. The sell-off came despite a robust flash PMI. The eurozone composite jumped to 56.0 from 54.4. The median guesstimate in the Bloomberg survey was for a little slippage to 54.3. The details were also favorable. |

Eurozone Markit Composite PMI, January 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

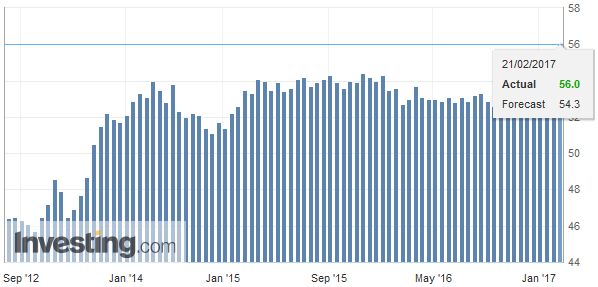

| The manufacturing PMI rose to 55.5 from 55.2. The median looked for a softer number. |

Eurozone Manufacturing PMI, January 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

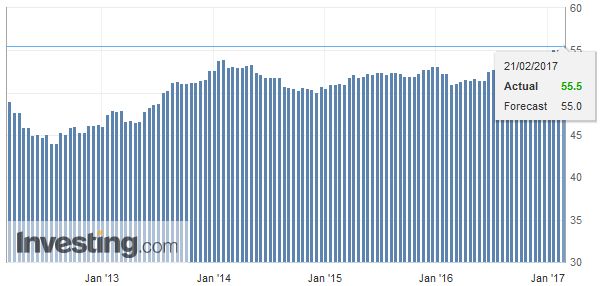

| Economists expected an unchanged the service PMI. Instead, it jumped to 55.6 from 53.7. New orders reached a six-year high and prices charged rose to the highest level since July 2011. |

Eurozone Services PMI, January 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

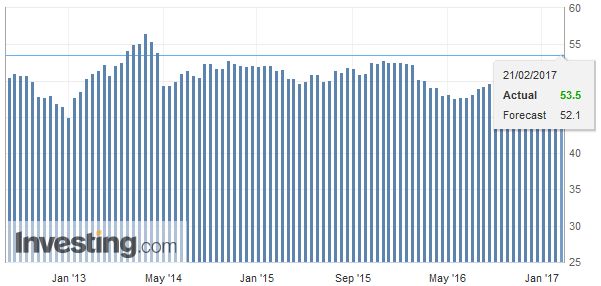

JapanIn addition to the eurozone PMI, the flash manufacturing PMI for Japan was reported. It rose to 53.5 from 52.7. |

Japan Manufacturing PMI, January 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

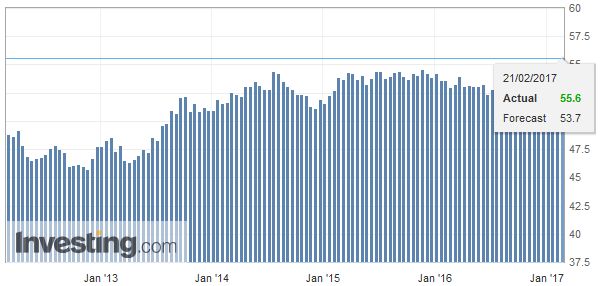

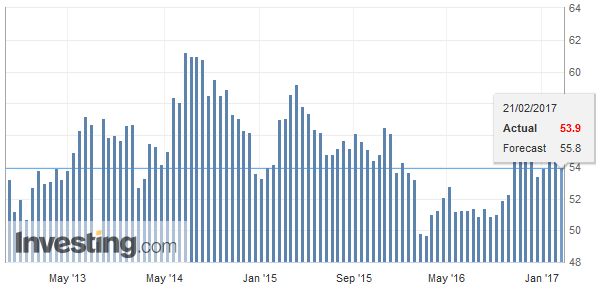

United StatesMarkit reports its preliminary manufacturing, service, and composite PMI for the US today. Modest upticks are expected. The backdrop is that the US, Europe, and Japan are off to a firm start to the year. Equity markets seem to appreciate this. The MSCI Asia Pacific eked out a small gain, its fourth in the past five sessions. Of note, Korea’s Kospi rose 0.95 to its best level since mid-2015. In Europe, the Dow Jones Stoxx 600 is up nearly 0.3%. It is the third consecutive gain and the tenth advance in 11 sessions. |

U.S. Manufacturing PMI, January 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| Financials are the weakest sector in Europe, off about 0.7%, dragged in part by the disappointing earnings at HSBC. On the other hand, BHP Billiton and Anglo-American beat expectations. Iron ore future extended this year’s rally, adding 3.2% to bring the year-to-date advance to 34%. Copper, zinc and lead prices also rallied. |

U.S. Services PMI, January 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,France Manufacturing PMI,French Markit Composite PMI,GBP/CHF,Germany Composite PMI,Germany Manufacturing PMI,Germany Services PMI,Japan Manufacturing PMI,newslettersent,SPY,Switzerland Trade Balance,U.S. Manufacturing PMI,U.S. Services PMI