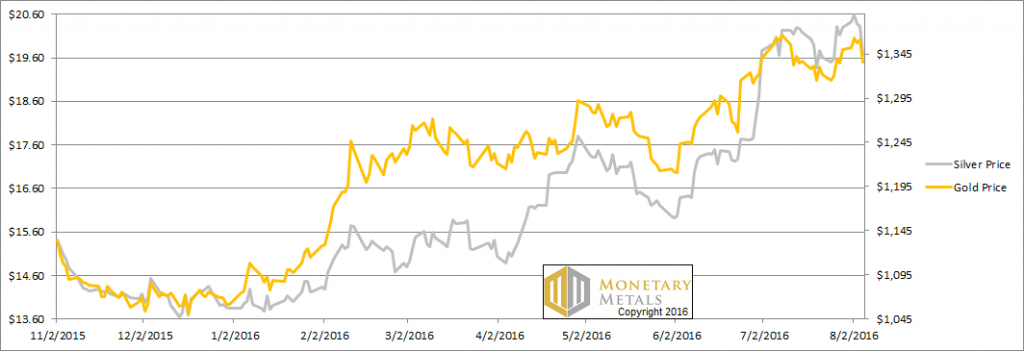

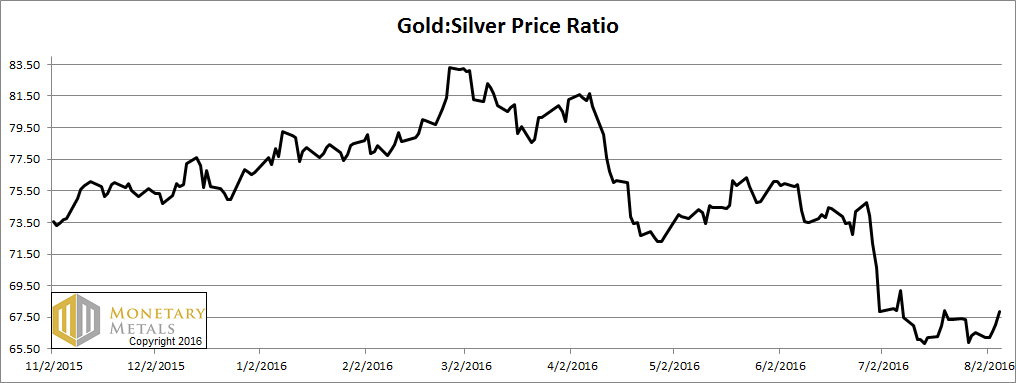

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Bubble Conditions The price of gold was down about fifteen Federal Reserve Notes this week. The price of silver was down sixty-two copper-plated zinc pennies. Is the Federal Reserve Note a suitable instrument with which to measure gold? Can one really use debased pennies – which aren’t even made of the base metal copper any more – to measure the value of gold? We don’t know. We just work here. Quick, buy some silver, we hear it’s going to 0! Not so fast. As the headline suggests, we think silver has been bid into a speculative bubble. We’ll cover that and show a new graph to support our discussion. Bubbling silver… Image credit: Trevor Scobie Fundamental Developments Read on for the only the only true picture of the supply and demand fundamentals for gold and silver. But first, here’s the graph of the metals’ prices. Gold and silver prices – click to enlarge. Gold-silver ratio Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose this week. Gold-silver ratio – click to enlarge. For each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold ratio, Great Silver Bubble, newsletter, Precious Metals, silver basis, Silver co-basis, silver price, silver ratio

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Bubble ConditionsThe price of gold was down about fifteen Federal Reserve Notes this week. The price of silver was down sixty-two copper-plated zinc pennies. Is the Federal Reserve Note a suitable instrument with which to measure gold? Can one really use debased pennies – which aren’t even made of the base metal copper any more – to measure the value of gold? We don’t know. We just work here. Quick, buy some silver, we hear it’s going to $100! Not so fast. As the headline suggests, we think silver has been bid into a speculative bubble. We’ll cover that and show a new graph to support our discussion. |

|

Fundamental DevelopmentsRead on for the only the only true picture of the supply and demand fundamentals for gold and silver. But first, here’s the graph of the metals’ prices. |

|

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose this week. |

|

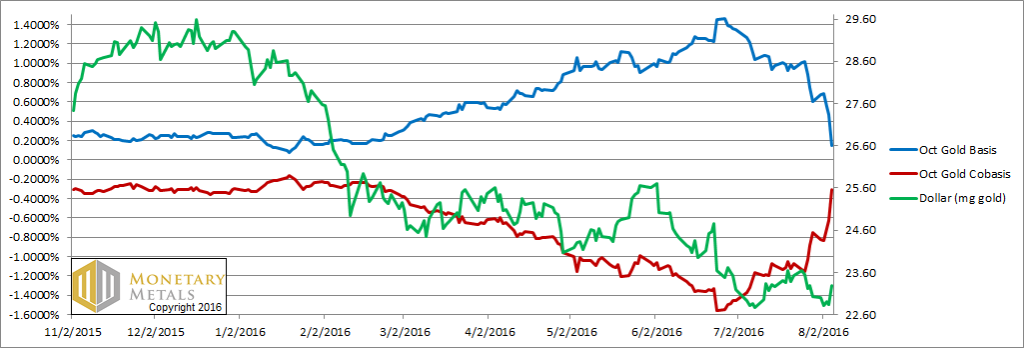

Gold basis and co-basis and the dollar priceHere is the gold graph. A little move down in the FRN-price of gold, i.e. a ¼ milligram move up in the price of the dollar as measured in gold… and we see larger moves in the basis and co-basis. The abundance of gold fell, and its scarcity increased. The market price may have dropped, but our calculated fundamental price bumped up. It’s still below the market price, but not all that much. |

|

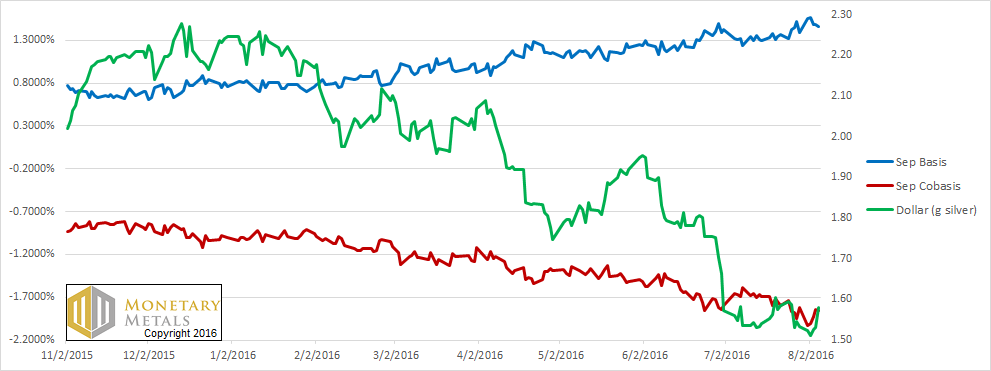

Silver basis and co-basis and the dollar priceSilver is another story, so let’s turn to silver. Note: we switched from the September contract to December as September is too close to expiry to be usable as a signal now. The price of silver fell more than gold in proportion, but we do not see anything similar in the move in its bases. Unsurprisingly, the fundamental price of silver fell. It’s way, way under the market price. |

|

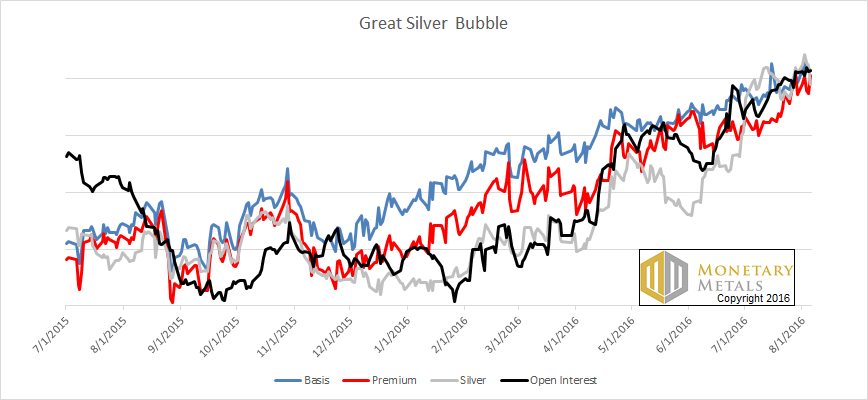

| Consider the following graph.

The above is a picture of the price of silver, along with the basis, premium (the market price – our fundamental price, shown as a percentage), and open interest in the futures market. As we have written in the past, open interest tends to rise as the basis rises, because a higher basis is a greater incentive to carry silver. To carry metal, you simultaneously buy a bar and sell a contract. You are not betting on price, but earning a small spread—the basis spread. The basis and our calculated premium bottomed and began their current rise around late November. The price of silver began moving up a bit later, around mid-January. And open interest bottomed in late January (it is subject to other factors, such as bank credit availability). Since then, a great bubble has been inflating, with a small leak in May. The correlation of these four numbers – price, basis, premium, and futures open interest – is not perfect, but it’s uncannily close. Who knows when the air will be let out of it? All we can say is that Friday’s 61-cent price action is likely a small down payment on a $3 move south. |

Charts by: Monetary Metals