Home of the Anti-Bubble It seems like almost everybody has an opinion about Twitter (TWTR) – both the company and the stock. As for the company it seems that their “window of opportunity” to massively succeed has essentially closed as user growth and revenue have both slowed, quite dramatically, over the past 18 months. Plus management turnover is clicking at a rapid pace. Company executives typically do not leave if the firm’s future seems bright. Even the ubiquitous Co-Founder/CEO, Jack Dorsey, has halfway bailed out of his San Francisco based money burner for another cash shredding unicorn – Square – separated by less than one mile. How convenient for him to toggle between both executive offices. Jack Dorsey, the ubiquitous Photo credit: John Sebastian Russo The only real obstacles on his Market Street walking route are a polarized mix of vagrants (cell phone in one hand + bitcoin donation cup in the other hand´) and long-bearded/well tailored hipsters (cell phone in one hand + Blue Bottle coffee cup in the other hand). Unfortunately, judging by the price chart below, many Twitter shareholders are as dour as the collectively sad futures of those homeless chaps Dorsey regularly dodges. TWTR, weekly – no joy for shareholders as what Sornette calls an “anti-bubble” plays out with rather merciless persistence – click to enlarge.

Topics:

Dominique Dassault considers the following as important: Debt and the Fallacies of Paper Money, Featured, Jack Dorsey, newsletter, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Home of the Anti-BubbleIt seems like almost everybody has an opinion about Twitter (TWTR) – both the company and the stock. As for the company it seems that their “window of opportunity” to massively succeed has essentially closed as user growth and revenue have both slowed, quite dramatically, over the past 18 months. Plus management turnover is clicking at a rapid pace. Company executives typically do not leave if the firm’s future seems bright. Even the ubiquitous Co-Founder/CEO, Jack Dorsey, has halfway bailed out of his San Francisco based money burner for another cash shredding unicorn – Square – separated by less than one mile. How convenient for him to toggle between both executive offices. |

|

|

The only real obstacles on his Market Street walking route are a polarized mix of vagrants (cell phone in one hand + bitcoin donation cup in the other hand´) and long-bearded/well tailored hipsters (cell phone in one hand + Blue Bottle coffee cup in the other hand). Unfortunately, judging by the price chart below, many Twitter shareholders are as dour as the collectively sad futures of those homeless chaps Dorsey regularly dodges. |

|

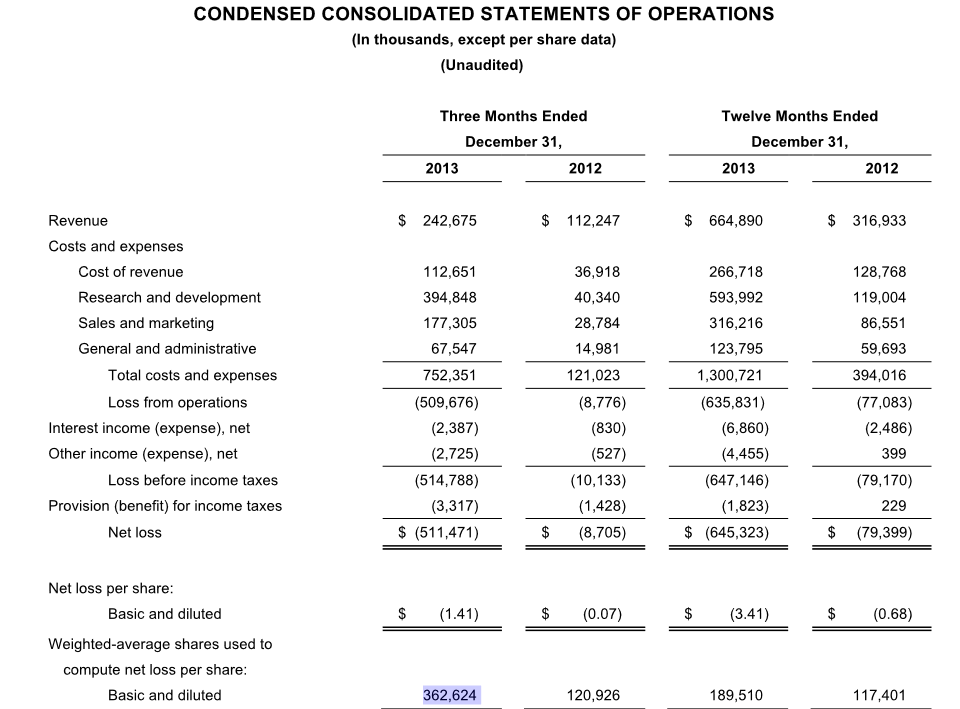

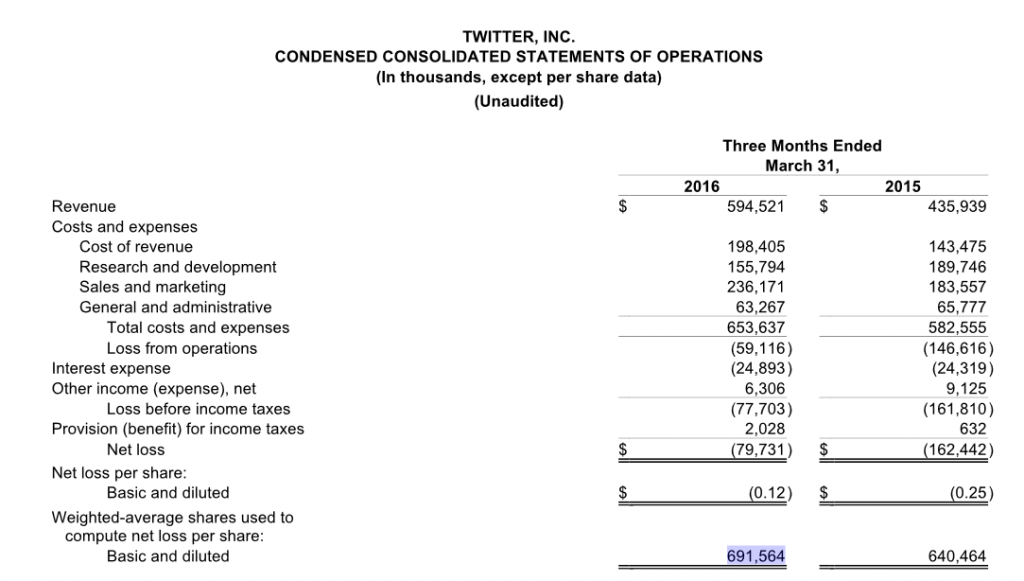

Management Has no Shame About a Huge Ramp in Shares OutstandingAnd interestingly, as Twitter’s income statement metrics continually flutter/flatten, there is one contrasting line item that regularly soars higher = shares outstanding ….as Dorsey and his Board of Directors obviously missed the memo about maximizing share-holder value. Perhaps the memo was constrained by a 140 character limit and the -holder value portion was somehow excluded? So the instruction they actually follow = maximizing shares. To demonstrate, consider the following: in just 2 1/2 years as a public company (between December 2013 and March 2016), Twitter’s fully diluted shares outstanding have increased by a stunning 90.71%, from 362.6M to 691.5M (see highlighted sections below). This may explain why this tweeting bird’s stock cannot seem to sustain flight. The weight of all those additional stock certificates folded under both wings is just too much cargo to carry…rendering it incapable of vectoring up and correcting its irreversible flight path of “down and to the right”. |

|

|

Further, this contrasts to many other companies QE era-ed stock repurchases. Reduced Shares + Flat Income = Increased Earnings per Share. Of course earnings per share is not the ultimate measure of a company’s profitability or of how sustainable that “free cash flow” may be, but it does demonstrate a commitment to shrink a company’s capitalization with internally generated cash, which ultimately benefits all stakeholders. Naturally many of Twitter’s technology contemporaries are following this injured bird’s destructive and dilutive path…and, as might be expected, it is just so “techno-progressive” and contrarian – as in burn (rather than generate) cash and issue (rather than retire) shares. If business at Twitter does not quickly accelerate Dorsey may start requiring his employees to shave their fashionable beards and shed their trendy threads in exchange for a clean shave and a Brooks Brothers suit. Now that would truly be contrarian. |

|

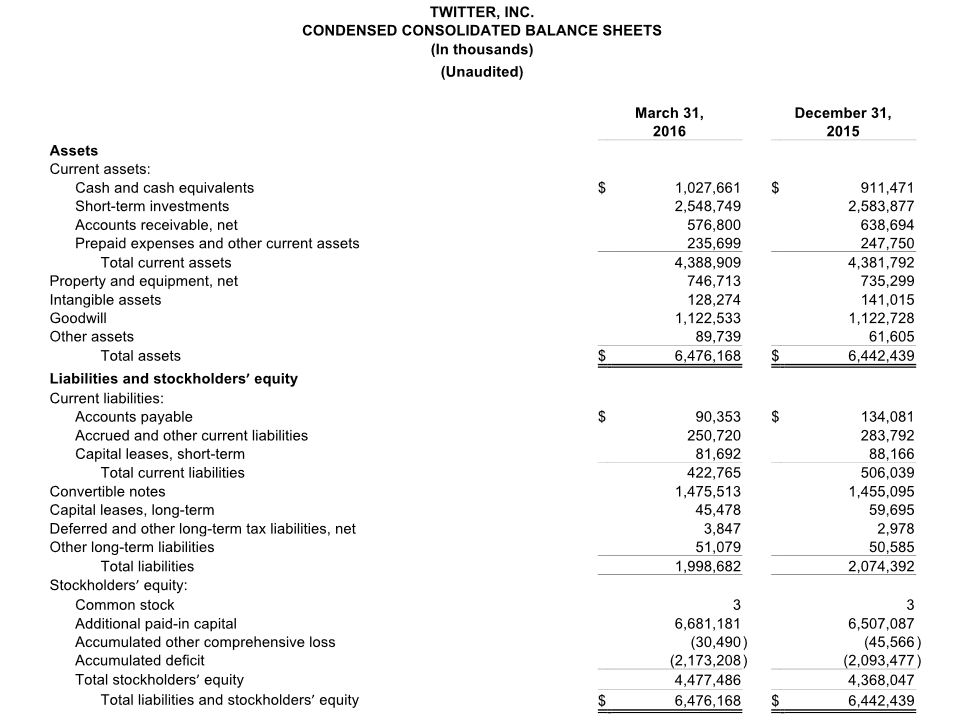

As the Share Price Declines, Ever More Shares are Issued for CompensationSo as executives flee and business flat-lines Twitter methodically/consistently issues more stock. It is difficult to contemplate a more shareholder unfriendly strategy, especially as the company’s balance sheet swells with $3.55B in cash/liquid securities and a net cash position of about $2B (see below), thanks to a $1.8B September 2014 convertible bond offering (with a $77.64 strike price suggesting that this debt will ultimately/permanently swell the balance sheet). |

|

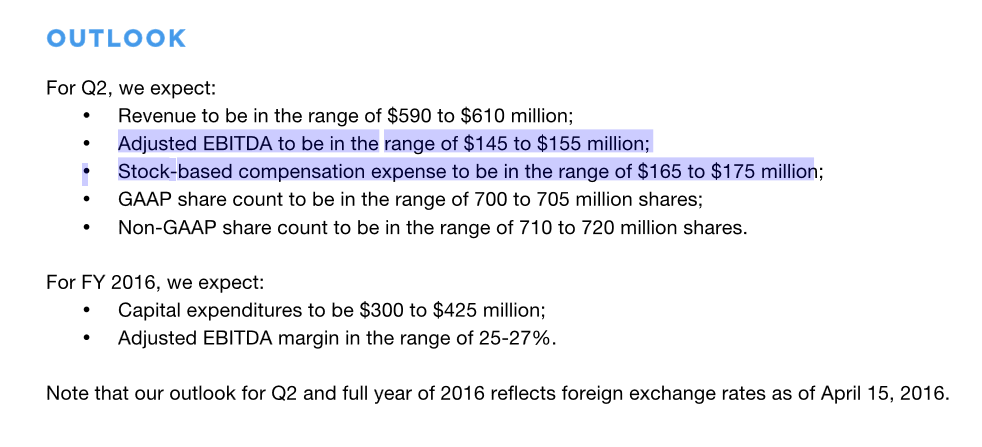

OutlookTwitter complicates matters further by continually issuing shares as the stock price decreases. Simple math calculations explain that more shares must be issued to reflect the same granted equity value (at a higher share price), which by the way regularly approximates/exceeds quarterly EBITDA (see below). I know the familiar refrain: it is a non-cash charge – and it is – but it also undeniably dilutes existing shareholders, and the chronically lower share price initiates a pernicious negative feedback loop that Twitter/Dorsey seem to have fully embraced, and for which they offer no explanations to existing shareholders. |

Conclusion

Oddly, the strategy at Twitter seems to be not to thrive, but just to survive…that missing great success is acceptable as long as below average success comes without complete failure, as cash is hoarded in lieu of more stock certificates. What a joke.

Chart by: StockCharts

Chart and image captions by PT

This article has originally appeared at Global Slant.

Previous post Next post