Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into nothing more than a TV studio for financial cable networks. Some might be closer to the truth and say that the most important building is the true New York Stock Exchange located in Mahwah, New Jersey however that also is not true as the NYSE now accounts for just a small fraction of total traded volume. No, the real answer of what the most important building if for US capital markets, and not just stocks, but all assets classes, as under its roof on a daily basis electronic trades representing many trillions of dollars’ worth of equities, derivatives, currencies, and fixed-income take place, is the Equinix NY4 data center, located at 755 Secaucus Road, in Secaucus, NJ 07094. This, as Bloomberg puts it in its fascinating profile of this particular structure, "is where Wall Street actually transacts." Behold what the new trading floor looks like: This view from a catwalk shows some of the miles of fiber-optic cable that connect to machines below.

Topics:

Tyler Durden considers the following as important: Bank of America, Bloomberg News, Capital Markets, China, Comcast, dark pools, Direct Edge, Fail, fixed, goldman sachs, High Frequency Trading, Mahwah, NASDAQ, New York Stock Exchange, Switzerland, Verizon

This could be interesting, too:

investrends.ch writes Öl, Inflation und die Fed: Das geldpolitische Dilemma im Zeichen des Nahost-Konflikts

investrends.ch writes Wie globale Investoren dem Trump-Trade den Rücken kehren

investrends.ch writes Gold über 5’000 Dollar: Warum der Bullenmarkt trotz Turbulenzen intakt bleibt

investrends.ch writes Hedgefonds-Branche erlebt Gründungsboom – Kapital erreicht Rekordhöhe

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into nothing more than a TV studio for financial cable networks. Some might be closer to the truth and say that the most important building is the true New York Stock Exchange located in Mahwah, New Jersey however that also is not true as the NYSE now accounts for just a small fraction of total traded volume.

No, the real answer of what the most important building if for US capital markets, and not just stocks, but all assets classes, as under its roof on a daily basis electronic trades representing many trillions of dollars’ worth of equities, derivatives, currencies, and fixed-income take place, is the Equinix NY4 data center, located at 755 Secaucus Road, in Secaucus, NJ 07094.

This, as Bloomberg puts it in its fascinating profile of this particular structure, "is where Wall Street actually transacts."

Behold what the new trading floor looks like: This view from a catwalk shows some of the miles of fiber-optic cable that connect to machines below.

Photo: Bloomberg

The first thing that any entrant in this giant, semi-refrigerated warehouse containing millions of servers will notice is that there are virtually no humans to be seen anywhere. Yes: the Equinix's NY4 data center hosts 49 exchanges (among the customers that pay to use this Secaucus location) and it is all just servers and fiberoptic interconnections either between them, or to the outside world.

This is how Bloomberg introduces this new nerve centre of virtually every capital markets in the US: "six miles northwest of the New York Stock Exchange as the microwave flies, across the Hudson River and within earshot of Interstate 95, is a building with no name. Only three numbers mark its address, and, like much of its surroundings, it’s nondescript, encircled by windblown trash and lonely semitrailers waiting to be hauled away somewhere. It’s a part of New Jersey that’s, well, ugly."

That's not a coincidence: the building wants to attract as little attention to itself as possible because it happens to be the most critical node in the U.S. financial system. "The 49 different exchanges that lease space at this data center sent a record 9.6 million messages per second through its fiber-optic cables in February. Every day, electronic trades representing trillions of dollars’ worth of equities, derivatives, currencies, and fixed-income assets pass under this roof. This is NY4."

NY4 is just one of the core assets, or "crown jewels" of Equinix, the $22.7 billion company that’s quietly grown into the world’s largest owner of interconnected data centers, which really is a fancy name for warehouses.

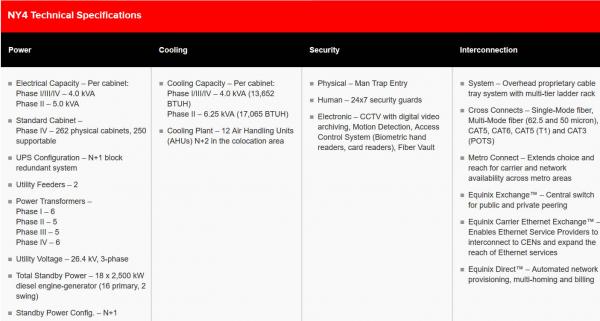

The full public technical specs of this vast building are below:

However, Equinix pitches its centers as more than just storage space for servers.

As Bloomberg reports, its clients pay in part because of who else is there. NY4 Clients includes the Chicago Board Options Exchange, Direct Edge, ICAP, Nasdaq, the NYSE, and Bloomberg LP, the parent company of Bloomberg News.

Servers in cages at NY4. Photo: Bloomberg

It's not just legacy Wall Street firms, or their more recent collocated High Frequency Trading spawn that call Secaucus their home. IEX Group, the firm that starred in Michael Lewis’s 2014 book Flash Boys, stashes a key piece of its hardware in one of Equinix’s New Jersey data centers: a coil of fiber-optic cable that slows orders down by a fraction of a second. And those firms are just from the handful of financial industry customers Equinix discloses. It connects more than 6,300 businesses to their customers, and most of those firms don’t want it known that they lease one of NY4’s metal cages, which are identified only by numbers, not names.

It's not just Wall Street. Equinix’s nonfinancial clients, meanwhile, include some of the Internet’s biggest names: Amazon.com, AT&T, China Mobile, Comcast, Facebook, Hulu, LinkedIn, Microsoft, Netflix, Pandora, and Verizon.

It is the immediate proximity of these non-financial that makes the building all the more desirable for financial companies which are located at the very place where the servers of companies whose assets they trade billions of times per day, are actually located.

As Bloomberg adds, much of the Internet is literally run through the nondescript buildings Equinix has scattered around the world. “They’re a crucial component of how the cloud works,” says Colby Synesael, an analyst at Cowen & Co. who covers Equinix. “It’s where the Internet lives.”

As it turns out, the internet is very heavily protected. The security at NY4 is unprecedented: to get from the parking lot to a spot where you could touch one of the servers you’d have to go through five checkpoints. One of them is a so-called man trap with two automatic steel doors that never open at the same time. Your palm print is required twice in addition to your PIN code. A wall of video monitors captures every nook and cranny of the 338,000-square-foot building.

Those lucky enough to enter will notice that once in, the space is enveloped by a rush of white noise from the thousands of computer fans whirring away to keep the servers cool. To help maintain the temperature, the ceiling is 45 feet high, roughly four stories up. It’s barely visible—not just because of its height, but also thanks to all of the suspended trays of cables and cooling ducts running overhead. All this goes toward one statistic: Equinix says in its annual filing that it kept its facilities up and running 99.9999 percent of the time in 2015.

The 12 air-handling units in NY4 move cold air via overhead ducts.

However, in the off chance that primary power is somehow interrupted, NY4 is protected: the company prides itself on its backups. According to Bloomberg, the structure's uninterrupted power supply room has 5,600 batteries on standby to provide eight minutes of electricity while the generators rev to life. Should the air conditioning fail and risk the servers overheating, there are three 150,000-gallon tanks filled with water chilled to 45F. Running that cold water through pipes would give NY4 staff 20 minutes to get the AC fixed.

Finally, there are the generators: 18 of them, "each the size of a locomotive engine and able to crank out 2.5 megawatts of power" Equinix keeps 180,000 gallons of diesel fuel on-site to run them. In terms of footprint, NY4 is roughly the same size as a Manhattan block. If you want to look out the window, too bad. There isn’t one.

Standby power comes from 18 generators that can crank out 2.5?megawatts each. Photo: Bloomberg

Then there is the matter of the Feng Shui.

As Bloomberg, whose reporters recently visited the facility, reports "there’s a slick appearance to it all, from the red-lit foyer to the metal all around and the blue lights that shine from above. This last feature comes in handy at night for security purposes, but it’s also got an aesthetic touch to it. “When everything is dark and you only have these blue lights, it looks really cool,” says Michael Poleshuk, senior director of operations for Equinix in the northeast region, as he leads a tour."

And this is the brilliance of Equinix: while exchanges, dark pools, ATS bicker and compete who gets what traffic, and cloud providers scramble to reach clients, one company has managed to roll up the most mission-critical providers of life in the US as we know it - it would not be an exageration to say that a double digit percentage of US GDP is made possible thanks to this one warehouse.

But there are many more.

Another reason the location is important to Wall Street is because NY4 is only one part of Equinix’s Secaucus, N.J., campus. This is how the company pitches its services on its website:

- Connections to 125+ network service providers

- Facilities compliant with SSAE16 SOC-1 Type II, an auditing standard for service provider locations (NY1, NY2, NY4, and NY7 only)

- Ability to interconnect directly to 750+ companies colocated with Equinix in New York

- Customer population comprised of many financial services firms, media companies and large enterprises

- 7 buildings with 484,000+ square feet of colocation space

The company has spent the last 20 years growing and consolidating the industry into its own spider web of interconnected data centers from Frankfurt to Tokyo to London to Rio de Janeiro to Sydney. This is the company that controls a significant part of modern finance: the sites where you plug in the actual computers that fuel today’s hyperfast and hyperconnected electronic trading.

“I call them the 800-pound gorilla of the data services market,” says Inder Singh, an analyst at SunTrust Robinson Humphrey. “I see these guys as a key bridge between customers and suppliers.”

More importantly, Equinix is effectively a monopoly. As such it does not need to compete with customers. Singh says. “It is the Switzerland of data center players,” he says. That has a downside, though. “Equinix definitely leaves some money on the table. But they would probably be losing some of their coveted customers.”

Then there are the subservice providers, because Equinix provides only “dark fiber”; it doesn’t move data itself.

That’s created opportunities for other companies. A startup called Lucera is one of them. The company operates something like a telecom within the data center by using software to interconnect the banks, exchanges, and investment firms that have servers at NY4.

"If Goldman Sachs wants to connect to 100 people, they just run one cable to us,” says Jacob Loveless, Lucera’s co-founder and chief executive officer. In turn, that one cable from a firm can then connect the client to any of the other 52 data centers around the world where Lucera operates.

Loveless' idea was to provide a seamless interconnection between traders by moving Wall Street into the cloud. He realized there were too many trades out in the world that were great ideas but impractical: Implementing them would take six months and $500,000 because of the connections that needed to be made to another bank or investor or exchange that might be halfway around the world. Additionally, it would take a bank about three months to create a new connection to another bank if it did it on its own, Loveless says. Lucera’s fastest time to connect two of its users is eight seconds. That’s because the company is software-based and relies on hard-wired connections already created by Equinix. Lucera’s mean connection time is only two hours, Loveless says. In short, everything is digital, everything is hotswappable, and everything is modular.

How did Loveless get his idea? He spent 10 years at Cantor Fitzgerald, where he was the firm’s head of high-frequency trading.

* * *

What happens at NY4 today is vastly different from Wall Street 30 years ago, or 20 years ago, or even 10 years ago.

At the dawn of electronic trading in the 1980s, major banks such as Goldman Sachs or Bank of America had to lay wire and cable to create their own networks to connect to customers. If you laid one bank network atop the other, they would have all been basically the same, Loveless explains, which is another way of saying it was hugely inefficient. Then in 2000, a company called Radianz set out to create a global network that promised access to the major financial institutions through a single connection and it worked. British Telecom bought Radianz in 2005 for about $130 million. Lucera, which got its start in 2013, is now a sort of second-generation Radianz as it offers to handle the complicated interconnections within a data center like NY4 for its clients.

In effect, even the act of collocation has been outsourced to "cloud" vendors: "If I’m a customer and I want to connect to 270 companies, I can either run 540 connections out of my own cage or they can run a pair to us and we’ll run the rest,” says Michael Badrov, global head of operations for Lucera.

* * *

When one re-emerges from this massive "cloudy" server farm, and stands on the roof of NY4, the skyscrapers of Manhattan could just be seen to the east. To the west, planes lined up to land at Newark airport.

And everywhere there are microwave antennas that are pointed toward Chicago, Newark, and north of the city to either Mahwah and the NYSE, or to a transducer station where the signal can get hooked into the fiber-optic cable that ends in London. That’s where Equinix’s LD4 center is located.

This global network of densely packed data centers is now the reason you can trade a stock on your smartphone in a way that was unimaginable 10 years ago. The six or seven intermediaries needed—AT&T, your brokerage, the NYSE, and so forth—are all housed under Equinix’s enormous roof.

And this is what the nerve center of the real US capital markets looks like.